Send A Pay For Delete Letter

If you have a significant amount of debt, you may benefit from pay for delete services. This method removes negative items from your credit report in a settlement negotiation with debt collectors or the original creditor, but it’s not without risk. For example, if you make a promise of payment, this extends the statute of limitations and makes collection enforceable on debt that otherwise might be uncollectible.

How Long Does It Take To Rebuild Credit

For many people, low credit scores are the result of unfortunate circumstances. Your car breaks down the same week your bills are due. Or, a medical procedure leads to lost work and you have to pick and choose which payments to make on time and which have to wait.

The time it takes to rebuild your credit can depend on what hurt your credit in the first place, how much time has passed, and whether youre adding positive info to your credit reports.

Unfortunately, theres no instant cure for poor credit. Bringing your accounts current and paying off a collection account wont remove those negative marks from your , and they can continue to hurt your credit scores for years.

The time it takes to rebuild your credit can depend on what hurt your credit in the first place, how much time has passed, and whether youre adding positive info to your credit reports.

It can take longer to recover from more serious negative marks. There are many types of negative items, or derogatory marks, that can lower your credit scores. These include:

- Late payments

- Foreclosures

- Bankruptcies

The impact of a negative mark can depend on what happened and on your overall credit profile.

For example, a 90-day late payment or foreclosure is worse for your credit than a 30-day late payment. A late payment also might not hurt your credit as much if you have a robust and long credit history compared to someone whos new to credit.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Recommended Reading: How Often Does Apple Card Report To Credit Bureaus

What’s Considered A Late Credit Card Payment

This would make a good trick question on a test. While the obvious answer is “any credit card payment made after the due date,” that’s not how the credit bureau sees it.

Your card issuer can’t report your payment as late to any of the three credit bureaus until it’s at least 30 days past the due date. That’s because all those credit bureaus use the Metro 2 Reporting Format, which requires that creditors follow the Industry Standard for Reporting Account Delinquency. Here’s how it works.

On the reporting date, your card issuer sends a status code about your account to each credit bureau that it reports to . That code indicates your account’s current standing. Accounts from zero to 29 days past due are a Code 11, the code for current accounts. The codes for reporting late payments start with accounts that are 30 to 59 days past due.

This doesn’t mean it’s a bright idea to take your time with your credit card payments. Your card issuer still can charge a late fee as soon as you miss the due date, and you’ll also have to pay interest on the amount due. You might also get hit with an interest rate hike.

How Will Late Payment Affect Your Credit Score

Many of us forget to pay our bills on time. Fortunately, a late payment does not affect your credit score unless it is 30 days past due. After 30 days, if you still are left to pay your dues, you might fall in one of these caps.

When I say charged-off, it means creditors consider it as a loss and forget.

If you are making late payments, you will fall under any of these categories. Your creditor will report to based on these categories. The more you delay on your side, the more it will affect your credit score.

Suppose you fall under the category of 150 days past due. It will have more effect on your credit score than falling under the category of 30 days past due. So, even if you are late in paying your dues, you should pay it off as soon as possible.

Read Also: When Are Bankruptcies Removed From Credit Report

What Is Considered A Late Payment

Technically speaking, a payment is late as soon as its past the due date, even if its one minute past midnight. If youre looking for the nitty-gritty details, check your contract to see when your payment is specifically due. For example, your payment might be due by 5 p.m. instead of midnight.

However, once the deadline passes, many creditors have whats called a grace period for you to make your payment before charging a late fee. Once the grace period is overor if there is no grace period outlined in your contractyour provider will typically charge a late fee.

What Is Considered A Late Payment And When Does The Seven

Theres no set rule that applies to all lenders frustrating, we know. Each lender decides what is considered a late payment and when to report it to a credit bureau.

In most cases, if your payment is more than 30 days late, the major credit bureaus are notified, meaning the late payment will show up on your credit reports.

A late payment, also known as a delinquency, will typically fall off your credit reports seven years from the original delinquency date. For example: If you had a 30-day late payment reported in June 2017 and bring the account current in July 2017, the late payment would drop off your reports in June 2024.

The same generally applies if you miss two payments in a row. If you had a 60-day late payment reported in June 2017 and bring the account current in August 2017, both late payments would be removed in June 2024.

Also Check: How Much Does Credit Score Affect Mortgage Rate

When Is A Payment Considered Late

When payments are considered late can vary depending on the credit card issuer. But as long as a credit card payment is received by 5 p.m. on the date itâs due, the Consumer Financial Protection Bureau says it canât be considered late. Some issuers may even accept payments later than 5 p.m. on the due date without considering them past due.

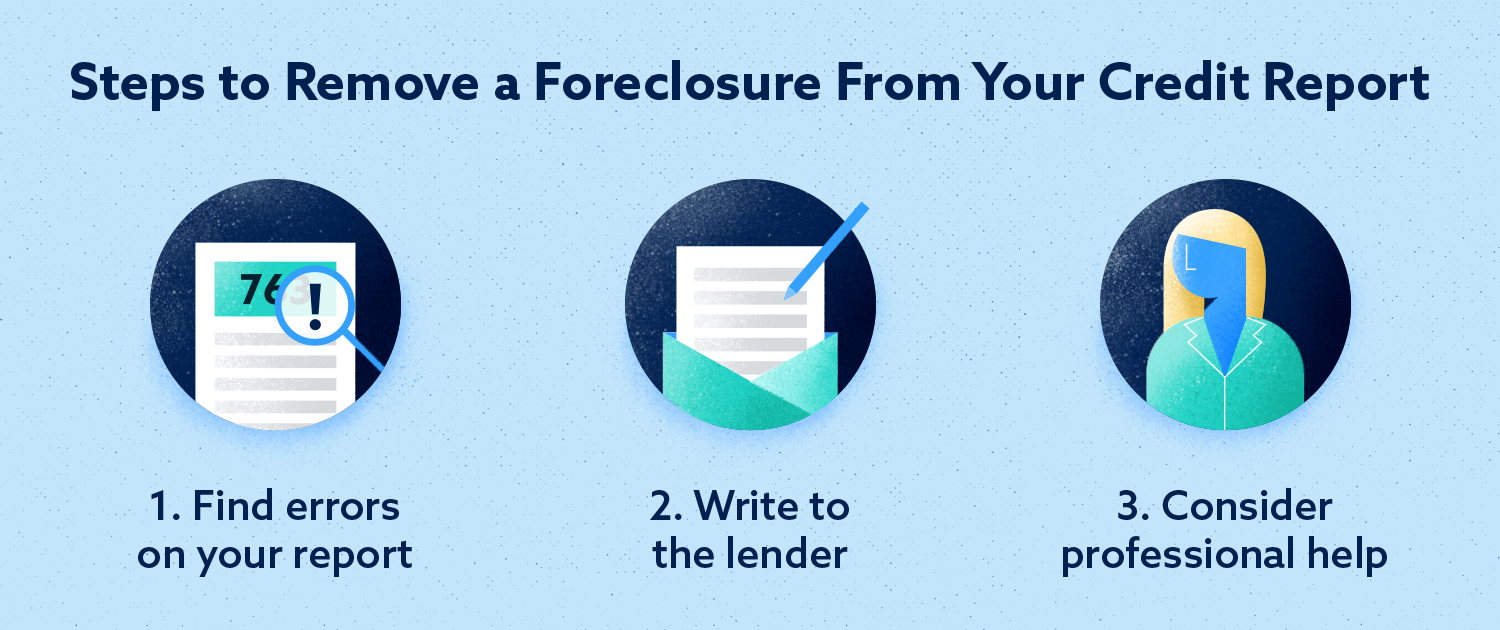

Dispute With The Lender

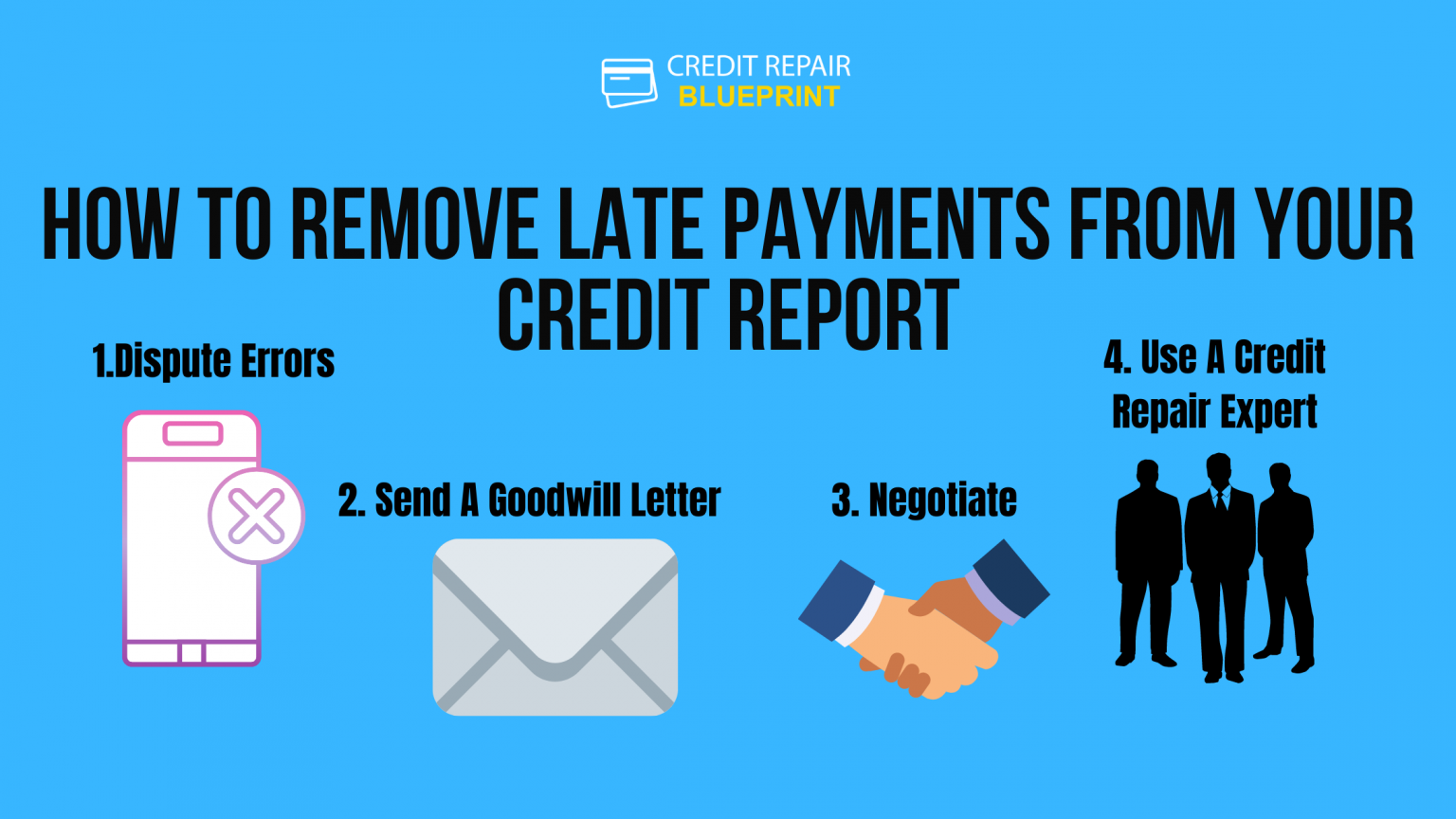

Once you know that theres an incorrect late payment on one or more of your credit reports, its time to contact the lender who reported it.

If this is a credit card issuer, this may be as simple as calling the number on the back of your card, or checking our list of credit card company contact numbers. Otherwise youll need to look up the appropriate contact information to call your lender.

You may have success simply by calling and notifying them of the error. They might check their own records, see the mistake, and take steps to fix it.

In other cases, the lender may request proof that you didnt make a late payment, i.e., proof that you made a timely payment for the billing period in question. A letter containing a copy of a bank statement showing the payment, or some other kind of documentation, may be able to satisfy a creditors request for proof. If your lender is satisfied, it will fix the error.

As a template for this letter, check out our sample letter to a credit bureau below. Youll have to change some of the information to send it to your lender instead of a credit bureau, and youll also have to adjust some of the text based on what they tell you on the phone. But this should give you a good starting point.

If the lender agrees that the delinquency is an error, get it in writing. Get a written verification that the late payment was a reporting error by the lender, and not your fault.

You May Like: What Credit Score Do You Need For Capital One

How To Keep Late Payments Off Your Credit File

If youre reading this and already have delinquencies reported on your credit report, its obviously too late to prevent the negative marks from appearing in your credit history.

You should stick to the methods I outlined above to remove the late payments and restore your credit.

But if you arent yet 30 days late on a payment, read this section carefully.

You can still prevent a late payment from hurting your credit score.

Doing this will be much easier than trying to remove the negative items from your credit report later.

Heres what you can do:

Is There Any Way To Reduce The Impact Of Late Payments

It is rightly said,

When there is a will, there is a way!

Even if you have made late payments, try not to panic. There are hardly any humans who do not fall under any of these categories of late payment. You may have intentionally or unintentionally made late payments in the past.

Experians consumer credit review suggested that 1.5% of all consumers had made late payments, and they fall under the categories of 30 & 180 days. Hence, never get disturbed when you make any late payments.

However, we are here to understand whether there is any way to reduce the impact. Hence, let us concentrate on it and learn how we can do it.

Suppose you have a good track record with your creditors. You have been timely in making the payments. But supposedly, you have missed one. You can request your creditor to wave off the late payment fees and forgive occasional late payments.

Secondly, in such a case, if you can make some payment by the due date and request the creditor to pardon you for some days, it will not have a significant impact on your credit report. The smaller the amount left in your late payment past due, the lesser it will impact your credit report.

Lastly, if you cannot pay a single penny before your due date, you may connect with your creditor and help them understand your situation. They might avoid informing credit bureaus, thus avoiding the significant impact.

Read Also: How To Fix Errors On My Credit Report

Closing A Line Of Credit That Is Already Behind On Payments

Closing a card thats behind on payments doesn’t eliminate the debt. In fact, it can lower your credit score by increasing your debt-to-credit ratio, also known as credit utilization percentage. This ratio represents the amount of credit you’re currently using divided by the total amount of credit you have available.

For example, if you have two credit cards, each with a maximum credit limit of $5,000, your total available credit is $10,000. Owing $3,000 on one card and $2,000 on the other would mean you’re using 50% of your total available credit.

To improve your credit score, experts recommend keeping your credit utilization under 30%. Following the example mentioned above, that would mean using only $3,000 or less per cycle.

If you close one of your credit cards instead of paying it, you’ll have less available credit. Creditors evaluate your debt-to-credit ratio when you apply for new cards or loans. If your ratio is over that threshold, they might classify you as a high-risk borrower, offer you less attractive interest rates or even deny you credit altogether.

Summary Of Moneys Guide For Getting Negative Items Removed From Your Credit Report

- Order a copy of your credit report through AnnualCreditReport.com and search for inaccurate information, like missed payments or accounts that don’t belong to you.

- If you find any, file a dispute online or through the mail with the credit bureaus Equifax, Experian and TransUnion.

- You should also notify your bank or credit card issuer. They can help you verify that the information in your report is, in fact, erroneous and notify the bureau.

- Be on the lookout for a response from the bureau. It should arrive in around a month or less. If they accept your dispute, request your credit report again to make sure the negative information was removed.

- If your report is riddled with errors or you’re finding the dispute process difficult, consider hiring a .

- Categories

Recommended Reading: How To Improve Mortgage Credit Score

Is There Any Way To Avoid Late Payments

There are several ways if you accept it and follow them. In short, it depends on your intentions. If you have a clear intention to pay off your dues, it will secure you in the long term.

Please follow the following tactics to avoid late payments.

When Is A Late Payment Reported To Credit Bureaus

Just because a payment is late doesnât mean it will be reported. If a payment is made before itâs 30 days past due, it likely wonât show up on credit reports from the three major credit bureaus: Experian®, Equifax® and TransUnion®.

There are a few reasons for that. One is because those bureaus have standardized the way negative information is reported. That includes late payments. And within that system, thereâs no method or code available to report payments that are between one and 29 days late.

What Happens if a Payment Is Between 1 and 29 Days Late?

Even if a late payment isnât reported, there could still be consequences. Your issuer can charge a late fee, even if itâs the first time your credit card payment is late. And being late again within the next six billing cycles can result in an even higher fee.

Late payments could also affect your interest rate. You can check with your credit card issuer or read your card agreement for more information.

What Happens if a Payment Is More Than 30 Days Late?

Late payments are also typically reported at 60 days, 90 days, 120 days and 150 days. At 180 days, an account is required to be charged off. That means the account is closed and written off as a loss by the issuer.

But be aware that some lenders may charge off accounts earlier than 180 days. And even when an account is charged off, the debt is still owed. And it could be sent to collections.

You May Like: How To Remove Credit Report Freeze

Request A Goodwill Adjustment

This is an ideal option if you generally have a good payment history with your creditor and have been a customer for a while.

To do this, write a goodwill letter to the credit card issuer or lender and explain your situation. Credit card companies have some flexibility when it comes to reporting late payments. They can remove late payments from your credit report under the right circumstances.

Did you have an unexpected expense arise last month that made you late? Are you trying to perfect your credit score so you can get a mortgage or an auto loan?

Include your personal story in the goodwill letter so that the customer service representative reading your letter understands why this would be helpful.

Many people succeed with this method because creditors dont want to risk losing your account because of a single disagreement.

How To Remove Negative Items From Your Credit Report

Amarilis YeraNorma RodríguezAndrea AgostiniTaína CuevasAmarilis Yera26 min read

Your is meant to be an accurate, detailed summary of your financial history however, mistakes happen more often than you may think.

Whether its accounts that dont actually belong to you or outdated derogatory information thats still being reported, incorrect information could be bringing your score down unnecessarily.

Read on to learn how to remove erroneous information from your credit report and some tips on how to handle those negative items that are dragging your score down.

Also Check: What Is The Max Credit Score

Why Late Payments Are Bad For Your Credit Report

Although everyone would want to be able to pay their bills on time, its not always possible. People may encounter different issues. They either dont have the time to do so, or they dont have enough money to pay them, so they end up being late. Unfortunately, this will show up on their and affect it.

When it comes to determining your credit score, your payment history is the main factor that allows it to be calculated. This is why its always recommended to pay for everything on time. Depending on factors like your credit history and score, how bad the late payment was, and how long ago it happened, it can seriously harm your credit score.

Your credit score shows your reliability with credit. When you want to borrow money, your score will be calculated by the potential lender to see if you meet the criteria to get a loan. Your credit history comes into play here. There are companies that dont ignore late payments when calculating credit scores, because late payments could be a good sign that the borrower would be too risky. As a result, you may not be able to obtain financing from these companies.