What Affects Your Credit Score

On the list of what affects your credit score, two factors have the biggest influence: Payment history, which is whether you pay on time, and credit utilization, which is how much of your credit limits you have in use.

Other factors matter but carry a little less weight: how long you’ve had credit, whether you have a mix of credit types and how frequently and recently you’ve applied for credit.

Dont Apply For Loans Or Credit Cards For At Least A Year

Once youve paid down your installment loans, I suggest you stop applying for loans and credit cards altogether. By this point, you should have a few credit cards in your wallet, a couple of paid off cars, and a mortgage.

When youre in this position, there is really no need to apply for more credit.

By not applying for credit, you wont get any hard inquiries on your credit report and this helps your credit score. If you need to apply for credit, just keep in mind the hard inquiries will stay on your credit for about a year.

Again, you should be in a situation by this point where you dont need anymore credit.

Can I Get A Personal Loan Or Credit Card W/ A 759 Credit Score

Like home and car loans, a personal loan and credit card is easy to get with a 759 credit score.

You donât need to apply for a secured card with Discover or Capital One, who may make you pay $500-$1000 just for a deposit.

You can get even better terms on your personal loan or credit card by repairing your credit and waiting a few short months until your score improves.

A 759 score means you likely have few-no negative items on your report. Removing any outstanding negative items is usually the quickest way to fixing your report.

We recommend speaking with a friendly credit repair expert online to help guide you through this process. Your consultation is completely free, no-pressure, and will set you on the right path toward boosting your score.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

The Benefits Of An 800 Credit Score

So what exactly do you gain by having an 800 credit score? Is this something you should strive for? Here are three benefits of having an 800 credit score:

- You’re more likely to have your applications approved. Remember that credit scores indicate your creditworthiness. Along with your other financial information, your credit score helps lenders predict whether you’ll repay the money you borrow. With a high credit score, lenders see you as a less risky borrower, increasing the chances that they will approve your credit.

- You’re more likely to qualify for lower interest rates. Your credit score is a major determining factor in the interest rate on loans. Having an 800 credit score will help you qualify for lower interest rates and save you thousands of dollars over the life of your loan. You’ll see the biggest impact with larger loans that you repay over a longer period of time, such as mortgage and auto loans.

- You’ll receive better credit card offers and pay less in interest. Regardless of credit score, everyone can avoid paying credit card interest by paying their credit card balance in full each month. An 800 credit score can help you qualify for credit cards that offer a 0% promotional rate on purchases and balance transfers. Having one of these credit cards in your wallet gives you the flexibility to carry a credit card balance and pay it off over time while avoiding finance charges on your balance.

What Happens If Your 759 Score Goes Up Or Down

If your score moves, then you have to plan accordingly and fix it accordingly. Sometimes when it moves it is only slightly, while other times it might be a drastic change that happens on your credit score. Either way, it is important to monitor your score for these changes.

If your score goes up, which it is able too a bit, then you do not want to do anything to fix it. This is a great thing. Whether you are lower or higher, having a score that gets higher is never a bad thing or something to worry about.

If the 759 score gets lower then the individual will want to look into many factors that might have caused a negative impact on the score such as just opening a new account, defaulting on a loan, being late with payments or using too much of the available credit that they have. When either of these is a problem, you can fix it according to the issue. Paying down your credit usage, making on time payments, catching up with the defaulted loan or waiting out new accounts until they become older are all fixes. Hard credit checks can also negatively impact your score, so it is important to note that these will go away with time.

As a general rule of thumb, you always want your score to go up and never down. When it goes down, it is important to note why it is and then change the issues that the score is having so that it goes back to where it was or higher.

Read Also: Does Opensky Report To Credit Bureaus

Improving Your Credit Score Range

So now you know where your three-digit number falls in the credit score ranges. If you already have excellent credit ranging from 780 to 850 congratulations.

Your only job now will be to keep doing what youre doing to maintain stellar creditworthiness.

If you have very good credit, you may want to figure out how to optimize your score even more to achieve an even-better three-digit number. Keep reading to learn ways to fine-tune your credit life.

For everyone else, you probably have a little work to do to get into a better credit score range.

Like I said above, dont worry if your credit score has parked itself at the lower end of the spectrum. Ill show you exactly where to start working to achieve the best credit possible.

You can improve your credit score in no time if you dedicate some time to learning about how credit repair works.

What An Excellent/exceptional Credit Score Means For You:

Borrowers with exceptional credit are likely to gain approval for almost any credit card. People with excellent/exceptional credit scores are typically offered lower interest rates. Similar to “exceptional/excellent” a “very good” credit score could earn you similar interest rates and easy approvals on most kinds of credit cards.

Don’t Miss: Removing A Repossession From Credit Report

Diversify With A Personal Loan

Your go-to way to build credit might be paying back the money youve charged on your credit card each month. Lenders want to see that you have experience managing multiple types of credit and adding a small loan to your credit mix can help build up your score.

Your best bet is to choose a small personal loan if youve never taken out a loan before. Unlike other types of loans you can use a personal loan for just about anything. You can get a loan, treat yourself to some new furniture or a weekend away, pay it back and see your score rise.

Are you looking for an easy way to get a personal loan to boost your score? MoneyLion Plus members can get up to $500 in a low-interest personal loan with a few taps of a smartphone. Seventy percent of people who take out a credit builder loan with MoneyLion see their score rise. Get a MoneyLion membership if your credit profile needs a little more diversity.

Measuring Your Credit Score

Measuring your credit score is something that has to be done. Every specific credit bureau has a different way of measuring the score. Some measure to 850 while others will measure to 830 and so on. Each one is different and while one might record one default on their records, another might not and so on.

With the three major credit reporting agencies: TransUnion FICO, Equifax and Experian, you can be sure that you have all of the information you need. Youre allowed to have a free print out of your credit score every year from each of these three bureaus. If youre ever curious about what is on your report or ways that you can find out what you can do to fix your report, printing a copy and reading it is the best way to find out more about it, as well as report anything that shouldnt be on the report.

Also Check: Report Death To Credit Bureaus

Mortgage Rates For Excellent Credit

Having excellent credit is one of the first steps to getting a great mortgage rate. But there are other factors at play here too, like the total cost of your home and your debt-to-income ratio.

Once youve got a sense of how much house you can afford and the type of mortgage you want, its time to shop around to understand the rates that might be available to you. Getting a mortgage preapproval can help you understand how much you can borrow and make your offer more competitive.

Compare current mortgage rates on Credit Karma to explore your options.

How To Improve Your Credit Score From 753 To 800+

A credit score of 753 is on the brink of perfection, and you probably wont have to change much to join the 800+ credit score club. Your personalized credit analysis from WalletHub will tell you what needs improvement and exactly how to fix it.

A few things in particular tend to stand between a credit score of 753 and perfect credit, though. And if you do nothing else, make sure to take the following steps.

You May Like: Does Klarna Report To Credit

What Is The Difference Between A Hard And Soft Credit Check

In simple terms, a hard credit check is one that impacts credit scores, and a soft check does not. In most cases checking your own credit score has no impact on the score itself especially if you go through third party providers like Mogo, Borrowell and Credit Karma but when creditors or lenders consider providing a loan the check is recorded in your credit report and could ultimately impact your score. In fact, hard inquiries can stay on your credit report for three to six years, according to Credit Karma, while soft inquiries are only visible to you and the entity that made the request.

Its therefore important to ask anyone that will be checking your credit score how the inquiry will be recorded before providing permission to allow that check to happen. In most cases job, insurance, home and auto rental applications register as soft checks and thus wont impact credit scores, according to TransUnion. The credit bureau also confirms that credit scores arent impacted when a credit grantor has verified your identity for the purpose of offering you credit and when a credit grantor with whom you have a business relationship has reviewed your account with them.

Should You Shoot For A Perfect Credit Score

A strong credit score can have a powerful impact on your financial life: it influences your ability to get a credit card, finance a car, get a mortgage, and possibly to rent an apartment. The higher your score, the more easily youll qualify for loans, other lines of credit, and lower interest rates. But does that mean your goal should be to achieve an absolute perfect credit score? The answer might surprise you.

What is a perfect score?

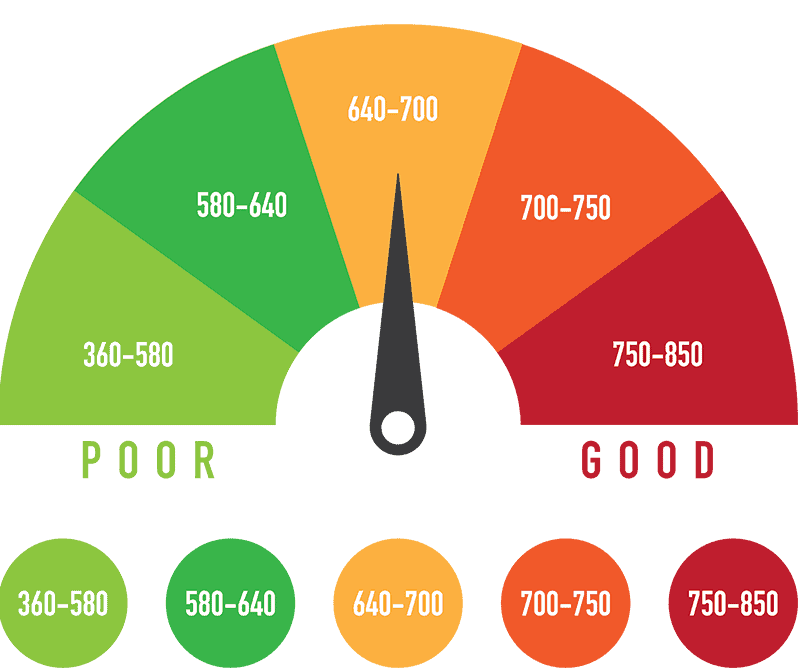

For the VantageScore 3.0 and FICO 8, the two most common credit scoring models used to measure a consumers credit risk, credit scores range from 300 to 850. Roughly, scores ranging from 300 to 629 are considered bad, 630 to 689 are fair, 690 to 719 are good, and 720 to 850 are excellent. Believe it or not, according to a recent study by Experian , there are Americans with a perfect score of 850! Although not manyat the time of the study, only 1.2% of all FICO scores in the U.S. stood at 850.

How do you get to 850?

In general, to reach that top tier, you will need to make on-time bill, credit card, and loan payments have a high credit card capacity but low credit utilization have a long credit history utilize a mix of credit and not have many new credit inquiries.

Importantly, while access to some credit products can be limited by income, your paycheck isnt a direct barrier to achieving a perfect FICO score.

What does a perfect score get you?

Recommended Reading: How Accurate Is Creditwise Credit Score

What Is A Good Vantagescore

FICO’s competitor, VantageScore produces a similar score using the same credit report data from the three bureaus.

A good VantageScore lies between 661 and 780, which the company calls a “prime” credit tier. VantageScores above 780 are considered “superprime” while those between 601 and 660 are “near prime.” VantageScores below 600 are considered “subprime.”

The average VantageScore 3.0 in July 2021 was 693.

What Is Credit Monitoring

Credit Monitoring can even help prevent against fraud and identity theft, according to the Government of Canada. You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach, recommends an article on the Canada.ca website. This can help you see if somebody is trying to apply for credit in your name.

You May Like: Paypal Credit Report

Take Responsibility For Your Credit Score

As you can see, taking action and being responsible in your 20s can help you build your credit over time. So, refer back to this guide and start improving your credit score now. And, just think: This will help you land that apartment, buy a new car, or get your first rewards credit card. Are you ready to improve your credit score in your 20s and start adulting?

This page is for informational purposes only. Chime does not provide financial, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for financial, legal or accounting advice. You should consult your own financial, legal and accounting advisors before engaging in any transaction.

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

Recommended Reading: What Credit Score Does Carmax Use

Tips To Get A Perfect Credit Score

The first thing to keep in mind is that obtaining a perfect credit score takes time.

Its rather easy to remove negative items from your credit report and get a better score, but a perfect score is another story.

Now, assuming you dont have any negative items on your credit report like late payments or a collections account, lets get into the more advanced credit behavior youll need to learn and put into practice.

Keep in mind that all of the steps outlined below are based on my personal experience, not random advice Ive read on the internet.

What Are The Average 759 Credit Score Car Loan Rates In 2021

For those that have excellent credit scores, they can ensure that they will qualify for just about any type of loan that they wish to take out, whether it is an auto loan or a mortgage. Personal loans are also something that are easier for them to borrow with such a high credit score. It is important to provide proof of your income when applying for any loan, though.

| FICO Credit Score |

|---|

| 3.34% |

All the calculation and examples below are just an estimation*.Individuals with a 759 FICO credit score pay a normal 3.4% interest rate for a 60-month new auto loan beginning in August 2017, while individuals with low FICO scores were charged 14.8% in interest over a similar term.

So, if a vehicle is going for $18,000, it will cost individuals with excellent credit $326 a month for a sum of $19569 for more than five years at 3.4% interest. In the meantime, somebody with a lower credit score paying 14.8% interest rate without an upfront installment will spend $426 a month and wind up burning through $25584 for a similar auto. That is in excess of a $6015 distinction.

The vast majority wont fall in the highest or lowest class, so heres a breakdown of how an extensive variety of FICO scores can influence the aggregate sum paid through the span of a five-year loan:

| FICO Range | |

|---|---|

| $7,582 | $25,584 |

You May Like: How To Get Credit Report Without Social Security Number