Who Can Access My Credit Report

Your credit report is a private document and is not available for anyone in the public domain. The only people who can access your report is you and the lender to whom you apply for credit.

Your lender can access your credit report only when you have submitted an application to credit like a loan or a credit card. In no other circumstances can the lenders gain access to your credit report.

Also if you take up Credit Improvement Service, the authorized agent may access your credit report but again it will be needed to be authorized by you.

Off late, some employers also ask for credit reports to be submitted for verification, however, these will have to be provided by you. Your employer would not have access to your Credit report.

How To Get Free Credit Reports From Each Of The Three Credit Bureaus

The Fair Credit Reporting Act requires each of the three credit bureaus to provide consumers with one free credit report per year. Federal law also entitles consumers to receive free credit reports if any company has taken adverse action against them. This includes denial of credit, insurance or employment, as well as other reports from collection agencies or judgments. But consumers must request the report within 60 days from the date the adverse action occurred.

In addition, consumers who are on welfare, unemployed people who plan to look for a job within 60 days and victims of identity theft are also entitled to a free credit report from each of the credit bureaus.

How Do Public Records And Judgments Impact Fico Scores

Public records are legal documents created and maintained by Federal and local governments, which are usually accessible to the public. Some public records, such as divorces, are not considered by FICO® Scores, but adverse public records, which include bankruptcies, are considered by FICO® Scores. FICO® Scores may be affected by the mere presence of an adverse public record, whether paid or not. Adverse public records will have less effect on a FICO® Score as time passes, but they can remain in your credit reports for up to ten years based on what type of public record it is.

Recommended Reading: How To Obtain A Free Credit Report

Apply For A Card That Fits Your Credit Score

Always check your credit score before applying for any kind of credit if you dont know what your credit score is. You may want to check your credit report too for inconsistencies. This way, if you catch an error, you will be able to contest and get it rectified, leading to a rise in your credit score. Naturally, this will lead to better credit card offers as well. That is why it makes for a good habit to periodically check your credit score.

Knowing your credit score will also give you some idea of the types of cards that you can apply for. You can check your credit score online through our website, as well as get a free credit report.

Once you know your credit score, start shopping around for credit cards within your credit score range. You can enter your details on our websites and check which cards you qualify for to avoid unwanted rejections which may affect your credit score.

Other factors taken into account while applying for a credit card are:

- Your income

- Your debt levels

Its important to keep in mind that credit score is just one way that banks asses you. Your income is also taken into account and so is your current debt levels while assessing your application. Just because you may have a lower credit score doesnt mean that you will be straightaway rejected. For instance, if you have a lower credit score but a higher income, your application may be accepted. This is because your repayment strength is higher, and the lender may view you favorably.

Why Do Fico Scores Fluctuate

There are many reasons why your score may change. The information on your credit report changes each time lenders report new activity to the credit bureau. So, as the information in your credit report at that bureau changes, your FICO® Scores may also change. Keep in mind that certain events such as late payments or bankruptcy can lower your FICO® Scores quickly.

FICO® Scores consider five main categories of information in your credit report.

- Your payment history

- Types of credit in use

Also Check: How Long Does A Repo Stay On Your Credit Report

What Is A Credit Score

Checking your credit report is an important part of maintaining your financial health. It’ll allow you to pick up on any mistakes – or even fraudulent applications – that could hinder your chances of getting credit.

There’s no such thing as a universal credit score. Each lender has its own system in place to decide whether or not to accept you as a customer, meaning you could be turned down by one, but successful with another.

To give you a better idea of how your application might be viewed by lenders, credit reference agencies produce their own version of your credit score.

The higher this number, the higher your chances of getting the best credit deals – but a good score from a credit reference agency is no guarantee that your application will be successful.

And confusingly, each credit reference agency uses a slightly different scale. For example, a score of less than 560 is ‘very poor’ with Experian, but ‘excellent’ with Equifax.

What Are Fico Scores

FICO® Scores are the most widely used credit scores and are used in over 90% of U.S. lending decisions. Your FICO® Scores are based on the data generated from your credit reports at the three major credit bureaus, Experian®, TransUnion® and Equifax®. Each of your FICO® Scores is a three-digit number summarizing your credit risk, that predicts how likely you are to pay back your credit obligations as agreed.

Read Also: Is 530 A Bad Credit Score

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

How Will I Know If My Fico Score Is Available

If your account is eligible, the link to View Your FICO® Credit Score will automatically display on your Account Summary screen. Just select the link to opt in and view your FICO® Score.

Note: You can also access your FICO® Score in Spanish with your smartphone.

- Direct your mobile browser to wellsfargo.com or download the Wells Fargo Mobile® app.

- You can update your setting any time on the Language Preference screen. Just sign on to your account, go to the Profile and Settings menu, and select Language Preference.

Recommended Reading: Does Klarna Show Up On Credit Report

How Does Applying For New Credit Impact My Fico Score

Applying for new credit only accounts for about 10% of a FICO® Score. Exactly how much applying for new credit affects your score depends on your overall credit profile and what else is already in your credit reports. For example, applying for new credit may have a greater impact on your FICO® Scores if you only have a few accounts or a short credit history. That said, there are definitely a few things to be aware of depending on the type of credit you are applying for. When you apply for credit, a credit check or inquiry can be requested to check your credit standing.

If you don’t see the answers to your questions:

Important Disclosures And Information

Bank of America credit cards are issued and administered by Bank of America, N.A. Better Money Habits, Merrill Lynch, U.S. Trust, Bank of America and the Bank of America logo are registered trademarks of Bank of America Corporation. All other company and product names and logos are the property of their respective owners.

Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. Message and data rates may apply.

You May Like: How Long Do Late Payments Stay On Your Credit Report

Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

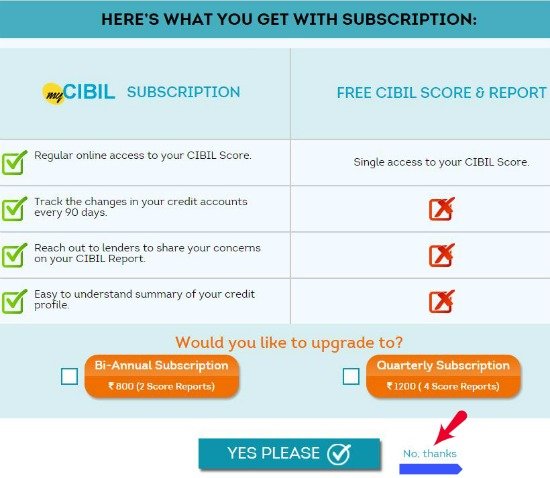

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

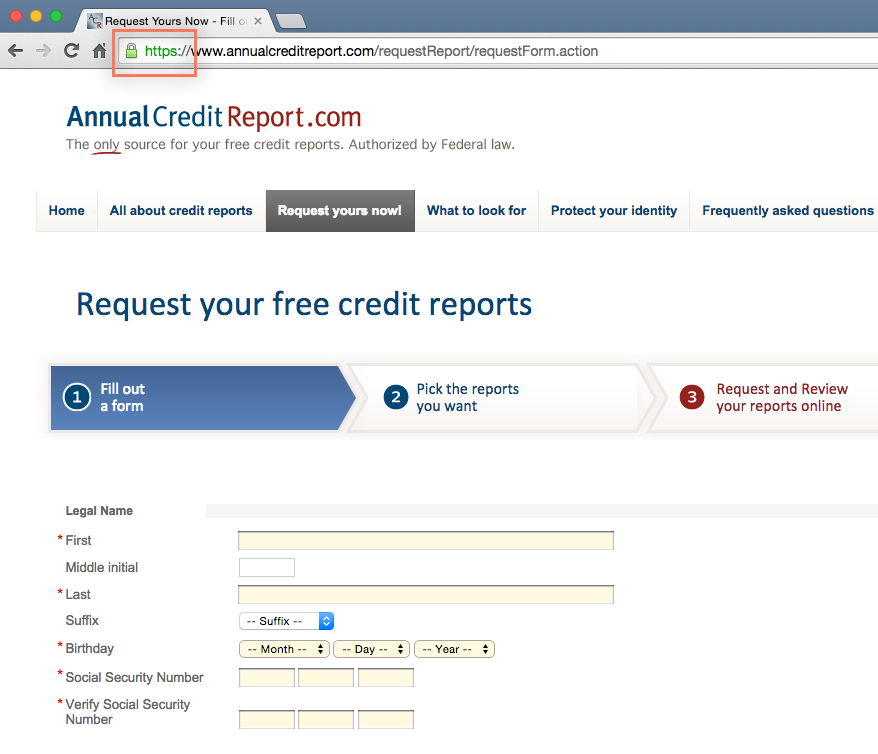

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

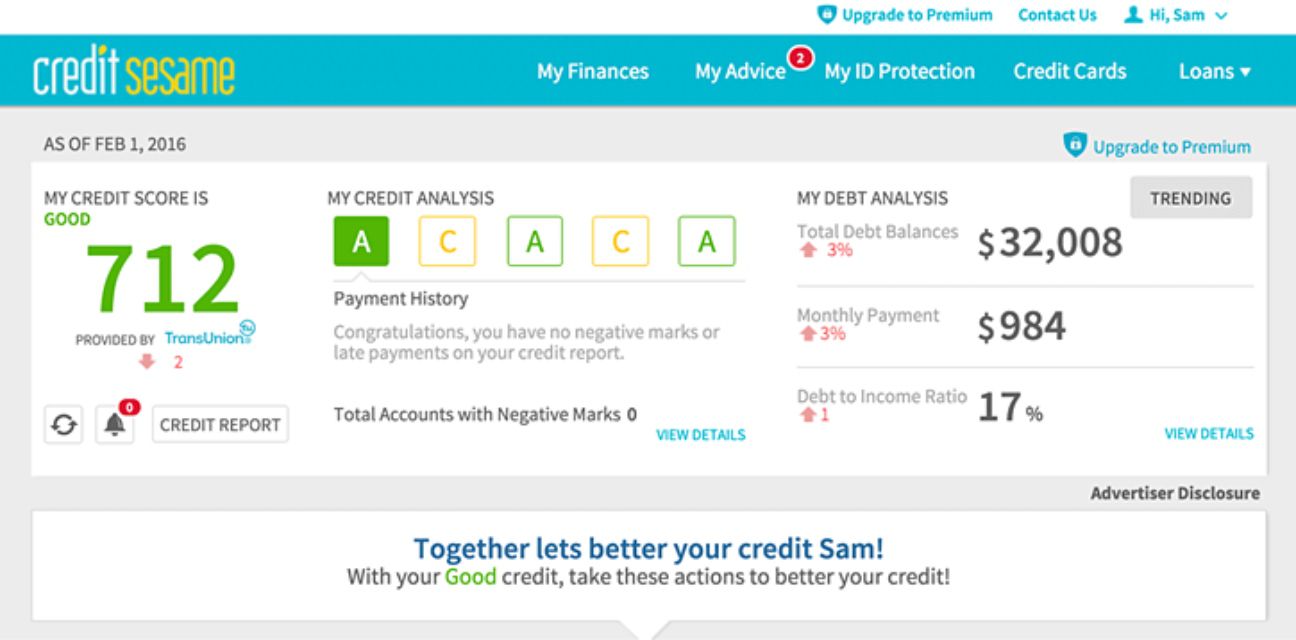

See Your Latest Credit Information

See the same type of information that lenders see when requesting your credit.

Your Credit Report captures financial information that lenders use to determine your creditworthiness. This includes the type of credit accounts, current balances, payment history, and any derogatory items you may have. You will also get a summary of your account totals, total debt, and personal information.

Also Check: What’s The Best Way To Check Your Credit Score

Where Is Wells Fargo Getting This Score

We will obtain your FICO® Score that is calculated from information in your Experian® credit report. The score provided under this service is intended for educational purposes. The FICO® Score reflects a general snapshot of your credit profile at a specific point in time and can vary month-to-month. Obtaining your FICO® Score results in a “soft inquiry” at the consumer reporting agency and does not affect your credit score.

What Affects My Credit Score

Your score will ultimately be based on how responsibly you use your credit facilities.

For example, you lose 130 points with Experian if you fail to pay a bill on time but will gain 90 points if you use 30% or less of your credit card limit.

Like lenders, each credit reference agency has its own system for assessing your creditworthiness and will take into account different factors when calculating a score.

However, certain things will have a negative impact on your score regardless of the agency – for example, not being on the electoral roll, or making a late payment.

Bear in mind that the timing of entries in your report is more important than the type of activity.

Lenders are most interested in your current financial circumstances, so a missed payment from a few years ago is unlikely to scupper your chances of getting credit.

Also Check: What Credit Score Do Apartments Look For

How Insurers Use Medical History Reports

When you apply for insurance, the insurer may ask for permission to review your medical history report. An insurance company can only access your report if you give them permission. The report contains the information you included in past insurance applications. Insurers read these reports before they’ll approve applications for:

- life

- disability insurance applications.

Loan Restructuring May Affect Credit Score And Eligibility

The Reserve Bank of Indias had permitted financial institutions to provide a loan restructuring scheme to borrowers of loans in order to help mitigate financial challenges in light of the Covid-19 pandemic. This would help borrowers to pay off their Equated Monthly Instalments in a way that was more feasible and affordable to them.

The loan restructuring was a one-time measure after the end of the 6-month moratorium that was offered from March to August 2020. The RBI has allowed financial institutions to report these loans to credit bureaus as ‘restructured’ while maintaining them as ‘standard’ in their own loan books. This was meant to help lenders to lower their Non Performing Assets . However, restructured loans often have a negative impact on the credit scores of borrowers. This usually affects the eligibility when applying for future loans as well.

However, it is not yet clear how this restructuring will affect the credit scores of borrowers. Restructured loans may also have higher interest rates, which will depend on the lender. The interest lost by the lender during the period of restructuring of the loan may also be added to the principal amount, which will further increase the outgo of interest for the borrowers.

6 October 2020

Recommended Reading: What Date Does Capital One Report To The Credit Bureaus

What Do I Need To Sign Up For A Credit Karma Account

In addition to creating a username and password, Credit Karma may ask you for your Social Security number. This information allows us to confirm your identity with the consumer credit bureaus to ensure that we show you accurate data.

You must be at least 18 years old to sign up for a Credit Karma account.

Minimum Credit Score For Business Loan Eligibility

There is no minimum credit score requirement for a business loan. But for specific types of loans, lenders strongly prefer to see your credit score. There are no hard and fast rules for having a particular credit score number. Each and every lender will have a different range for determining your creditworthiness. Hence, there are no specific credit score numbers that you really need to have. But it helps to have a good credit score.

Every loan application is evaluated on a case-by-case basis, and every borrower is approved or denied based on a combination of aspects they have mentioned in their application. But assuming your other credentials meet the lenders other standard requirementssuch as, for instance, annual profits and time in businessthen possibilities are that you could be approved even if you dont have a favorable credit score.

Having said that, there are minimum credit scores you should aim to have in order to make your chances of approval high.

Read Also: Does Experian Boost Report To All 3 Credit Bureaus

Indias Cut In Credit Rating

Indias credit rating has moved one step closer to junk after Moodys Investors Service had downgraded the country to a low investment grade level and had also surprised the economists.

Moodys had reduced the long-term foreign-currency credit rating to Baa3 from Baa2, and this implies that it can get cut further. This action brings it in par with the BBB- assessment from Fitch Ratings Ltd and S& P Global Ratings. The economy is now facing a huge contraction in over four decades.

4 June 2020

How Your Credit Score Is Calculated

Your credit score is calculated based on what’s in your credit report. For example:

- the amount of money youve borrowed

- the number of credit applications youve made

- whether you pay on time

Depending on the credit reporting agency, your score will be between zero and either 1,000 or 1,200.

A higher score means the lender will consider you less risky. This could mean getting a better deal and saving money.

A lower score will affect your ability to get a loan or credit. See how to improve your credit score.

Also Check: Can You Check Your Credit Score Without Affecting It

How To Sign Up For Infoalerts

Your TransUnion Credit Score is provided by TransUnion Interactive, Inc. and is brought to you by Scotiabank at no additional charge. Accessing your TransUnion Credit Score will not impact your Credit Score. Scotiabank is not responsible for the TransUnion Credit Score or any of the information provided to you through TransUnion’s Credit Score services.

To access your TransUnion Credit Score, Scotiabank will share your personal information such as name, address and date of birth with TransUnion so that TransUnion can identify you and provide your Credit Score. Your information will not be used or disclosed by TransUnion for any other purposes.

The TransUnion Credit Score service is subject to certain terms and conditions that can be viewed here Terms of Use.

How To Get A Free Credit Score

There are several third-party services online that provide Canadians with a free copy of their credit score, and most require no more than a few minutes investment. Generally, theyll ask you to sign up for an account before you can obtain your score, which requires your email and a password. After creating an account, these services will request some additional details to verify your identity and make a matching request from credit bureaus.

Recommended Reading: Which Credit Score Is Accurate

Enter Your Personal Information

Once youre on the correct website, click on the button near the top of the page or bottom left that says, Request your free credit reports. Afterward, click on the button with the same words below the line that reads, Fill out a form. Finally, complete the form by entering your name, birthdate, current address and Social Security number .

If you havent lived at your current address for at least two years, youll have to enter your previous address, too.