Poor Credit Scores From Fico

FICO considers a credit score to be poor if it falls below 580. According to FICO, a person with a FICO score in that range is viewed as a credit risk. Why? Their research shows that about 61% of those with poor credit scores end up delinquent on their loans.

This level of risk could make it difficult to get approved for credit cards, mortgages, car loans and more. A poor score can come with other consequences too. For example, you may need to pay a fee or put down a deposit to get a credit card or home utilities.

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page.

How To Earn An Excellent/exceptional Credit Score:

Borrowers with credit scores in the excellent credit range likely haven’t missed a payment in the past seven years. Additionally, they will most likely have a credit utilization rate of less than 30%: meaning that their current ratio of credit balances to credit limits is roughly 1:3 or better. They also likely have a diverse mix of credit demonstrating that many different lenders are comfortable extending credit to them.

You May Like: Can I Check The Credit Report Of A Deceased Person

Regularly Read Your Reports

Since your credit score is based off of the information in your credit report, take time to review your reports regularly. You want to be sure everything is an accurate, true reflection of your financial story. As you become more comfortable reading and understanding the data in your report, the easier it is to identify which information is potentially causing changes in your credit score.

To help you understand your credit report, weve created an interactive guide that breaks down each section and explains how the information may impact your credit score.

Disclaimer: The information posted to this blog was accurate at the time it was initially published. We do not guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit transunion.com. This site is governed by the TransUnion Interactive privacy policy located here.

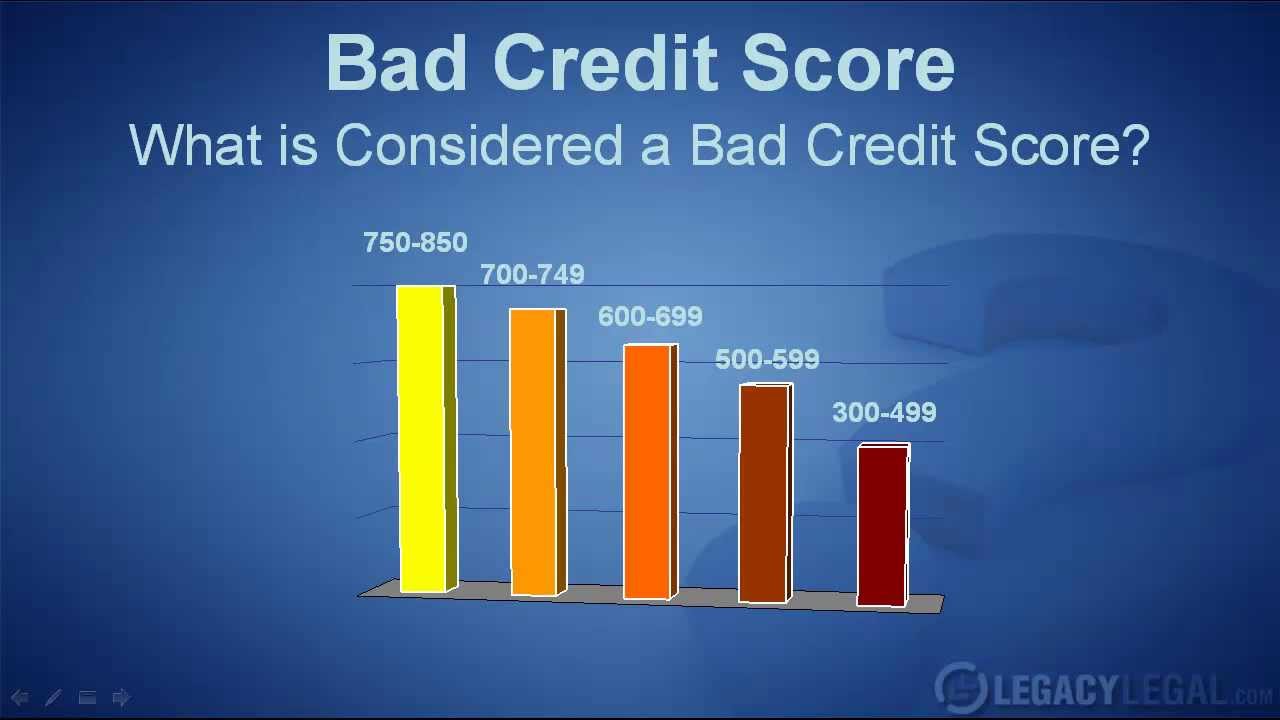

What Is Considered A Bad Credit Score How Can I Fix It

Experts typically define a bad credit score as anything under 600. Find out more about poor credit scores and what you can do to raise them.

WHAT IS YOUR CREDIT SCORE · Perfect Credit · Excellent Credit · Good Credit · Fair Credit · Poor Credit · Very Poor

Apr 18, 2019 What is a bad credit score? Scores within this range are considered poor, and improving them should be a top goal.Best For: No monthly maintenance fee: Best For:

Read Also: Is 694 A Good Fico Score

Where Can I Find Out My Credit Score

When you request a copy of your credit report, youll see your financial history listed out over several pages . However, you wont get your actual credit score when you order your report.

Lenders look at both pieces of information to determine your loan offer, so its essential to know where you stand in terms of both your credit report and credit score. So how can you get your credit score?

What Is Considered A Bad Credit Score

A credit score is considered to be bad if its below 660. Banks and other lenders refer to people with a low score as subprime which defines someone who they think will struggle to pay back loans.

Having a bad credit score means you may be a high-risk borrower. If youve failed to make repayments on loans or credit cards in the past your score will decrease.

Don’t Miss: Suncoast Credit Union Truecar

Is Your Credit Score Average For Your Age

Given that younger borrowers may not have a long history of credit to drive their credit score up, it shouldn’t be surprising that average credit scores for American borrowers improve throughout their lifetime. As borrowers mature, they also become more aware of the factors that drive credit score improvement and are motivated to increase their scores to allow home purchases and other large investments that require loans or lines of credit.

What Is An Excellent Credit Score Range

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

You May Like: How To Fix A Repossession On Your Credit

What Are The Penalties

Having bad credit often indicates that you are a more risky borrower, which can make it harder to get approved for new credit cards, a mortgage, or other loans. If you are approved, you may be offered only a high interest rate or other unfavorable terms.

Bad credit can impact other areas of your life as well. If you have bad credit, landlords may not accept you as a renter, or may only agree if you have a co-signer. It can even make it harder for you to get a job if your potential employer checks your credit score as part of your job application.

A good credit score shows youre a dependable borrower, which makes lenders more willing to have a relationship with you and give you funds. Consumers with very good and exceptional credit scores have better odds of loan, rental, and mortgage approval. They can choose from a wider selection of credit cards and loans with more favorable interest rates.

Most businesses that check credit scores are easier to work with when you have a good credit score.

The Highs And Lows Of Credit Scores

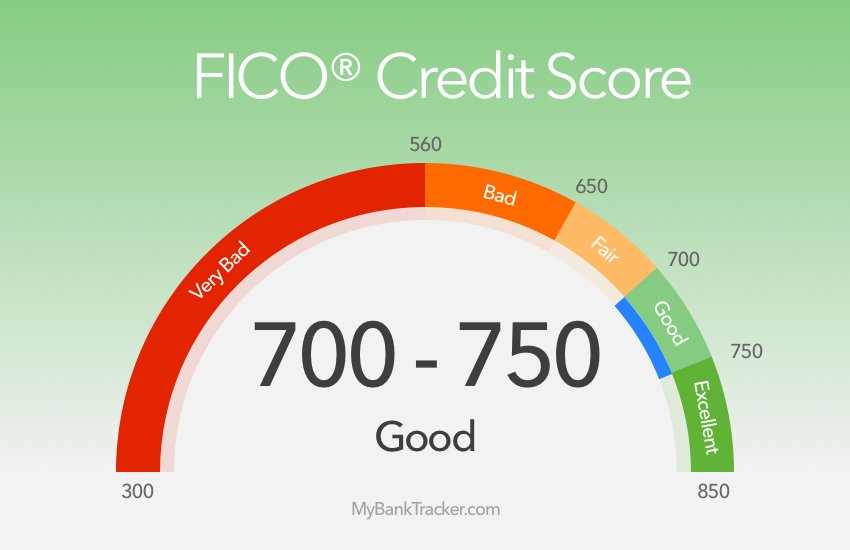

The most commonly used credit scores are calculated by FICO® and VantageScore®, but the two companies rank scores a little differently.

| FICO® 8 | |

|---|---|

| Very Poor | 300-499 |

To complicate matters, lenders may choose from multiple scoring models and industry-specific scoring models, which makes it tricky to know which one youre being evaluated on. And your credit scores vary-yes, you have multiple scores.

A score in the 600s is typically high enough to qualify for some loans and credit cards. And generally, the best rates go to borrowers with scores in the mid-700s and above.

Whats the nationwide average? Good. As of this writing, Americans had an average FICO Score of 711 and VantageScore of 688.

Recommended Reading: 671 Credit Score Good

What Is Your Credit Score

The most common credit score range is 300 to 850. In other words, 850 is the best credit score you can have, while 300 is the worst. And a good credit score is anything from 700 to 749. All of the most popular credit-scoring models, including those from VantageScore and FICO, now use that 300-to-850 credit score scale. Thats good because knowing the possibilities for what a credit score could be is the first step toward truly understanding what your credit score means.

To help you better understand the significance of your score, whichever it happens to be, WalletHub analyzed every single credit score from 300 to 850. Below, you can take a closer look at the different tiers in the credit score range, learn everything you need to know about your particular score, and see what steps you can take to improve.

What Is Considered As A Poor Credit Score

According to Capital One, a FICO score that falls below 580 is considered to be a poor credit score. Lower credit scores can make it difficult to get approved for credit cards or loans as approximately 61 percent of those with low credit scores fall behind on their loans11.

Come up with a credit card debt or loan repayment plan to reduce debt and credit utilization, look for accounts that build credit, and find other ways like Experian Boost to improve your score if you have negative items contributing to your bad credit.

Experian also offers free credit score checks to help you stay on top of your score and payment history. Your credit card balance doesnt have to stop you from moving forward financially.

Don’t Miss: Uplift Pulls Which Credit Bureau

How To Go From Good To Great

To borrow from Leo Tolstoy, all great credit scores are alike, but all bad credit scores are bad in their own way. That is, ideal credit scores are built on a similar set of healthy financial habits, but your scores can be damaged by any number of factors. There are many different issues that can hurt your credit, such as:

Late or missed payments. Too many open credit accounts. High credit card balances. High balances on loans. Too many credit applications.

The first step toward improving your credit health is avoiding getting trapped in the highs and lows of managing your credit.

Heather Battison, vice president of TransUnion Canada explains how consistency is key: The most important factor for building and maintaining your scores is to pay your bills on time and in full each month. This activity demonstrates your ability to responsibly manage credit and can positively impact your credit scores.

Its also key to remember that your payment history isnt just about paying your credit card bill. It also includes things like your cellphone bill, says Trevor Gillis, associate vice president of account management at TD Credit Cards.

Gillis says building good credit scores is based on using your credit card responsibly, which means making at least the required monthly minimum payment , making your payments by the payment due date and keeping your credit card utilization low.

Do You Have A Poor Credit Score

All three leading credit rating agencies rate credit scores five categories: excellent, good, fair, poor and very poor. Depending on your credit score, youll fall into one of these categories. The important thing to remember is that each CRA uses a different numerical scale to determine your credit score. So a score of 500 could be good, great or bad depending on which CRA its from.

|

Experian |

|

|---|---|

|

280-379 |

561-565 |

The important thing to remember is that all three agencies base their scores on similar criteria. So if you got a poor rating from one, youre likely to get a similar rating from the others.

You May Like: Factual Data Hard Inquiry

What Is A Bad Credit Score Forbes Advisor

May 21, 2021 What Is a Bad VantageScore? The VantageScore credit scoring model also has a range between 300 to 850. However, according to this model, a

What is a Bad Credit Score range? Bad credit score = 300 549: It is generally accepted that credit scores below 550 are going to result in a rejection of

What A Fair Credit Score Means For You:

Borrowers within the “fair” credit score may push interest rates higher for their lines of credit. Borrowers in this range may incur higher charges associated with a loan or line of credit. It may be difficult to obtain a 30-year mortgage at the lower end of this range and you may expect higher interest rates. Auto loan APRs may have higher rates and credit cards may have lower limits and higher APRs.

Don’t Miss: Affirm Financing Credit Score Needed

Things You Need To Know About Bad Credit Scores And How It Is Considered To Become One

Poor credit, more known as bad credit, refers to a persons history of not paying bills on time, as well as the probability that they will do so in the future. A low credit score is often the result. Individual lenders and card issuers describe what constitutes a weak credit score.

Every lender makes their own choices about the risks they are willing to take when extending credit. Below, you will see an approximate.

Tips To Improve A Bad Credit Score

If you’re having trouble getting approved for a credit card or loan, you have options to work towards building your credit score.

Consider the following tips:

- Become an authorized user on someone else’s account, and make sure the other user is someone who is responsible with credit.

- Get a cosigner who has great credit. The lender will consider your cosigner jointly responsible for any debt.

- Open a secured account. You can put cash in an account and the issuer will allow you to borrow up to a certain percentage of the money.

- Work to pay off your debt and keep balances low.

- Keep unused credit cards open.

Recommended Reading: Does Carmax Work With Poor Credit

Paying Attention To Revolving Debt

Part of your credit score depends on the amount of credit you have relative to the amount youre using. This is known as your credit utilization ratio.

Its generally a good idea to use no more than 30% of your total available credit.

The CFPB says that paying off credit card balances in full each month helps to keep the ratio low and strengthen a credit score.

Your Credit Scores Are An Important Aspect Of Your Financial Profile

They may be used to determine some of the most important financial factors in your life, such as whether or not youll be able to lease a vehicle, qualify for a mortgage or even land that cool new job.

And considering 71 percent of Canadian families carry debt in some form , good credit health should be a part of your current and future plans.

High, low, positive, negative theres more to your scores than you might think. And depending on where your numbers fall, your lending and credit options will vary. So what is a good credit score? What about a great one? Lets take a look at the numbers.

You May Like: Does Klarna Financing Report To Credit Bureaus

Percent Of Credit Files That Dont Qualify For A Fico Score

The Ascent reports that data released in 2019 found 11 percent of Americans dont qualify for a FICO credit score5.

In order to qualify for a FICO score, you must have:

- At least one credit account that has been open for at least six months

- At least one account that has reported to credit bureaus within the past six months

- No deceased status on your account6

If you share a credit card or other types of credit with someone who has passed, this may account for the deceased status thats preventing you from receiving a FICO score on your credit report. Watch your credit with a credit reporting agency like Experian to report this.

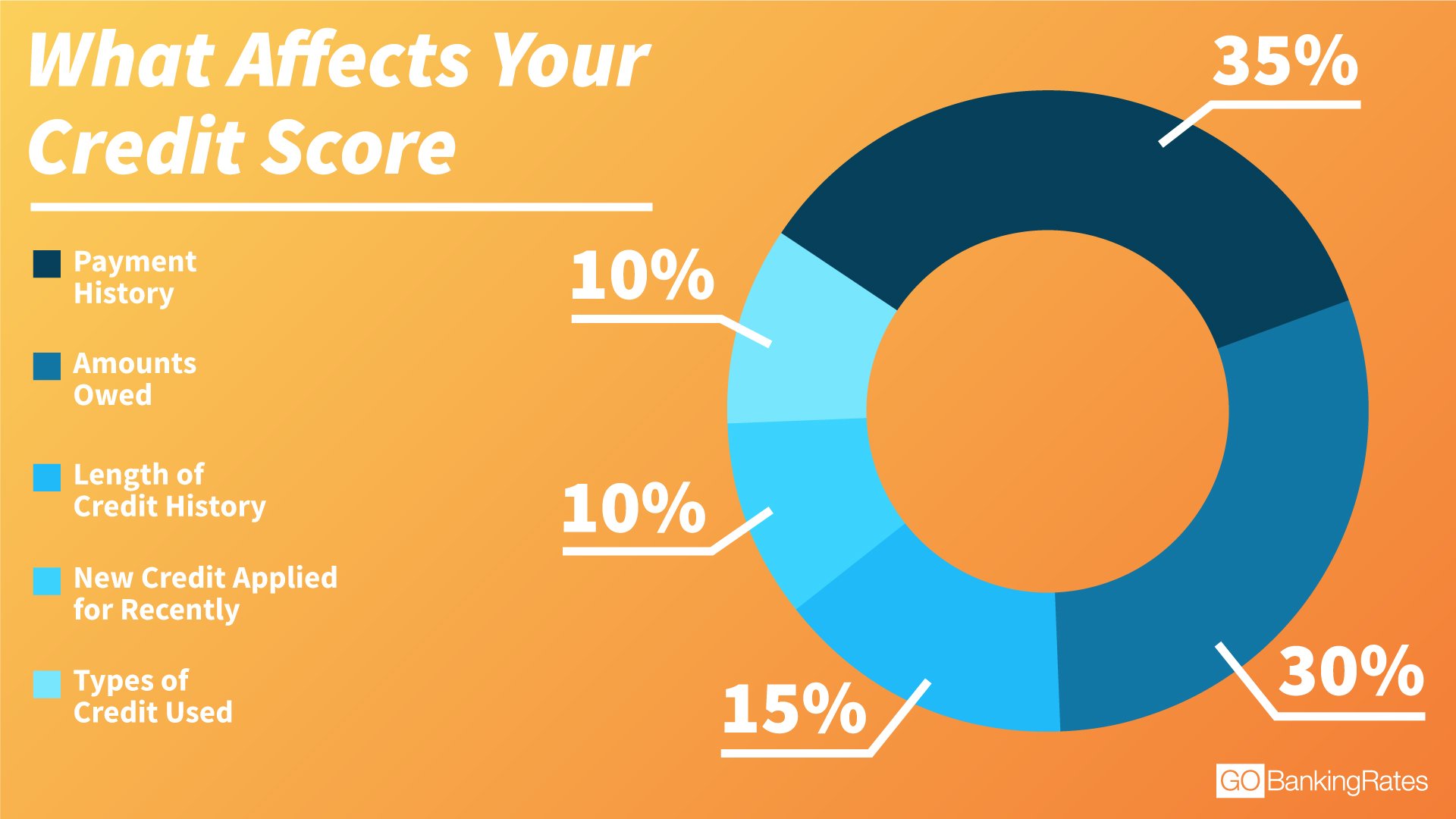

What Causes A Bad Credit Score

There are various factors that make up your credit score, all of them unique to you and as an accumulation of your financial habits. Typically, bad credit scores are due to factors such as:

Poor Payment History

Your payment history is the biggest factor that impacts your credit score, making up around 35% of your score.Missing one bill payment can decrease your credit score by as much as 150 points, according to Borrowell internal data. A single late payment could prevent you from qualifying for prime credit cards, low-interest loans, and attractive mortgage rates.

Lenders look at your credit score when qualifying you for products. Late payments will impact your credit score and raise red flags to lenders. In order to keep your credit score healthy and maintain your financial reputation, itâs important that you stay on top of your bill payments.

The key takeaway is that the longer a bill goes unpaid, the more potential damage it can have on your credit score.

High Credit Utilization Rate

Credit utilization is another important factor that affects your credit score. Your credit utilization rate determines around 30% of your overall score. Simply put, your credit utilization rate is how much credit you have used up compared to the total amount of credit available to you.You should always aim to keep your credit utilization rate below 30%.

Here is a four-step process you can take immediately to calculate your credit utilization rate:

Also Check: What Credit Score Is Needed To Buy A Car At Carmax

Ways To Help Improve Bad Credit Scores

With time, credit scores can improve. In general, you can help yourself by committing to responsible credit use and good financial habits. Here are some strategies that might help: