You May Have No Credit Scores Even If You Have Open Accounts

The number of active accounts on your report is a factor in calculating your scores. Most scoring models look for activity within the last two years. If youve had credit in the past but no longer use credit cards, or you have closed accounts on your report, there wont be recent activity to produce a score for you.

And even if you have recent credit activity, you still may not have scores if your lenders dont report to the bureaus. Lenders might only report to one bureau, two bureaus or none at all, but they arent required to report to any of them. If you have an open account that isnt reported to a particular bureau, you wont see it on that bureaus credit report.

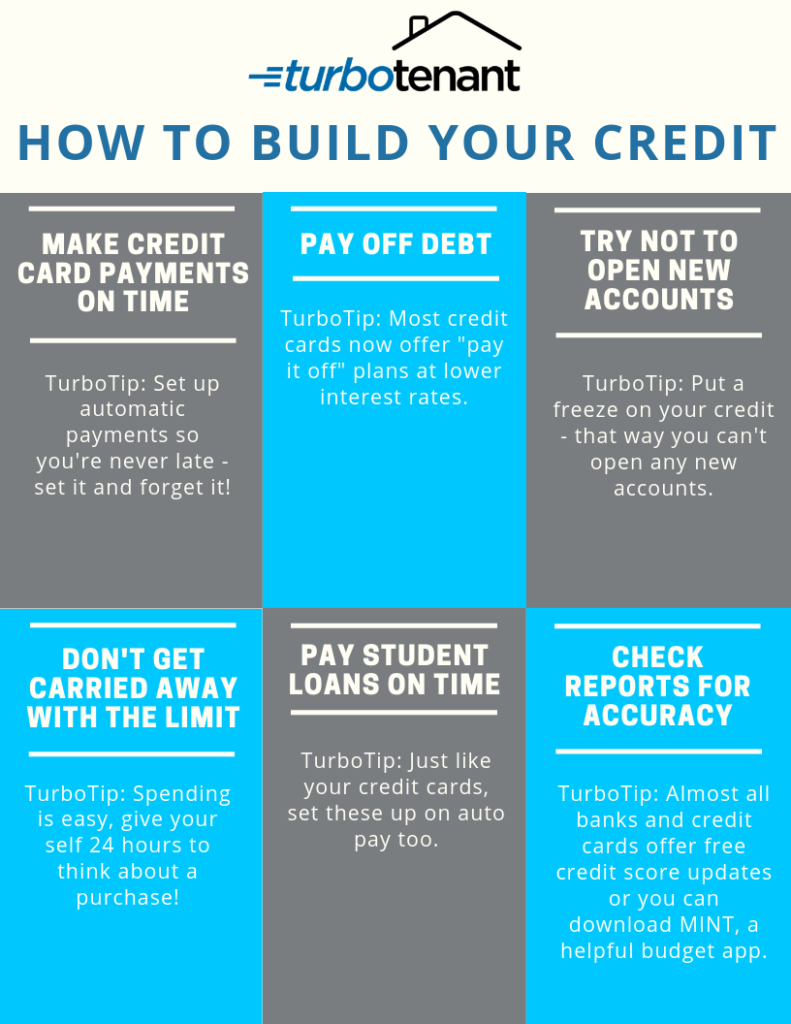

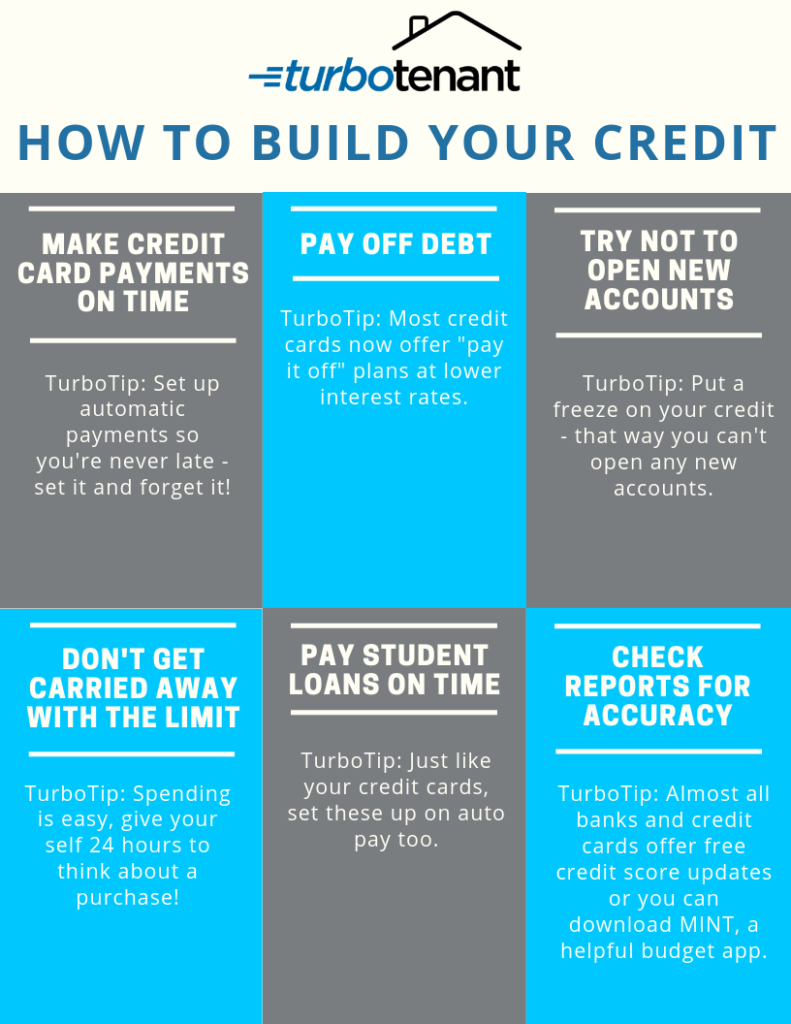

If you want to build your credit, before you apply for any type of credit, be sure the card issuer or lender reports to all three major bureaus. If your lenders dont report your on-time payments to all three of these bureaus, potential lenders wont see the healthy credit habits youve established.

What Are The Benefits Of 850 Credit Score

Everyone dreams of having an 850 credit score. Its the highest score possible under most FICO scoring formulas. Its been listed as one of the most common wishes that American adults would make. Get to know the benefits of 850 credit score?

Very few people in the United States actually have a credit score of 850, though. So we set out to answer the question: what does an 850 credit score actually get you? But first, lets break down some information about credit scores and why an 850 is so good.

Also Check: Paypal Credit Score Requirement

My Income Impacts My Credit Score

False. Your salary and income are considered measurements of your capacity to pay bills, not your potential credit risk.

“Income isn’t even on your credit reports so it can’t impact your score,” Ulzheimer says. “Wealth metrics aren’t considered by credit scoring models.”

While it’s good to know that the size of your paycheck has no influence on whether you have good or bad credit, you should know what does impact your score. Variables include your payment history, amounts owed , length of credit history, new credit and credit mix .

Don’t Miss: How To Remove Repos From Credit Report

How Your Credit Score Affects You

Suppose you want to borrow $200,000 in the form of a fixed rate thirty-year mortgage. If your credit score is in the highest category, 760-850, a lender might charge you 3.307 percent interest for the loan.1 This means a monthly payment of $877. If, however, your credit score is in a lower range, 620-639 for example, lenders might charge you 4.869 percent that would result in a $1,061 monthly payment. Although quite respectable, the lower credit score would cost you $184 a month more for your mortgage. Over the life of the loan, you would be paying $66,343 more than if you had the best credit score. Think about what you could do with that extra $184 per month.

Why Is Having A High Credit Score Important

While its not necessary to have an 850 score, its important to maintain a high credit score. This will make it easier for you to buy a home, purchase a car and even get a job.

Your credit score shows your history of repaying your debts and making your monthly payments on time. If you have an excellent or even perfect credit score, the lender assumes youre not a risky investment because they assume that you will treat new credit as you have credit in the past and pay it back responsibly.

But, if your credit history shows that you dont pay your bills on time, some lenders may be hesitant to extend you a line of credit. They may be more concerned that this pattern will repeat itself, and they will be out that money.

Many workplaces are increasingly looking to hire employees with high credit scores. Thats because a good credit score demonstrates a history of financial responsibility.

You May Like: Kroll Factual Data Complaints

What Does Age Have To Do With Credit Score Fluctuation

Typically, the younger the age group, the lower their average credit scores are. However, this doesnt necessarily mean that young borrowers are bad with money or irresponsible with their . So, what else could be the cause of a such a low average among the younger crowd? Well, there are several key factors that cause your credit score to rise and fall in various ways.

Payment History

As we said, younger people are not necessarily more likely to make irresponsible credit transactions than older people. However, at one point or another, weve all missed a few credit card payments, especially when we were in the 18-25 age group and were still learning how to use them properly. Before we discovered the benefits of things like online banking and automatic payments, that is.

Debt Owed

Since the amount of credit debt you carry also plays a key role in the calculation of your credit score, its no wonder age becomes a factor. As we said, your payment history can be affected by how expensive and manageable your credit products are. Simply put, the more unpaid debt you carry, the lower your credit score may be. Once again, the way age becomes a factor here could be because the younger you are, the more you tend to spend and the less income youll be making to counteract it. However, it could also be because the older you get, the more significant your debts will become. After all, whats a few hundred dollars worth of credit card bills, compared to a $350,000 mortgage?

New Credit

A Perfect Credit Score Doesn’t Really Matter

True. While it would be fun to say you are in the elite 850 club, there are no additional benefits of having a perfect score. No loan and credit products exist that are only available for people with perfect scores, and once you reach a certain score, you pretty much get all the same benefits anyways.

“If you have a 760 or above, you’ll likely qualify for the best deals on everything,” Ulzheimer says.

Also Check: Carvana Down Payment Bounced

Become An Authorized User

If a spouse or family member can add you as an authorized user on a card, you have an opportunity to start building credit. Keep in mind that as an authorized user you wonât be solely responsible for paying the bill, so make sure to coordinate accordingly.

Also, others may be reluctant to add you if you have a history of questionable money mistakes. In that case, see if you can be added as an authorized user but not actually get the physical card to spend on. This move can also affect your score negatively if the person fails to pay a bill, so partner up with someone who is money smart.

Monitor Your Credit For Progress

Monitoring your credit score is always a must whether youre concerned about unusual activities in your account or when youre trying to work towards a better credit rating.

You can get a free credit report from each credit bureau every 12 months, but you can also track and monitor your progress 24/7 using products like RoarMoney.

Dont forget to check the details in your credit report and dispute errors if necessary. If your credit report lacks financial information, consider linking your rent payments to Rent Track or using Experian Boost so rent and utility payments would be considered in your FICO score.

Don’t Miss: Can You Get An Eviction Removed From Your Credit

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

A Good Credit Score Is Always Useful

As we said, a good credit score is one of the best things you can use in your day-to-day life, no matter what age group you fall into. Not only can a high score help you get the credit products you need, it also helps you save money in interest, money that can come in handy later in life. So, for the sake of your financial well being, its best to start building healthy credit early on and maintain it throughout the years.

Rating of 3/5 based on 74 votes.

You May Like: Can A Repo Be Removed From Credit Report

Paying Off Debt Increases Your Credit Score

True and false. This is true for , but not so true for installment debt, such as a mortgage or student loan. While it is good for your overall financial life to be totally debt free, you won’t see a bump in your credit score if you pay off your car loan, for example. It can actually ding your score because it means having fewer credit accounts. That doesn’t mean you shouldn’t pay off the loan, though you don’t want to pay unnecessary interest over time just to save a few credit score points.

Because credit cards usually have higher interest rates than installment loans, paying off credit card debt first can help you while also improving your score .

What Credit Score Does Everyone Start With

No one starts with a zero credit score, but its possible to have no credit score. Having a non-existent credit score could happen if:

- You have never used a traditional credit account such as credit cards and personal loans with a bank or financial institution that reports to credit bureaus.

- You are a recent immigrant. Credit scores from other countries will not count towards your U.S. credit score.

- You have no experience with credit because you are too young. This is one reason why most 18 to 19-year-olds have no credit score.

- You have not used credit for the past two years.

Recommended Reading: Credit Score Of 524

How To Get Your Experian Credit Score For Free

The largest credit reference agency offers new customers a free 30-day trial of its , which gives you access to your credit report, score, and email alerts about any changes on your file.

After the trial ends, it will cost you £14.99 a month.

You can access your Experian credit score through a free Experian account. This is designed to help people shop around to see how they can save money by comparing credit deals based on their financial profile.

Once you’ve signed up, your score will remain free to access, but unlike the paid-for CreditExpert service, you won’t be able to see your credit report.

To be able to access both your Experian credit report and score for free, you can sign up to the Money Saving Expert Credit Club.

You can also see how likely you are to be accepted for the market-leading cards and loans and work out how much you can afford to borrow.

Unlike CreditExpert, you won’t receive alerts about any changes to your report.

Myth : If I Ever Need Credit Itll Be Easy To Boost My Score Quickly

Maybe you donât want credit now, thereâs nothing wrong with that. But if thereâs one thing thatâs certain, itâs that life tends to throw up some unpredictable changes.

While you may not need credit now, you might want it in the future. Maybe youâll want a mortgage or a loan for a wedding.

To get accepted for these credit products youâre going to need a credit score.

But you canât just boost your score overnight, they can take a while to build up. If you’re starting off with no score, youâve got to build up enough credit history for there to be a record of you. And even after that it could take some time before there is enough data for credit reference agencies and lenders to make the calculations that create your credit score. If you’re looking to improve your score, this can also take a bit of time. Lenders often prefer to see a pattern of reliable behaviour over time.

So taking steps to boost your credit score now, when you donât have an immediate need for credit, can help set you up for whatever comes your way in the future.

Read Also: Chase Sapphire Preferred Score Needed

Where Does Your Credit Score Start

Having no credit history doesnt necessarily mean your credit score starts at zero. Thats because the FICO and VantageScore credit models dont go that low. Instead, the lowest possible credit score you can have with either model is 300. A score of 850 is the highest score you can achieve.

If you have no credit history at all, then you likely have no credit score. Once you begin to build and improve credit, your score may start at 300 and climb from there. So what affects your credit scores?

The short answer is that it depends on the credit scoring model. As FICO scores are most widely used by lenders, heres a breakdown of how these scores are calculated:

- Payment HistoryThirty-five percent of your FICO score is based on payment history, with on-time payments helping your score and late payments hurting it.

- Thirty percent of your FICO score is based on credit utilization, which is the amount of your available credit limit youre using at any given time.

- Fifteen percent of your FICO score is based on your credit age, which is the length of time youve been using the credit.

- Ten percent of your FICO score is based on the types of credit youre using, such as revolving credit lines or installment loans.

- Ten percent of your FICO score is based on how often you apply for new credit, which results in a hard credit check.

You can visit AnnualCreditReport.com to obtain a free copy of your credit report, which can tell you if theres enough information to generate a credit score.

I Opted In But It Says No Score Is Available Why

The most common reasons a score may not be available:

- The credit report may not have enough information to generate a FICO® Score

- The credit bureau wasnt able to completely match your identity to your Wells Fargo Online® information. To keep your information current, sign on to Wells Fargo Online®, visit the Profile and Settings menu, select My Profile and then Update Contact Information. Make sure your email addresses, phone numbers, and mailing addresses are current.

- If you’ve frozen your credit with the credit bureau, you may not immediately receive a credit score. A score should become available for you to view after the next monthly update. Contact Experian® with further questions.

Also Check: Factual Data Inquiry

Is Your Credit Score Average For Your Age

Given that younger borrowers may not have a long history of credit to drive their credit score up, it shouldnt be surprising that average credit scores for American borrowers improve throughout their lifetime. As borrowers mature, they also become more aware of the factors that drive credit score improvement and are motivated to increase their scores to allow home purchases and other large investments that require loans or lines of credit.

Read Also: How To Get Credit Report With Itin Number

Your Starting Score Isnt Your Forever Score

As you start your credit journey, remember there are ways to start positive financial habits right away to help you continue building to a better credit score.

Consider monitoring your credit to see how your most recently reported balance impacts your scores. from Capital One is a free tool that lets you monitor your VantageScore® 3.0 credit score. Using CreditWise to keep an eye on your credit wonât hurt your score. And itâs free for everyone, not just Capital One customers.

You can also get free copies of your credit reports from all three major credit bureausâEquifax®, Experian® and TransUnion®. Call 877-322-8228 or visit AnnualCreditReport.com to learn more. Keep in mind that there may be a limit on how often you can get your reports. You can check the site for more details.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

Recommended Reading: Can You Use Klarna At Walmart

Getting Approved For A Credit Card

Check credit score requirements before applying for a credit card. Some credit cards only approve people with excellent credit. Others are made especially for people with low or no credit. Here are our favorite credit cards organized by credit score requirements:

- 740 or higher:Best cards for excellent credit

What Is A Credit Score

Your credit score reflects your creditworthiness, impacting whether potential lenders would lend money to you or not. This score is based on your credit history, which comes from the following five factors:

- 35% comes from your payment history. This component shows your ability to make timely payments you will have a lower score if you miss a payment date and an even lower score for payments past due for more than 30 days.

- 15% comes from the length of your credit history. You will get a higher score if you have a long history. Having no credit history could hurt your score.

- 30% comes from your credit utilization. Credit use reflects the proportion of the money you owe versus the credit available to you. Maxed out credit cards and high loan balances could drag down your score.

- 10% is from your credit mix. Having a good mix of installment debt such as personal loans and home loans and revolving debt such as credit card debt yields a higher score for this component.

- 10% accounts for your recent credit activity. This score comes from inquiries from a new loan application and opening new accounts, which may temporarily decrease your credit score.

Also Check: Increase Fico Score 50 Points