What Information Does National Consumer Telecom & Utilities Exchange Check

The National Consumer Telecom and Utilities Exchange is a consumer reporting firm that collects consumer information such as account history and payment information from paid telecommunications, utilities and TV services. This information is useful for lenders and other financial firms who want to assess the creditworthiness of prospects who lack an extensive credit history. By analyzing this information, lenders, financial firms and employers can make safer decisions concerning people they deal with.

The NCTUE provides valuable information that services can make use of when signing up new customers. This information will help them to assess the risk of losses, unpaid dues and other problems.

What Is Nctue Account

A. NCTUE is a credit reporting agency whose membership is comprised of companies that provide services and report and share data relative to their customers’ account to aid in risk management. NCTUE maintains data such as payment and account history reported by its members.

Also question is, what does Nctue mean?

Beside above, what is exchange service center? The Exchange Service Center provides consumer services on behalf of the National Consumer Telecommunications Utility Exchange . The Exchange Service Center is operated by Equifax. At this web site, you can add, temporarily lift, or permanently remove a security freeze from your. Exchange Data Report.

People also ask, should I freeze Nctue?

NOTE: Some news outlets have reported that cell phone companies have opened fraudulent accounts using credit reports provided by the National Consumer Telecom & Utilities Exchange . We therefore also recommend freezing your credit report at NCTUE.

What is the main service provided by Equifax?

In 1999, Equifax began offering services to the credit consumer sector in addition, such as credit fraud and identity theft prevention products.

You May Like Also

Is Corelogic A Credit Reporting Agency

CoreLogic Credco is a third-party consumer credit reporting agency that provides merged credit reports to a number of mortgage lenders. These are called merged credit reports because they combine data from the single reports of the three major consumer credit bureaus: Equifax, Experian and TransUnion.

Read Also: Does Affirm Show On Credit Report

Voice Of The Consumer: What Looks Like A Scam May Not Be

This article was originally posted in 2016 as a “Voice of the Consumer” column penned by now-retired Call For Action investigator Betty Sexton. We are reposting following a resurgence of viewer calls.

A lot of you have called and emailed me about a notice you received from a group called National Consumer Telecom & Utilities Exchange.

I want to thank Ann for asking me to dig deeper into this. The letter says there’s negative information on your credit report and you can find out about it by contacting the agency. You’re supposed to call, email or write the agency and give a representative your Social Security number and date of birth.

It sounds like a scam, right? Well, it isn’t.

NCTUE is a consumer reporting agency governed by federal law, and an affiliate of Equifax, one of the three major credit reporting agencies.

The difference between NCTUE and Equifax, TransUnion, or Experian is that it is a member-owned database that deals specifically with information on cable, Internet, phone, and utility records. Companies that are members exchange information. So if you’ve had billing issues in the last 12 months with a phone, cable, Internet, gas, or electric company, that information can be shared among NCTUE members.

A customer service rep with NCTUE said thousands of letters went out to Colorado consumers. She also said, “Whenever there’s negative information for the Colorado consumers we are sending letters to those consumers to check out their credit report with us.”

Equifax Helps Credit Card Issuers Expand Access To Credit With New Insight Score For Credit Cards

Industry-Specific Credit Risk Score Leverages Both Traditional Credit Data and NCTUE Telecommunications, Pay TV and Utility Data Only Equifax Can Provide for New Decision Intelligence

ATLANTA, June 24, 2021 /PRNewswire/ — Equifax is helping credit card issuers expand access to credit with the new Insight Score for Credit Cards. This industry-specific credit risk score combines traditional credit data with differentiated data that only Equifax can provide utility, pay TV, Internet and wireless phone payment history for more than 430 million accounts from the National Consumer Telecom & Utilities Exchange . Layering NCTUE data with traditional credit information can provide a more complete financial picture of card applicants, helping lenders expand their view into consumers with little to no credit history and approve more customers who might previously have been turned down for a credit card account.

More than 30 million consumers are not scorable by credit data. By adding NCTUE data to the credit decisioning process, Equifax estimates that 5.5 million U.S. consumers would be able to move from unscorable or subprime into prime or near-prime offers. Reaching these consumers is critical to helping lenders reach new customers and foster greater financial inclusion within the U.S. economy.

For more information on Insight Score for Credit Cards, visit Equifax.com.

FOR MORE INFORMATION

Don’t Miss: How Many Years Does An Eviction Stay On Your Record

A Credit Reporting Agency You Probably Never Heard Of

May 24, 2018 | Blog Post

If you have placed freezes on your credit files at Experian, Equifax and TransUnion, no one can fraudulently open a new account pretending to be you, right? Not exactly. Freezing your files at the big three credit reporting agencies goes a long way to protecting you from identity fraud, since most major retailers and lenders check them when consumers apply for credit. Some landlords, employers and insurers also check peoples credit files. Freezing your files blocks access to that information, essentially preventing the applications from being approved. When you are applying for credit, housing, insurance or a job, simply lift the freezes temporarily and reset them when access to your credit file is no longer needed.

But not everyone checks consumers credit files at the big three. Many phone companies, for instance, rely on information about new account applicants from the National Consumer Telecommunications and Utilities Exchange . Never heard of it? I hadnt, either, until I read an article by security expert Brian Krebs. Some gas, electric, water and cable companies also use the information from NCTUE in their approval process for new accounts. If you want to prevent someone from using your personal information to get phone or utility services, you need to freeze your file at the NCTUE.

Ii The Magistrate Judge’s R & R

In their motion for summary judgment, the defendants argued that they were entitled to summary judgment because they did not invade the plaintiff’s privacy, so the plaintiff has no injury in fact and lacks Article III standing to sue and because the Insight Scores at issue in this lawsuit were not consumer reports. The R & R, however, found that the plaintiff had alleged and presented credible evidence showing an actual unauthorized disclosure of at least some of his NCTUE credit information to Equifax, and that this disclosure amounted to an invasion of privacy, which is the type of injury that Congress sought to protect through the FCRA. Accordingly, it concluded that the plaintiff had Article III standing to assert his claims. The magistrate judge also concluded that the Insight Score was a consumer report, and the fact that specific Equifax operators were not able to view any of the underlying NCTUE data that went into creating the Insight Scores did not alter the fact that Equifax obtained had proprietary credit data from the plaintiff’s NCTUE credit file and used it, in combination with Equifax’s own credit data, to generate a credit risk score as a product to be offered for sale by Equifax to the consumer and possibly third parties.

Read Also: Comenity Bank Credit Bureau

Can You Open A Bank Account If You Owe Another Bank Money

bank willopenaccountyou if youowe another bankaccountif youaccountyoubankIf you doyoubankthey willmoney5 Steps to Clear Up Your ChexSystems Record

Q What Are Nctue Data Reports And Disclosure Reports

A. The NCTUE data report is a record of all telecommunication, pay TV and utility accounts reported by exchange members, including information about a consumers account history, unpaid closed accounts and customer service applications. This information is used by other telecommunication, pay TV and utility service providers, who are members of the exchange, to assist them in the decision to extend services. The NCTUE Disclosure Report is the disclosure to a consumer of the information contained in his or her data report.

Don’t Miss: Carmax Bad Credit Finance

Place A Nctue Security Freeze

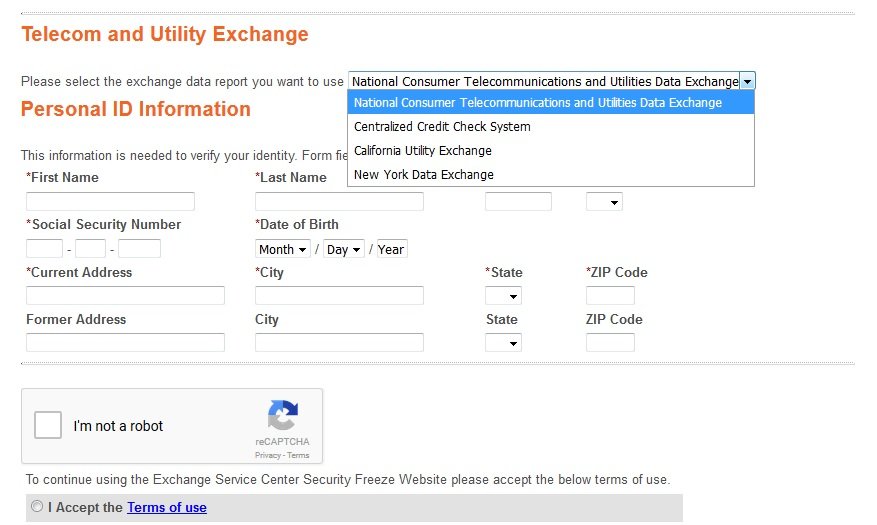

To place, request a temporary lift, or remove a NCTUE security freeze, please click here.

Depending on your state, please select the appropriate exchange data report. Make sure to unfreeze the file before applying for new utility accounts.

You can learn more about NCTUE on their website.

§For NortonLifeLock offerings provided to you by a Service Provider or through channels outside the United States, the LifeLock identity theft protection services and coverage, plan feature names and functionality might differ from the services offered directly by NortonLifeLock. Please contact your Service Provider for details on their NortonLifeLock plan offerings.

Defendants’ Belief That The Nctue Data Was Not A Consumer Report

Under the FCRA, a consumer report is “any communication of any information by a consumer reporting agency bearing on a consumer’s credit worthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living which is used or expected to be used or collected in whole or in part for the purpose of serving as a factor in establishing the consumer’s eligibility for credit or insurance to be used primarily for personal, family, or household purposes employment purposes or any other purpose authorized under section 1681b ….” 15 U.S.C. § 1681a. At issue here is the “used or expected to be used or collected” language.

The defendants’ first argument is that they reasonable believed the NCTUE datasummaries of the plaintiff’s account payment history, the number of accounts, the type of accounts, his available credit, his credit used, and the length of his credit historydid not constitute a consumer report because it was neither used nor expected to be used by Equifax for the purpose of any credit, insurance, or employment decision.

Much more on point are the cases cited by the plaintiff, Yang v. Gov’t Employees Ins. Co. , 146 F.3d 1320, 1325 and St. Paul Guardian Ins. Co. v. Johnson , 884 F.2d 881, 88485 , which both hold that, in addition to the “used or expected to be used” language, the purpose for which the information was collected also governs whether the report is a consumer report under the FCRA. Yang , id. .

Recommended Reading: Credit Check Without Permission

Defendants’ Belief That Equifax Was A Reseller Under The Fcra

The defendants next claim that their contractual agreement provides that Equifax was acting as a “reseller” with respect to its access to the NCTUE data. The FCRA defines “reseller” as a CRA that “assembles and merges information contained in the database of another consumer reporting agency or multiple consumer reporting agencies concerning any consumer for purposes of furnishing such information to any third party” but “does not maintain a database of the assembled or merged information from which new consumer reports are produced.” 15 U.S.C. § 1681a. This definition, the defendants claim, suggests that the disclosure of information from a CRA to a reseller does not require a permissible purpose under § 1681b only the disclosure of information from the reseller to a third party implicates § 1681b. They also submitted guidance from the FTC to support their position.

According to an FTC Staff Report from 2011, “a CRA may furnish a consumer report to another CRA, so that the second CRA can sell such reports to subscribers with a permissible purpose. In these circumstances, the receiving CRA must carry out the responsibilities of companies that procure reports for resale, as set forth in section 607 . If the CRA meets the definition of reseller, it must also comply with provisions imposed on resellers. “——–

The defendants’ objection to the magistrate’s conclusion that they are not entitled to summary judgment on the issue of willfulness is OVERRULED.

Is It Good Idea To Freeze Your Credit

A credit freeze means potential creditors will be unable to access your credit report, making it more difficult for an identity thief to open new lines of credit in your name. So, a credit freeze can help protect against, for example, an identity thief taking out a mortgage or other debt in your name.

Recommended Reading: Credit Monitoring Services Usaa

Q How Can I Correct Or Dispute Inaccuracies In My Nctue Disclosure Report

A. If you believe that any item of information contained in your NCTUE Disclosure Report is incomplete or inaccurate, notify our team directly and if warranted, we will investigate the matter with the source that provided the information free of charge.

Please complete and return the Research Request form included in the Disclosure Report and provide details of the information you believe is inaccurate. To enter a dispute by telephone, please call the number listed on your Disclosure Report:. Remember, you must have a copy of your current Disclosure Report available during the call.

Based on the results of the investigation, we will either update the current status of the disputed information or delete the item from your Disclosure Report.

If the information that you have disputed has been verified as accurate by the service provider, it will remain on your Disclosure Report. However, you may add a statement of explanation to the report and work to resolve the dispute directly with the service provider that is the source of the information in question.

You may also submit your dispute via mail to NCTUE at the address below. Please include your name, address, Social Security number and date of birth in your request.

Would You Like To Join Ask Sawal

Ask Sawal is a fast growing question and answer discussion forum.

25 lakh+ questions were answered by our Ask Sawal Members.

Each day 1000s of questions asked& 1000s of questions answered.

Ask any question and get answer from 5 Lakh+ Ask Sawal Members.

Constant moderation and reporting option makes questions and answers spam free.

And also, we have free blogging platform. Write an article on any topic.

We have 10000+ visitors each day. So a beneficial platform for link building.

We are allowing link sharing. Create backlinks to your blog site or any site.

Gain extra passive income by sharing your affiliate links in articles and answers.

Recommended Reading: Does Carmax Do Credit Checks

Q How Can I Correct Or Dispute Inaccuracies In My Nctue Data Report

A. If you believe that any item of information contained in your NCTUE data report is incomplete or inaccurate, notify us directly and we will investigate the matter with the source that provided the information, free of charge. Complete and return the Research Request form included in the disclosure report and provide details of the information you believe is inaccurate. For disputes by telephone, a telephone number has been provided to initiate disputes on your data report .

Based on the results of the investigation, we will either update the current status of the disputed information or delete the item from your data report. If the information that you have disputed has been verified as accurate by the service provider, it will remain on your data report, but you may add a statement of explanation to your data report. You may also work to resolve the dispute directly with the service provider who is the source of the information in question.

Is Nctue Legitimate

4.5/5NCTUElegitimateNCTUENCTUE

Regarding this, should I freeze Nctue?

NOTE: Some news outlets have reported that cell phone companies have opened fraudulent accounts using credit reports provided by the National Consumer Telecom & Utilities Exchange . We therefore also recommend freezing your credit report at NCTUE.

Similarly, what is the main service provided by Equifax? In 1999, Equifax began offering services to the credit consumer sector in addition, such as credit fraud and identity theft prevention products.

Also Know, what is the National Consumer Telecom & Utilities Exchange?

The National Consumer Telecom and Utilities Exchange is a non-profit “member” association that warehouses consumer payment data related to utility bills cable, electric, gas, water and phone. It is run by Atlanta-based Equifax, the same company that had a record-breaking 143 million-file data breach last year.

What is exchange service center?

The Exchange Service Center provides consumer services on behalf of the National Consumer Telecommunications Utility Exchange . The Exchange Service Center is operated by Equifax. At this web site, you can add, temporarily lift, or permanently remove a security freeze from your. Exchange Data Report.

You May Like: Affirm Credit Score For Approval

What Is Sage Stream

SageStream is a consumer reporting agency that is regulated by the Fair Credit Reporting Act. As part of LexisNexis Risk Solutions, SageStream provides consumer reports and credit scores to different types of companies including credit card issuers, retailers, and wireless telephone service providers.

Iv Standard Of Review

To challenge the findings and recommendations of the magistrate judge, a party must file with the clerk of court written objections. These objections “must specifically identify those findings objected to. Frivolous, conclusive, or general objections need not be considered by the district court.” , 847 F.2d 1536, 1548 see alsoHeath v. Jones , 863 F.2d 815, 822 . If timely and proper objections are filed, the district court “shall make a de novo determination of those portions of the report or specified proposed findings or recommendations to which objection is made.” 28 U.S.C. § 636. The court “may accept, reject, or modify the recommended disposition receive further evidence or return the matter to the magistrate judge with instructions.” FED. R. CIV. P. 72.

You May Like: When Does Paypal Report To Credit Bureau