Background Of Credit Score In India

In India, the RBI has licensed four companies to access and manage credit information. CIBIL started its activities in 2001 and has since been one of the most popular credit information companies in the country. Others include Equifax, Experian, and High Mark. Each of these organisations has its unique scoring system.

However, one thing that is common between all scores is that if you have no credit history, your score will be -1. Likewise, if you have a credit history that is less than 6 months old, you will receive a credit rating of 0. Apart from this, these credit information companies also provide an in-depth credit report. Your credit report is the basis on which you are given a credit score.

How Do Credit Bureaus Get Your Information

The data that the bureaus collect can come from a number of different sources:

Information reported to the bureaus by creditorsInformation collected or bought by the bureausInformation that gets shared among the bureaus

We polled some of our Credit Sesame members to find out what questions they have about credit bureaus. Heres what they asked and how we answered.

Free Annual Credit Report

As a result of the FACT Act , each legal U.S. resident is entitled to a free copy of his or her from each credit reporting agency once every twelve months. The law requires all three agencies, Equifax, Experian, and Transunion, to provide reports. These credit reports do not contain credit scores from any of the three agencies. The three credit bureaus run Annualcreditreport.com, where users can get their free credit reports. Non-FICO credit scores are available as an add-on feature of the report for a fee. This fee is usually $7.95, as the FTC regulates this charge through the Fair Credit Reporting Act. The FTC tracks various scams and reports on other sites that provide fake credit reports or charge fees for their services. Instances of illegal behaviors by credit report services have been settled in court such as that of Experian Consumer Direct that was charged with deceptively signed people up for credit report monitoring services that charged them monthly fees.

Recommended Reading: When Does Affirm Report To Credit Bureaus

A Quick Guide Explaining Credit Scores Including How They Work What Range Is Considered Good And Why Theyre Valuable

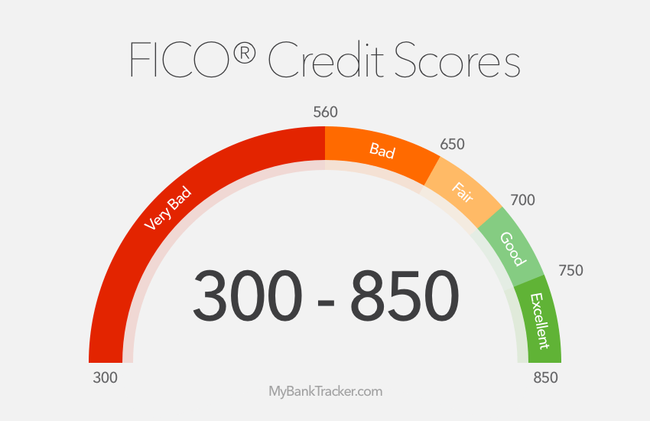

- FICO says good credit scores fall between 670 and 739. Thatâs on a scoring range from 300 to 850.

- VantageScoreâs good scores are reported to fall between 661 and 780, also on a 300â850 range.

But thereâs a lot more to it than that. So keep reading to take a closer look at credit scores, including how theyâre determined, whoâs looking at them and what you can do to monitor and improve yours.

What Is An Excellent Credit Score

You probably already know that your credit score is a three-digit number based on the information in your credit report, which includes items like your loan payment history and credit card balances. Multiple companies have models that calculate credit scoresFICO and VantageScore, for example, which both operate on a scale from 300 to 850.

Generally speaking, a higher credit score can translate to cost savings, perks and more. Your credit score is a key factor considered by lenders, so a better score can help you get more credit at attractive interest rates . Landlords and employers can also check your credit score as part of their due diligence process. And some of the best reward credit cards are only available to those with the highest scores.

So how high should you aim? Getting a perfect score is extremely difficult, so many credit overachievers strive for a score in the high 700s or 800+. That puts you squarely in the highest range for most credit scoring models .

If youre nowhere close, dont worrythe tips below will still help you improve your credit score over time. You can actually reap many of the benefits listed above with a score thats considered good. But if good doesnt cut it, read on for your roadmap to excellent credit.

Also Check: What Company Is Syncb Ppc

Various Credit Score Maximums

The maximum credit score you can achieve depends on the credit scoring model thats being used. Perhaps the most recognizable credit score is the FICO score, which has a maximum possible score of 850 . Credit scores generated using the VantageScore 3.0 model have a maximum score of 850, while previous VantageScore versions could be as high as 990.

There are other credit scores, from the credit bureau and other third-parties. If you purchase one of these scores, the score provider will give you the scale for that score. These scores often mimic the FICO score, with a maximum of 850.

Having the maximum credit score is extremely rare. According to FICO, only 1.6% of scoreable people in the United States have a perfect 850 FICO score.

What Are The Credit Score Ranges For 2021

Each of the three major credit bureaus evaluates credit scores differently, with each score falling into a specific range. However, the most commonly used basis for these credit scores was created by FICO. The FICO credit score ranges vary from poor to excellent, with specific factors affecting the score you receive. The better you manage specific areas of your finances, the more likely your score will be to improve. Having a good credit score will raise your chances of receiving low interest rates on credit cards and loans.

No matter your credit score, a financial advisor can help you plan for the future. Talk to a local financial advisor today.

Don’t Miss: Notifying Credit Bureau Of Death

What Is A Good Credit Score In Canada

Your credit score is used by lenders to determine what kind of borrower you are. It can affect your eligibility for certain loans or credit cards as well as the interest rate you get.

In Canada, your credit score ranges from 300 to 900, 900 being a perfect score. If you have a score between 780 and 900, thats excellent. If your score is between 700 and 780, thats considered a strong score and you shouldnt have too much trouble getting approved with a great rate. When you start hitting 625 and below, your score is getting low and youll start finding it more and more difficult to qualify for a loan.

Ways To Improve Your Credit Score

If youre looking to improve your score, there are some basics that you can work on. Those are:

If you put some of these strategies into play, its not difficult to move from one credit ranking to another.

Recommended Reading: Unlock My Experian Credit Report

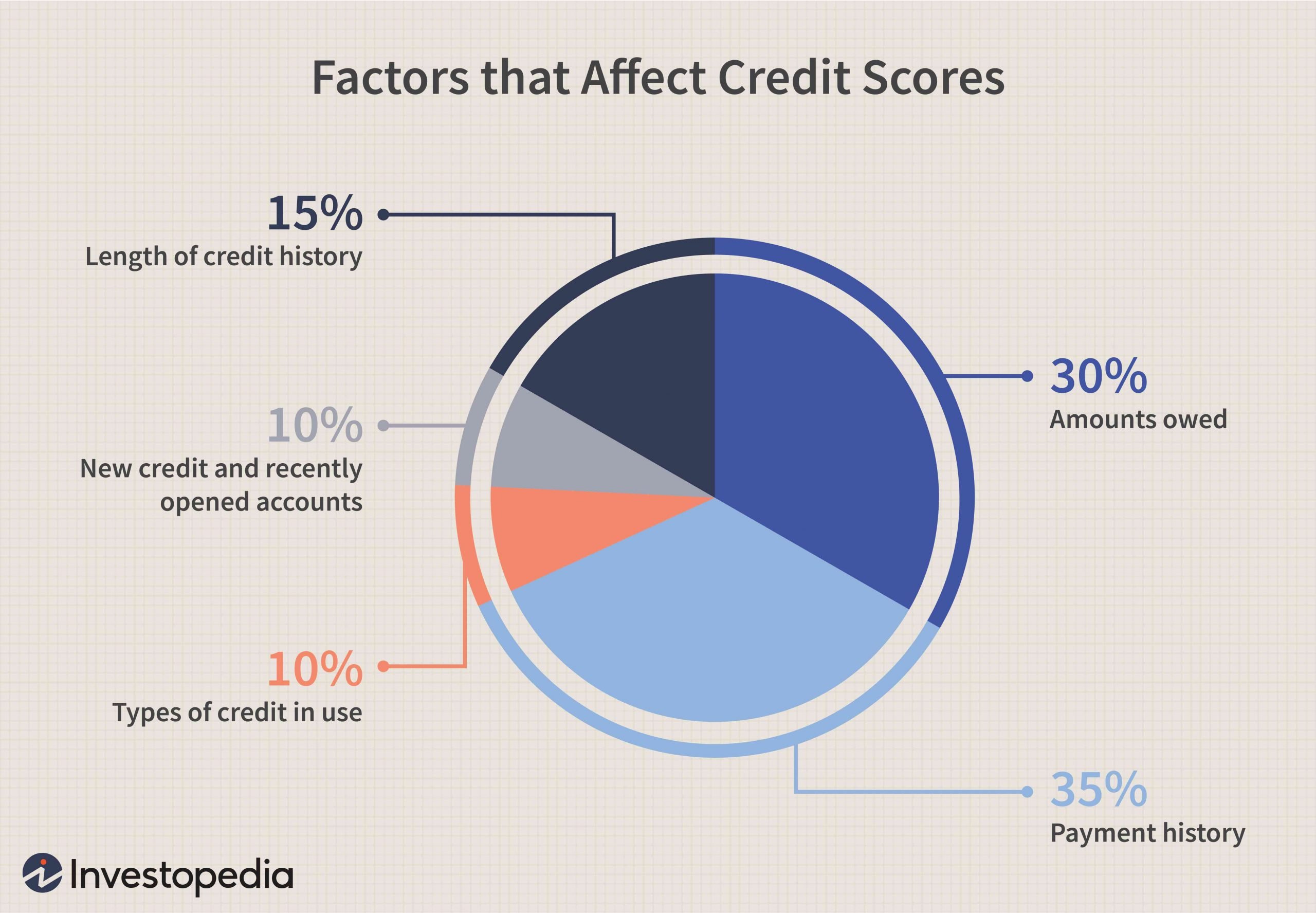

Factors That Affect Credit Scores

So, you can see credit-scoring models and credit reports are two big factors that determine your credit score. But if you donât know what information from your credit report is being used, itâs not much help.

Here are a few factors the CFPB says âmake up a typical credit scoreâ:

- Payment history: How well youâve done making payments on time.

- Debt: How much current unpaid debt you have across all your accounts.

- A ratio that reflects how much of your available credit youâre using compared with how much you have available. is usually expressed as a percentage.

- Loans: How many loans and what kinds they are, such as revolving credit accounts and installment loans. Sometimes this is called your credit mix.

- How long youâve had your accounts open. But remember, what qualifies as your oldest line of credit depends on whatâs being shown in your credit reports.

- New credit applications: How many times youâve applied recently for new credit. The effect on your scores might be minor, but a lot of new hard credit inquiries could still give a negative impression to lenders.

How Does FICO View Those Credit Factors?

FICO is pretty specific about what it views as the most important credit factors: Payment history makes up about 35% of its scoring. About 30% is based on the total debt. The other primary factors are credit history , credit mix and new credit .

How Does VantageScore View Those Credit Factors?

How Does A Bankruptcy Impact My Fico Score

A bankruptcy is considered a very negative event by FICO® Scores. As long as the bankruptcy is listed on your credit report, it will be factored into your scores. How much of an impact it will have on your score will depend on your entire credit profile. As the bankruptcy item ages, its impact on a FICO® Score gradually decreases. Typically, here is how long you can expect bankruptcies to remain on your credit reports :

- Chapter 11 and 7 bankruptcies up to 10 years.

- Completed Chapter 13 bankruptcies up to 7 years.

These dates and time periods refer to the public record item associated with filing for bankruptcy. All of the individual accounts included in the bankruptcy should be removed from your credit reports after 7 years.

Don’t Miss: Carmax Minimum Credit Score

What Is The Highest Credit Score Can You Get A Perfect Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The highest credit score you can have on the most widely used scales is an 850. For common versions of FICO and VantageScore, the scale ranges from 300 to 850 and lenders typically consider anything above 720 excellent credit.

Even if you succeed in getting the highest credit score possible, you’re unlikely to keep it month after month. Scores fluctuate because they are a snapshot of your credit profile, which changes over time.

The widely-used FICO 8 scoring model and the VantageScore 3.0 are both on a 300-850 scale. Credit scoring company FICO says about 1% of its scores reach 850. VantageScore spokesman Jeff Richardson says fewer than 1% of its credit scores are perfect.

The way people get perfect scores is by practicing good credit habits consistently and for a long time. As you might expect, older consumers are more likely to have high scores than younger ones.

But scores fluctuate because they are a snapshot of your credit profile. Even if you succeed in getting the highest credit score, youre unlikely to keep it month after month.

How You Get The Max Credit Score

Getting the maximum credit score is a difficult task and is not something that happens overnight. Only approximately 1% of the U.S population has ever achieved a maximum credit score of 850, which should tell you how difficult this task really is. The people that weve interviewed who have been able to achieve this credit score have over 10 to 20 years of flawless credit history, meaning they have repaid every single dollar that theyve ever borrowed on time and somehow managed to keep any derogatory marks from appearing on their credit report.

In the event that you were able to achieve the highest possible credit score, maintaining it is a whole different story. The algorithms that the credit reporting bureaus use to calculate your credit score are constantly changing, so even if you were, at some point, to achieve the best score, there is no guarantee that youll keep it even if you continue to make all your payments on time. That said, we will share some tips and how to improve your credit score and with some hard work you may actually be able to achieve the max credit score or at a minimum a score in the 800s range.

You May Like: 830 Credit Score

What Is A Good Credit Score

What is considered a good credit score? :59

Reading time: 3 minutes

-

Theres no magic number to reach when it comes to receiving better loan rates and terms

Its an age-old question we get, and to answer it requires that we start with the basics: What is a, anyway?

A credit score is a number, generally between 300 and 900, that helps determine your creditworthiness. Credit scores are calculated using information in your , including your payment history the amount of debt you have and the length of your credit history.

Its also important to remember that everyones financial and credit situation is different, and theres no magic number to reach when it comes to receiving better loan rates and terms.

There are many different credit score models used today by lenders and other organizations. These scores all have the same goal: to predict a consumers likelihood to pay their bills. There are some differences around how the various data elements on a credit report factor into the score calculations.

Although credit scoring models vary, generally, credit scores from 660 to 724 are considered good 725 to 759 are considered very good and 760 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behaviour in the past, which may make potential lenders and creditors more confident about your ability to repay a debt when evaluating your request for credit.

How Do Your Actions Impact Credit Scores?

Percent Of Adults Who Check Their Score Monthly

Data regarding how many adults check or dont check their scores will vary from study to study due to the nature of the sample population. Research offered by CreditCardInsider.com found that only 21 percent of their respondents check their credit score on a monthly basis9.

This low number can be supported by data in other studies, such as a LendingTree survey that found only 33 percent of adults checked their score within the past year in 202010.

Don’t Miss: Opensky Available Credit

Are Fico Scores Unfair To Minorities

No. FICO® Scores do not consider your gender, race, nationality or marital status. In fact, the Equal Credit Opportunity Act prohibits lenders from considering this type of information when issuing credit. Independent research has shown that FICO® Scores are not unfair to minorities or people with little credit history. FICO® Scores have proven to be an accurate and consistent measure of repayment for all people who have some credit history. In other words, at a given FICO® Score, non-minority and minority applicants are equally likely to pay as agreed.

Does It Matter If I Don’t Have The Highest Credit Score

If you don’t have a perfect score, there’s no need to fret. Most people don’t. According to Experian, only 1.2% of Americans have the highest credit score.

So does that mean that only 1.2% of people qualify for the best interest rates? No. You don’t need an 850 credit score to qualify for prime interest rates. But you will want your score to fall within a certain range.

- Very Good: 740-799

- Exceptional: 800+

Working towards a credit score in the “Good” range would be a great initial goal. And if you’re able to build a score that falls within the “Very Good” or “Exceptional” range, you can expect to receive some of the best interest rates currently available.

It’s also possible to have no credit score whatsoever. If you’ve never applied for credit before or haven’t used credit in more than 24 months, you could find yourself in this situation.

In its 2015 report, the Consumer Financial Protection Bureau found that 26 million people were “credit invisible.” While having no credit isn’t the same as having bad credit, it still makes it difficult to qualify for the best rates on loans.

Also Check: How To Check Credit Score Without Ssn

Check Your Credit With A Secure Credit Check From Birchwood Credit

Finding out your credit score may bring on feelings of stress, but it doesnt have to. Understanding your credit situation will help you become financially independent, work towards realistic goals and empower you to feel confident with managing your finances.

Now you can get a complimentary, secure credit report so you can know where your credit stands. Start your Secure Credit Check and take your first step to financial independence.

If you need a new vehicle and are looking for an affordable payment plan, our credit experts are ready to help you, even if you have bad credit. You can fill out an online Car Loan Application and our credit experts will help you find a payment plan that meets your budget and lifestyle.

What If I Dont Want Wells Fargo To Display My Fico Score Anymore

You can opt out of the service at any time. On the FICO® Score screen, select the I no longer want Wells Fargo to display my FICO® Score link. If you decide to start the service again in the future, you can select View Your FICO® Credit Score on the Account Summary and follow the instructions to opt back in.

Read Also: Protectmyid Deluxe Reviews

Keep Watch Over Your Hard

A FICO® Score of 850 is an accomplishment built up over time. It takes discipline and consistency to build up an Exceptional credit score. Additional care and attention can help you keep hang on to it.

Whether instinctively or on purpose, you’re doing a remarkable job navigating the factors that determine credit scores:

Utilization rate on revolving credit. Utilization, or usage rate, is a measure of how close you are to maxing out credit card accounts. You can calculate it for each of your credit card accounts by dividing the outstanding balance by the card’s borrowing limit, and then multiplying by 100 to get a percentage. You can also figure your total utilization rate by dividing the sum of all your card balances by the sum of all their spending limits .

| Balance | |

|---|---|

| $20,000 | 26% |

If you keep your utilization rates at or below 30% on all accounts in total and on each individual accountmost experts agree you’ll avoid lowering your credit scores. Letting utilization creep higher will depress your score, and approaching 100% can seriously drive down your credit score. Utilization rate is responsible for nearly one-third of your credit score.

Time is on your side. Length of credit history is responsible for as much as 15% of your credit score.If all other score influences hold constant, a longer credit history will yield a higher credit score than a shorter one.