How Can I Remove Hard Inquiries

Disputing hard inquiries on your credit report involves working with the credit reporting agencies and possibly the creditor that made the inquiry. Hard inquiries cant be removed, however, unless theyre the result of identity theft. Otherwise, theyll have to fall off naturally, which happens after two years.

What Is A Hard Inquiry

Hard inquiries generally occur when a financial institution, such as a lender or credit card issuer, checks your credit when making a lending decision. They commonly take place when you apply for a mortgage, loan or credit card, and you typically have to authorize them.

A hard inquiry could lower your scores by a few points, or it may have a negligible effect on your scores. In most cases, a single hard inquiry is unlikely to play a huge role in whether youre approved for a new card or loan. And the damage to your credit scores usually decreases or disappears even before the inquiry drops off your credit reports for good .

That doesnt sound so bad, but you may want to think twice before applying for a handful of credit cards at the same time or even within the span of a few months. Multiple hard inquiries in a short period could lead lenders and credit card issuers to consider you a higher-risk customer, as it suggests you may be short on cash or getting ready to rack up a lot of debt. So consider spreading out your credit card applications.

How Long Do Hard Credit Inquiries Stay On Your Credit Reports

Hard inquiries may stay on your credit reports for up to two years. However, hard inquiries that are more than a year old might not affect your scores.

As Equifax®, one of the three major credit bureaus, explains, âHard inquiries serve as a timeline of when you have applied for new credit and may stay on your credit report for two years, although they typically only affect your credit scores for one year.â

FICO confirms that this is how their credit scores work: âAlthough FICO Scores only consider inquiries from the last 12 months, inquiries remain on your credit report for two years.â

Also Check: 739 Credit Score Mortgage Rate

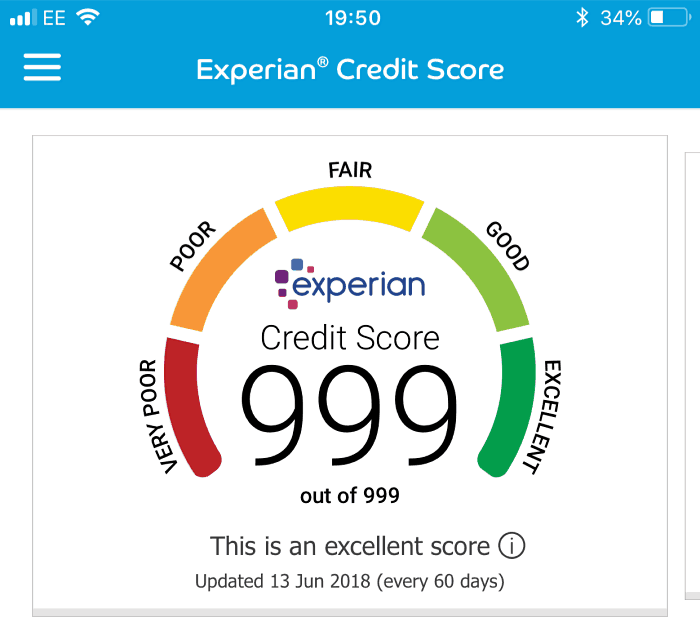

Is Experian Better Than Credit Karma

While Experian compiles your credit report and determines your credit score, Credit Karma simply shows you credit scores and report information from Equifax and TransUnion.

Think of it this way Credit Karma is like a newspaper that writes about the credit scores other companies give you. But we have no influence over your scores.

Loan Restructuring May Affect Credit Score And Eligibility

The Reserve Bank of Indias had permitted financial institutions to provide a loan restructuring scheme to borrowers of loans in order to help mitigate financial challenges in light of the Covid-19 pandemic. This would help borrowers to pay off their Equated Monthly Instalments in a way that was more feasible and affordable to them.

The loan restructuring was a one-time measure after the end of the 6-month moratorium that was offered from March to August 2020. The RBI has allowed financial institutions to report these loans to credit bureaus as ‘restructured’ while maintaining them as ‘standard’ in their own loan books. This was meant to help lenders to lower their Non Performing Assets . However, restructured loans often have a negative impact on the credit scores of borrowers. This usually affects the eligibility when applying for future loans as well.

However, it is not yet clear how this restructuring will affect the credit scores of borrowers. Restructured loans may also have higher interest rates, which will depend on the lender. The interest lost by the lender during the period of restructuring of the loan may also be added to the principal amount, which will further increase the outgo of interest for the borrowers.

6 October 2020

Recommended Reading: Does Walmart Use Klarna

Why Its Important To Check Your Credit Score

Viewing your credit score can alert you to potential problems, like a fraudulent account opened in your name or a bill you forgot about that went to collections.

If you check your score regularly, you can deal with these problems as they come up. If you dont check your credit score until youre applying for a mortgage or other major loan, you may discover a huge mistake that takes weeks to fix.

How Experian Boost Works

Of these new credit-building products, Experian Boost is the most established, following its release in early 2019. It works by increasing your positive payment history, a vital factor in calculating your credit score, by adding recurring, but not traditionally reported, payments to your credit report. These payments include utilities such as electricity, water, cellphone, internet, and natural gas and, most recently, even your Netflix payment.

When they evaluate your score to determine your creditworthiness, lenders are really determining how likely you are to pay back the money you borrow from them based on your past behavior.

For someone with few accounts on their credit report, proving that creditworthiness is a bigger challenge reporting these nontraditional payments is one way to help overcome that challenge.

You May Like: Reporting Death To Credit Agencies

How To Get Your Transunion Credit Score For Free

You can access your TransUnion report and score for free via its service. This also advertises loans and cards you are likely to be accepted for.

Signing up to a free trial with CheckMyFile will give you access to all the information held on you by TransUnion, Experian and Equifax for 30 days.

After this, youll have to pay £14.99 a month to keep the service.

Can Service Accounts Impact My Credit Score

Service accounts, such as utility and phone bills, are not automatically included in your credit file. Historically, the only way a utility account could impact a credit score was if you didn’t make payments and the account was referred to a collection agency.

But this is changing. A revolutionary new product called Experian Boost now allows users to get credit for on-time payments made on utility and telecom accounts.

Experian Boost works instantly, allowing users with eligible payment history see their FICO® Score increase in a matter of minutes. Currently, it is the only way you can get credit for your utility and telecom payments.

Through the new platform, users can connect their bank accounts to identify utility and phone bills. After the user verifies the data and confirms they want it added to their credit file, they will receive an updated FICO® Score instantly. Late utility and telecom payments do not affect your Boost scorebut remember, if your account goes to collections due to nonpayment, that will stay on your credit report for seven years.

Don’t Miss: The Lowest Fico Credit Score Is Brainly

Will Checking Your Credit Hurt Credit Scores

Reading time: 2 minutes

Highlights:

-

Checking your credit reports or credit scores will not impact credit scores

-

Regularly checking your credit reports and credit scores is a good way to ensure information is accurate

-

Hard inquiries in response to a credit application do impact credit scores

Many people are afraid to request a copy of their credit reports or check their credit scores out of concern it may negatively impact their credit scores.

Good news: Credit scores arent impacted by checking your own credit reports or credit scores. In fact, regularly checking your credit reports and credit scores is an important way to ensure your personal and account information is correct, and may help detect signs of potential identity theft.

Impact of soft and hard inquiries on credit scores

When you request a copy of your credit report or check credit scores, thats known as a soft inquiry. Other types of soft inquiries result from companies that send you promotional credit card offers and existing lending account reviews by companies with whom you have an account. Soft inquiries do not affect credit scores and are not visible to potential lenders that may review your credit reports. They are visible to you and will stay on your credit reports for 12 to 24 months, depending on the type.

The other type of inquiry is a hard inquiry. Those occur after you have applied for a loan or a credit card and the potential lender reviews your credit history.

Getting your credit reports

Most Important: Payment History

Your payment history is one of the most important credit scoring factors and can have the biggest impact on your scores.

Having a long history of on-time payments is best for your credit scores, while missing a payment could hurt them. The effects of missing payments can also increase the longer a bill goes unpaid. So a 30-day late payment might have a lesser effect than a 60- or 90-day late payment.

How much a late payment affects your credit can also vary depending on how much you owe. Dont worry, though: If you start making on-time payments and actively reduce the amount owed, then the impact on your scores can diminish over time.

If youre having trouble making payments at all, you could also wind up with a public record, such as a foreclosure or tax lien, that ends up on your credit reports and can hurt your scores. Sometimes a single derogatory mark on your credit, such as a bankruptcy, could have a major impact.

Recommended Reading: Does Opensky Report To Credit Bureaus

Recommended Reading: 779 Credit Score

Does Checking My Free Credit Score Affect It

Checking your free credit score for yourself is what is considered as a soft inquiry. Soft inquiries are not a factor in calculating a persons credit scoring, and therefore will not impact your credit score.

Checking your free credit score for yourself is what is considered as a soft inquiry. Soft inquiries are not a factor in calculating a persons credit scoring, and therefore will not impact your credit score.

Please try one more time!

What Information Is In A Credit Report

A typical credit report includes:

-

Personal details about you for example, your name and address

-

Details about all your credit accounts that is to say bank accounts, credit cards, utility bills, phone accounts, store cards and mortgages

-

Payment status for example, do you pay your bills on time

-

History of paying things back for example, have you missed payments in the past

-

Your outstanding balance how much you have borrowed in total, by type

-

How much spare credit do you have for example, you have a £1,000 credit card limit , but are only £50 into it

-

How long have you had these accounts the longer, the better your score in many cases

-

How often you’re asking for new accounts if you’ve just applied for 20 new credit cards, that will show up to anyone looking at the report

-

Are you on the electoral roll

-

Have you had any CCJs, IVAs or been declared bankrupt in the past 6 years

-

Do you have debts at a previous address

-

Have you been a victim of ID theft

-

How many addresses are you linked to ie do you have credit accounts where the payment address is not current, or different from your main address

-

Past names

Recommended Reading: Does Paypal Credit Check Your Credit

Whats Bad For Your Credit Score

When lenders check your credit history, they may see some kinds of financial behaviour as a red flag. If possible, you should avoid or minimise these to keep your score as high as possible:

Why Isnt Experian On Credit Karma

You may have noticed that one of the nationwide credit bureaus is missing from your Credit Karma update: Experian.

Why isnt Experian part of Credit Karma? Well, .

What does this mean?

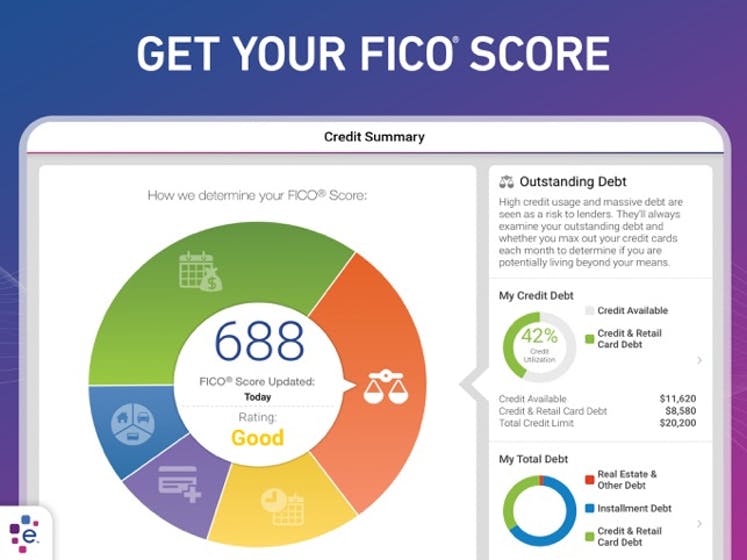

Well, FICO and VantageScore are essentially two companies, offering different models for credit scoring. Both are widely used when it comes to making lending decisions, but they differ slightly when it comes to how credit scores are calculated and predicted via the use of a credit score simulator.

Both FICO and VantageScore use their scoring models so that your credit report is turned into an updated credit score for each of the three main consumer credit bureaus TransUnion, Experian, and Equifax.

Therefore, as Equifax and TransUnion both use the VantageScore scoring model, it makes sense to combine them. This allows for the most accurate reflection of your credit score based on the VantageScore approach.

As there is no Credit Karma FICO score check, its a good idea to access your Experian FICO Score as well. The credit bureau also has a feature known as Experian Boost. This is a tool that can potentially boost your credit score if youre making regular payments on your account for things like your mobile phone contract or your Netflix subscription. Equifax and TransUnion dont provide such a service.

Recommended Reading: How To Remove Repossession From Credit Report

Don’t Miss: How To Dispute Repossession On Credit Report

Get A Copy Of Your Credit Reference File

You can ask for a copy of your credit reference file from any of the credit reference agencies. If you have been refused credit, you can find out from the creditor which credit reference agency they used to make their decision. Your file shows your personal details such as your name and address, as well as your current credit commitments and payment records.

You have a right to see your credit reference file – known as a statutory credit report. A credit reference agency must give it to you for free if you ask for it.

If you sign up to a free trial and decide its not right for you, remember to cancel before the trial ends or you might be charged.

What Doesnt Affect Your Credit Score

Typically, there are lots of myths and falsehoods swirling around about what affects your credit score and what doesnât. Hereâs a list of common misconceptions â things that donât have any impact on your credit score:

Don’t Miss: How To Dispute A Repossession

Does Klarna Perform A Credit Check On Me And Will This Affect My Credit Score

As a responsible lender, we want to make sure were helping our customers make the right financial decisions for their circumstances. When a credit check is performed, we verify your identity using the details you provided and we look at information from your credit report to understand your financial behaviour and evaluate your creditworthiness.

Depending on the payment method or service you choose, we may perform different types of searches to check your financial standing. You can find an overview of the credit checks we run for our payment options and services and whether they impact your credit score below.

Using Klarna will not affect your credit score when:

- Creating a One-time card

- Taking out a Covid-19 related payment holiday.

For the above mentioned, we will perform a credit check will not be visible to other lenders and therefore wont impact your credit score in any way.

Using Klarna might affect your credit score when:

- Applying for one of our Financing options.

- Taking out a standard payment holiday for our Financing options.

If you decide to use Financing, we might perform a credit check with credit reference agencies to complete your credit assessment. This credit check will show up as an inquiry on your credit report, will be visible to other lenders and might impact your credit score.

These checks are performed in accordance with Klarnas Terms & Conditions.

Was this article helpful?