Can You Erase Bad Credit Overnight

The short answer is no. Fixing bad credit is a time-consuming process that often takes months. It involves contacting credit agencies and lenders to dispute inaccurate information, and they can take up to 30 days to respond to your request. They may also ask for more documentation to validate your dispute, further prolonging the process. Additionally, note that accurate negative items cannot be deleted from your report and will remain on your record for at least seven years.

Dispute With The Business That Reported To The Credit Bureau

Now, you can completely bypass the credit bureau and dispute directly with the business that reported the error to the credit bureau, e.g., the credit card issuer, bank, or debt collector. You can make the dispute in writing, and the business is required to do an investigation just like the credit bureau.

When the business determines that theres indeed an error on your credit report, they must notify all the credit bureaus of that error so your credit reports can be corrected.

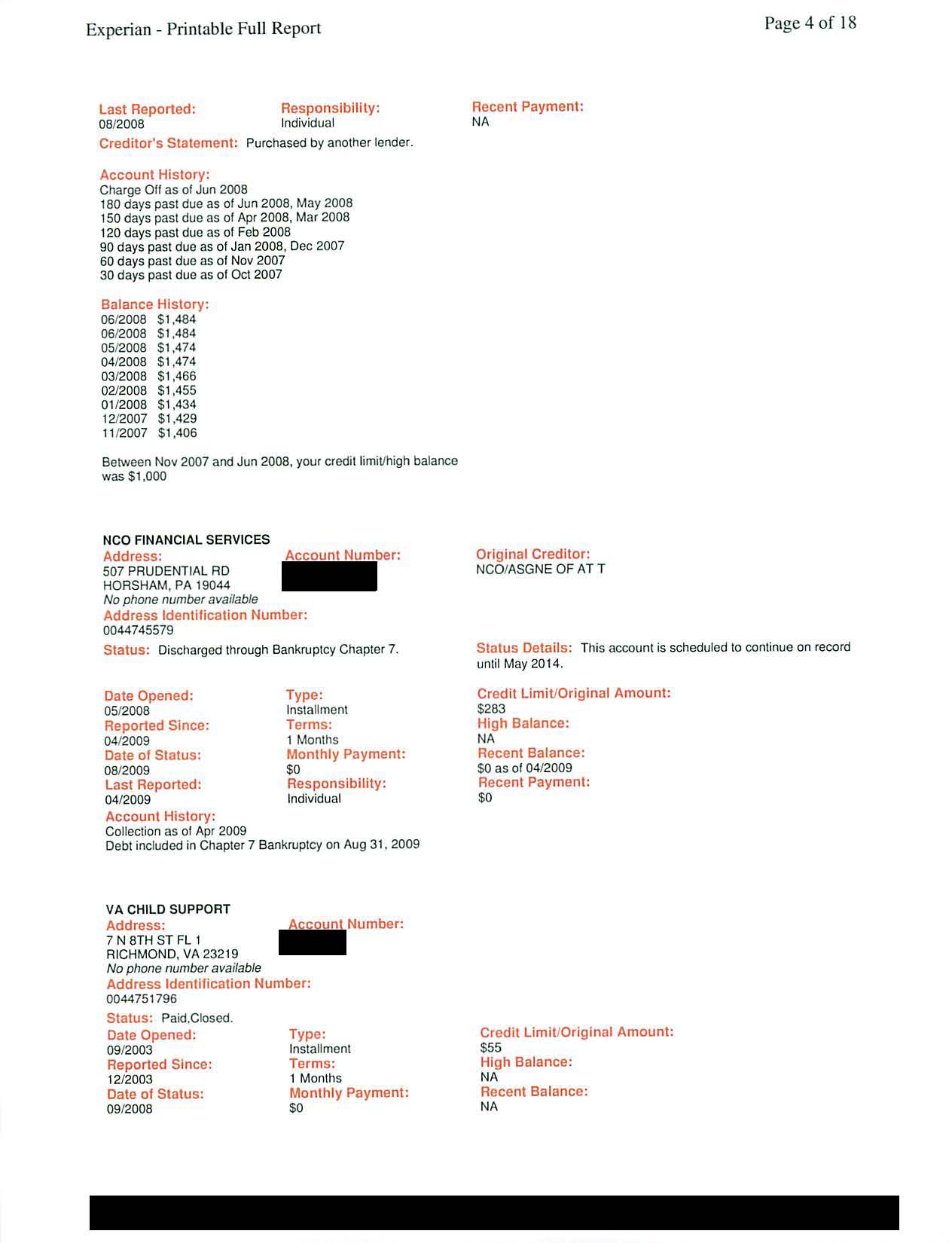

How Long Discharged Debts Can Appear On Your Credit Report

A discharged debt can appear, as discharged or closed, for up to seven years after the debt has been waived. This is true of most debts, even those paid in full. A Chapter 13 Bankruptcy also remains on your credit report for seven years, while a Chapter 7 bankruptcy remains for up to 10 years.4

If you see debts, even marked as empty or discharged, for longer than seven years, youll need to take measures to have these debts removed or discover who illegally sold your debt to renew and lengthen the time limit.

Don’t Miss: Is 780 A Good Credit Score

How Long Does A Debt Settlement Stay On Your Credit Report

A debt settlement will remain on your credit report for seven years from the original delinquency debt, or longer if you cannot effectively make timely settlement payments. If you settled your debt five years ago, you would have to wait for the seven years to be completed.

It is crucial to note that the credit report presents a history of managing your credit accounts. When a debt is paid off and an account is closed, the lender updates the report’s new payment status. However, paying off an account and closing it does not change its status on the report immediately.

Hire A Credit Repair Service

![How to Remove a Bankruptcy from Your Credit Report [See Proof]](https://www.knowyourcreditscore.net/wp-content/uploads/how-to-remove-a-bankruptcy-from-your-credit-report-see-proof.jpeg)

Disputing errors can be time consuming, especially if your history has several mistakes or if you were a victim of identity theft. Reputable credit repair companies such as , Lexington Law or Sky Blue may be viable solutions if your file is riddled with inaccuracies.

Credit repair services can help you dispute inaccurate negative information and handle creditor negotiations. However, if you decide to hire a credit repair agency, remember there are consumer protection laws that regulate how they operate and what they can do. The establishes the following regarding credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the services they provide

- They cannot charge for their services until they have been completed

- There must be a written contract detailing the services theyll provide, the time frame in which these services will be provided and the total cost for them

- They cannot promise to remove truthful information from your record before the term set by law

- You have three days in which to review the contract and cancel without penalty

Don’t Miss: How Bad Is A Judgement On Your Credit Report

Main Types Of Bankruptcy For Consumers

Consumers primarily use Chapter 7 and Chapter 13 for filing bankruptcy. Either will activate an automatic stay to prevent creditors from collecting debt while your case is being processed. Filing either type of bankruptcy will decrease your anywhere from 130 to 240 points. People with higher credit scores will see their credit scores drop more than those whose credit scores were lower at the time of filing. But regardless of what your credit score is, when you file for bankruptcy, you will likely end up with a bad credit score for a while.

Bankruptcy can be complicated, so it might be a good idea to hire a bankruptcy attorney. If you have a simpler, Chapter 7 case, you can use Upsolveâs online tool to file for free without an attorney.

Can You Legally Remove Bankruptcy From A Credit Report

By FindLaw Staff | Reviewed by Bridget Molitor, J.D. | Last updated June 30, 2021

It depends on the situation. You can remove bankruptcy from your credit report if it is untrue, misreported, disproved, or inaccurate.

You cannot legally remove bankruptcy on your credit report just because:

- You do not want it on your record

- You have a good credit score again

- Your debts are paid off

Legally, bankruptcy will stay on your record for 10 years if you filed for Chapter 7 bankruptcy or seven years if you filed for Chapter 13 bankruptcy. After that time, it should be automatically removed.

According to the Fair Credit Reporting Act , these timelines set the maximum time for a bankruptcy filing to stay on your credit report. In some cases it may be on your for less time.

Don’t Miss: How To Get Charge Offs Removed From Your Credit Report

Ask Creditors To Remove Negative Items

It is possible to ask creditors to remove items from your credit report in certain circumstances. For example, if you made regular payments for your auto loan on time, but then missed a single payment, you may be able to contact your creditor and get them to agree to remove the offending negative item.

You could also offer to pay the outstanding debt on a late bill this practice is known as debt re-aging. But be careful when using debt re-aging. While it can help you if the creditor agrees to remove the negative item from your report, your credit may be further negatively affected if you fail to pay the agreed-upon amount.

Dispute When Collectors Sell

Collection accounts often change hands. Debts are assigned and sold to other collectors, so theres a strong possibility the collection agency listed on your credit report isnt the agency thats currently collecting on the debt. When this happens, you can have the older collection removed by disputing it with the credit bureaus. If the debt collector fails to respond to the dispute, the credit bureau should remove the account since it has not been verified.

Don’t Miss: Is 590 A Bad Credit Score

Ask The Credit Bureaus How The Bankruptcy Was Verified

If the bankruptcy is verified by the , you will next need to send them a procedural request letter asking them who they verified the bankruptcy with.

In some instances, they will claim it has been verified with the courts, even if it is not. In most cases, the courts do not verify bankruptcies for the credit bureaus.

If the credit bureau claims it was verified with the courts, then proceed to step 4.

Remove Items From A Credit Report Legally

If you are working to remove items from a credit report legally, it can often be very time-consuming. Speaking to an agency can speed up the process and allow you to ask for advice on the matter. Certain debts can stay on your debt account for 6 years however they become less of an issue, the longer they are on the system. Find out more about first if you are unsure on how they work.

The best way of getting a debt cleared from the credit file would be to contact the lender and agree that it was not justified in the first place. If you cannot agree that the debt was unjustified, the lender will have had a duty of care to report this and it will remain on your account information for the 6 years.

Read Also: How To Bring My Credit Score Up

What Happens After My Bankruptcy Ends

When your bankruptcy ends, most of your debts are released and you no longer need to pay them. However, there may be some debts that you still need to pay find out more on what happens to my debts.

Your name continues to appear on the National Personal Insolvency Index showing your bankruptcy has ended.

Waiting For A Bankruptcy Removal From Your Credit History

Once you wait seven to 10 years, the bankruptcy public record will automatically be deleted, and future creditors won’t be able to see it.

The individual accounts that had the debts may have already been deleted during the bankruptcy discharge and bankruptcy plan phase. In some cases, these accounts must remain on the credit report.

The best thing to do is build credit while waiting for the bankruptcy record to clear, follow repayment plans, and avoid more debt.

Also Check: Which Credit Score Is More Important

Can Cancelled Debt Be Removed From Credit Report

candebtcanceledreportcancelledcancellationdebt

. Consequently, what happens when debt is Cancelled?

Debt cancellation happens when a lender forgives or discharges some or all of a debt that you owe. The process typically doesnt affect your credit scoreunless it happens in bankruptcybut it could end up costing you. Debt cancellation typically happens in accordance with a debt forgiveness program.

Secondly, how do you get a debt discharged off your credit report? To help on your way to better credit, here are some strategies to get negative credit report information removed from your credit report.

Consequently, can Cancelled debt be collected?

When you are unable to pay a debt, the creditor can commence the collection process. When a debt in excess of $600 is truly uncollectible, the creditor may write off the bad debt. The tax code requires the creditor to issue an IRS Form 1099-C, which notifies the debtor that the debt has been canceled or forgiven.

Can a creditor collect after issuing a 1099 C?

How To Dispute Or Remove A Charge

John Ulzheimer is an expert on credit reporting, credit scoring, and identity theft. The author of four books on the subject, Ulzheimer has been featured thousands of times in media outlets including the Wall Street Journal, NBC Nightly News, New York Times, CNBC, and countless others.With over 30 years of credit-related professional experience, including with both Equifax and FICO, Ulzheimer is the only recognized credit expert who actually comes from the credit industry.He has been an expert witness in over 600 credit-related lawsuits and has been qualified to testify in both federal and state courts on the topic of consumer credit. In his hometown of Atlanta, Ulzheimer is a frequent guest lecturer at the University of Georgia and Emory University’s School of Law.

Edited by: Lillian Guevara-Castro

Lillian brings more than 30 years of editing and journalism experience, having written and edited for major news organizations, including The Atlanta Journal-Constitution and the New York Times. A former business writer and business desk editor, Lillian ensures all BadCredit.org content equips readers with financial literacy.

It can be tough to earn great credit scores when there are negative items on your credit reports. One such item is the so-called charged-off account or, informally, a charge-off.

But, if a charge-off is incorrect or contains questionable information, it may be possible to get it removed from your report much sooner.

You May Like: How To Get Rid Of Inquiries On Your Credit Report

Do I Need To Keep In Contact With My Trustee

Normally you don’t. In some cases, your trustee continues to manage your bankruptcy, even after it has ended.

Your trustee may still request that you:

- provide information about your financial situation

- make any outstanding compulsory payments

- cooperate with obtaining valuations/appraisals of property

- keep your contact details up to date

Getting A Copy Of Your Credit Record

Privacy Act 2020, s 22, Principle 6, s 1

You have the right to ask for a copy of your credit report. If any of the information isnt correct, you can apply in writing to the credit reporting companies for it to be corrected.

Three credit reporting companies operate in New Zealand. To check your record, or to correct any information, youll need to contact them all .

A credit reporting company must give you a copy of your report within 20 working days after you ask for it. They cant charge you for this unless you ask for them to provide it within five working days, in which case they can charge you up to $10 .

Don’t Miss: How To Get Your Full Credit Report

How To Check Your Credit Report

You can get a free copy of your report from each Equifax, Experian and TransUnion at annualcreditreport.com.

Until the end of 2022, you can get free weekly reports through that platform instead of the usual once a year.

Look specifically for medical debts that you’ve already paid in full, advises the US PIRG.

[That is the debt that should disappear with the new rules.

Check the section where the report flags new debts, as well as the account information or collections section of the report.

If you see a debt you’ve already paid , you can dispute it directly with the credit reporting company whose document contains the error.

Each of the reports may contain different information, so it’s worth checking all three.

Federal law requires credit bureaus to investigate disputes within 30 days and to notify you within five days of their investigation.

If your dispute is denied or the error is not removed from your report, you can file a complaint with the Consumer Financial Protection Bureau, notes the US PIRG.

This article is part of the

Invest in You: Ready series.

Set.

Can A Debtor Receive A Second Discharge In A Later Chapter 7 Case

The court will deny a discharge in a later chapter 7 case if the debtor received a discharge under chapter 7 or chapter 11 in a case filed within eight years before the second petition is filed. The court will also deny a chapter 7 discharge if the debtor previously received a discharge in a chapter 12 or chapter 13 case filed within six years before the date of the filing of the second case unless the debtor paid all “allowed unsecured” claims in the earlier case in full, or the debtor made payments under the plan in the earlier case totaling at least 70 percent of the allowed unsecured claims and the debtor’s plan was proposed in good faith and the payments represented the debtor’s best effort. A debtor is ineligible for discharge under chapter 13 if he or she received a prior discharge in a chapter 7, 11, or 12 case filed four years before the current case or in a chapter 13 case filed two years before the current case.

You May Like: How To Keep Your Credit Score High

Fair Credit Reporting Act

All the late payments we make on our debit and credit card bills are duly reported to the credit bureaus by our creditors and lenders, which is why our credit score is reflective of all such delinquencies.

However, the Fair Credit Reporting Act offers coverage and leniency to people who are burdened with financial challenges and cannot effectively repay their debt. Negatives about your credit that are over seven years old or caused by bankruptcies more than ten years old cannot be reported as negative information to credit bureaus.

You dont have to wait for seven years, and in most cases, you can effectively remove settled accounts from your credit report.

Formerly Secured Creditors Still Reporting That You Owe Them Money

This is particularly common following Chapter 13 bankruptcy. If you had a car that you surrendered to the bank and you were upside down on it. Lets say it was worth $20K and you owed 35K.

That $15K is now unsecured debt and it gets paid in accordance with the Chapter 13 plan. When your Chapter 13 is completed and you receive your discharge, then you do NOT owe that money.

However, those creditors will often report to the credit bureaus that you do.

Also Check: How To Check My Credit Score With Itin Number

What Is A Credit Score

You are given a credit score this is a number between 0 -1,000 . This indicates how credit worthy you are and how likely you are to pay back the loan on time so a history of paying your bills on time will give you a higher score. Your score isnt fixed it can change over time as old information drops off your credit file, for example a default from ten years ago wont affect your score anymore.

If you have never applied for any credit that gives you no credit history at all. No credit history means the lender has no information about you or the likelihood you can make your repayments. This might lead them to turn you down.

Ways To Remove Old Debt From Your Credit Report

According to the Federal Reserve Bank of New York, 2.5 percent of outstanding debt is in some degree of delinquency as of September 2021. However, having an accurate and up-to-date credit history without old collections or delinquent accounts is important when youre applying for loans or other new credit.

If youve noticed old debts on your credit report, its best to act as soon as possible to remove these items. Here are a few steps you should take.

Don’t Miss: Does Spectrum Report To Credit Bureaus