What Is A Background Check

A background check is when an employer or other company obtains information about a persons history. This includes gathering information about a persons criminal history record.

An employer/company can conduct a criminal history background check either:

- on its own, or

If an employer performs its own criminal history record check, note that it:

- might be quite thorough, or

- performed with less detail.

If a company hires a third party, this entity is known as an investigative reporting agency. These agencies are in the business of:

- searching,

How Can I Check My Criminal Record In California

California residents can order their criminal record by:

- getting fingerprinted at one of these Live Scan locations, and

- paying a $25 fee to the California Department of Justice

Non-California residents can order their criminal record by:

- getting fingerprinted ,

- making a $25 personal check, certified check, or money order to the California Department of Justice, and

- mailing the above documents to the California Department of Justice, Bureau of Criminal Identification and Analysis, Record Review & Challenge Section, PO BOX 160207, Sacramento, CA 95816-020719

Expired And Extraneous Information

At some point, even relevant financial information becomes old news. Following are a few examples of when items expire and should automatically drop off your credit report:

- Chapter 7 bankruptcy: 10 years

- Chapter 13 bankruptcy: 7 years

- Collection accounts: 7 years

- Late or missed payments: 7 years

- Closed credit accounts in good standing: 10 years

Your credit report also excludes personal information that is irrelevant to your credit. Examples include:

- Political affiliations

Also Check: Coaf Credit Inquiry

How To Check If Someone Is Using My Identity

suspect

- Bills which are in your bank statement and they should not be there

- You got a credit request refused

- Your credit score is low with no particular reason

- You receive mail or email that are unexpected. For example items that you didnât purchase

- You donât receive mails that should come, as bills or checks

To check

- Order a credit report. Your credit report contains a lot of information about your credit history where you can find for example if someone opened a bank account in your name, or opened a credit line on your name, if your address information are correct and much more. Check it here.

- Check your online identity has not been used online for frauds globally through. Check it here.

things you can do

- Report it to the Australian Competition and Consumer Commission https://www.scamwatch.gov.au/ so they can create a scam alert for the community.

- Contact IDCARE , which is a free service which helps you your identity theft issue.

Why Check Your Credit Report

- Identity theft. Check if someone is using your identity to ask for credit.

- Correct personal information. Check your details are stored correctly .

- Check your debts are stored correctly. Check your debts are listed correctly, They may be wrong or duplicated.

- Apply with confidence. Apply for your loan, or for your next job with confidence of knowing what others will be likely to know about you.

- Denied credit. You have been denied credit. Find out what information is on your credit report.

- Improve your credit reputation. Improve how lenders see your credit score.

Also Check: How To Notify Credit Bureau Of Death

What Does A Criminal Background Check Show

The information that shows up on a criminal background check can include felony and misdemeanor court records, including deferred, pending, failure to appear, and warrant information as allowed by the Fair Credit Report Act .

In most U.S. states, crimes are divided into two broad categories: misdemeanors and felonies. The most significant difference between the two is the maximum punishment.

Misdemeanor crimes are punishable by fines and/or county jail time for less than a year. Some examples of misdemeanor crimes:

- Shoplifting

- Simple assault

Felonies are series of offenses that carry a penalty of incarceration from one year to a life sentence in state prison. It also includes the death penalty. Some examples of felony crimes:

- Murder

- Rape

To learn more about the most common types of criminal background checks, read our blog here.

What Potential Concerns Might An Employer See On Your Credit Report

Employers who review your credit report may view the following as potential problem areas:

- Employment history: While employment information on a credit report can be highly inaccurate and is rarely used in hiring decisions, wrong or conflicting information could be seen as a possible concern by a potential employer.

- Late payments: A pattern of late payments is a big red flag. It can indicate any number of things about your character to a potential employer, including an inability to budget and an inability to meet deadlines.

- Charge offs and debt collection: Creditors may charge off your loan if you have not made a payment in over 180 days. They can then attempt to collect themselves or sell the debt to a collection agency. The presence of this type of activity on your credit report communicates possible financial distress to your employer, a potential security risk, as well as irresponsibility.

- Foreclosures: Its challenging to put a positive spin on walking away from big problems. You need to be prepared to explain what led to these choices in order to put a potential employer more at ease.

- Liens: Liens are another sign of irresponsibility as well as an indicator that you have not been resourceful enough to negotiate a settlement.

- Lawsuits and judgments: Creditors can sue you for unpaid debt and these suits will stay on your credit report for seven years.

You May Like: Qvc Card Credit Score

How To Apply For Police Check

Go to BackyCheck website at backycheck.com.au/background-check-services

- Select the check you want. You can also bundle with other checks you may want, as VEVO check.

- Complete your purchase, and you will receive a link where you can complete online the request by verifying your identity online, and upload your documets.

- You will then receive your police check.

Head Of Global Digital Marketing

With more than 9 years of experience working in fintech and e-commerce, Anna is helping people all over the world change the way they manage their finances.

Hand crafted with ⥠in Cape Town

Clearscore Limited

Company registered in South Africa

NCR Authorised

Central Office Park No 4,

257 Jean Avenue, Centurion, 0157

South Africa

You May Like: Is Ic Systems A Legitimate Company

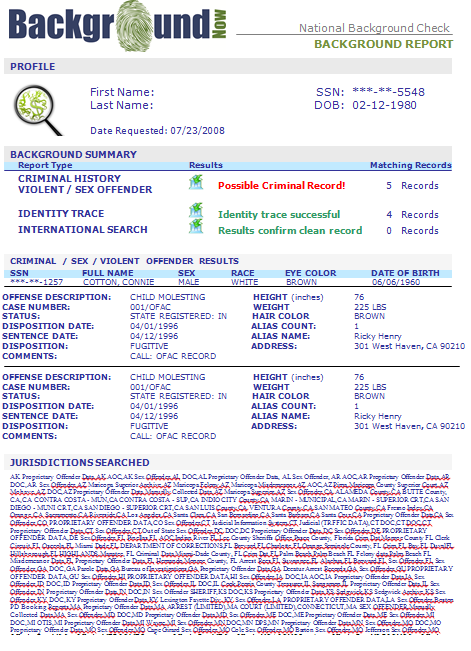

Identity And Address Verification

A fraudulent SSN may be indicative of identity theft, incorrect claims of citizenship status, or concealment of a “past life”. Background screening firms usually perform a Social Security trace to determine where the applicant or employee has lived. The hiring of undocumented workers has become an increasing issue for American businesses since the formation of the Department of Homeland Security and its Immigration and Customs Enforcement division, as immigration raids have forced employers to consider including legal working status as part of their background screening process. All employers are required to keep government Form I-9 documents on all employees and some states mandate the use of the federal E-Verify program to research the working status of Social Security numbers. With increased concern for right-to-work issues, many outsourcing companies are sprouting in the marketplace to help automate and store Form I-9 documentation.

What Is A Criminal Background Check

A criminal background check provides information about an individual’s criminal history. Employers use criminal background checks as part of a comprehensive screening process on potential hires and existing employees. These records help the employer assess the possible risk an individual might pose in their workplace.

Also Check: Speedy Cash Collections

Faqs And Helpful Links

You have questions we have answers.

You can request a copy of your report through our online form, by email, or by phone. for more information on requesting a copy of your report.

You can dispute the contents of your background check report by using our online form, by email, or by phone. for more information on disputing your report.

Before a prospective employer can order a background check on you, it has to tell you that it will do so through a proper disclosure and it also has to get your written permission. The forms that an applicant signs off on are commonly referred to as the disclosure and authorization forms. However, letting you know it will run a check as part of the hiring process and getting your permission in advance doesnt always mean that the company will actually run a background check.

Depending on its hiring process, some companies may have all applicants fill out a consent form and receive a disclosure as one part of the application process. However, the company will only run the background check on the candidate actually being considered for the position.

The other scenario involves the prospective employer only making a disclosure and obtaining consent once a conditional offer of employment has been made to the candidate.

An applicant can either ask the HR department directly or if it knows which background check company the prospective employer uses, it can ask the screening firm if a report was prepared.

Are Background Checks Legal In California

Background checks are generally legal in California. However, California law imposes several restrictions/obligations on companies when performing them for employment purposes. Some of these are found in:

Read Also: When Does Capital One Report To Credit Bureau

What Is A Consumer Reporting Agency Or Credit Bureau And What Does It Do

Consumer reporting agencies, like TransUnion, serve consumers and businesses by providing credit information and risk management tools to help businesses make credit-granting decisions.

Lenders and other institutions provide credit bureaus with factual information about how their customers pay their bills and other debts. Credit reporting agencies compile payment histories, along with public record information, into a “file” for each consumer. Credit grantors and authorized institutions obtain credit reports about individual consumers. Consumers benefit through faster credit decisions.

TransUnion generates millions of credit reports each year to make buying on credit fast, easy and safe for qualified applicants.

Honesty: Still The Best Policy

Perhaps a more critical question that applicants should consider during their application process is whether or not to be frank with HR or interviewing staff. We hear all too often that employers sometimes cant move forward with an offer because the applicant failed to disclose information, and that act of omission is viewed negatively, when many times the offense itself is not a disqualifying factor. The hiring organization perceives the omission or falsification of the application by the applicant as an act of dishonesty, which for many employers, is hard to look past. Further, they have to apply that rule consistently. So when an applicant is asked about past criminal history that is neither sealed nor expunged , it simply makes sense to be forthcoming. In that same breath, the applicant can easily explain the circumstances around a particular record and provide insight into rehabilitative efforts or call attention to their stable record of employment post criminal incident. In short, having a criminal record will not necessarily limit an otherwise strong candidate from obtaining the position, but dishonesty might.

Recommended Reading: Does Stoneberry Report To Credit Bureau

Does Checking Your Credit Score Affect Your Credit Rating

Checking a credit score, such as your Equifax Credit Score will not change the score itself regardless of how many times you check your own score. Being aware of your credit score and the information contained on your credit report can be a useful way of ensuring all the information is correct and understanding factors that may help improve your score. What will be reflected on your credit report are searches by other organisations e.g. when you make an application for credit, or security searches, which can happen in some companies when you apply for a new job. Looking up your own score is something completely different.

Important Considerations Before Ordering Employment Credit Reports:

- Is there a comprehensive policy stating which positions within your company will require a credit report before hire?

- Is the policy being used consistently for all candidates applying for those outlined positions?

- Is the information received from the credit report directly related to the job?

- Is the credit report coming directly from a reliable source such as a consumer reporting agency that is authorized to provide employment credit reports?

- Have your hiring managers been trained in how to interpret credit reports?

- Are candidates on whom you run credit reports given the opportunity to review and dispute any information found on the report?

- Is the credit report a determining hiring factor between two equally qualified candidates?

- When during the hiring process is the credit report being used?

Crimcheck is a consumer reporting agency which is authorized to provide employment credit reports to approved corporations. Contact our sales staff for more information.

You May Like: Paypal Credit Report

What Id Do I Need To Prepare To Do The Police Check

ACIC requires you to provide 4 documents from 3 categories, as below:

- ONE Commencement of ID Document

- ONE Primary Use in the Community Document

- TWO Secondary Use in the Community Documents

In all instances, the combination of identity documents must contain at minimum your full name, date of birth and a photograph.

If you have provided identity documents using a former name, such as a maiden name, you must provide evidence of the name change in addition to the four identity documents.

The nature of the documents in each of the categories is summarised below:

Commencement of ID

- Australian birth certificate or authorised record of birth

- Australian citizenship certificate

- Australian visa current at time of entry to Australia as a resident or tourist, supported by a foreign passport, which is needed for verification

- ImmiCard issued by Department of Home Affairs that enables the cardholder to prove their visa and/or migration status and enrol in services

- Current Australian passport not expired,

Primary Use in Community Document

ONE is required

Secondary Use in Community Document

TWO are required

- Certificate of identity issued by DFAT to refugees and non-Australian citizens for entry to Australia

- Document of identity issued by DFAT to Australian citizens or persons who have the nationality of a Commonwealth country for travel purposes

- Convention travel document secondary issued by DFAT

- Foreign government issued documents

- Medicare card

One Email A Day Could Help You Save Thousands

Tips and tricks from the experts delivered straight to your inbox that could help you save thousands of dollars. Sign up now for free access to our Personal Finance Boot Camp.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

Recommended Reading: What Credit Score You Need For Care Credit

Reading And Correcting Your Credit Report

How do you find what portion of your credit report is public record? When you pull view credit report, you can locate the public record items under the section entitled Public Information. There, you will see a listing of the type of public information and the date on which it occurred.

What if your credit report includes public record information that should already have been removed? This is why it is so important to take a close look at your credit report from time to time. You are not required to pay for your credit report you can request it for free from each of the three reporting agencies. Remember to get all three they may have different information.

Once the credit bureau makes a determination, it will send you a summary of its findings. If it determines that a public record should not be included in your report, that record will be deleted. If the bureau has found the public record to be verifiable and decided it should remain, you have the option of re-disputing the matter. If you havent found any additional information to support your argument, its unlikely that the bureau will change its original decision.

A deleted item could reappear at a later date on your credit report if resubmitted by a reporting entity. If this happens, the credit bureau must notify you and you can dispute the item again. To prevent this from happening, you can dispute the information with the entity that originally reported it, such as the local court.

What Sources Of Personal Information Does A Background Check Pull From

A background check will gather information from the following sources:

- criminal/arrest records and court records,

- worker compensation records,

- social security records, and

- state licensing records.

A background check does not have to collect information from all these sources. A check may just collect from a few of them.

Also, California law may place exemptions on the type of information that can be pulled from these sources. For example, listed in Section 2 above are limitations regarding criminal records.

As to medical history, California law imposes strict requirements that protect the confidentiality of a persons medical information. Most employers can only gather information about an applicants ability to perform specific job functions.

California law imposes several restrictions and obligations on employers when performing background checks on job applicants.

Read Also: When Does Capital One Report To Credit

Certified Criminal Record Checks

A certified criminal check is more involved than a regular check. It requires fingerprints from an authorized agency or the police. This type of criminal record check is required for:

- Adoptions

- Visa applications

- Work permits

Requests for certified criminal background checks can be made through the local police or RCMP detachment. If you need to submit your fingerprints for criminal record checks, it will take up to three business days for your employer or other organization to receive the results if you dont have a record. If you do have a record, it can take up to 120 business days for the results to return.

Fingerprints continue to be a vital part of criminal record checks since theyre a unique identifier. Theyre also still part of the arrest and booking process. Today, fingerprinting can be done with digital scanners and are sent electronically to the RCMPs secure database, so criminal record checks are completed much faster. The traditional method of using ink and paper for fingerprinting is still used as an alternative in some cases.

A certified criminal record check has a $25 mandatory fee for federal processing. In some cases, the fee is waived, such as if youre applying for citizenship or the Canadian police.