Do You Need To Track All Of Your Credit Scores

Consumer credit behavior has changed over the years. In order to offer credit scores that are as accurate and competitive as possible, both FICO and VantageScore update their scoring systems from time to time. Releasing new credit score versions also gives FICO and VantageScore new products to sell and more ways to make money.

Yet just because FICO or VantageScore releases a new credit score doesnt mean that every lender will upgrade and use it. Instead, different lenders may use different credit score versions. The concept is similar to the idea that all PC owners dont automatically update their computer software when Microsoft introduces a new operating system.

Because there are so many credit scores on the market, tracking all of them would be virtually impossible. But you dont need to track all of your credit scores either. Its far better to keep tabs on the information that influences your credit scores. In other words, you need to review your credit reports. Clean credit reports should equal solid credit scores under any FICO or VantageScore brand scoring model.

What Is The Difference Between Fico 8 And Fico 9

Asked by: Maximillian Gorczany

FICO 9 is similar to FICO 8 but differs when it comes to collections and rent payments. … Additionally, FICO 9 ignores accounts in collections that have a zero dollar balance. If you had a credit card account go to collections but later paid it off, FICO 9 will no longer use said collections account against your score.

Why Do I Have Different Fico Scores

FICO offers multiple versions of its credit score for different uses. For example, you have one FICO credit score that’s used when applying for auto loans and another that’s used when applying for credit cards. FICO often updates its credit scoring models. They can also be different depending on which credit report is used to calculate them. If a creditor reports a loan account to one credit bureau but not the other two, that can affect the FICO credit scores generated by each credit report.

Read Also: Walmart Klarna

How Are Credit Scores Generated

When someone refers to a “credit score,” they’re generally referring to a three-digit rating that represents a borrower’s history of repaying loans and lines of credit. The credit score is generated by applying credit rating company’s algorithm like VantageScore® and FICO® to a borrower’s credit report.

What Score Matters Most To Your Lender

According to leading financial industry analyst Mercator, FICO® Scores are used in over 90 percent of credit lending decisions in the United Statesbut that doesnt mean your lender is guaranteed to evaluate just your credit score to approve you for a loan. Lenders use a variety of information and tools in addition to credit scores when evaluating your creditworthiness. It is important to track your credit score, understand the different versions available and confirm which one your lender is using for your application to prevent any surprises.

FICO, in particular, offers a range of scores depending on the type of loan youre requesting . This helps ensure lenders accurately evaluate your creditworthiness, in turn providing you with the line of credit you require. You can learn more about these scoring variants on myFICOs FICO Score Versions page.

Also Check: Affirm Required Credit Score

What Is Capital One Creditwise

Capital One CreditWise is a free tool that allows you to check and monitor your credit score. The tool also allows you to discover key factors that impact your score and receive email alerts when something on your account changes. You can even monitor your Social Security number and track the dark web.

All of your data is encrypted with 256-bit Transport Layer Security , and you can access CreditWise online or via their app for iOS and Android devices.

You dont need to be a Capital One customer to utilize their CreditWise benefits. However, you do need to be at least 18 years old with a valid Social Security number they can use to verify your identity and access your TransUnion credit profile.

Once your account is set up, you can access your credit score by logging into your account and visiting the credit summary on the home page. There, youll also find factors that contribute to your score, such as on-time payments and credit line ages.

What Is My Real Credit Score

Companies can choose which score to purchase and use when reviewing applications and managing customers’ accounts, which is one reason there’s competition in the credit scoring world. With this in mind, there isn’t a single, “real” credit score.

For example, when you’re shopping for an auto loan, you may try to get offers from several lenders. One lender might use a FICO® Score 8, another a FICO® Auto Score 2, and a third a VantageScore 4.0. Your scores may vary, but each is very real in the sense that the lender is using it to determine if you qualify for a loan and the rates and terms to offer you.

Generally, you won’t know which of your three credit reports or which credit score a lender will use. However, because credit scores all rely on the same underlying data, building positive credit can help you get good credit scores regardless of the model. Conversely, negative items, such as late payments or a bankruptcy, could hurt all of your credit scores.

Also Check: Does Affirm Report To The Credit Bureau

Ways To Improve Your Fico And Credit Scores

Whether you’re trying to build credit or improve your current scores, there are several ways that you can do this.

Lets look at those ways now.

Repay Debts on Time

One thing you can do to improve your credit score is to pay off outstanding debts and keep them paid off in the future. If you owe bills, such as credit card debt, make sure to pay them back on time every single month.

You can improve your credit by making payments on time, which shows that you are responsible for the way you manage debt.

Do Not Close Accounts With Debt

Another thing you can do is avoid closing accounts with debt.

Even if you don’t use your credit card, paying off debt on time each month will improve your FICO score and credit history. If you have a bad FICO or poor credit score for various reasons, you might need to hold on to more debt.

However, you can still improve your FICO and credit scores by paying off debt, so it looks like you have fewer accounts with debt. This will help boost your score since debt is one of the most critical factors in determining a credit score.

Keep Accounts Active

You should also keep your accounts open for as long as you can. If you have an old account with little to no debt, then there’s no need to close it. In fact, closing credit cards and other accounts may even hurt your FICO and credit scores since this shows that you’ve closed accounts recently.

Review Annual Credit Report

Another vital thing to do is review your annual credit report.

What Is Fico 8

FICO 8 is still the most widely used FICO credit score today. If you apply for a credit card or personal loan, odds are that the lender will check your FICO 8 scores from one or more of the major credit bureaus.

FICO 8 is unique in its treatment of factors such as , late payments, and small-balance collection accounts. Here are some key things to note about FICO 8:

- This scoring model is more sensitive to higher credit utilization .

- Isolated late payments on your credit report may not count against you as much as having multiple late payments.

- Small-balance collection accounts in which the original balance was less than $100 are ignored for credit scoring purposes.

Its also worth pointing out that there are different versions of FICO 8. With FICO Bankcard Score 8, which is used when you apply for a credit card, the focus is on how youve handled credit cards in the past. FICO Auto Score 8, on the other hand, doesnt emphasize credit card activity and history as heavily.

Regardless of which FICO credit scoring model is involved, the same rules apply for maintaining a good score. These include paying bills on time, maintaining a low credit utilization ratio, and applying for new credit sparingly.

Recommended Reading: Tri Merge Credit Report With Fico Scores

Fico Score Open Access Program

The FICO® Score Open Access Program, offered by credit counseling partners and lender partners, was developed so that partners may share FICO® Scores for use in credit counseling/education and lender evaluation scenarios for free with consumers.

According to FICO, over 200 financial organizations take part in this program, which effectively grants consumers free access to their FICO®Scores, including a breakdown of elements that affect your credit score.

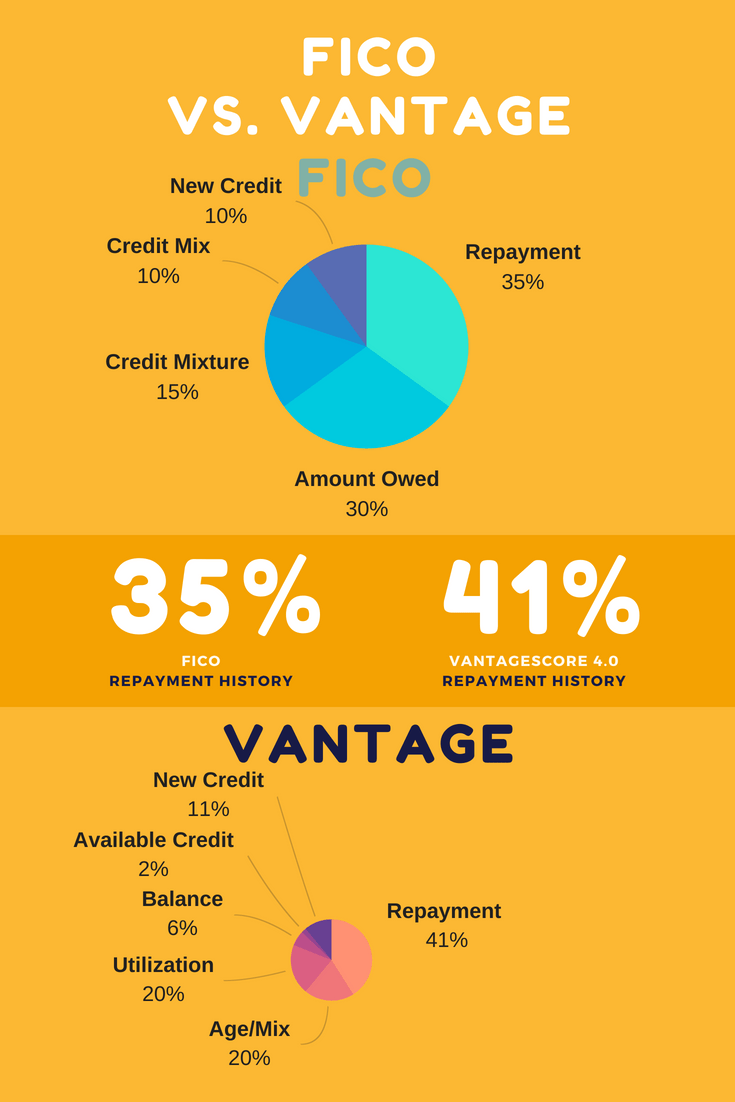

Whats The Difference Between Vantagescore And Fico Credit Scores

VantageScore and FICO both use credit data to produce three-digit scores, generally ranging from 350 to 800, that predict how likely a consumer is to repay debts on time. But they calculate risk slightly differently, giving different weights to different data points. In addition, VantageScore can provide a score for someone with just one month of credit history. FICO requires six months of credit history to provide a score.

You know your credit score is important. A healthy score can open doors, helping you borrow, buy, and do many things all while spending less on premiums. A poor credit score can have the opposite effect, making it difficult to wrangle the finances you may need to power your dreams.

But not all credit scores are created equal. There are two major systems used to determine creditworthiness VantageScore and FICO. Well show you how they calculate your score and why it matters.

Don’t Miss: How Long Does A Voluntary Repossession Stay On Your Credit

Key Differences Between A Fico Score And Credit Score

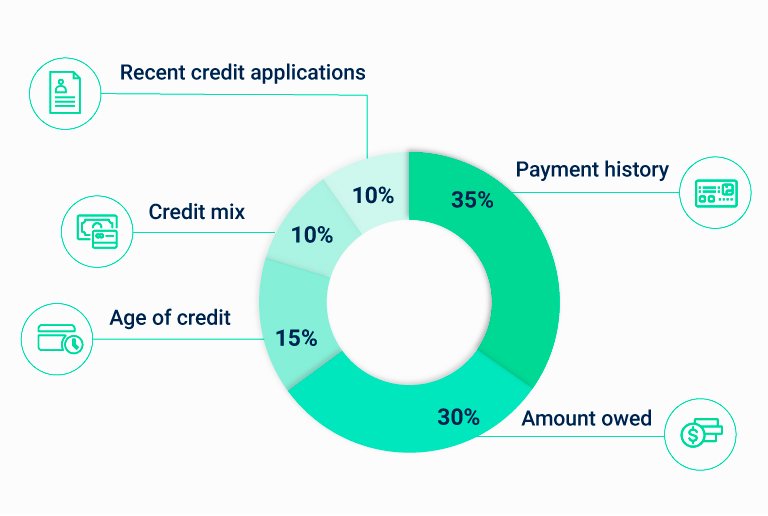

FICO is short for Fair Isaac Corporation, the first company to offer a credit-risk score. Its the most widely used type. FICO uses a formula to measure and assign your creditworthiness. In order of importance, its based on these factors:

- Payment history

- New credit

Using these criteria, credit users are assigned a number in the FICO score range between 300 and 850, with a higher score indicating better credit. FICO also has a variety of scores based on loan types, such as a FICO Mortgage score, FICO Auto Score and more. Its possible to have dozens of different types of different FICO scores, each with a different number.

In addition, the FICO credit score changes in 2020 with the UltraFICO score. This new score is good news for people who are just starting to build a credit history or those who are looking to repair their credit. It is based on the same number scale but also uses deposit account activity to calculate a score.

Another type of credit score is your VantageScore, which was created in 2006 by the three major credit bureaus: Equifax, Experian, and TransUnion. A VantageScore uses the same range, but it is generated with just one month of credit history, making it better for new credit users. VantageScore also uses a different formula to calculate a persons score. In order of importance, its based on:

- Near prime: 601-660

- Subprime: 300-600

Top 3 Reasons You Should Choose Fico Scores Over Non

“For years, there has been a lot of confusion among consumers over which credit scores matter. While there are many types of credit scores, FICO Scores matter the most because the majority of lenders use these scores to decide whether to approve loan applicants and at what interest rates.” The Wall Street Journal1

So why choose FICO Scores over other scores? Here are just a few reasons:

2.You can make more informed financial decisions. With FICO Scores, you’re better prepared to know when to apply for credit because you’re viewing the scores used by 90% of the top lenders.

Remember, non-FICO credit scores can differ by as much as 100 points. Other credit scores may vary from your FICO Score by several points. This variance could cause you to overestimate your likelihood of getting approved. According to a recent Consumers Union report, “score discrepancies can give consumers the false hope that they qualify for credit or low-interest rates when they do not. Consumers can face higher interest rates than expected, or be denied credit.”2

On the flip side, non-FICO credit scores can lead you to underestimate your creditworthiness, keeping you from purchasing a much-needed family car or refinancing a mortgage that could save you thousands in interest.

Also Check: Syncb Ntwk Credit Card

Do Lenders Use Fico Score Or Credit Score

When you apply for loans or lines of credit, it’s likely that a lender will check at least one of your credit scores. The majority of lenders rely on FICO credit scores but it’s possible that a lender may use an alternative credit scoring model when determining whether to approve you for a loan or line of credit.

How Other Credit Scores Work

With some lenders calculating scores based on their own proprietary algorithms, identifying exactly how other credit scores work is a little tricky. Fortunately, many credit scoring systems base their results on similar factors to FICOs scoring model, with specific criteria and considerations varying slightly.

VantageScore, for example, breaks down their model and how they weigh contributing factors to their calculations as follows:

- Total credit usage, balance, and available credit

- Payment history

- New accounts opened

- Age of credit history

Ultimately, all credit scores work on credit report data that will help lenders better understand your existing debt burden and how trustworthy you are when it comes to repaying what you owe. Ask lenders about their approval criteria and which scoring model they leverage so that you have a better idea of what to expect.

Recommended Reading: Comenity Bank Credit Bureau

The Credit Score You Need For A Mortgage

All the major mortgage investors that have home loan programs take a look at your FICO® Score. When it comes to a mortgage, VantageScore® can be helpful in seeing where you need to improve and how youre trending, but its more of a guidepost.

Mortgage lenders and investors may have different requirements. The following are based on the guidelines of our friends at Rocket Mortgage®.

You can get a loan through FHA with a median FICO® Score of as low as 580. However, its important to note that youll really have to keep minimal debt with a credit score this low. Youll also be required to have a debt-to-income ratio of no higher than 38% before the house payment is included and 45% afterward. If you have a median score of 620 or higher, you can have a higher DTI which could help you afford more home if you need it.

At Rocket Mortgage®, the minimum median score for qualification is 580 with the same DTI restrictions you would have on VA loans with that credit score.

While the USDA sets no specific minimum qualifying score, it’s often considered harder to qualify would say median score below 640. This loan is available to people looking to live in certain rural areas or those on the edge of suburbia who meet income restrictions.

How Do I Access My Credit Report

The Fair Credit Reporting Act allows consumers access to one free credit report annually from each of the three major credit reporting agencies, through AnnualCreditReport.com. By viewing your credit reports, you will be able to know what lenders will see when you apply for a loan. The free annual credit report will not contain your credit score.

You May Like: How Do I Unlock My Credit Report

Ficos Credit Score Formula

The all-industry FICO® Score ranges from 300 to 850, and the higher the score, the more attractive you are to lenders as it indicates higher odds of repayment. Heres a look at the FICO®Score ranges, according to myFICO:

- Poor credit: 580 and under

- Fair credit: 580 to 669

- Good credit: 670 to 739

- Very good credit: 740 to 799

- Excellent credit: 800 and up

Below are the five categories, weighted according to importance, that help make up a FICO®Score:

Factors That Affect Credit Scores

FICO and CreditWises VantageScore 3.0 have more in common than otherwise since their goal is to predict your lending risk based on your past financial behavior. VantageScore and FICOs newest XD model can use phone and cable bills to predict borrowing behaviors, even if you dont have established credit.

However, each model places different emphases on factors that contribute to your credit score, leading to different calculations. These factors include when your score is determined, if youve recently missed a payment, how long youve had credit, if you have a low-balance collection on your report, and how far back your hard inquiries go.

Read Also: How To Report A Death To Credit Bureaus

The Basics: What Is A Fico Score

A FICO® Score is a credit score model from Fair Isaac Corporation that is used by thousands of lenders to help them assess the credit risk of individual consumers. Its a three-digit number ranging from 300 to 850, where higher is better , and has been the industry standard since the products founding in 1989.

Tom Quinn, vice president of Scores at FICO, says that there are numerous versions of FICO credit scores because they are periodically redeveloped to incorporate new analytic tools. Through the updating process, FICO releases new FICO Score versions to the market, at which point lenders determine if theyre going to migrate to a newer version of the FICO® Score or continue using the version they are currently using.

In addition, there are FICO® Score versions tailored to assess the credit risk for specific types of financial products. In addition to the base model, which is designed to predict the general risk of any credit obligation, Quinn points out that there are industry-specific versions focused on auto and bankcard risk.

According to myFICO.com, the industry-specific FICO credit scores leverage all the predictive power of the base FICO® Scores while also providing lenders a further-refined credit risk assessment tailored to the type of credit the consumer is seeking.

And then we have three bureaus, so you multiply everything by three, says Quinn.