Equifax Financial Health Index

The Equifax Financial Health Index uses information from Open Banking or the information that customers supply themselves, which they combine with existing credit record information, to develop a fuller picture of customers financial circumstances.

The Financial Health Index lets you add information to your credit records about:

- savings and investments.

The Index can also fill in credit information gaps, by including information such as rent and utilities payments.

There are other credit reference agencies joining the market, such as Credit Kudos, which also take Open Banking into account.

Only Borrow What You Can Afford

A credit card isn’t a permission slip to buy things you can’t afford. This is the quickest way to get into debt and credit trouble.

The best way to build good credit is to create the habit of charging only what you can afford. This habit lets future lenders and creditors know you’re a responsible borrower. You’ll find it easier to borrow money and get new credit when you show that you have the discipline to borrow only what you can afford to repay. Not only that, only charging what you can afford helps you avoid excessive debt.

The same rules applies to loans. Regardless of what the lender says you qualify for, you should only borrow what you can pay back. Before you shop for a loan, review your budget to see what monthly payment you can afford. Make sure your loan payment doesn’t exceed the amount you’ve come up with.

Keep Your Balances Low Too

Do your best to avoid carrying high balances on your credit cards month-to-month, which can signal to lenders that you may have trouble managing your debt load. And because credit scoring models reflect lender confidence, high balances can drop your credit score if it seems that youre not managing your debts well.

Keep in mind that you want to maintain a rather low credit utilization, which describes how much credit youre actually using in relation to how much you have available to use. Just because you have a $15,000 credit limit across three credit cards doesnt mean you should carry that big of a balance each month. Remember, you have to repay whatever you spend, so its best to only charge amounts you know you can repay fairly quickly. Making minimum monthly payments is fine, but if you can pay off the full amount, do it.

Don’t Miss: Affirm Credit Score Needed

Consider Getting A Credit

If you have a poor credit history, you might want to think about getting a credit-builder credit card. These are cards designed for people who either have made little previous use of credit or who have a bad credit history. But credit limits on these cards are often low and the interest rates are high. This reflects the level of reassurance your credit file information provides to lenders.

Butbe aware that the interest rates charged are much higher than standard credit cards. Typically, youll be paying over 30% in interest a year, which is another reason to try to pay off any balance in full each month. Otherwise, you might end up in debt that you struggle to get out of, which could harm your credit rating even further.

What To Do If Youve Been A Victim Of Credit Fraud

If youve been a victim of identity impersonation or credit fraud, your credit score might have taken a hit. Improving your credit score in these situation involves taking many of the steps on this page.

When you check your credit file, keep an eye out for a Victim of impersonation notice. This marker is provided by Cifas, a not-for-profit fraud prevention service.

Cifas markers are put on credit files by lenders in cases where they believe there has been an attempt at fraud by people mis-using a loan applicants identity. Lenders are legally obliged to report such concerns.

Having a Cifas marker on your file serves as a warning to future lenders that youve been a victim, or are vulnerable to becoming a victim, of fraud.

The marker will stay on your file for 13 months.

The good news is that having a Cifas marker doesnt affect your credit score and doesnt stop you from taking out credit. But it may create problems if youre applying for credit that is processed automatically, such as store finance. This is because a lender would have to carry out a manual review of your file to understand why the marker has been added.

Find out more on the Cifas website

Read Also: Does Affirm Report To The Credit Bureau

Your Credit Score Isn’t High Enough

Some credit card companies are more flexible than others when it comes to credit score requirements. To be clear, there are plenty of credit card offers available to applicants whose credit scores could use some work. But certain offers are only really applicable to consumers with great credit. If you want to open the door to more credit cards, you should look into boosting your credit score.

How can you do that? Paying your bills on time will help a lot, as your payment history carries more weight than any other factor when calculating your credit score. You can also raise your score by paying off some existing credit card debt and correcting errors on your credit report that may be working against you — for example, past-due bills you’ve already settled.

Average Credit Score By Age

Your credit score is a powerful number that directly impacts many of your financial moves. The three-digit number is based on the information in your credit report, which is a compilation of your credit history from businesses where youve had credit accounts.

One thing that generally is not a factor in your credit score is your age. With few exceptions, lenders arent able to use your age to determine your creditworthiness, and it is never acceptable for a scoring system to negatively impact someone’s score because they are 62 or older.

However, there definitely is a correlation between age and credit scores. Research shows that credit scores typically rise with age, but that likely is because of the way scores are calculated. For example, 15% of your credit score is based on the length of time that youve been using credit, which is the age of your credit history. The more experience you have with credit, the better, especially if you have a positive credit history. It stands to reason that the older you get, the more experience you have with credit. That experience can give your credit score a boost.

Recommended Reading: Comenity Bank Shopping Cart Trick Stores

What Goes Into A Credit Score

There are actually a number of factors that go into a credit score. Each major credit bureau has its own method of weighing different factors, and many banks and insurance companies have their own specific formulas. But most credit scoring formulas are based on the original breakdown put out by the Fair Issac Company . You can get a good idea of what is important in your credit score by using the following as a guide:

- Payment history: 35%

- Length of credit history: 15%

- New credit and hard inquiries: 10%

- Types of credit you have: 10%

As you can see, the most important factor related to your credit score is your payment history. Paying on time, and paying the full amount you should be paying, is the single most important thing you can do. After that, the most important thing you can do is to keep the amount of debt you have low. While other factors have some bearing on your credit score, you will find the most success in raising your credit score if you focus on making your payments on time, and reducing the amount of debt you have.

Don’t Close Old Credit Cards

When you close a credit card, your credit card issuer no longer sends updates to the three major credit bureausExperian, Equifax, and TransUnionwhich hurts your score because the credit scoring formula places less weight on inactive accounts. After 10 years or so, the credit bureau will remove that closed account’s history from your credit report altogether, and losing that credit history will shorten your average credit age and cause your credit score to drop.

Closing a credit card also reduces your available credit. For example, if you have three cards with a combined credit limit of $10,000 and you close one with a $3,000 limit, your combined credit limit will be reduced to $7,000. Since your goal is to keep your credit card balances at less than 30% of your available credit, closing that card reduces your threshold by $900.

Read Also: Barclaycard Fico Score Accurate

How Would A Late Payment Affect An Already High Credit Score

If you already have a high credit score, a late payment is going to have more of a dramatic effect on your credit score than if your credit score was previously lower.

“Imagine a brand new car in pristine condition,”Wilson Muscadin, financial coach and founder at The Money Speakeasy, tells CNBC Select. “A visible scratch on the hood of that car is going to have a more dramatic effect on the value of that car than a scratch on a 3-year old used vehicle. That credit score impact could be as much as 100 points.”

Let’s take a look at an example of just how much a missed or late credit card payment could affect your credit score. Below is an example of the effect that a 30- and 90-day missed credit card payment has on two consumers, according to FICO data.

| Sophia | ||

|---|---|---|

| Total credit score drop for a 90-day missed payment | 27-47 points | 113-133 points |

As you can see in the above, the higher Maria’s credit score, the greater negative effect a 30- or 90-day missed credit card payment has on her account. Sophia already has her past behavior reflected in her lower credit score, but for Maria, the addition of one more indicator of risk is more significant because of her clean credit history.

Dont Close Unused Cards

As you take steps to get your credit in order, you may want to clear out financial clutter by closing credit cards that you dont often use.

While this could make managing your wallet easier, closing an account can also lower your available total credit and increase your credit utilization rate.

Davies says the impact of closing an account depends on the credit scoring model. For example, some credit-scoring models may consider the age of your oldest open account. If you close that account, your credit scores could drop.

Read Also: Does Speedy Cash Report To Credit Bureaus

Use A Secured Credit Card

Another method that can be used either to build credit from scratch or improve your credit is by using a secured credit card. This type of card is backed by a cash deposit you pay it upfront and the deposit amount is usually the same as your credit limit. You use it like a normal credit card, and your on-time payments help your credit. Choose a secured card that reports your credit activity to all three credit bureaus. You may also consider looking into alternative credit cards that don’t require a security deposit.

Reduce The Amount Of Debt You Owe

Your , or the balance of your debt to available credit, contributes 30% to a FICO Score’s calculation. It can be easier to clean up than payment history, but it requires financial discipline and understanding the tips below.

Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score.

Pay off debt rather than moving it around: the most effective way to improve your credit scores in this area is by paying down your revolving debt. In fact, owing the same amount but having fewer open accounts may lower your scores. Come up with a payment plan that puts most of your payment budget towards the highest interest cards first, while maintaining minimum payments on your other accounts.

Don’t close unused credit cards as a short-term strategy to raise your scores.

Don’t open several new credit cards you don’t need to increase your available credit: this approach could backfire and actually lower your credit scores.

Read Also: Syncb/ppc Credit Card

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How To Get Excellent Credit: 5 Expert Tips

1. Always pay on time. Always.

Payment history heavily influences your credit score. In fact, it is the most influential factor for FICO and VantageScore.1 To stay on top of your payments, set up a calendar reminder or enroll in automatic payments. The on-time payment goal applies to all your bills, including utilities, rent and cell phone service.

What if you were late on a payment a few years ago? While late or missed payments can stay on your credit report for seven years, the impact on your credit score decreases over time. Most negative items have little impact on your score after two years2 so be patient, keep making timely payments, and youll soon be on your way to an excellent credit score.

2. Optimize your credit utilization ratio.

is another key piece of your credit score puzzle. Credit utilization measures the balances you owe on your credit cards relative to your cards credit limits. Its calculated on an overall basis .

The general rule of thumb with credit utilization is to stay below 30%.3 This applies to each individual card and your total credit utilization ratio. Strategies for improving your credit utilization ratio focus on reducing the numerator and managing the denominator .

Try one of these techniques to improve your credit utilization ratio:

3. Regularly monitor your credit scores for inaccuracies.

4. Be strategic about taking on new debt and closing accounts.

5. Consider your credit mix.

You May Like: Does Speedy Cash Check Your Credit

Use Credit Boosting Services

There are a couple of innovative ways of boosting your credit score, above and beyond the ordinary pay on time methods. One company is helping individuals take out a loan and pay it off each month. Whenever you make a payment, theyll report the good behavior to the credit bureaus and your credit score and profile will likely improve.

Another is Experian Boost, which allows you to include your positive payment history for utility bills and cell phone bill payments to your credit score payments which otherwise would not affect your score at all. Best of all the service is completely free.

Review Your Credit Reports

To improve your credit, it helps to know what might be working in your favor . Thats where checking your credit history comes in.

Pull a copy of your from each of the three major national credit bureaus: Equifax, Experian, and TransUnion. You can do that for free once a year through the official AnnualCreditReport.com website. Then review each report to see whats helping or hurting your score.

Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit. Late or missed payments, high credit card balances, collections, and judgments are major credit score detractors.

Check your credit report for errors that could drag down your score and dispute any you spot so they can be corrected or removed from your file.

You May Like: Does Paypal Credit Report To Credit Bureaus

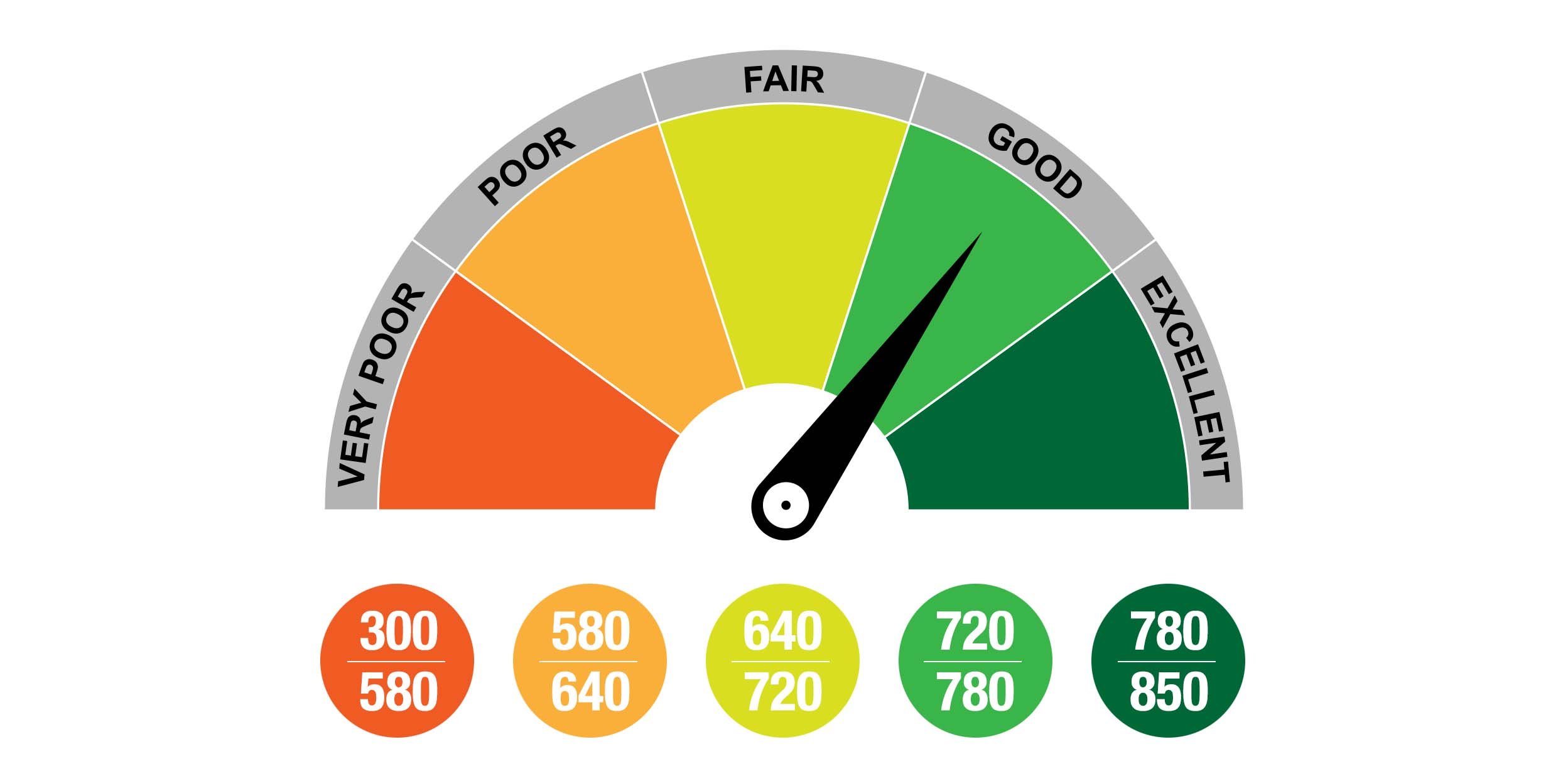

What Is A Credit Score

A credit score is a numeric summary of your credit history, a commonly used method for lenders to predict the likelihood that you will repay any loans they make to you.

There are no exact cutoffs for good scores or bad scores, but there are guidelines for each. Most lenders view scores above 720 as ideal and scores below 630 as problematic.

Consumers are becoming more aware of how raising their credit score improves their financial outlook and Homonoffs study has evidence of it. She found consumer behavior improved dramatically when people were aware of their credit score.

Many people thought they had a great score, but then found out they overestimated it, she said. They realized they had to start changing credit behaviors, so they stopped making late payments, they paid off cards with a balance and their scores improved.

The FICO credit score is used by 90% of the businesses in the U.S. to determine how much credit to offer a consumer and what interest rate to charge them for that credit.

FICO uses five major components in the equation that produces your credit score. Those five include:

How Long Will A High Balance Hurt My Credit Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Your credit utilization ratio the amount of credit you use as compared to your credit card limits is a big factor influencing your credit score.

Carrying a high balance on a credit card can hurt your score. But once youve paid it down and your credit reports update, it wont continue to affect your score.

Carrying a high balance on a credit card for a short period of time won’t do long-term damage, but its still important to keep your credit utilization ratio low.

Experts advise keeping your usage below 30% of your limit both on individual cards and across all your cards.

In the widely used FICO scoring model, your credit utilization accounts for about one-third of your overall score, while its competitor, VantageScore, calls it highly influential.

» MORE: Tips for lowering your credit utilization

Don’t Miss: How To Get Rid Of Repossession On Credit Report