Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Free Alternative Credit Reports

TransUnion, Experian and Equifax arent the only credit reporting agencies that track your financial performance. Tens of other companies across the country maintain data on your rent payments, check-writing history and insurance claims. Along with traditional credit data, this alternative information is then factored into the decisions made by financial institutions, landlords, employers and insurers.

Fortunately, the Fair Credit Reporting Act entitles consumers to free annual copies of these specialty reports. You can order them directly from the companies that compile them, and you can find contact information for each one in WalletHubs .

What Is A Credit Score

A credit score is a number. It is based on your credit history. But it does not come with your free credit report unless you pay for it.;

A high credit score means you have good credit. A low credit score means you have bad credit. Different companies have different scores. Low scores are around 300. High scores are around 700-850.

Read Also: Does Paypal Working Capital Report To Credit Bureaus

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services.;These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Monitor Your Credit Regularly

Monitoring your scores and reports can tip you off to problems such as an overlooked payment or identity theft. It also lets you track progress on building your credit. NerdWallet offers both a;free credit report;summary and a;free credit score, updated weekly.

Heres how the information youll get from AnnualCreditReport.com differs from what free personal finance sites may provide:

AnnualCreditReport.com provides:

-

Data from all three major credit bureaus

-

An extensive history of your credit use

Personal finance websites, including NerdWallet, provide:

-

Unlimited access

You May Like: Comenitycapital/mprcc

How To Log A Dispute

The National Credit Act provides you with the right to dispute any factually incorrect information on your credit report generated by a credit bureau and to have this information corrected.

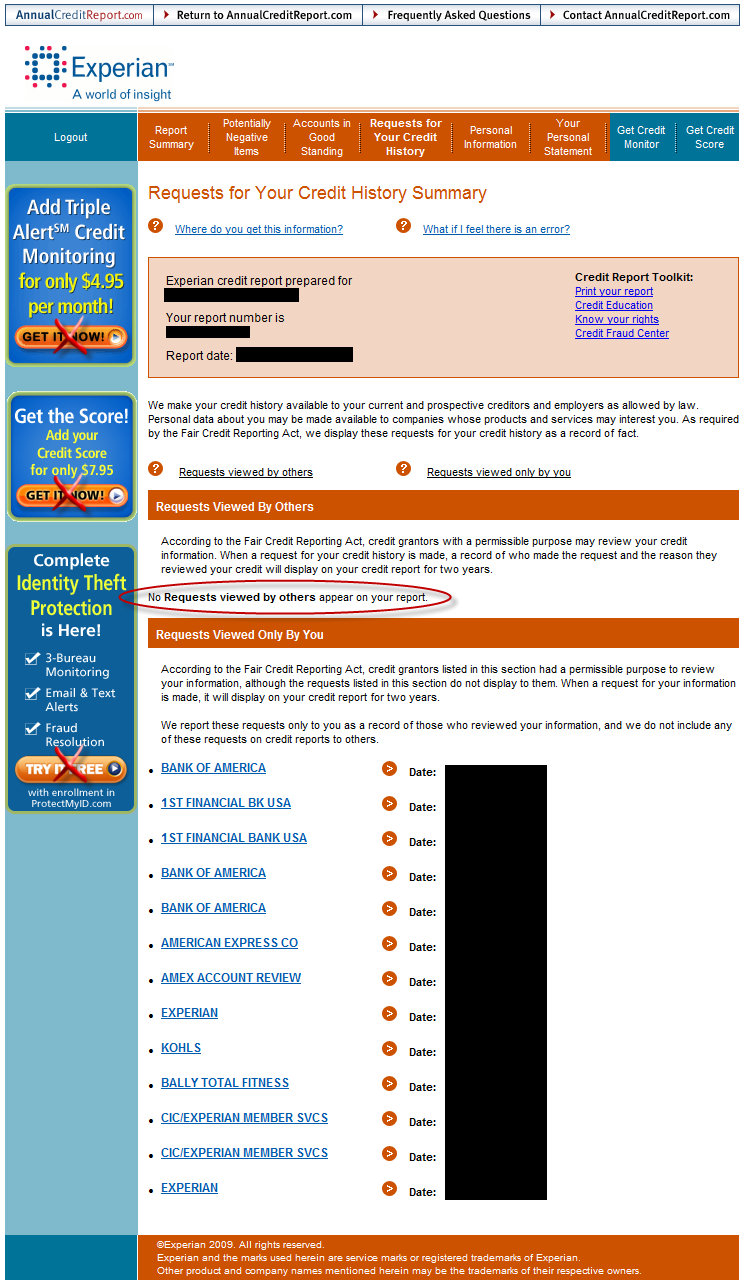

Logging a dispute with Experian is free of charge. Why pay one of the many credit clearing companies that charge money for doing something that you could do for free? Once you have logged a dispute with us, we have 20 business days to investigate the dispute. To find out more about logging a dispute at Experian, please visit our blog by clicking here.

In the event that you are not satisfied with the outcome of the dispute, you may refer the matter as follows:

Bank account information:

- National Credit Regulator; 0860 627;627

Retail and other non-bank information:

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

You May Like: Cbcinnovis On My Credit Report

Why You Could Have Different Credit Reports From Different Bureaus

The credit bureaus can only report on the information thats provided to them. Since lenders are not required to report to all three major credit bureaus, you might find information about certain accounts on one credit report, but not others.

Even when lenders do report information to all three major bureaus, they may report that information at different times. Given all the credit information included in a typical credit report, its perfectly normal to observe some minor differences between your credit reports.;

Mistakes do happen from time to time. If you think your credit reports are different due to legitimate errors, you can dispute those errors with each credit bureau.;

What Are Credit Monitoring Services

If you spot entries in your credit report that don’t seem to relate to you , you may be a victim of the rapidly-growing crime of identity theft. You should notify the credit reporting company immediately.

There are companies that will take the effort of checking your credit report off your hands;;for a price. The credit reporting bureaus are, not surprisingly, very active in this area. At TransUnion, their credit monitoring service costs $14.95 a month and includes unlimited access to your credit profile and credit score. At Equifax, credit monitoring and identity theft protection starts at $16.95 a month.

There are several other companies offering similar services for similar prices. They usually include features like e-mail alerts when there’s a change to your credit report.

It’s a personal decision whether you feel these services are worth the money. The bottom line is you can always check your credit report for free by mail. Or, you can pay to get it online whenever you want. People who have been the victims of identity theft or people who are worried that they may be susceptible to ID theft may consider the expense worthwhile.

Recommended Reading: How To Get Credit Report Without Social Security Number

How To Order Your Free Annual Reports From Specialty Consumer Reporting Agencies

All of these reports are ordered through automated telephone systems. The system will ask you for personal information, including your Social Security number, to identify your file. In some cases, you will be sent an order form to fill out and mail in.

- CLUE Personal Property and/or Auto Report

- WorkPlace Solutions Inc. Employment History Report

Which Credit Report Is Most Accurate

No one credit report is innately more accurate than the others. Your TransUnion credit report might contain information that your Equifax credit report doesnt, or vice versa.

This is partly because lenders are not required to report your information to all three credit bureaus. In some cases, they may only report to one bureau and not the others, or they may report information at different times.;

In any case, its a good idea to review your credit reports on a regular basis so that you can be sure any discrepancies are minor.;

Ready to help your credit go the distance? Log in or create an account to get started.

Also Check: Aargon Collection Agency Address

Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Read Also: How To Remove Hard Inquiries From Credit Report

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days.

- Online at AnnualCreditReport.com youll get access immediately.

- using the Annual Credit Report Request Form; itll be processed and mailed to you within 15 days of receipt of your request.

It may take longer to get your report if the credit bureau needs more information to verify your identity.

Why You Should Check Your Credit Report Regularly

Your credit report shows any credit cards or loans you have open as well as the balance on those accounts. Whether you have a lot of debt or no debt at all, its important to keep tabs on this report because you need to prove good credit health if you want to access new creditlike to buy a new car, buy a home, or go to collegedown the road.

The CARES Act required many creditors to report accounts in temporary forbearance as current instead of past due, including federally backed mortgages and federal student loans. This important difference can help preserve credit scores as much as possible during the pandemic.

During a time of widespread economic crisis such as the Covid-19 pandemic, increased accessibility to credit report information helps those who are struggling the most, says Bruce McClary, senior vice president of communications at the nonprofit National Foundation for Credit Counseling. As special arrangements are made to help people keep accounts on track, they can monitor how those accommodations are reported.

Checking your credit report often helps you to identify potential fraud quickly. Fraudsters have made quick work taking advantage of people during the pandemic: Identity theft reports made to the Federal Trade Commission more than doubled between 2019 and 2020, with credit card fraud, government documents or benefits fraud, and loan/lease fraud the most prevalent types of identity theft.

Also Check: Does Paypal Credit Affect My Credit Score

Plus Credit Monitoring2 Id Restoration And Identity Theft Insurance5

-

Youll know if key changes occur to your Equifax, Experian and TransUnion credit files, because well be monitoring all three and provide you with alerts.

-

ID Restoration

Recovering from identity theft on your own can be time consuming. Let us help make it less of a pain. Our;dedicated ID restoration specialists will work on your behalf to help you recover from ID theft.

-

Identity Theft Insurance 5

If you’re a victim of ID theft, we have your back. We provide up to $1 million in coverage for certain out-of-pocket expenses you may face as a result of having your identity stolen.

How To Get Your Annual Credit Reports From The Major Credit Bureaus

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

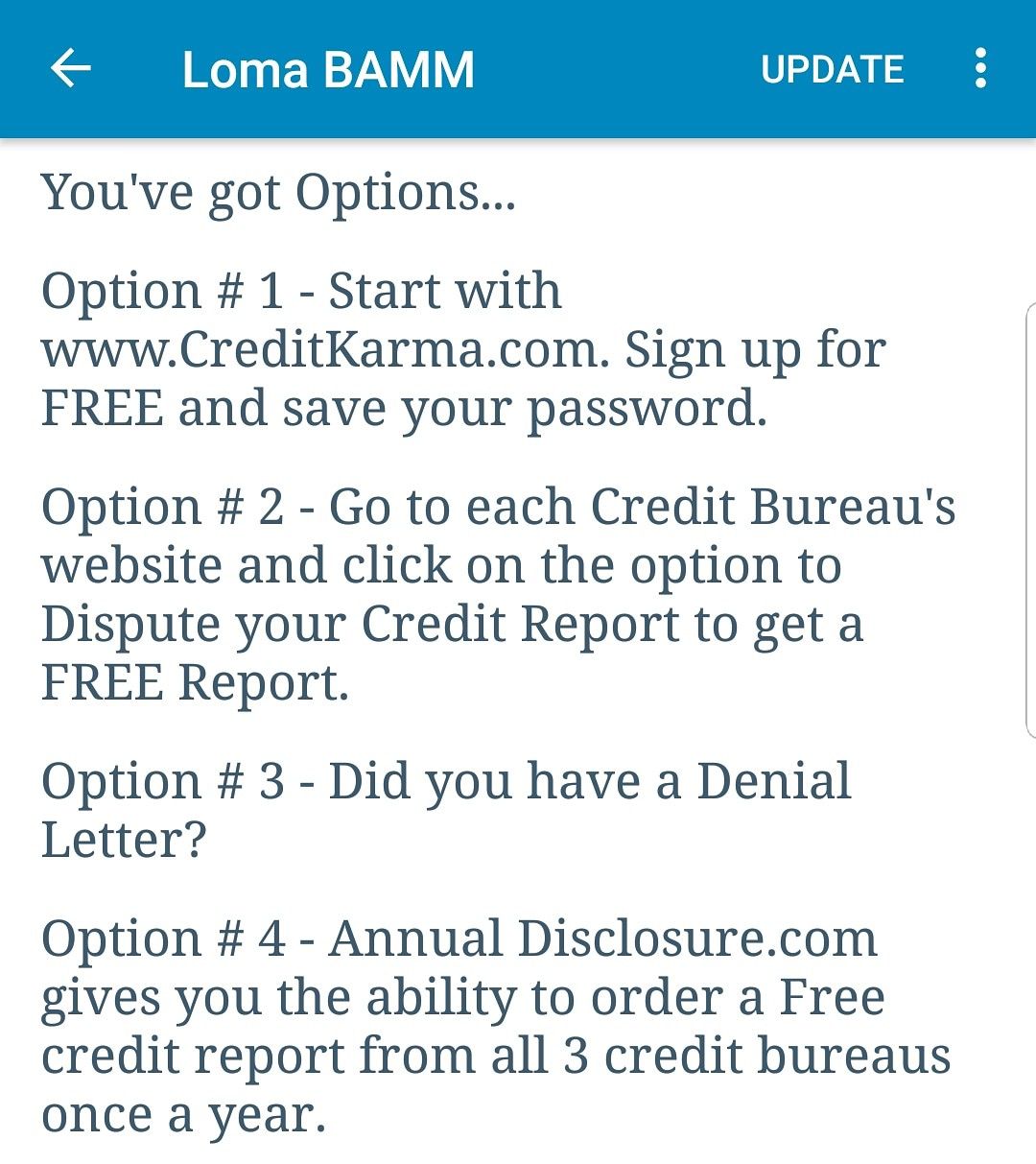

Federal law gives you free access to your credit reports from the three major credit bureaus:;Equifax, Experian and TransUnion. Using the government-mandated;AnnualCreditReport.com;website is the quickest way to get them, but you can also request them by phone or mail.;Until April 20, 2022, those reports which had been limited to once a year are available weekly to help consumers manage their finances.

Your credit reports are a detailed record of your past use of credit but they do not include your credit score. NerdWallet offers a free credit score and report, updated weekly using TransUnion data. Checking your score does not damage your credit.

Heres how to use AnnualCreditReport.com.

Also Check: Why Is There Aargon Agency On My Credit Report

Free Annual Credit Report

Review your credit report often to make sure the information is accurate.;If you see something on your report that you didnt do, it could mean youre the victim of identity theft.

You can get one free credit report each year from each of the three nationwide credit bureaus. The website annualcreditreport.com is your portal to your free reports.

Note: when you leave that website and move to the company website to get your free report, the company will probably try to get you to sign up for costly and unnecessary credit monitoring services.

You can also get your credit reports by phone by calling 1-877-322-8228. Under North Carolina law, credit monitoring services are required to tell you how you can get credit reports for free.

To keep track of your credit during the year, request a free report from a different credit bureau every four months. You can also pay for additional copies of your credit report at any time.

How Do I Improve My Credit

Look at your free credit report. The report will tell you how to improve your credit history. Only you can improve your credit. No one else can fix information in your credit report that is not good, but is correct.

It takes time to improve your credit history. Here are some ways to help rebuild your credit.

- Pay your bills by the date they are due. This is the most important thing you can do.

- Lower the amount you owe, especially on your credit cards. Owing a lot of money hurts your credit history.

- Do not get new credit cards if you do not need them. A lot of new credit hurts your credit history.

- Do not close older credit cards. Having credit for a longer time helps your rating.

After six to nine months of this, check your credit report again. You can use one of your free reports from Annual Credit Report.

Recommended Reading: When Does Paypal Credit Report To Credit Bureau

Read Your Reports And Fix Errors

-

Accounts that arent yours or you didnt authorize.

-

Incorrect, negative information.

-

Negative information thats too old to be included. Most negative information, other than one type of bankruptcy, should be excluded after seven years.

These errors have the potential to hurt your credit score, says Chi Chi Wu, a staff attorney with the National Consumer Law Center. You might see other types of errors, such as out-of-date employment information, she says, but those arent factored into your score.

If you find errors, dispute them. The credit bureaus will investigate and must remove information that they cant verify.

What Is A Free Credit Report

The free My Credit Check and My Credit Expert services generate full free credit reporst which provide a comprehensive records of your financial history, detailed information on your borrowing and spending habits, payment trends and contact details. Information includes accounts you opened, payments youve skipped, judgments taken against you and what you owe your creditors.;

You May Like: Does Klarna Build Credit

How To Get A Free Annual Credit Report:

- Online: Visit AnnualCreditReport.com and click on Request Your Free Credit Reports, then fill out the request form, which will require your name, address, Social Security number, and date of birth. Then, choose which bureau you want a report from to view them online.

- : Call 1-877-322-8228 and press 1, then follow the prompts. You will need to provide the same information as the online method.

- : Print and fill out the Annual Credit Report Request Form. Then, mail it to Annual Credit Report Request Service / PO Box 105281 / Atlanta, GA 30348-5281.

If you get a report from AnnualCreditReport.com, its best not to check your Experian, Equifax and TransUnion reports all at the same time. Review one of them now, and save the others for later, spreading them out across the year. Pulling your reports in rotation will help you ensure that youre not missing anything for an extended period of time.

Just bear in mind that using only AnnualCreditReport.com would be a mistake, as it would normally blind you to credit-report changes for much of the year. Due to the COVID-19 pandemic, however, all three credit bureaus are offering free reports weekly on AnnualCreditReport.com through April 2021.

While WalletHub and AnnualCreditReport.com are the best options for getting a free credit report, there are plenty of other choices, too.

Why Do I Have A Credit Report

Businesses want to know about you before they lend you money. Would you want to lend money to someone who pays bills on time? Or to someone who always pays late?

Businesses look at your credit report to learn about you. They decide if they want to lend you money, or give you a credit card. Sometimes, employers look at your credit report when you apply for a job. Cell phone companies and insurance companies look at your credit report, too.

Recommended Reading: Does Opensky Report To Credit Bureaus