What Is The Average Credit Score By Age Group

The average credit score across various age groups in the U.S. reveals an upwards trend in the average credit score, with each age group experiencing a minor credit score increase in comparison to average credit scores reported in 2019.3

Here is the following average score breakdown by age group:

- Ages 18-23: 674

Do You Need An 800 Credit Score

Have you always been insatiably curious about your credit score? I am. In my mind, my credit score is kind of like a report card, like a race toward personal best.

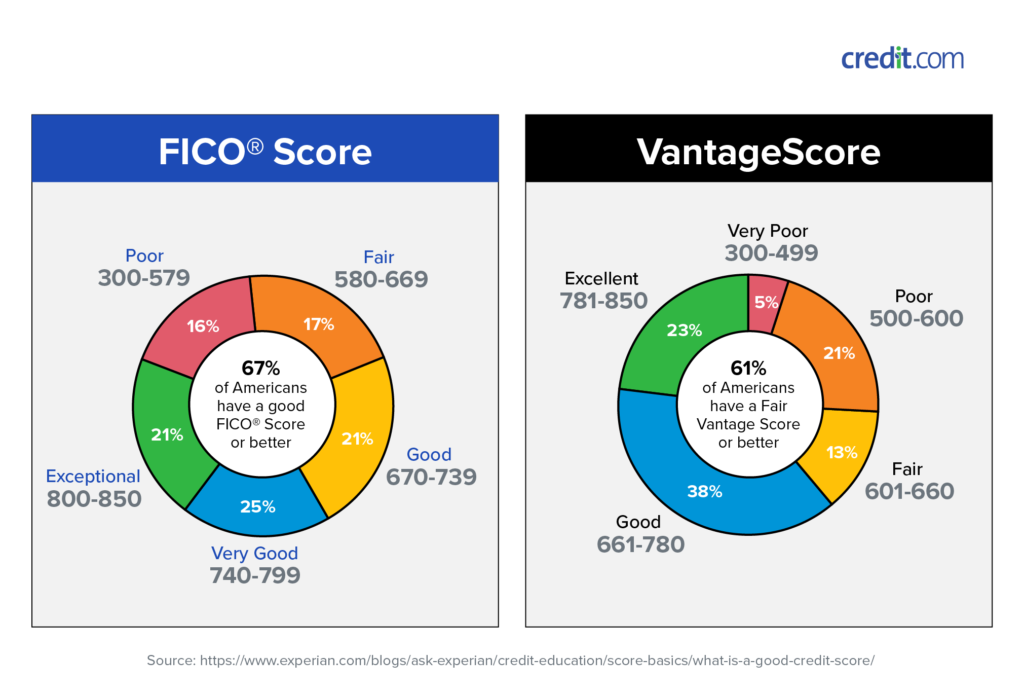

Despite widespread media reports of Americans’ debt challenges, most consumers have credit scores that fall between 600 and 750. More good news: In 2020, the average FICO Score in the U.S. reached a record high 710, according to Experian.

So, speaking of an 800 credit score what is it and should you work toward achieving it? Let’s dive in.

Number Of Americans With No Credit History

According to the Consumer Financial Protection Bureau , approximately 26 million adults are considered to be credit invisible, meaning they have no credit history as theyre without credit cards, loans, and other lines of credit.1

Of course, if you have a credit card, that doesnt necessarily mean you will have a credit score. Around 19 million adults lack a score altogether due to credit reports with minimal credit usage or out-of-date credit history. Nows the time to open a credit card or loan to build your history.;

You May Like: How To Get Credit Report Without Social Security Number

Drop In Credit Utilization Delinquency Drives Score Growth

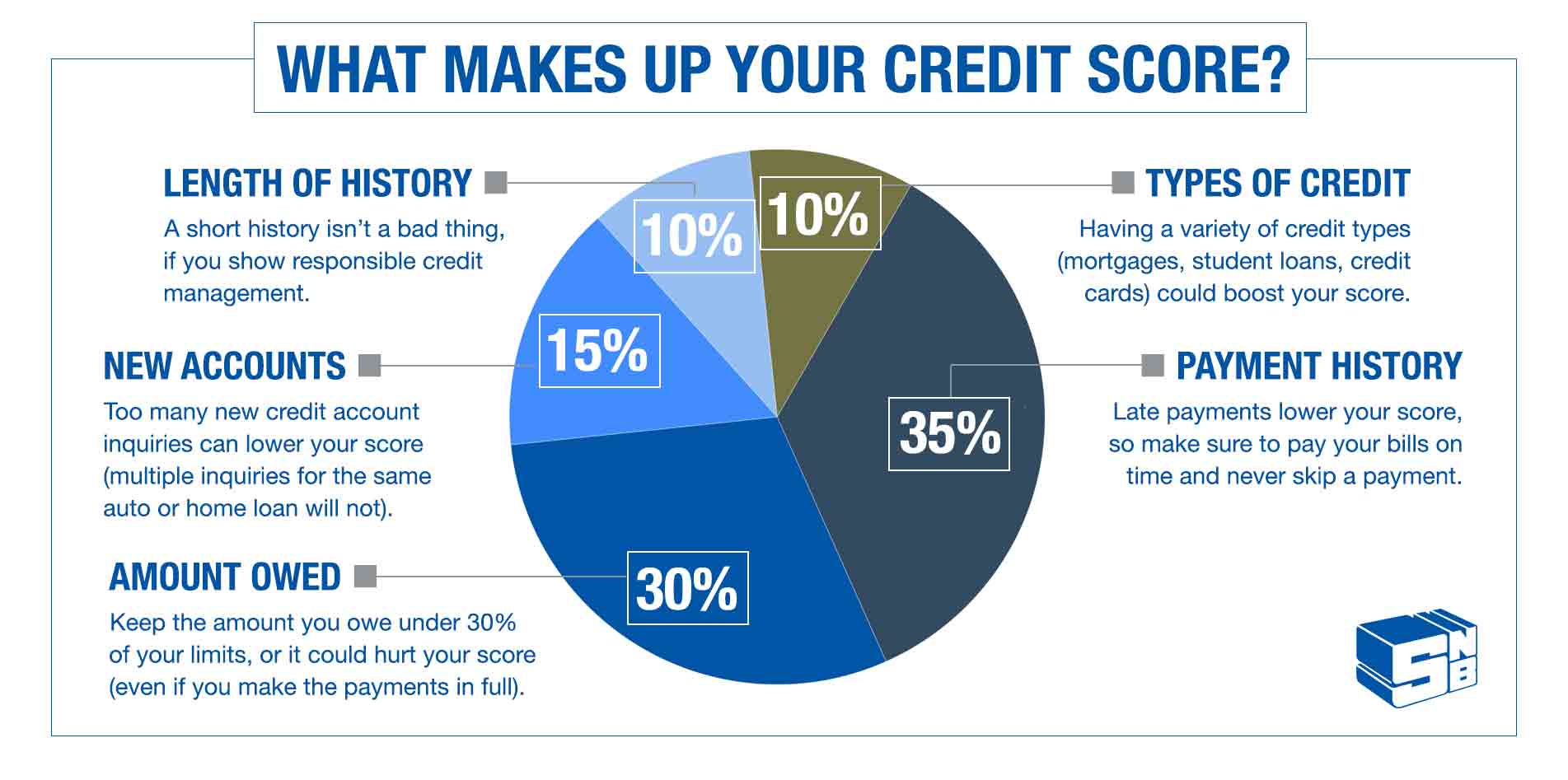

Of the five major factors that impact credit scores, payment history is the most important, accounting for 35% of a person’s FICO® Score. Credit utilization, which is the amount of available revolving credit in use compared with credit limits, is the second most important, representing 30% of the score. Updates to these factors can change a credit score, causing it to rise or fall depending on what changes.

In 2020, consumers reduced their the most commonly held form of revolving debtby 14%. This in turn impacted average credit utilization, which dropped 3.5 percentage points, from 28.8% in 2019 to 25.3% in 2020. It’s unclear what drove Americans’ ability to pay down their credit card debt, but the impact has clearly been reflected in the improvement of the average credit score.

| Snapshot: Consumer Credit Utilization |

|---|

Exceptional Credit Score: 800 To 850

Consumers with a credit score in the range of 740 to 850 are considered consistently responsible when it comes to managing their borrowing and are prime candidates to qualify for the lowest interest rates. However, the best scores are in the range of 800 to 850.

People with this score;have a long history of no late payments, as well as low balances on credit cards. Consumers with excellent credit scores may receive lower interest rates on mortgages, credit cards, loans, and lines of credit, because they are deemed to be at low risk for defaulting on their agreements. Having an excellent credit score is particularly useful for qualifying for a personal loan, as it typically more than makes up for a lack of collateral.

Read Also: Does Paypal Credit Report To Credit Bureaus

Tips For Improving Your Credit Score

You can work toward improving your credit score no matter where you live. Since payment history is the biggest factor influencing your credit score, paying your bills on time is the best thing you can do to improve your credit score. Catch up on past due accounts and take care of debt collections.

Minimize the amount of credit you’re using. Having high credit card balances;also will bring down your credit score. While it’s easier on the budget to pay just the minimum on your credit cards each month, that’s not the best thing for your credit. Work on paying down your credit card balances to below 30 percent of the credit limit. The lower the better. Maintaining extremely low credit card balances will help boost your credit score. This shows lenders that you can handle credit responsibly and not allow it to get out of control.

Apply for new credit only as needed. While each new credit card will ding your credit a little, the real harm in opening several credit cards is the risk of running up large balances and missing payments. Minimize the number of credit cards you apply for.

Average Credit Score In The Us Reaches A Record High

Despite the overall economic decline, the average FICO® Score in the U.S. climbed 1% in 2020, reaching a record score of 710, according to Experian data from Q3 2020. Compared with the average growth seen over the past 10 years, the increase in 2020 is unusually high.

| Snapshot: Consumer Credit and Debt |

|---|

| 2019 |

| +$248 |

For the past decade, the average FICO® Score has grown at around one point per year. Before 2020, the largest increase in points was a spike of 3.8 points between 2015 and 2016.

In 2020, 69% of Americans had a “good” credit score of 670 or above. That’s a 3 percentage point improvement since last year, and shows that the recent growth in scores is helping many Americans move their credit into favorable territory.

“Missed payments reported are down, consumer debt levels are decreasing and the significant steps taken by both the government stimulus spending and private sector lender payment accommodations to help consumers affected by COVID-19 are all contributing to this trend in average score,” says Tom Quinn, vice president of scores for FICO.

Also Check: Is 779 A Good Credit Score

How To Improve Your Credit Scores

To improve your credit scores, focus on the underlying factors that affect your scores. At a high level, the basic steps you need to take are fairly straightforward:

- Make at least your minimum payment and make all debt payments on time. Even a single late payment can hurt your credit scores and it’ll stay on your credit report for up to seven years. If you think you may miss a payment, reach out to your creditors as quickly as possible to see if they can work with you or offer hardship options.

- Keep your credit card balances low. Your is an important scoring factor that compares the current balance and credit limit of revolving accounts such as credit cards. Having a low credit utilization rate can help your credit scores. Those with excellent credit scores tend to have an overall utilization rate in the single digits.

- Open accounts that will be reported to the credit bureaus. If you have few credit accounts, make sure those you do open will be added to your credit report. These could be installment accounts, such as student, auto, home or personal loans, or revolving accounts, such as credit cards and lines of credit.

- Only apply for credit when you need it. Applying for a new account can lead to a hard inquiry, which may hurt your credit scores a little. The impact is often minimal, but applying for many different types of loans or credit cards during a short period could lead to a larger score drop.

How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- ;;;;;Cleaning up your credit report

- ;;;;;Paying down your balance

- ;;;; Negotiating outstanding balance

- ;;;; Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

Also Check: What Credit Report Does Comenity Bank Pull

Other Places To Check Your Credit Score

Although other scores arent used as often by lenders, they are still useful for tracking changes to your credit and are offered for free.

If you dont have a credit card or other product that provides free access to your score, it doesnt hurt to track one of the other scores, even though it isnt a FICO score.

You can also use these scores to check if you are making progress on your credit, and if there is a major decline or suspicious activity on your credit report, you can catch it right away. Then, you can at least investigate the activity and fix any issues.

Some of the other credit scores you might want to keep an eye on include the following:

Read Also: Aargon Debt Collector

Whats The Average Credit Score By Age

Your age doesnât directly impact your credit scores. But older people generally have better credit scores than younger people do.;

According to Experian, Americans who are 75 and older regularly have the highest FICO scores of any generation. One possible reason: Credit scores are partly determined by your . And a longer history of responsible credit use can result in a better score.

You can use the following average scores to get a sense of where you stand compared with others your age.

Average FICO Score by Age Group in 2020

| Age Group |

|---|

Read Also: Credit Score 584

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

Percent Of Credit Files That Dont Qualify For A Fico Score

The Ascent reports that data released in 2019 found 11 percent of Americans dont qualify for a FICO credit score5.;

In order to qualify for a FICO score, you must have:

- At least one credit account that has been open for at least six months

- At least one account that has reported to credit bureaus within the past six months

- No deceased status on your account6;

If you share a credit card or other types of credit with someone who has passed, this may account for the deceased status thats preventing you from receiving a FICO score on your credit report. Watch your credit with a credit reporting agency like Experian to report this.;

Also Check: Paypal Credit Soft Or Hard Pull

Average Credit Score In America: 2021 Report

By:;Christy Bieber | April 20, 2021

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Amidst bad economic news in 2020, there was a bright spot. Consumer credit scores increased by leaps and bounds thanks to a reduction in late payments and an aggressive effort to reduce credit card debt.

With reduced consumer spending, thousands of dollars in government stimulus funds, and smart tactics like loan consolidation and balance transfer cards, many people got a better handle on their debt.

But there may be change afoot for credit scores, too — President Joe Biden has expressed interest in a public credit reporting agency that would take the place of credit bureaus like Experian, TransUnion, and Equifax. That would cause a huge shift in how we keep track of creditworthiness.

Until that happens, though, we’ll continue to use systems like the FICO® Score. Let’s take a look at how the average American’s credit looks in 2021.

Why Does My Credit Score Show Different On Sites

Your score differs based on the information provided to each bureau, explained more next. Information provided to the credit bureaus: The credit bureaus may not receive all of the same information about your credit accounts. Surprisingly, lenders arent required to report to all or any of the three bureaus.

You May Like: 524 Credit Score

What Is The Average Credit Score In America

The average credit score in the U.S. is at an all-time high of 711. This coincides with what the Consumer Financial Protection Bureau defines as “prime.”

About 1 in 5 American adults either have no credit history or are unscorable. As a result, these individuals will have difficulty obtaining new lines of credit.

In the eyes of lenders, credit scores fall into several buckets, which indicate how risky it may be to extend credit to an individual. Outside of playing a role in approvals for a loan or credit, these scores can also impact an individual’s lending terms. Perhaps the most important terms among those are interest rates.

The higher an individual’s credit score, the lower their quoted APR will typically be.

FICO credit scores break down in the following manner:

- 800 to 850: Exceptional

- 300 to 579: Very poor

This means the average credit score of 711 is in the good range.

Though the average credit score has generally improved since 2005, slight dips were seen around the Great Recession that ended in 2009. A large number of people declaring bankruptcy or defaulting on their loans would have caused their credit scores to plummet, which in turn would have affected the overall average.

Vantagescore Credit Score Ranges

Launched in 2003, VantageScore is a joint venture between the three major credit reporting agenciesEquifax, TransUnion and Experian. Although FICO Scores are the most popular choice among lenders, VantageScore credit scores deserve your attention too.

VantageScores use a 300 to 850 credit score range. Just like FICO Scores, the higher your credit score on the VantageScore scale, the lower the risk you represent to lenders.

Also Check: Mprcc On Credit Report

Understanding Fico Vs Non

When you check your credit score, youll see a number between 300 and 850. This is the number that lenders use to determine how big of a credit risk you are. The lower the number, the bigger the risk. The higher the number, the more likely it is youll be extended credit on good terms.

Somewhere around that number, you should see language that tells you whether that score is a FICO scoreor a VantageScore, which is a non-FICO score. While both types of scores operate on that 300-850 range, there are some big differences between them.

There is one source and one source only for your true credit score: the Fair Isaac Corporation, Clark says. That would be your FICO score, the one that most lenders will use when theyre deciding to loan you money or not.

You have a FICO score with each of the three major credit bureaus Equifax, Experian and TransUnion but they all should be fairly similar.

However, youll find that the most popular places people are getting their free credit scores these days are showing a VantageScore instead.

The three main bureaus hate that FICO dominates the credit score market, so they started selling their own impostor score called a VantageScore, Clark says.

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

Read Also: How To Remove Hard Inquiries From Credit Report

Drops In Delinquency Utilization Likely Driving Score Growth

The standout growth of the average FICO® Score in 2020 can likely be attributed to shrinking debt, decreased credit utilization and a drop in delinquencies . Since the onset of COVID-19 in January 2020, consumer debt management has trended in a positive direction.

FICO® Scores are calculated using information from consumer credit reports. And when features of consumers’ credit profiles improve, their scores typically do as well. Not all changes will have an immediate or visible impact, but improvement in key areas of credit reports will.

FICO® Scores are based on five types of information found in your credit report:

Since 2019, consumers have seen record improvement in utilization rates, debt amounts and number of delinquencies. The most significant changes between 2019 and October 2020: