What I Learned From Being Denied Credit Cards

When I was finally prepared to get a credit card on my own, none of the banks I applied to would give me a chance.

It went like this:

| I am unemployed, have no credit history, and have a couple of thousand dollars in college debt that I will have to start paying on in the next year or two. |

Not exactly a winning pitch to convince someone to give you a line of credit! Two banks denied me, but one banker was kind and shared some info that has helped me raise my credit score over 100 points in the past five months.

First, I should stop trying to apply for credit cards that would get denied. His reasoning was simple: when you apply, they do a hard credit check which, in turn, can lower your credit score even more.

His second piece of advice was to get a secured credit card.

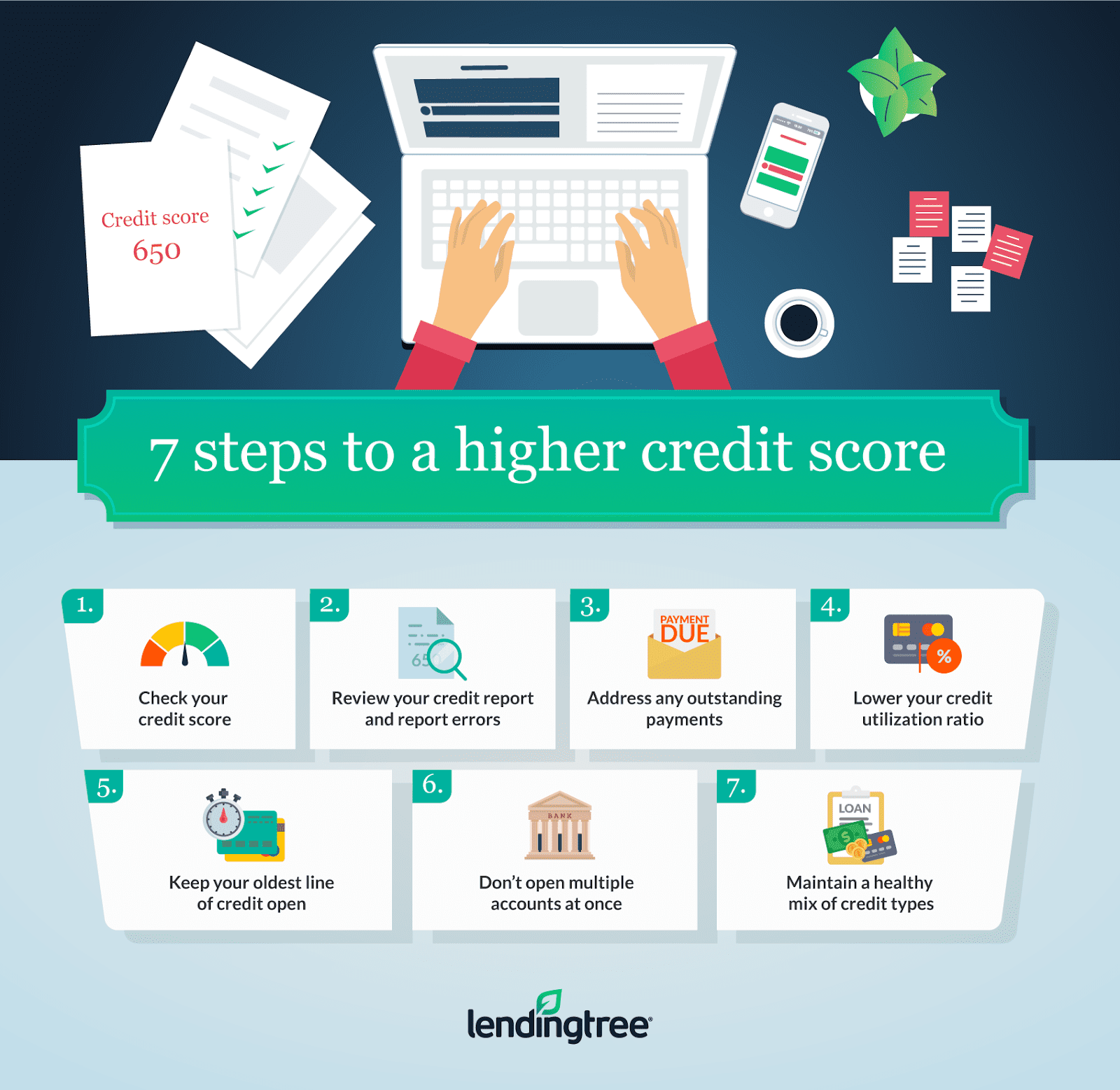

Ways To Increase Your Credit Score By 100 Points

Shutterstock

Everyone knows the basic human necessities: food, clothing, shelter, and a good credit score. Slight exaggeration aside, the fact remains that a bad credit score can be very prohibitive to your life.

Conversely, an excellent credit score gives you a lot of freedom. Not only does it make it easy to be approved for a loan and get a great rate, but it also makes you more attractive to prospective employers even car insurance companies check credit and factor it into their underwriting. Whether youre suffering from bad credit or no credit, the good news is that you hold the power in your very own hands to get a top tier score.

What Is A Good Credit Score?

The very top tier generally starts around 750, however, scores of 700 or greater are generally considered to be indicative of good money management . Below the 700 mark, you start getting into the not necessarily declined, but not the best rate territory. Anything below 650 or so is no good.

How To Get There

Before you can begin repairing and rebuilding, you first need to know what youre working with. Request a free credit report to see where you are, then get to work on achieving credit score brilliance.

1) Check For Errors. If you see any, call the lender and dispute it. You could even have it removed entirely it has been known to happen

2) Set Up Automatic Payments. For those you cant set up automatically or need to make more than a minimum payment, set up payment reminders in your calendar

Dispute Credit Report Errors

A mistake on one of your credit reports could be pulling down your score. Disputing credit report errors can help you quickly improve your credit.

You’re entitled to free reports from each of the three major credit bureaus. Use AnnualCreditReport.com to request them and then check for mistakes, such as payments marked late when you paid on time, someone else’s credit activity mixed with yours, or negative information thats too old to be listed anymore.

Once you’ve identified them, dispute those errors.

Impact: Varies, but could be high if a creditor is reporting that you missed a payment when you didn’t.

Time commitment: Medium to high. It takes some time to request and read your free credit reports, file disputes about errors and track the follow-up. But the process is worthwhile, especially if you’re trying to build your credit ahead of a milestone such as applying for a large loan. If you’re planning to apply for a mortgage, get disputes done with plenty of time to spare.

How fast it could work: Varies. The credit bureaus have 30 days to investigate and respond. Some companies offer to dispute errors and quickly improve your credit, but proceed with caution.

Don’t Miss: How To Get Navient Off Credit Report

The Importance Of Credit History

The length of your credit history accounts for 15% of the score. Keeping a long credit history is always beneficial and therefore closing your old accounts is not advised. The last two factors credit mix and new credits contribute to the remaining 20% of the score. Financial experts advice to maintain a different type of credit accounts such as car loans, credit cards, installment loans, etc. They also suggest refraining from opening new accounts, which is an indication of greater risk and it will impact your score negatively.

If youre not sure of determining your credit score based on the above five factors, you can use this online credit score calculator to find where you stand in the credit tiers.

Lower Your Credit Utilization Rate

The fastest way to get a credit score boost is to lower the amount of revolving debt youre carrying.

The typical guidance from personal finance experts is to use no more than 30% of your credit limit, which applies both to individual cards and across all cards. For example:

- On a card with a $500 credit limit, spend no more than $150.

- On a card with a $700 credit limit, spend no more than $210.

- On both cards , spend no more than $360.

How much will this action impact your credit score?

Reducing your balances is the single most effective way to boost your credit score. Provided you have no derogatory marks on your credit reports, such as late payments or delinquencies, you are guaranteed to see a big jump in your scores quickly if you knock down your balances to $0 or close to zero.

Still, if your utilization is currently over 30%, and simply paying the debt off immediately isnt a viable option, there are a few other ways to lower your credit utilization rate.

Read Also: Will A 2 Day Late Payment Affect Credit Score

Why Try To Raise Your Credit Score By 100 Points

Anytime youâre working to improve your credit, it can be helpful to identify why you want a better credit score in the first place. In other words, you need to ask: what is your goal?

Working to increase your credit score isnât always an easy journey. Still, if you focus on why youâre trying to improve your credit, it might keep you motivated if the process doesnât go as smoothly or as quickly as youâd hoped. Here are some reasons to consider putting in the work to raise your credit score and build credit, even if the results wonât be immediate.

Option 2 Apply For A New Credit Card

Applying for a new credit card is also a tactic that could reduce your credit utilization ratio. By adding a new line of credit, youre essentially boosting your overall credit line, which can help if youre unable to quickly pay down existing credit card debt.

Before you apply, determine the following:

- What type of credit card you need. If you have poor or fair credit, youll want to consider a card meant to help you build a good credit history, such as a secured card. Secured cards require a deposit in the amount of your credit limit, and protect the issuer in case you default on the debt. On the other hand, if you have good credit or better, you could choose to apply for a card that earns rewards or offers an introductory APR period.

- If you prequalify for any cards. Some issuers such as American Express, Capital One, Chase and Discover allow consumers to check if they prequalify. While prequalification doesnt guarantee youll be approved once you apply, it does indicate a better chance.

How much will this action impact your credit score?

Much like requesting a credit limit increase, the amount that getting a new card can improve your credit score depends on the credit limit youre granted on the new card. The lower it brings your utilization, the better for your score.

Consider the following examples:

Don’t Miss: How Often Is Credit Report Updated

Add Utility And Phone Payments To Your Credit Report

Typically, payments such as utility and cellphone bills wont be reported to the credit bureaus, unless you default on them. However, Experian offers a free online tool called Experian Boost, aimed at helping those with low credit scores or thin credit files build credit history. With it, you may be able to get credit for paying your utilities and phone bill even your Netflix subscription on time.

Note that using Experian Boost will improve your credit score generated from Experian data. However, if a lender is looking at your score generated from Equifax or TransUnion data, the additional sources of payment history wont be taken into account.

There are also services that allow rent payments to be reported to one or more of the credit bureaus, but they may charge a fee. For example, RentReporters feeds your rental history to TransUnion and Equifax however, theres a $94.95 setup fee and a $9.95 monthly fee.

How much will this action impact your credit score?

The average consumer saw their FICO Score 8 increase by 12 points using Experian Boost, according to Experian.

When it comes to getting your rent reported, some RentReporters customers have seen their credit scores improve by 35 to 50 points in as few as 10 days, according to the company.

Dispute Any Errors You Find On Your Credit Reports

Before you do anything else, check for and dispute errors on your credit report.

A 2013 study found that one in five Americans had an error on at least one of their credit reports, and another study found that 0.93% of consumers had at least one error worth 25 points or more. 23 Extremely damaging items can be worth even more for instance, removing a repossession from your credit report could earn you over 100 points.

Its important to check your reports from all three of the major credit bureaus , which you can do at AnnualCreditReport.com. Even small errors are worth disputing getting a hard inquiry off your credit report, for instance, could add up to 5 points to your credit score. 4

Use this to file a dispute directly with one of the credit bureaus. Mistakes in your personal information , as well as credit accounts that you don’t recognize, should usually be disputed with the bureaus. Often they’re the result of the bureau confusing you for someone else.

Recommended Reading: Does Getting Married Affect Your Credit Score

What Is A Secured Credit Card

A secured card basically functions the same way as a regular credit card except in one significant way: The cardholder guarantees the repayment of the debt they accumulate on the card by providing a cash deposit. In essence, the cardholder secures their credit card with their own money.

The deposit required by the issuing financial company ranges, but is usually anywhere from the exact amount of the secured credit cards spending limit, to double the amount of the limit. For example, if you want a spending limit of $500, youll probably need to deposit $500 to $1000 dollars. If you miss a payment, the credit card company can draw on your deposit to cover your balance.

Its this deposit that differentiates a secured card from an unsecured card/regular credit card. With unsecured cards, consumers dont provide the credit card company with a deposit against non-repayment of their accumulated balance. In effect, their good credit score acts as a guarantee of repayment.

Be Strategic About Your Payments When Youre Coming Up Short

As far as your credit score is concerned, the credit bureaus view a $25 overdue debt the same way they would view a $2,000 overdue debt. This means that if you only have enough money to pay off two small debts or one large debt, you should pay off the two smaller ones first.

You should also avoid making partial payments. Those wont help youyour creditor will still report them as missing payments.

Also, be aware that not all debts are created equal. There are two types of credit: installment loans and revolving credit . 13

Revolving credit accounts typically carry more weight than installment loans when it comes to your credit score. If you have the opportunity to put extra money towards your debts, its best to pay down your revolving accounts. However, you should still make the minimum monthly payments for all of your accounts to avoid incurring penalties.

Read Also: Is 670 A Good Credit Score

Become An Authorized User On Someones Credit Card

If you dont have your own credit card but someone you trust does, they can add you as an to their credit card. It is important that this person has good credit and is responsible with their credit. Being an authorized user on someone elses credit card could help improve your credit score if they are making their payments on time, otherwise it could also negatively impact your credit. If you arent responsible with your payments, that could negatively affect the original card holders score, too.

Keep Your Old Credit Card

One of the things that affects your credit score is the age of your credit account. It can be tempting to close your oldest credit card, but doing that can affect your utilization ratio and reduce your credit score. Try to have some transaction activity on your old credit card, even if you rarely use the card.

However, due to inactivity, your credit card can be cancelled by your provider. To avoid such, you can gradually build your credit history by setting up auto payments for lower expenses such as your monthly subscriptions.

You May Like: What Does Unlisted Mean On Credit Report

Review Your Credit Score Report For Errors

Once you know where your credit score stands, its time to check your credit reports from each of the major credit reporting bureaus.

Your credit report includes the positive and negative credit history that impacts your score. Credit reports list your financial accounts with payment history and, in some cases, public records or accounts in collections.

Due to COVID-19, you can now request a credit report for free once a week from each of the three major credit reporting bureaus Equifax, TransUnion or Experian at AnnualCreditReport.com.

Scan your report to look for any errors, such as accounts that dont belong to you or incorrect late payments. If youre wondering how to increase your credit score by 100 points fast, erasing negative records on your credit report, like an inaccurate late payment or a delinquent account that was fraudulent opened in your name, could be one way to do it.

You can dispute errors on your credit report by opening inquiries with each of the three major credit bureaus online or by writing a letter. Be prepared to provide any documents proving the mistake in your credit report. Dont forget to follow up if you dont get a response within 30 days.

When youre looking at your credit report, also take note of which parts of your credit history have room for improvement. Do you have high debt balances? Have you missed payments recently? These are two key areas to consider focusing on to help grow your score in the coming months.

How To Raise Your Credit Score By 100 Points In 5 Months

Certified financial planner Jeff Rose wants to help you improve your credit.

Entrepreneur

In this video, certified financial planner and Entrepreneur Network partner Jeff Rose tells you the steps you can take to improve your credit score. But, before we get there, it’s important to know what your credit score actually is and how it can affect your investments and ability to get loans.

Rose breaks down all of that, then tells his story of how he improved his credit score by 100 points in just five months. Hopefully, if you’re struggling with your credit score, you can use a similar strategy to get back on the right track.

Don’t Miss: Is 804 A Good Credit Score

Increase Your Credit Limit

The credit limit is the maximum amount you can spend with your credit card or line of credit. You can ask for an increase in your credit limit from the credit card issuer or lender. Try your best to spend less than your credit limit.

Although raising your credit card limit increases your score, you must however be careful not to spend more than your available limit. For instance, if you ask for a raise in your credit card limit from $3000 to $5000, try to keep your balance below $1500.

To increase your credit score, the balance of each personal credit card or line of credit account should be thirty percent or less. Spending less than thirty percent of your credit limit can increase your credit score by up to 100 points over time.

Take Out A Secured Credit Card

Another way to build your credit score is by taking out a secured credit card with a card issuer. With a secured credit card, youll pay an upfront deposit which serves as collateral for the credit line. This will cause a credit limit increase which could potentially increase your credit score on your credit account.

If you default on the card, your lender will keep your deposit. But if you continue making payments and keep the account in good standing, your lender will eventually return the deposit to you.

This is a good option for anyone who cant get approved for a traditional credit card due to bad credit. However, these cards often come with hidden fees, so youll want to compare offers from multiple companies first.

Don’t Miss: Does Simm Associates Report To Credit Bureaus

Tips That Can Help Raise Your Credit Scores

Because , building credit takes time. Depending on your individual situation, there may be ways to raise your scores quickly like paying down all your debt in a very short span of time. But if youre starting out with bad credit, even a drastic measure like that may not have the immediate effect youre looking for. No matter what, the most impactful thing you can do for your credit is to create some consistent habits. Here are some tips that can help you raise your credit scores over time.