How Your Credit Score Is Determined

All the leading credit rating agencies rely on similar criteria for deciding your credit score. Mostly, it comes down to your financial history how youve managed money and debt in the past. So if you take steps to improve your score with one agency, youre likely to see improvements right across the board.

Just remember that it may take some time for your credit report to be updated and those improvements to show up with a higher credit score. So the sooner you start, the sooner youll see a change. And the first step to improving your score is understanding how its determined.

Here are some of the factors that can harm your credit score:

- a history of late or missed payments

- going over your credit limit

- defaulting on credit agreements

- bankruptcies, insolvencies and County Court Judgements on your credit history

- making too many credit applications in a short space of time

- joint accounts with someone with a bad credit record

- frequently withdrawing cash from your credit card

- errors or fraudulent activity on your credit report thats not been detected

- not being on the electoral roll

- moving house too often.

Can My Credit Score Drop For No Reason

Since your credit score is based on information found in your credit reports, it only changes as new information is reported. For example, if youve been using more of your available credit or your credit limit has decreased, this can cause your score to drop. If you cant think of any action youve taken to lower your score, review your credit reports for errors and signs of identity theft.

How This Site Works

We think it’s important you understand the strengths and limitations of the site. We’re a journalistic website and aim to provide the best MoneySaving guides, tips, tools and techniques, but can’t guarantee to be perfect, so do note you use the information at your own risk and we can’t accept liability if things go wrong.

- This info does not constitute financial advice, always do your own research on top to ensure it’s right for your specific circumstances and remember we focus on rates not service.

- We don’t as a general policy investigate the solvency of companies mentioned , but there is a risk any company can struggle and it’s rarely made public until it’s too late .

- Do note, while we always aim to give you accurate product info at the point of publication, unfortunately price and terms of products and deals can always be changed by the provider afterwards, so double check first.

- We often link to other websites, but we can’t be responsible for their content.

- Always remember anyone can post on the MSE forums, so it can be very different from our opinion.

MoneySavingExpert.com is part of the MoneySuperMarket Group, but is entirely editorially independent. Its stance of putting consumers first is protected and enshrined in the legally-binding MSE Editorial Code.

You May Like: Is 724 A Good Credit Score

It Can Take Time To Build A Credit Score

Theres no set amount of time it takes you to get a score. Many factors contribute to your score, including your payment history and how long youve had credit.

Building credit essentially means showing your ability to repay debts over a period of time. Once youve established credit by getting a loan or opening a credit card account, youll begin building your credit history as you pay those bills back responsibly.

Heres Whats Behind That Zero Credit Score

- 14 February 2017

Getting a zero credit score can be a bit of a shock. If they were emojis, it would be a bit like this guy.

But dont worry, you can turn your emoji frown upside down with a few fixes.

But first, a bit about why you got a zero score.

For 85% of people with zero scores, theyll have a default or a bankruptcy on their file. This is the major problem: not paying your bills. Lenders want to know if youre going to pay your bills on time thats why they check your credit score. And your credit history gives them an idea of your financial behaviour, so its important to show that youre a good risk for them.

The remaining 15% of people with zero scores are more likely to be late making your payments, but those payments havent actually been late enough to get recorded as a default. So if youre getting a zero score but not seeing any defaults on your file, that could be why.

Its a good idea to get your full credit report so you can check everything on there and figure out exactly why youre getting the zero score. You can do this through illion, Credit Simples parent company. Its free and you can do it online .

Once youve got that info , you can start making changes to fix stuff up. A few tips include:

Other factors can also drag your score down to the unhappy zone, such as making a lot of recent applications for credit .

If youre constantly overdue with your payments, that also looks bad.

Don’t Miss: How To Correct Credit Report Transunion

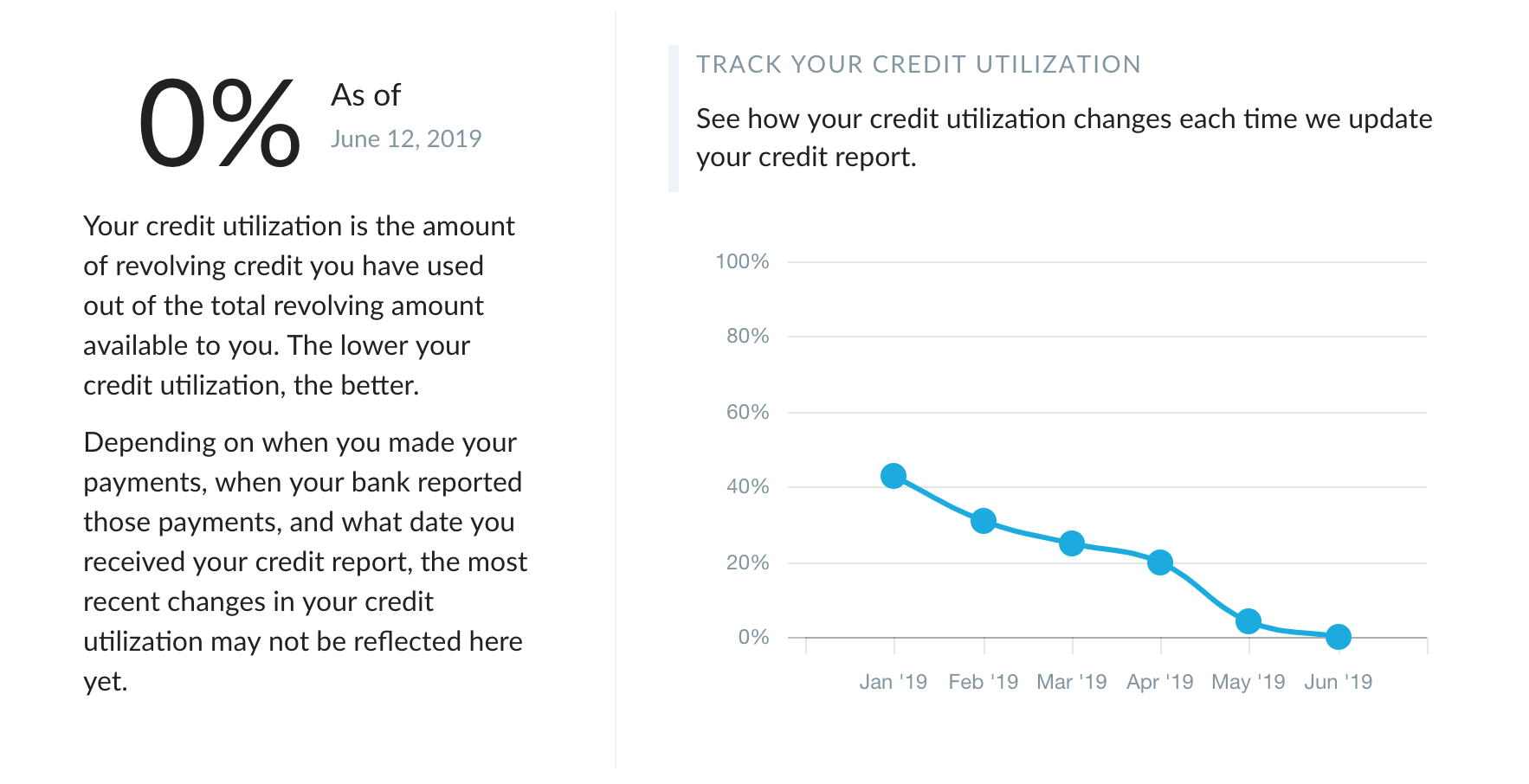

How To Calculate Your Credit Utilization Rate

Your credit utilization rate measures how much credit you are using compared to how much you have available. The calculation looks at both your and your .

For example, if your current balance is $2,000 and you have a $5,000 limit, that makes your credit utilization rate 40%.

“It’s not the dollar amount owed that’s important, it’s the percentage,” Droske says. “So, a $500 balance on a $10,000 credit limit is a 5% ratio, but the same $500 balance on a $1,000 limit is 50%.”

Can You Have A Credit Report And No Credit Score

Yes, you can have a credit report but no credit score. This is difference between being unscorable or credit invisible, which mean different things in the credit industry: 1

- You have no credit reports and no credit activity thats been reported to the credit bureaus This also means you have no credit score.

- Unscorable: You may have a credit report, but you still have no credit score. This means the information in your credit report doesnt meet FICOs or VantageScores minimum scoring requirements.

Its important to remember the distinction between your . Both are used to assess your creditworthiness, but you need a credit report in order to get a credit score.

Recommended Reading: How To See Your Credit Score

Which Credit Score Matters The Most

While there’s no exact answer to which credit score matters most, lenders have a clear favorite: FICO® Scores are used in over 90% of lending decisions.

While that can help you narrow down which credit score to check, you’ll still have to consider the reason why you’re checking your credit score. If you’re accessing your credit score simply to track your finances, a widely-used base score like FICO® Score 8 works. This version is also helpful for gauging which credit cards you qualify for.

If you plan to make a specific purchase, you may want to review an industry-specific credit score.FICO lists the specific scores that are used for various financial products. FICO® Auto Scores are ideal if you want to finance a car with an auto loan, while it’s good to check FICO® Scores 2, 5 and 4 if you plan to buy a house.

Dont miss:

What To Do If You Have A Zero Credit Score

Join millions of Canadians who have already trusted Loans Canada

Your credit scores are a metric that represents your to lenders and creditors. Whenever you apply for a loan, lenders will access your credit report to assess the likelihood that you will make timely payments. If you have a high credit score, lenders will usually be more than happy to approve your application. They may also reward you with a low-interest rate. Remember, credit scores are only one of the many factors that lenders consider when approving applications.

But suppose you have a low credit score. In that case, they may be hesitant to provide you with funds, as your poor crediting standing indicates you may be likely to honour your payment obligations.

Maintaining healthy credit scores is important if youre in the market for a loan. But what if you lack a credit score entirely? What are the implications, and what should you do to get one?

Recommended Reading: Can Medical Bills Affect Credit Score

No Credit Score Doesnt Mean A Zero Credit Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The most frustrating thing about credit might be the chicken-and-egg problem of establishing it: Nobody wants to give you credit when you dont have a track record of using credit.

But if youve never had credit and dont have a credit score, that doesnt mean you have a zero credit score. You have the absence of a score: Youre credit invisible.

Having No Credit Score Doesnt Mean You Have Bad Credit

A lack of credit score doesnât tell lenders that you canât handle credit. Itâs more an indication that you havenât proven yourself yet. As soon as you start participating in credit-building activities, you can quickly see your score appearâand improve, if done responsibly. It’s sometimes much easier to build a credit score from scratch than it is to fix a weaker one.

You May Like: Does Having Multiple Bank Accounts Affect Credit Rating

How Does Your Credit Score Compare

Most of the top credit rating agencies have five categories for credit scores: excellent, good, fair, poor and very poor. Each credit rating agency uses a different numerical scale to determine your credit score which means each CRA will give you a different credit score. However, youll probably fall into one category with all the agencies, since they all base their rating on your financial history.

|

628-710 |

A fair, good or excellent Experian Credit Score

Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good. A score of 961-999 is considered excellent .

A fair, good or excellent TransUnion Credit Score

TransUnion is the UKs second largest CRA, and has scores ranging from 0-710. A credit score of 566-603 is considered fair. A credit score of 604-627 is good. A score of 628-710 is considered excellent .

A fair, good or excellent Equifax Credit Score

Equifax scores range from 0-700. 380-419 is considered a fair score. A score of 420-465 is considered good. A score of 466-700 is considered excellent .

To get a peek at the other possible credit scores, you can go to ‘What is a bad credit score‘.

Youre In Complete Control Of Your Finances

Like weve said before: Cash is king, baby! When you start saving up for lifes big purchases , youll find that a credit score is worthless. Not only will you have the power of negotiation on your side, but youll also find out how much easier it is to buy things outright. Whos going to turn down cash?

Don’t Miss: How To Find Out Your Credit Score

Borrowing : Introduction To Loans And Lines Of Credit

With all the different credit options available in Canada, itâs important to understand the differences between each one so that you can find the right product for your needs. Credit can be useful to help you establish a history and finance purchases, but should be used mindfully.In this Borrowing 101 article, weâll give you an overview of personal loans and lines of credit to help you understand how they work, when to use them, and what to be careful of in order to protect your credit score.

The Borrowell Team

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

Read Also: When Late Payment Report To Credit

Financial Information On Your Credit Report

Your credit report may contain the following financial information:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a lien on a car that allows the lender to seize it if you dont make payments

- remarks, including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if you made your payments on time

- if you missed payments

- if your debt has been transferred to a collection agency

- if you went over your credit limit

- personal information thats available in public records, such as a bankruptcy

What Does No Credit History Mean

A credit score is a mathematical likelihood of repaying debt. Credit bureaus compile information about how youve handled debt in the past, which is reported by credit card companies and other lenders , and then a credit scoring model uses that information to generate your score.

So, having no credit history doesnt mean you have never paid any bills. It just means that none of your bills or expenses have been reported to the credit bureaus.

You might have no credit history if you have never had a credit card or if youre someone who prefers to pay for everything from homes to cars with cash. A lack of credit history doesnt indicate youre irresponsible, either. Instead, it means you havent used financial products that helped you build credit.

Also note that, even when you do get a line of credit, it can take time for a credit score to show up. According to Experian, you can be assigned a VantageScore as soon as a credit account shows up on your credit report.

However, you wont have a FICO credit scorewhich is used by 90 percent of top lendersuntil an account is at least six months old. This means that no credit history can be a prolonged problem, even after you open your first account.

You May Like: How To Have Collections Removed From Credit Report

Have Your Rent And Bill Payments Reported

If you want to get a credit score but you dont want to open a credit account, you can get credit for the bills youre already paying, such as your:

- Rent

- Phone bills

- Streaming service payments

To build credit from your rent payments, you can sign up for a rent-reporting service, such as Rental Kharma, LevelCredit, or PayYourRentalthough bear in mind you might need your landlords approval first.

To get credit for your other bills, you can either sign up for a paid bill-reporting service or sign up for Experian Boost free of charge to have your on-time bill payments added to your Experian credit report.

Boost your credit for FREE with the bills you’re already paying

5.0/5

No credit card required. Results may vary, see website for details.

Boost your credit for FREE with the bills you’re already paying

- Experian Credit Report and FICO® Score updated every 30 days on sign in

- Instantly increase your credit scores for FREE with Experian Boost

- Daily Experian credit monitoring and alerts

Open A New Credit Account

The simplest way to become scorable is to open a new credit account so that the tradeline is added to your credit reports. However, it can be hard to get an account if you have no credit score.

This is the catch-22 of credit-building: its hard to get credit if youve never had credit before.

Fortunately, there are credit accounts designed specifically for building credit when you have no credit history or you have bad credit:

As the name suggests, are specifically designed for improving your credit score. Unlike traditional installment loans , credit-builder loans go straight into a secured bank account instead of your wallet. Youll still repay the loan amount over a fixed period, but your lender will only give you access to the funds once youve made all your payments.

Secured credit cards

Unlike unsecured credit cards, secured credit cards require a security deposit, which will serve as your credit limit and as collateral that your credit card issuer can keep if you dont make your payments. This makes the card less risky for your lender, which means they might offer it to you even if you have no credit.

Weve listed some noteworthy secured credit cards below.

As long as you make all your payments as specified in your credit agreement, youll build a credit history and eventually obtain a credit score. From there, youll be able to apply for unsecured forms of credit.

Also Check: Does Quadpay Report To Credit Bureaus