What A Good Credit Score Can Get You

Having good credit matters because it determines whether you can borrow money and how much you’ll pay in interest to do so.

Among the things a good credit score can help you get:

-

An unsecured credit card with a decent interest rate, or even a balance-transfer card.

-

A desirable car loan or lease.

-

A mortgage with a favorable interest rate.

-

The ability to open new credit to cover expenses in a crisis if you don’t have an emergency fund or it runs out.

A good credit score helps in other ways: In many states, people with higher credit scores pay less for car insurance. In addition, some landlords use credit scores to screen tenants.

So having a good credit score is helpful whether you plan to apply for credit or not.

If your credit score is below about 700, prepare for questions about negative items on your credit record when shopping for a car. People with major blemishes on their credit are routinely approved for car loans, but you may not qualify for a low rate. Read about what rates to expect with your score.

You dont need flawless credit to get a mortgage. In some cases, credit scores can be in the 500s. But credit scores estimate the risk that you wont repay as agreed, so lenders do reward higher scores with lower interest rates. Read about your mortgage options by credit score tier.

Landlords or property managers generally aren’t looking for immaculate scores, they are interested in your credit record. Learn more about what landlords really look for in a credit check.

What Is Your Credit Score

One smart thing to do before you begin the car loan process is to check your own credit score. Be sure you’re looking at a FICO® Score, as that’s what the lender you apply to are most likely to use.

Many credit card issuers give customers a free FICO® Score as a perk of membership, but it can be a smart idea to pay for a score-monitoring service. I use myFICO.com, as it’s run by the creators of the FICO® Score. Not only does this get you access to FICO® Scores from all three major credit bureaus, but there are many other useful tools as well .

Credit Score: Personal Loan Options

With a credit score between 700 and 749, youre just one step away from the top rung of the credit score ladder. Working to improve your 724 credit score means getting the best personal loan rates possible. However, interest rates with a score in this range are still ideal. Theyll very from fourteen to sixteen percent, often falling on the lower end of that spectrum.

Recommended Reading: What Collection Agency Does Usaa Use

How To Improve Your Credit Score

The steps you can take to rebuild your credit score fall into two categories:

- Short-term credit fixes: Things you can do right now to improve your score in the short term

- Long-term solutions: Things you can do to help strengthen your score in the long term

Ultimately, how long it will take to repair your credit depends on your credit history, your personal finances, and the decisions you make.

Whats A Utilization Ratio Or Debt

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that youre a higher-risk borrower.5 Thats because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

Don’t Miss: Do Pre Approvals Hurt Credit Score

How Your 724 Credit Score Was Calculated

As mentioned earlier, the two main credit scoring models are FICO and VantageScore. Although the two models have minor differences, both calculate credit scores based on the following factors:

- Payment history:Late payments lower your credit score. The later the payment, the more damage it will do. Charge-offs, collection accounts, and bankruptcies are even more damaging to your score.

- : This refers to the proportion of your available credit that youre using . A lower utilization rate is better for your credit score. Many experts recommend keeping yours below 30% . VantageScore recommends keeping your credit utilization even lower, under 10% if possible. 1

- Length of credit history: This is determined by the age of your oldest and newest credit accounts as well as the average age of all of your accounts. Old accounts that youve had for many years boost your credit score, whereas new accounts lower it.

- : Your credit score will be lower if you dont have a balanced mix of revolving credit accounts and installment accounts .

- New accounts: When you apply for a credit card or loan, the lender will run a credit check. This will trigger a hard inquiryHard inquiries take a few points off your credit score, and the effect lasts for up to 12 months. 2 Actually opening the account can further hurt your score and have even longer-lasting effects.

To maintain your good credit score, follow these tips:

Beware These Car Loan Mistakes

Regardless of whether you have excellent credit, terrible credit, or you’re somewhere in between, there are a few potentially-costly mistakes that are important to avoid.

Don’t Miss: Does Affirm Show Up On Credit Karma

Negotiating With Your Creditors

Despite what many people believe, your creditors are not your adversaries and they are not working against you. Therefore, you should not treat them as such. Instead, your creditors are working with you in an attempt for both of you to gain a profit.

If you fail to do things, such as pay your bills on time, it negatively impacts the ability of your creditor to do business with you. While they should be understanding of any reasonable financial hardships that youhave undergone in the past few weeks or months, they can tell the difference between short term financial problems that were out of your control and blatant financial responsibilities on your part.

Ultimately, its your responsibility to communicate effectively with your creditor so that you can both benefit equally from your business agreement.

For an example, if you are forced to skip on a payment or to default on an entire loan the very first thing you need to do is to contact your creditor and talk about the Issue in detail with them. This action alone will tell them that what has happened is out of your control and that you are trying to correct the Issue in contrast to them believing that you are just behaving irresponsibly. In addition, this will also strengthen your business relationship.

Examples of how your creditor may be willing to help you after you have discussed your problems with them include the following:

Vantagescore Vs Fico Credit Score Calculation Methods

VantageScore and FICO take the same factors into account to produce your score, but they weigh them slightly differently . Here are just a couple of the differences between FICO and VantageScore: 3

- VantageScore groups the length of your credit history and your credit mix into one category called Depth of Credit.

- In addition to your credit utilization , VantageScore also looks at your current balances and your remaining available credit .

The tables below show how the models weigh your financial decisions to produce your score:

| -64 | 688 |

Given time, you can get your credit score into the top ranges. This can mean developing your credit profile if you dont have much of a credit history or recovering from negative marks that brought your score down.

Regardless of your circumstances, there are steps that you can take immediately to increase your credit score.

Also Check: Chase Sapphire Score Needed

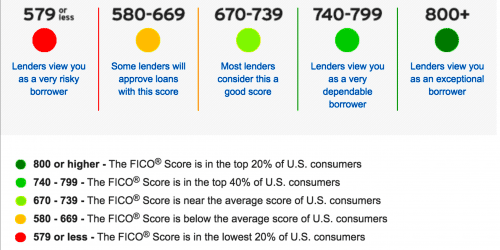

Fico Credit Score Ranges

Heres how to find out exactly where your credit score falls in the range of FICO scores.

- Excellent Credit : With an excellent credit score of 780 or higher you will get the best rates available.

- Very Good Credit : In this range you shouldnt have any problems getting good rates.

- Good Credit : This is a good credit range to be in, but you wont get the very best rates on loans or credit cards.

- Average Credit : Your score could use some improvements, but you should still be able to get decent rates. You can still qualify for most FHA mortgage loans, for example.

- Poor Credit : A credit score in this range means youre higher risk and might have trouble finding decent rates. Youll also get turned down on some credit applications. You could still get some USDA and VA loans if you qualify for those programs.

- Very Poor Credit : Anything less than 580 means that youre very high risk for borrowing. Youll get turned down for almost all credit applications. If you do get approved, the interest rates will be staggering. Dont worry though, this can be fixed!

Credit Score: Is It Good Or Bad

A FICO® Score of 724 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good range. A large number of U.S. lenders consider consumers with Good FICO® Scores “acceptable” borrowers, which means they consider you eligible for a broad variety of credit products, although they may not charge you the lowest-available interest rates or extend you their most selective product offers.

21% of U.S. consumers’ FICO® Scores are in the Good range.

Approximately 9% of consumers with Good FICO® Scores are likely to become seriously delinquent in the future.

Recommended Reading: How To Get A Repossession Off Credit Report

Charge No More Than You Can Easily Repay When The Bill Comes In

This really gets to the mechanics of paying off your balance each month. If you have room in your budget to pay $500 per month toward your credit card bill, then thats as much as you should charge on it. It makes it less likely youll need to carry a balance.

Remember, using a credit card responsibly does not mean maxing out your available credit every month!

Having High Credit Card Balances:

Maxed-out credit cards could negatively affect your credit scores.

Meanwhile, showcasing multiple examples of open credit accounts that don’t have late or missed payments may improve your credit scores. Learn more about what factors impact your credit scores or learn how to check your credit score here.

Read Also: What’s The Minimum Credit Score For Care Credit

Have At Least Three Credit Cards But Only Use One

This first step comes completely from my own experience after experimenting with different techniques.

To optimize your credit score, it works best to have no more and no less than three major credit cards.

These cards should have long, good payment histories, and low credit utilization .

Its best to use only one of these cards on a regular basis and simply keep the other two cards with a $0 balance.

Its not that you cant ever use the other two cards, but generally, I like to keep their balances at zero. This technique will maximize your credit score.

Shopping Around For A Car Loan Can Help

Perhaps the most important suggestion I can give you, especially if you have so-so credit, is to shop around for your next car loan. You may be surprised at the dramatic difference in offers you get.

Many people make the mistake of accepting the first loan offer they get . It’s also a smart idea to get a pre-approval from your bank as well as from a couple of other lenders. Online lenders and credit unions tend to be excellent sources for low-cost loan options. Not only are you likely to find the cheapest rate this way, but you’ll then have a pre-approval letter to take to the dealership with you.

The best part is that applying for a few auto loans won’t hurt your credit. The FICO credit scoring formula specifically allows for rate shopping. All inquiries for an auto loan or mortgage that occur within a 45-day period are treated as a single inquiry for scoring purposes. In other words, whether you apply for one car loan or 10, it will have the exact same impact on your credit score.

Don’t Miss: Prosper Webbank On Credit Report

A 724 Credit Score Is Considered A Good Credit Score By Many Lenders

| Percentage of generation with 700749 credit scores |

|---|

| Generation |

| 14.7% |

Good score range identified based on 2021 Credit Karma data.

A credit score is a number that lenders use to help assess how risky you might be as a borrower. Credit scores are based on credit reports, which contain information about your credit history. Generally, a good credit score can signal to lenders that youre more likely to pay back money you borrow.

Having good credit can be a game-changer. It can mean youre more likely to be approved when you apply for a credit card or loan. Good credit can also help you qualify for lower interest rates and better loan terms.

Its not quite as simple as that though. You dont have just one credit score. Heres why. Scores can be calculated using different scoring models, like the ones created by FICO and VantageScore. These credit-scoring models use several factors to generate your scores, drawing on data from different sources, namely the three main consumer credit bureaus . So there are actually many different versions of your credit scores.

With so many different credit scores out there, what counts as a good credit score can vary. What one model or lender defines as good could be different from what other models or lenders define as good.

Heres what you need to know about building and maintaining a good credit score and, if youre aiming higher, how you can eventually take that score from good to excellent.

Use Your Credit Card But Never Max It Out

Im not the type of person who buys everything on my credit card. I do use one of my credit cards a lot, however.

Ive found I need to use the credit card a lot to get the highest FICO score possible. The caveat is that you should never max out the card. In fact, I recommend you pay it down every month and never get even close to the credit limit.

As a general rule, you should try to keep your . In other words, if you have a credit card with a total credit limit of $1,000, never rack up more than $250 worth of charges on the card.

This is why its also important to have a credit card with a high limit. For example, my main credit card has a credit limit of $30,000, and I never get even close to 25% utilization.

If you dont have a card with a high enough limit to keep you comfortably under 25% utilization, give the creditor a call and request that they up the credit limit.

Read Also: Does Carmax Take Credit Cards

How Your Credit Score Affects The Cost Of A Car Loan

Just because you can get an auto loan with a low credit score doesn’t mean that it’s always a good financial move to do so. Whether or not it’s a good decision depends on your unique situation.

For starters, lenders tend to offer significantly higher interest rates to subprime and deep-subprime borrowers. This can make a car far more expensive than its sticker price might lead you to believe. Here’s a look at the national average auto loan APRs as of Dec. 11, 2018:

| FICO® Score Range | 60-Month New Auto Loan APR | 48-Month New Auto Loan APR | 48-Month Used Auto Loan APR |

|---|---|---|---|

| 720-850 |

Here’s what this means to you.

Let’s say that you want to buy a new car. You want to obtain a $30,000 loan to do it.

In this example:

- If you have a FICO® Score of 720 or higher: You will likely pay a $560 monthly payment. That’s $3,574 in interest over a 60-month car loan.

- If you have a 675 FICO® Score: Your payment would likely be closer to $610. That’s $6,611 in interest alone over the life of the loan — you’d pay $3,000 more in interest than a top-tier borrower.

- If your FICO® Score is 600: You’d probably pay $728 per month. That’s $13,673 in total interest — for the exact same car.

In this case, the difference between fair and good credit scores could literally mean more than $10,000 in additional interest.