Student Loan Delinquency Or Default

Late student loan payments can start to hurt your credit after 30 days for private student loans and 90 days for federal student loans, and those delinquencies stay on your credit report for seven years.

Federal student loans go into default if you dont make a payment for 270 days. And the government has strong debt-collection powers: It can garnish your wages, Social Security benefits or tax refunds. With private student loans, your lender can term you in default as soon as youre late, but it has to take you to court before it can force repayment.

What to do: If youve paid late but havent defaulted, consider switching to an income-driven repayment plan, putting your loan in deferment or forbearance, or asking your lender for a modified payment plan.

If youve defaulted on your federal student loans, the government offers three options: Repayment, rehabilitation and consolidation.

Strategies That Wont Help Remove Negative Information

So now you know four strategies for getting negative entries off your credit file.

Sometimes, though, it helps to know what wont help remove negative information.

If youre searching for credit repair answers, know that these things wont help fix your credit:

- Paying Off Old Stuff: A lot of people think debt collectors will remove negative information from their credit if they can just pay off the charge-offs, past-due balances, and collection accounts. In reality, paying off these accounts will not help your credit. Lenders will still see you had trouble paying off previous accounts.

- Bankruptcy: Filing bankruptcy could help restore your financial health by reorganizing or dissolving old debts. But it wont help your credit score. In fact, the bankruptcy will pull down your score for up to 10 years. Plus, the road to bankruptcy is paved with late payments, missed payments, and collection accounts all of which will remain on your credit report along with the bankruptcy.

- Closing Delinquent Accounts: A closed account wont look any better to prospective lenders than an open account. In fact, closing accounts could hurt your score since FICO places value on older average ages for credit accounts.

Get A Copy Of All Your Credit Reports

The first thing you need to do is to get a copy of all your credit reports. The main way to repair your credit is to challenge wrong or unfair information in your reports. Thats why you need a copy of all of them.

Of course, not all negative information you will find in your report is wrong. But in case you do find some, you can start challenging them right away. Plus, you have a right to see the reports the FCRA gives you the right to a yearly credit report for free from Equifax, TransUnion, and Experian, the three major credit bureaus.

Its vital to get the reports from all three since the agencies do not necessarily share information with one another.

Also Check: Does Ginny’s Report To Credit Bureau

What Will Help Improve Your Credit Score

- Your Payment History: Delinquencies and missed payments hurt your credit score more than most other factors. In fact, the FICO scoring model ranks payment history as most important in your credit profile.

- Your Credit Utilization Ratio: If youre using a lot of your available credit on your credit cards, expect your credit score to suffer. For best results, pay down your credit card balances to 25%. Never exceed 30% of your available credit lines. Often, keeping an account or two open after youve paid them off can decrease your credit utilization ratio and increase your score.

- Other Factors: Keeping a mix of different types of credit a student loan, a couple credit cards, a car loan, and a mortgage, for example will help your credit score some. Limiting new credit applications can help, too.

Developing these good habits will help a lot, but lets be clear: a major negative entry like bankruptcy, foreclosure, or repossession on your credit file will cause bad credit.

The good news: Even if you cant get them removed using the four strategies I outlined above, these negative items on your credit report hurt your score less and less as they age.

So by making good credit decisions now, youre adding positive information to your credit history thats newer than your negative information.

Your good decisions will help your score eventually!

How Can I Clean Up My Credit Report

To clean up your credit, start by reviewing your credit reports. You can get yours for free once every 12 months from each of the three credit bureaus at AnnualCreditReport.com. You can also access your free Experian credit report directly on Experians website. Look through all three of your credit reports thoroughly.

Don’t Miss: Does Removing Hard Inquiries Increase Credit Score

How Long Does A Chapter 7 Bankruptcy Stay On Your Credit Report

After you file for a Chapter 7 bankruptcy, it remains on your for up to ten years and youre allowed to discharge some or all of your debts. When you discharge your debts, a lender cant collect the debt and youre no longer responsible for repaying it.

If a discharged debt was reported as delinquent before you filed for bankruptcy, it will fall off of your credit report seven years from the date of delinquency. However, if a debt wasnt reported delinquent before you filed for bankruptcy, it will be removed seven years from the date you filed.

How To Remove Collections From Your Credit Report

However, there are some bright spots when it comes to removing collections from your credit report:

For older debts, especially, collection agencies are often unable to provide accurate information that proves they own the debt and that you owe it. So more often than not, it pays to dispute any inaccurate information.

Understanding these basics to clean up your credit will put you on the right path, but its only the first step. The sooner you get actually get started repairing your credit, the better off youll be, both financially and emotionally, in the future.

Recommended Reading: 728 Fico Score

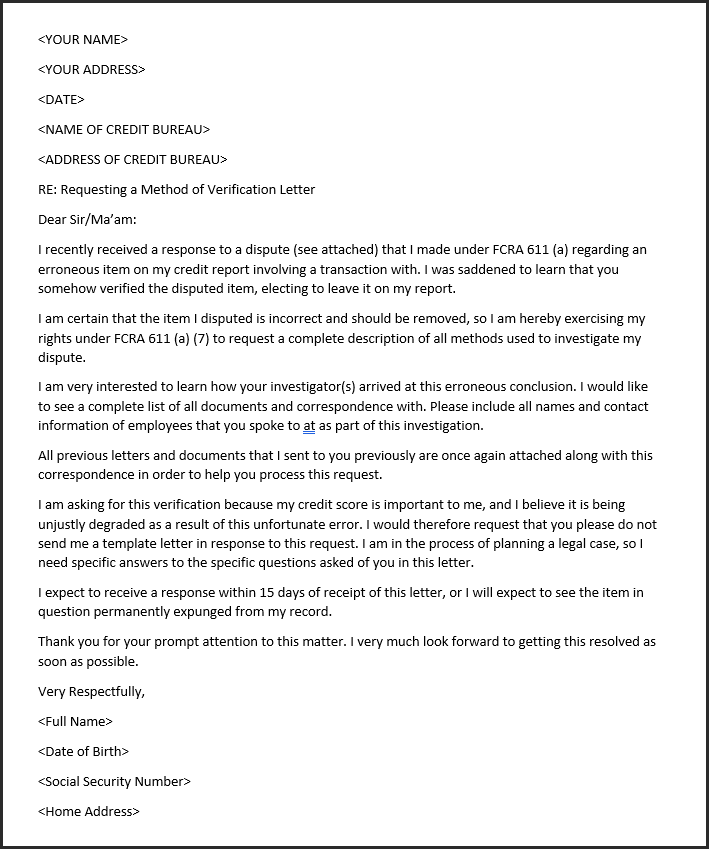

File A Dispute Directly With The Creditor

You can also contact the company that provided the information to the bureau in the first place, such as a bank or credit card issuer. Once it receives a dispute, a lender is also required to investigate and respond to all disputes that might impact your score.

Remember to include as much documentation as possible to support your claim. It’s also helpful to include a copy of your report marking the error.

The address you should mail the letter to is usually listed on your report, under the negative item you’d like to dispute. You can also contact the lender directly to verify the mailing address and the documents you should include.

If the lender finds that it was mistaken or cannot prove that the debt actually belongs to you, it will notify the bureau and ask it to update your file.

Correcting Misreported Discharged Debt

Disputing errors is relatively straightforward. You’ll do so by using the online procedure provided by each of the three major credit reporting agencies.

A creditor who repeatedly refuses to report your discharged debt properly might be in violation of the bankruptcy discharge injunction prohibiting creditors from trying to collect on discharged debts. If you take steps to remedy the misreporting, and the creditor refuses to fix the error, talk to a bankruptcy attorney.

Recommended Reading: What Credit Bureau Does Paypal Credit Use

Get A Free Copy Of Your Credit Report

Its important to check your credit report frequently annually, if not more often so you can catch any irregularities early on.

Under federal law, you have the right to obtain a free credit report from all three major credit bureaus once a year. However, because of the pandemic, all three bureaus are offering free weekly reports until April 2022.

You can request yours through AnnualCreditReport.com, the only free credit report website authorized by the federal government. Make sure to request and check your reports from all three bureaus since its not uncommon for each one to get different information from creditors and lenders.

You can also request them by:

Phone: 322-8228

Mail: Download, print, and complete the request form and mail to:

Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281

In addition to your annual report, you can request additional free copies if:

- You were denied credit, insurance, or employment based on your credit in the past 60 days

- There are sudden changes in your credit limit or insurance coverage

- Youre receiving government benefits

- You’re a victim of identity fraud

- Youre unemployed and/or will apply for employment within 60 days from the date of your request

Other ways to get your credit report

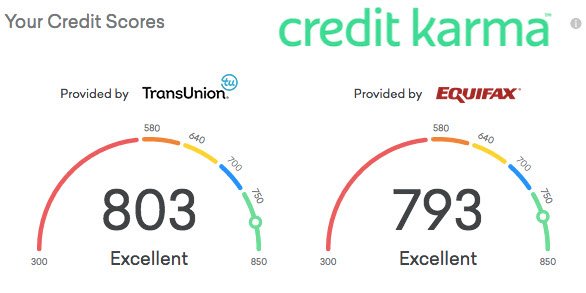

Each of the major bureaus offers credit monitoring services that include access to your report and your score, among other benefits.

Experian

TransUnion

How To Remove Items From Your Credit Report After 7 Years On Your Own

Here are the steps you can take to help you remove items from your credit report after 7 years.

Also Check: Credit Score For Paypal Credit

Late Payments: 18 To 24 Months

Remember, your payment history accounts for 35% of your credit score and is the most important factor in the FICO credit scoring model. This is because lenders like to see on-time payments when determining how creditworthy an applicant is. Late payments stay on your credit reports for seven years and the impact they have on your credit score decreases over time. It can take two years for your score to rebound from the damage of late payments.

The best way to lessen the impact of a late payment is to keep other areas of your credit report strong and to focus on making on-time payments moving forward. The more late payments you have on your credit report, the longer it will take to bounce back from them.

Alongside making on-time payments each month, try to lower your credit utilization ratio, improve your credit mix and keep older credit accounts open to keep your credit history nice and long.

What Makes Up Your Credit Score

Your is calculated using different scoring models, such as the VantageScore and FICO. These are the two most widely used credit-scoring models, and each has its own proprietary metrics and criteria. However, both models have one thing in common: they use data from the major credit reporting agencies to generate your score.

If you want to repair bad credit, it’s important to understand what factors VantageScore and FICO evaluate when generating scores.

VantageScore 4.0 Scoring Model

VantageScore prioritizes total credit usage, balance and available credit. Basically, the model first evaluates the amount of credit you have available to use and how much of it you’re using. Using 30% or more of your available credit can lower your score since lenders usually consider it a red flag.

Other factors considered include your credit mix, payment history, credit history length and new accounts.

FICO Scoring Model

The FICO score is the industry standard its the oldest credit scoring model and what most lenders use to evaluate a person’s creditworthiness. FICO’s scoring has five categories, each with a percentage value indicating how much weight they place on each:

You May Like: Experian Boost Paypal

Why Can’t You Delete My Credit File At Transunion

TransUnion is a credit reporting company that operates under the Fair Credit Reporting Act. Your credit file is maintained as allowed by federal and state laws. The Fair Credit Reporting Act does not require credit reporting companies to maintain a file on every person, or require credit reporting companies to delete files at a consumers request. The Act does require the companies to use reasonable procedures to assure accuracy. Creditors may access your credit report only if they have a permissible purpose under the Fair Credit Reporting Act.

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

Recommended Reading: 24 Hour Inquiry Removal

Do Collection Accounts Age Off Your Credit Report After 7 Years

So I have debt from store lines of credit to a bank credit card. I haven’t paid on them since at LATEST December 2007. Chase, citi financial and Sears line of credit all have it showing closed but I am getting reporting from some debt collector companies.

I live in Arizona and just ordered my actual credit report today. I viewed the information online through a credit score tracking website. I read a lot of comments and researched online somethings. My questions are can any of them take me to court still because from what I read some debts are 3 years and some are 6 here in Arizona, I am not sure what they fall under, also at 7 years they have to stop reporting to my credit so I am told. Does this mean that it will show the old reports but they cant continue to report and since the original lenders have the accounts closed can the debt collector who purchased the debt also show up as a closed account or do they just disappear forever?

Any information to better understand when or if this will ever not be an issue for me would be helpful, as these debts were ran up by my ex and are thousands of dollars I cant and haven’t been able to afford to even attempt to fix.

Do collection accounts get removed from my credit reports after 7 years?

Jennifer

Original lenders and creditors show payment default on your credit reports for up to 7.5 years from when you stopped paying on the account.

Have A Credit Repair Professional Remove The Negative Items

If youd rather not send dispute letters, goodwill letters, or negotiate pay-for-delete agreements, you could always hire a credit repair service to do this work on your behalf.

I suggest you check out Lexington Law, one of the nations leading credit repair companies.

Lexington Laws experts deal with credit reporting agencies every day. They know the Fair Credit Reporting Act inside and out.

They can usually remove inaccurate information a lot faster than you could by yourself. Professional credit repair projects tend to take two to three months.

You may spend $400 to $500. This would be money well spent if it restored your good standing with lenders in time to secure a loan with low-interest rates.

Learn More: Read our full Lexington Law Review or go straight to the companys website here.

You May Like: Chase Sapphire Preferred Card Credit Score Needed

Why Bad Debt Is Removed After 7 Years

There is no limit to how long a creditor can pursue a debt, but there is a limit on the amount of time they have to take you to court to collect it. That limit is between four and six years, depending on the state you live in. There is also a limit on how long the debt can be reported on your credit report. For unpaid or delinquent accounts, the limit is seven years. Debts that are being reported past the limit are often due to misunderstanding or error.

Why Do You Store Social Security Numbers On Credit Reports

Your personal information, such as name, address, date of birth, and Social Security Number, is reported to TransUnion by your creditors. TransUnion maintains a separate credit file for each individual. Without your Social Security Number, the quality and accuracy of your credit history could be compromised. The federal Fair Credit Reporting Act permits TransUnion to maintain personal and credit information in our records.

You May Like: Does Paypal Credit Help Your Credit

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

Request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB