Make Copies For Your Records

Before dropping your dispute letters in the mail, make copies of them for your files.

Do the same with all of your documentation, but be sure to keep the originals and send the copies after all, items can get lost in the mail. Keeping the originals will give you peace of mind, and ensure you have everything you need if you have to resend the letter and documentation.

To avoid the possibility of your letter being lost without your knowing it, send your disputes through certified mail with a return receipt requested. Upon receipt, the return request postcard will be mailed back to you, providing proof that the document was received and on what exact date.

What Can I Do About Defaulted Private Student Loans

Private student loans donât have the same protections and repayment options as federal student loans. The options available for private loans are up to the lenders and the loan terms the borrower agreed to when taking out a loan.

A private lender may offer some type of rehabilitation program or way for borrowers to catch up on missed payments. Contact your private loan lender to discuss options you might have to get your private student loan out of default.

Refinancing student loans is another way to get loans out of default status. You can refinance private or federal student loans . A refinanced loan is a new, private loan that pays off your original loans and leaves you with one monthly payment to make moving forward. Refinancing can pay off loans that are in default status, but it canât remove any of the negative reporting on your credit report that already exists. Eligibility for refinancing one or more student loans depends on your credit score and overall creditworthiness.

Directly Contact The Information Provider

Your dispute does not only have to include the credit bureaus: You can dispute an item directly through the information provider . The Fair Credit Reporting Act notes that both the credit reporting company and the information provider are responsible for correcting inaccurate information on your report, so you can exercise your rights by contacting both.

Put this dispute with the information provider into writing, just as you did with your communications to the bureaus. You may be able to find the information providers address on your credit report. If not, you can contact them directly to get it.

If you file a dispute with the information provider, a notice of your dispute should be included any time the institution reports the information to a credit bureau. If the information does indeed prove to be incorrect, the information provider must tell the credit reporting agency to update or delete the inaccurate item.

Don’t Miss: 611 Fico Score

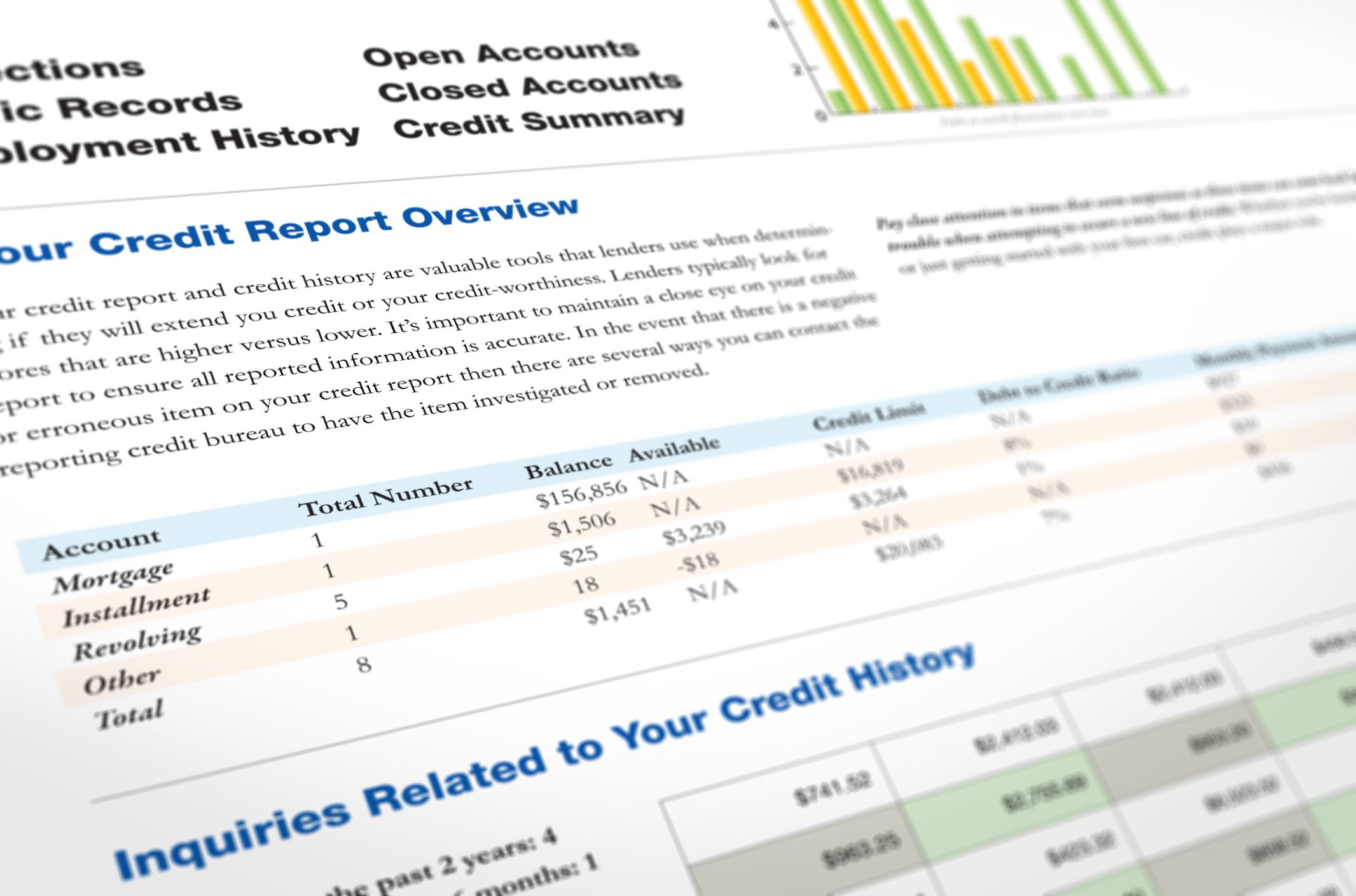

Look For Negative Information In Your Credit History

You may not even know if you have a derogatory account in your credit history. So you should start by getting your free credit report.

You can get your from many different services. But by law, each of the three major reporting bureaus has to give you a free credit report each year. And during the coronavirus pandemic, consumers are entitled to free weekly reports through April 2021, via AnnualCreditReport.com, the official U.S. government website.

When you open your credit report, you can find a list of all derogatory accounts. These include any account with a late or missed payment.

Below is a sample screenshot showing a credit card account that has a 30-day late payment from July 2011. You can see that its a derogatory item from the color some reports show yellow and red boxes and we know that it is a 30-day late payment because the box says 30 in it.

Image: Eric Rosenberg

Look through your credit report and make a list of all negative information. Then compare to your records to make sure everything there is accurate.

If its not accurate, getting it removed is imperative. And if it is accurate, its harder to remove, but still possible.

Stay In Close Communication With Your Lender

If you’re struggling to make your payments, contact your lender. You may be able to defer your payments, negotiate a repayment plan based on your income or consolidate your loans under a single interest rate. Even private lenders will typically work with borrowers to ensure they can make their payments.

Read Also: How Long A Repo Stay On Your Credit

How To Avoid A Student Loan Debt Default

Try to avoid entering a default if possible. Before you default, you can work out agreements with FedLoan Servicing that arent possible once your account has accelerated.

For example, student loan servicers automatically provided coronavirus relief deferments for borrowers in the spring of 2020.

You can avoid defaulting on your student loans by:

Include Payments In Your Budget

Build your student debt payments into your budget and make payments that are larger than the minimum payments. You can also speak with your financial institution about setting up automatic payments.

When planning your budget and automatic payments, make sure you know when your payments are due. Remember that if you have more than one loan or line of credit, you may have more than one payment due date.

Recommended Reading: Credit Report With Itin Number

Why Your Student Loans Should Stay On Your Credit Report

As you may have gleaned, you cant actually remove your student loans from your credit report. The only thing you can do is dispute the student loans on your credit report if they are being reported incorrectly. However, theres a bright side.

If youre paying your loans on time each month, that looks good on your credit report.

Its actually not a bad thing that your student loans are on your credit report. If youre paying them on time each month, that looks good on your credit report.

It shows lenders that you are responsible and when they lend you money, youre more likely to pay it back diligently and in full.

If youve run into some trouble paying your student loans on time because your income isnt where you would like it to be, try to figure out how to make your loans more affordable, either with a federal income-based repayment plan or by refinancing with an extended loan term.

Then start making your payments by the due date each month, and you may see that in time your student loans become a more positive mark on your credit report. As we mentioned earlier, remember that while these options provide short-term relief, they generally will result in paying more over the life of the loan.

Student Loans On Credit Reports

Credit reporting is a confusing topic for all types of debt, but it is especially confusing for student loans. This is largely because there are so many different types of student loans and they are governed by so many different rules. For example, there are multiple types of federal student loans, as well as private loans, and state loans that fall somewhere in the middle. Some student loans do not have statute of limitations but others do some federal loans have repayment plans that can result in forgiveness but others do not some of them can be rehabilitated but others do not.

In many ways, reporting student loans on a credit report is a lot like fitting a square peg in a round hole. The Departments of Education and Treasury, and the Consumer Financial Protection Bureau recently announced that they were going to work with the credit reporting industry to try to fix that hole, so to speak.

It is great that these agencies are paying this much attention to student loan credit reporting. As we stated in our submitted to the CFPB, they should improve student loan credit reporting practices based on best practices. We also urge the CFPB, Education Department, and Treasury to seek borrower input throughout the process. Borrowers are a key constituency in this process, and these agencies need to hear how credit reporting decisions impact borrowers.

How long can student loans be reported on a credit report?

Recommended Reading: Does Affirm Report To Credit Bureaus

How To Remove Closed Student Loans From Your Credit Report

, Results

Staying on top of your credit score means being proactive. One of the ways you can help it rise is by removing accounts that are closed from your credit report. Closing an account does not mean that it will no longer be on your record. One common question in this area comes from student debt. How exactly can you remove closed student loans from your report?

How Credit Scores Affect New Student Loans

All of your student loans can affect your credit. But you dont need good credit to take out a student loan in the first place.

-

For federal loans: Most types of federal student loans, including all federal loans for undergraduates, dont require a credit check. Federal direct PLUS loans, available to parents and graduate students, do require one. However, your credit score wont affect your rate all PLUS loans disbursed in the same year have the same rate.

-

For private loans: Private loans require that at least one borrower have good credit. The lender will perform a credit check to determine whether you qualify for the loan. The higher your credit score, the lower the interest rate youll likely receive. Often, undergraduate students need a co-signer to qualify for private student loans.

About the authors:Teddy Nykiel is a former personal finance and student loans writer for NerdWallet. Her work has been featured by The Associated Press, USA Today and Reuters.Read more

Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Also Check: How To Report To A Credit Bureau Landlord

Inaccurate Reporting Of Payments

If your loan has been reported as delinquent or in default to the credit bureaus, but you believe your payments are current, you can request a statement from your loan servicer that shows all the payments made on your student loan account, which you can compare against your bank records.

If some of your payments are missing from the statement provided by your loan servicer, you can provide proof of payment and request that your account be accurately reported to the credit reporting agencies.

In all three cases, if you believe there is any type of error related to your student loan on your credit report, its best practice to also send a written copy of your dispute to the credit bureaus so they are aware that you have reported an error.

Contact Your Lender Immediately If You Are Unable To Make A Payment

Should you have trouble making a student loan payment on time in the future, be sure to contact your lender right away to explain your circumstances. There may be options available to help you stay on track. While missing one payment isn’t good, the consequences of allowing your loans to go into default are far greater. Federal student loans are guaranteed by the government, so if you become seriously delinquent, the lender can file a claim with the government to recover the amount of the loans.

Once the claim is filed, the lender will report the original student loan accounts as “government claim.” The government can then consolidate the debt into a new loan in order to collect the debt from you, but the status of “claim filed by government” will remain on the original loans. A status of government claim is considered derogatory and will significantly impact your credit scores.

Thanks for asking.

You May Like: What Credit Score Does Carmax Use

How To Avoid Default In The First Place

Its possible to get a defaulted student loan removed from your credit report. But you may not have to even bother with it if you take the right steps to avoid default.

For borrowers who are struggling financially, the first thing they should do is call the loan servicer to explore their options, says Kantrowitz. You lose options if you default first.

Servicers are more willing to work with you if you talk to them when you start struggling. Dont wait until youve missed several payments.

Depending on the servicer, you can potentially apply for deferment or forbearance due to financial hardship. Both of these options can temporarily suspend your monthly payments while you get back on your feet.

If you have federal student loans, you can also consider an income-driven repayment plan. These plans can reduce your monthly payment to 10% to 20% of your discretionary income, giving you some room to breathe.

If Youre Having Trouble Repaying

If you need help with repaying your Canada Student Loan, you may qualify for the Repayment Assistance Plan .

If youre having trouble repaying a provincial student loan, contact your student aid office. For repayment assistance with a loan or line of credit provided by your financial institution, contact your branch to determine what your options are.

Understand that by making your payments smaller, it will take you longer to pay back your loan. Youll end up paying more interest on your loan.

If you consider refinancing or consolidating your student loan, note that there are important disadvantages.

If you transfer your federal or provincial student loan to a private lender, you will lose any tax deductions on your student loan interest. You wont qualify for the interest free period while you’re in school and will end up paying more interest over time.

Recommended Reading: Care Credit Dental Credit Score

Do Student Loans Go Away After 7 Years

Student loans don’t go away after 7 years. There is no program for loan forgiveness or loan cancellation after 7 years. However, if it’s been more than 7.5 years since you made a payment on your student loan debt and you default, the debt and the missed payments can be removed from your credit report. If that happens, your credit score may go up, which is a good thing. But you’ll remain responsible for paying back your loans.

How Student Loans Affect Credit

Student loans are considered an installment loan on your credit report, which means you make payments over a specified period of time until the loan is paid off .

Installment loans show that you can pay back borrowed money consistently over time. Other examples of installment loans are mortgages, auto loans, and personal loans. The biggest impact to your credit for installment loans is payment history.

Payment history is 35% of what makes up your credit score, so making your student loan payments on-time and in-full is key to maintaining a healthy credit score for student loan borrowers.

When you borrow student loans to fund your education, youll typically have separate loans for each semester or enrollment period. Each of these loans show up on your credit separately, even though you might have one payment to satisfy them all.

This doesnt positively or negatively affect you by a multiplier, however. Credit scoring systems recognize that the separate loan accounts are of the same type and effectively counts them as one loan when calculating a score. Credit scores acknowledge that student loans are unique and treat them differently in the calculation.

Recommended Reading: 586 Fico Score

Can Student Loans Be Deleted From Your Credit Report

After you take out a new student loan, the lender will report it to the three major credit bureaus. Each loan will be listed as a separate account on your credit report. Federal student loans and private student loans may begin reporting while youâre still in school and in deferment. Your credit score wonât be harmed by student loans in deferment, but future lenders could consider your student loan debt when determining creditworthiness.

Once youâre out of school and making student loan payments, your payment history will be reported on your credit report. On-time payments and late payments will both be reported.

Itâs important to monitor your credit report to make sure that your student loan, credit cards, and other consumer accounts are being accurately reported. Incorrect credit reporting can harm your credit scores. You can have multiple credit scores, depending on which calculating software is used and which lender checks your credit score. The most well-known and widely-respected credit score is your FICO score, which takes into account the credit histories reported by the three major credit reporting bureaus listed above. It is particularly important that you monitor activity on your credit histories maintained by each of these bureaus.

There are three ways to request your credit report. Youâll want to regularly monitor your credit report from each credit bureau.

Can Student Loans Be Removed From Your Credit Report

You can remove student loans from your credit report under two conditions.

If either condition applies to your student loan, then you can remove the inaccurate item from your report with a dispute.

You May Like: Zzounds Payment Plan Denied

Proof Of Any Errors And Relevant Documents

If youre writing about a mistake that occurred, still be friendly in tone, but back up the errors with documentation. Youll need proof that what youre saying is true. Unfortunately, errors are often made on credit reports, and it may have been a clerical error on behalf of your servicer. If you have any written correspondence with them, youll want to include it.