How To Remove Late Payments From Your Credit Report

An accurately reported late payment can remain on your credit report for up to seven years. Even if you bring the account current and aren’t late anymore, your credit report is telling an accurate story of your history with the account.

If a creditor reports your payment late when you actually paid on time, however, you can dispute the late payment with the credit bureau. You can file your dispute for free by mail, over the phone or online, and explain why you believe the late payment is an error. You can also send, attach or upload supporting documents, such as bank statements or cancelled checks showing when you paid the creditor.

After receiving a dispute, the credit bureau will investigate your claim and either confirm the late payment was accurate or update your credit history to reflect what actually happened.

Payments More Than 30 Days Late

Once a late payment hits your credit reports, your credit score will likely drop from 90 to 110 points. Consumers with high credit scores may see a bigger drop than those with low scores.

The first delinquency impacts FICO Score more than a different consumer who might have multiple delinquencies on credit history, said Tommy Lee, principal scientist at FICO.

Some lenders dont report a payment late until its 60 days past due. However, you shouldnt count on this when planning your payment. The later you pay, the worse the impact on your credit score. Late payments show on your credit report as 30, 60, 90, 120 and 150 days late.

Heres an example of the effect a 30-day delinquency has on two different consumers:

| 30-day delinquency |

| 90-110 |

*Note this study was done on selected consumer profiles, and there are a wide range of profiles so results may vary.

A: Call Your Creditor

For this step, all you do here is find out all the necessary information surrounding the late payment.

Start by finding out when the payment was due and when it was actually made.

For example, your creditor may say you had a payment due of $15 for a $300 balance which was due on June 1st, and the payment was not received until July 8th. Thereby you would have been 38 days late. As a result, they can legally report you as 30 days late on your payment.

After you have gathered this information, you want to see if there is any blame you can pin on the creditor. Find out if the late payment was due to any of the following issues:

1. You missed a payment that was due for an annual fee or membership fee from the creditor.

2. The creditor sent mail to your home, which they told you was actually returned as undeliverable

3. The payment took 2-3 days to process. Due to this, you went over the 30-day mark.

4. They were mailing statements to a misspelled address for you or had your apartment number missing from the address.

5. They were sending statements to an old address, even though you notified them of your new one.

6. You submitted the payment on time, but it bounced because they took down your incorrect bank account # to process the payment.

7. You paid the account off, but it incurred interest charges that were applied as the payment was processing.

8. The minimum payment had increased but the auto pay did not make this adjustment.

Read Also: Itin Credit Report

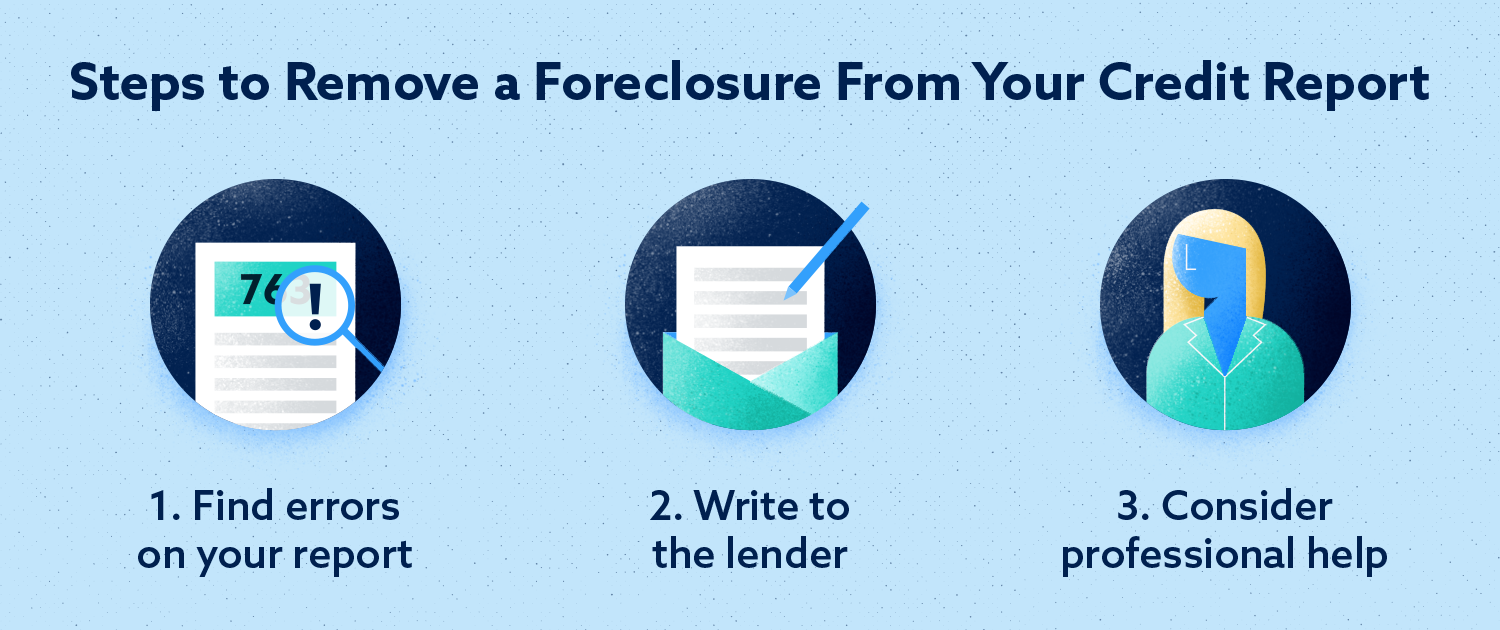

Hire A Professional To Remove Late Payments

To make this process easier, you can work with that will help you to challenge inaccuracies on your credit report. Credit repair professionals have the expertise, knowledge and, most importantly, the time available to help you through the dispute process from beginning to end.

You have the will, we have the way. Let us help you fix your credit. Call today to get started

Negotiate With A Pay For Delete Letter

If you dont have a great history with the lender, or if your debt has already been sent to a collection agency, you can consider sending a .

This letter is a negotiation tool you can use to offer a full payment of the debt in exchange for a removal of the negative mark. You can also offer to sign up for automatic payments to ensure payments are not late in the future.

The letter should explicitly include what youre offering , what you want in return and the date youd like a response.

You May Like: Business Credit Cards That Don T Report To Personal Credit

How To Get Your Credit For Free

The three credit bureau companies have created a central website, a toll-free telephone number, and a mailing address wherein you can ask for your free annual report, the Federal Trade Commission consumer information says.

Your credit report is vital because it has the information that determines whether you can get loans for buying a property and about your current balance.

On free credit reports, the FTC assures If you request your report online at annualcreditreport.com, you should be able to access it immediately. If you order your report by calling toll-free 1-877-322-8228, your report will be processed and mailed to you within 15 days. If you order your report by mail using the Annual Credit Report Request Form, your request will be processed and mailed to you within 15 days of receipt.

It can further be noted that under federal law, a person is entitled to a free report if a company takes adverse action against them, such as denying an application for credit, insurance, or employment, and seeking a report within 60 days of receiving notice of the action.

Furthermore, a person is also qualified for one free report a year if unemployed and is planning to look for a job within 60 days whether on welfare or if the report is a mistake because of fraud, including identity theft. Otherwise, a credit reporting group may charge a reasonable amount for another copy of the report within a year-long period.

You can reach the bureaus at:

Check Your Credit Reports After Your Disputes

If your late payment dispute with either Equifax or TransUnion is successful, the credit bureau will correct the error and remove the error from your credit report. The credit bureau agency should notify you of the results of their investigation. Even if theyâve said that theyâve corrected the error, check your credit reports from both bureaus to make sure the error was fixed. Make sure to follow up if the mistaken late payment notation is not removed within 30 days.

Read Also: How To Get Credit Report With Itin Number

Dispute Incorrect Negative Information

If you find a derogatory account that is incorrect, you can file a dispute with the credit bureau to have it removed.

| A real-life example of how to remove derogatory items from credit report |

|---|

|

In 2009, I found such an item on my credit report and filed an online dispute with TransUnion. That was the credit bureau that furnished the report with incorrect information. I filled out a short online form explaining the error and a few days later got a response that they had contacted the institution, verified the information, and it was removed. Talk about a piece of cake. Eric Rosenberg |

You can file a dispute from a link provided in your credit report from AnnualCreditReport.com, or through any of the links below.

Keep in mind, you may need to create an account with the credit bureau to complete the process. But you dont need to sign up for any subscription or other paid service with these companies in order to remove a derogatory mark.

You can also file disputes by mail. However, the online dispute process is much easier for anyone comfortable using a web browser.

The reporting bureaus are required by law to handle disputes in a timely manner, typically 30 days or less, according to the Federal Trade Commission. Removing inaccurate negative information from your credit report is one of the fastest ways to quickly improve your credit score.

How To Remove Items From Your Credit Report In 2021

Weve outlined how to remove negative items from your credit report, the paid services you can opt to use, and additional information to have on hand. It is important to clarify that only incorrect items can be removed. If youve done this already, but your credit score is still low, you will need to repair bad credit over time. Although accurate items cannot be removed by you or anyone else, there are still many credit report errors that can damage your score, and these are worth looking out for.

Don’t Miss: Can You Remove Hard Inquiries Off Your Credit Report

How Do Missed And Late Payments Affect Your Credit Score

Payment history is the single-most important factor affecting your , making up 35% of your FICO Score and 41% of your VantageScore.

For that reason, paying on time is crucial to maintaining a good credit score. If you do fall behind, taking action quickly can help prevent or mitigate damage to your credit score. The longer you wait, the more your credit score will drop.

Its also worth noting that the amount of the payment due can affect how many points your credit score goes down. Falling behind on a larger payment can have a bigger impact on your score if you have a large balance owed.

On the other hand, the type of account does not make a difference. A late payment on a credit card carries the same effect as a late payment on an auto loan or mortgage. However, note that mortgage payments are typically larger than those for credit cards or for other loans, so missing a mortgage payment could have a larger impact on your score because of the payment size and total amount owed.

Heres a breakdown of what you can typically expect depending on how late your payment is:

How To Rebuild Your Credit After A Late Payment

Categories

Uh-oh. Youve missed a payment. Maybe the cable bill slid down behind the desk or the postal strike meant you didnt receive your cell phone statement. Maybe an emergency expense popped up and you didnt have the cash to pay your utilities last month. Whatever the reason, you didnt make a payment on time. Do you know how this will affect your credit rating?

Cant make your loan payments on time? Read this.

To answer that question, lets look at how our creditworthiness is measured in Canada.

Read Also: How To Report To Credit Bureau As Landlord

Launch Disputes With Credit Bureaus

Major credit reporting bureaus must follow reasonable procedures to ensure that consumer reports are accurate. Section 611 of the Fair Credit Reporting Act provides the procedure for disputing the accuracy of reports.

You may question the accuracy or completeness of any entry by notifying the agency directly or through a reseller. After receiving the dispute, the agency will undertake a re-investigation. Its meant to establish if the record is accurate and ascertain its current status.

The countdown to finish the investigation starts from the date they receive the notice and ends after 30 days. Credit reporting agencies may extend their investigation for another 15 days if the time is not sufficient.

How do credit bureaus get late payments removed? First, the CRA notifies the information furnisher and provides evidence submitted by the consumer. Creditors or public record resources must determine the accuracy of the dispute within 30 days.

If the furnisher reports the delinquency as inaccurate, incomplete, or fails to verify it, the reporting agency will delete the item from their files. At times, customers have entries removed only to reappear. The situation occurs if there are delays in validating disputes. Furnishers may re-insert an entry as long as its complete and accurate. Upon re-insertion, credit reporting bureaus must notify consumers.

How to launch disputes with CRBs?

In summary, you can file disputes in the following order.

Should you choose online or mail?

How Do You Improve Your Credit Score After A Late Payment

Get current on payments and stay current

If youve missed a payment, the best thing you can do for your credit score is to bring the account current and make all future payments on time. If youre struggling financially, you may even be able to work something out with your lender many credit card issuers, for example, offer hardship programs for people dealing with situations like job loss, medical bills and natural disasters.

Follow theSE steps for building good credit

Once youre back on track with timely payments, know that the impact of one late payment will fade over time as you add more positive information to your credit reports. At its core, building good credit is a straightforward process. These steps will keep you on track:

You May Like: How To Unlock Experian Credit Report

How Do Late Payments Affect Your Credit Score

Having just one delinquent account on your credit report can be devastating to your credit scores.

Whether its a late car payment, credit card payment, or mortgage payment, a recent late payment can cause as much as a 90-110 point drop in your FICO score.

As time goes on, the late payment will hurt your credit score less and less until it drops off. However, potential creditors can still see that history as long as its listed on your report.

Late payments appear on your report as either 30 days late, 60 days late, 90 days late, or 120-plus days late. Each of these degrees of delinquency has a different impact on your credit.

The later you are, the more damage it does to your credit. More recent delinquent accounts also have a greater impact than older ones.

How Long Does A Late Payment Stay On Your Credit Report

A late payment typically stays on your credit report for up to seven years, according to information from the three major credit bureaus, Equifax, Experian and TransUnion.

Rod Griffin, senior director of consumer education and awareness at Experian, said the seven-year time frame for a missed payment deletion begins at the date of the first delinquency.

That means if you miss a single payment, then bring the account current, the late payment will be removed from the credit report seven years from the date of the missed payment, he explained.

He also noted that if a delinquent account is never again brought current and subsequently is transferred to a collection agency, the original debt and the collection account will be deleted seven years from the date of the original delinquency.

Collection agencies are required by federal law to report the original delinquency date from the first account and the result is that the original account and any subsequent collection account are deleted at the same time, Griffin said.

If you still havent paid the overdue amount after about 180 days or so, the issuer likely will charge it off and turn it over to a collection agency, which will damage your score even more.

See related: How to remove negative items from your credit report

Also Check: Will Paypal Credit Report To Credit Bureaus

Thoughts On Delete 30 Day Late Payments From Your Credit Report

Hi Ali, I incurred a 30 day late payment with Macys during the pandemic. This was not due to financially inability , but I just forgot. Ive called and theyve given me the cold shoulder and even lodged complaints with the CFPB. My credit is taken a dive and me and my partner cant get approved for a loan. What can you do to help ?

How Much Will Your Credit Score Rise When Negative Items Come Off

by Fred· Published October 19, 2016

Consumers often wonder how many points their credit score will rise once bad information comes off of their credit report. While the answer is complicated due to the way credit scores take this negative information into account, there are some basic patterns that have emerged from the credit reporting agencies over the years.

As time passes, negative information on your credit report gets looked at less in the eyes of the algorithms that make up your credit score. You will almost always see a bigger credit score bump from removing something like a collections account 3 months after it is put on as opposed to a 7 year old collections account falling off.

Financeography Tip: Checking your actual credit score through is completely free and only takes about 3 minutes.

As far as what you can normally expect in terms of how many points your credit score will rise, the following should serve as a decent guideline for most people. The higher end of the spectrum would be more of what you would see if something came off immediately, while the lower end is what you might expect after the seven year statute of limitations for credit reporting expires.

Late Payments: 5-60 points One 30 day late payment falling off of your account after seven years will have minimal effect while a 60 or 90 day late payment being removed immediately will have a very noticeable positive effect.

You may also like…

Also Check: Open Sky Unsecured

Can You Have A 700 Credit Score With Late Payments

A single late payment wont wreck your credit foreverand you can even have a 700 credit score or higher with a late payment on your history. To get the best score possible, work on making timely payments in the future, lower your credit utilization, and engage in overall responsible money management.

How To Offset The Credit Score Damage Of A Late Payment

Wade said there are many other steps that a consumer can take to offset the damage a late payment causes.

One of the easiest things to do is check your credit report for any errors that could be damaging your score and take steps to have them removed, which would raise your score.

Scanlon also suggested taking a look at your revolving credit card utilization or, how much of your available credit youre using to see if getting your utilization in a lower, more favorable range may help to boost your score and offset the late payments damage.

Don’t Miss: Aargon Collection Agency Scam