What Is A Good Credit Score For Buying A House

So far we’ve only discussed the minimum credit score that a mortgage lender will consider. But what type of credit score could qualify you for the best rates? FICO breaks its credit scores into five ranges:

|

FICO Credit Score Ranges |

| 800 and above | Exceptional |

Aiming to get your credit score in the “Good” range would be a great start towards qualifying for a mortgage. But if you’re wanting to qualify for the lowest rates, try to get your score within the “Very Good” range .

It’s important to point out that your credit score isn’t the only factor that lenders consider during the underwriting process. Even with a strong score, a lack of income or employment history or a high debt-to-income ratio could cause the loan to fall through.

Keep Your Credit Utilization Rate Low

The second most important credit score factor is your it accounts for 30% of your score. Your credit utilization ratio measures the amount of credit you use versus the amount you have available. While its usually recommended to keep your credit utilization ratio below 30%, a ratio closer to 0% will help boost your credit score even more.

How Do I Get The Highest Credit Score

While it is theoretically possible to achieve a perfect 850 score, statistically it probably wont happen. In fact, about 1% of all consumers will ever see an 850, and if they do, they probably wont see it for long, as FICO scores are constantly recalculated by the credit bureaus.

And its not like you can know with absolute certainty what is affecting your credit score. FICO says 35% of your score derives from your payment history and 30% from the amount you owe . Length of credit history counts for 15%, and a mix of accounts and new credit inquiries are factored in at 10% each. Of course, in actually calculating the score, each of these categories is broken down even further, and FICO doesnt disclose how that works.

The credit bureaus that create credit scores may also change how they make their calculationssometimes for your benefit. Changes were made in 2014 and 2017, for example, to reduce the weight of medical bills, tax liens, and civil judgments. However, changes made in January 2020 for FICO 10 involving trending data, credit card debt, personal loans, and delinquencies may make getting a higher score more difficult.

Read Also: Speedy Cash Collections

Getting A Perfect Fico Score

If you’ve been working to attain a perfect FICO® Score, here are a few takeaways to consider as you work toward your goal. Remember that having multiple credit cards or lines of credit is not a bad thingunless you mismanage your debt. Open new accounts when needed, and make sure to manage your debt and payments responsibly. In addition to making your payments on time and keeping your debt levels low, avoid any delinquent tradelines.

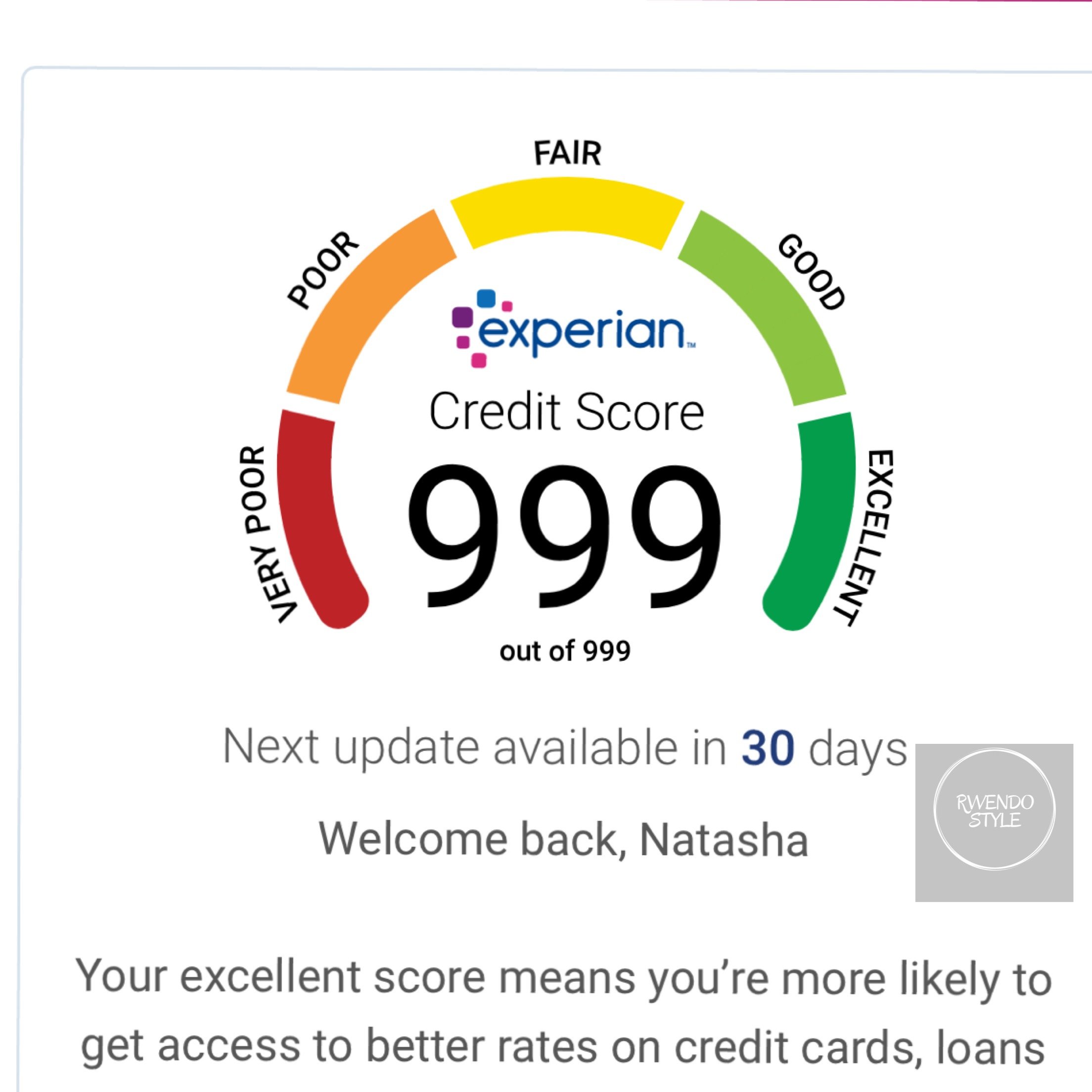

If you’re trying to build your credit score, periodically check your credit reports and scores so you can keep track of what is in your file and how it is affecting your score. You can get a free copy if your credit report and score from Experian and you can use the Experian to regularly track your score in the future.

What Is An Excellent Credit Score Range

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

You May Like: How Long A Repo Stay On Your Credit

Benefits Of A Perfect Credit Score

The benefits of a perfect credit score are more or less the same benefits you get from having excellent credit. When you have a perfect credit score, you become eligible for nearly all of todays best credit cards, including premium credit cards like the Chase Sapphire Reserve®, the Citi Prestige® Card and The Platinum Card® from American Express. Your credit card application could still get declined if you fall on the wrong side of something like the Chase 5/24 rule , but in most cases lenders will be eager to loan you money.

Plus, your perfect credit should score you some of the best interest rates on the marketwhether youre applying for a , shopping for a car loan or taking out a mortgage. In fact, if you took out your mortgage before you earned your perfect credit score, you might be able to save a lot of money by refinancing your mortgage and lowering your interest rates.

Having a perfect credit score can also make it easier to rent an apartment since landlords often perform a credit check after you turn in your application. Perfect credit might even help you during a job search if your employer checks your credit history during the interview process.

Done On The Web Loan Demand Function

A simple on the internet means normally link your with several prospective loan providers. More often than not, you may be expected to help you fill out your own very first email address, the total amount you would want to obtain as well as your borrowing from the bank guidance aforementioned. Once given, new sites program do a good pre-qualification and offer the guidance out-of possible lenders. From there, its up to you to examine its investigation.

Once youve chosen suitable bargain and you may financial for your requirements, you might just do it along with your no credit score assessment loan. The procedure depends on the newest lenders policy, nonetheless they may require more detailed guidance so youre able to submit the loan details. Following that, it needs to be smooth sailing to your loan .

Do not let a less than perfect credit rating otherwise record attract your towards considering you will be destined because the you arent. Here are a few solution alternatives if you fail to get a zero credit score assessment loan.

Read Also: Paypal Working Capital Review

What Is A Good Fico Score

FICO® creates different types of consumer credit scores. There are “base” FICO® Scores that the company makes for lenders in multiple industries to use, as well as industry-specific credit scores for credit card issuers and auto lenders.

The base FICO® Scores range from 300 to 850, and FICO defines the “good” range as 670 to 739. FICO®’s industry-specific credit scores have a different range250 to 900. However, the middle categories have the same groupings and a “good” industry-specific FICO® Score is still 670 to 739.

Personal Loan Growth Slowed From Last Year’s Record High

- 22% of U.S. adults have a personal loan.

- The average FICO® Score for someone with a personal loan in 2020 was 689.

- The percentage of consumers’ personal loan accounts 30 or more DPD decreased by 27% in 2020.

Despite growing by 12% in 2019, personal loan balances saw the least growth in 2020, at just 1%. Personal loan balances rank near the bottom compared with other debt types, with consumers owing an average of $16,458 in Q3 2020. Across the nation, nearly one-quarter of adults have a personal loan.

Personal loan accounts also saw a dramatic decrease in delinquencies, with the percentage of loans 30 or more DPD falling by 27% in 2020. Though personal loan delinquencies in 2019 also decreased from the prior year, this drop was 25 percentage points higher in 2020.

You May Like: What Credit Score Is Needed For Affirm

Increase Your Available Credit

Work to increase your available credit over time by applying for new lines of credit. Consider applying for a mix of credit that includes both revolving debt and installment debt . Dont apply for too much credit at once, because that could lower your credit score due to the hard credit inquiries associated with each application. Instead, wait between three and six months before adding another line of credit to your account.

Pay Your Bills On Time Every Time

One single missed payment on your credit report might ruin your chances of a perfect 850 forever! And thats not an exaggeration. Your on-time payments are the most important factors that affect your credit score and need to be at 100%. Miss one payment and your score might plummet more than 50 to 100 points.

Hey, Want some free cash?

- Rakuten: Get a free $30 Gift Card: Simply use Rakuten to find the best deals on items you were going to buy online anyway and get a free $20 gift card!All you have to do is sign up and make qualifying purchases totaling at least twenty dollars within ninety days of becoming a Member.Not only will you save money, but you’ll get paid too! Super easy!

Payments are usually not considered late until 30 days after their due date. Sure, you might end up paying late fees to your bank, but they dont report your late payment until its at least 30 days late. So start here.

Interesting articles on Digest Your Finances that you may want to read:

Recommended Reading: Can I Get A Repossession Off My Credit

Why Perfect Credit Doesnt Demand Perfection

Less than 1% of people have a credit score of 850, according to the major credit-scoring companies. And it simply wouldnt make much business sense for financial institutions to create special products for such a small target market. So they dont.

After all, when was the last time you saw a credit card for people with perfect credit? Never. Instead, you see offers for people with excellent credit.

But if it isnt 850, and there isnt one perfect credit score, where do you draw the line? Where does excellent credit end and perfect credit begin? Its all about risk and reward: how much risk you pose to lenders and when a higher credit score stops rewarding you with additional savings. And that point seems to be anywhere from 751 to 800.

Many lenders consider anyone with scores above 750 as being almost completely void of credit risk, said credit expert John Ulzheimer. Theres little incremental value in having an 850 over having a 750, as youre likely going to get the best treatment in either scenario.

In other words, a score above 750 is generally good enough for you to get the best terms on your credit cards, loans and insurance premiums. But you should shoot for 800 just to be safe. And anything beyond that is good for little more than bragging rights.

So as Stacy Smith of Experian recommends, Instead of chasing the impossible perfect score, strive for a score that is good enough to qualify you for the best rates.

Tips For Building A Perfect Credit Score

The process of perfecting your credit score is very similar to simply building a good credit score from scratch. You need positive information flowing into your credit reports on a monthly basis. And the easiest way to accomplish that is to use a credit card responsibly.

But there are a few things you can do to push your credit score into perfect territory once youve reached good or excellent credit.

For more tips and tricks, check out WalletHubs complete guide on How to Improve Your Credit Score.

Don’t Miss: Paypal Credit Affect Credit Score

How Long Does It Take To Build A Credit Score

It takes at least six months to build your first good credit score. Meanwhile, reaching a perfect or excellent credit score will take several years. You need to have a couple of years of only good credit history and a good mix of different credit lines to build an excellent score.

Does age matter in getting perfect credit scores? Age is not the only factor but yes, age affects your ability to get a perfect score. FICO research showed that older people tend to have higher credit scores. Remember that long-standing credit history contributes 15% to your credit score.

Older people tend to have long tradelines, and if theyre in good standing, they drive higher credit scores. On average, Americans with 800 to 850 scores are 61 years old.

If you have a low credit score, theres no overnight fix to that. But your efforts will pay off over the long term. If you have negative items on your credit report, recovery can take time, and it varies per person. In general, paying your bills on time can increase your credit score noticeably in six months.

Why Credit Scores Matter

You dont need perfect credit to get approved for a car lease. But the higher the credit scores, the greater the chances of getting approved. Why so? Its all a matter of risk to the lessor.

The average credit score to lease a new car was 729, according to Experian for 2020. If your credit score is on the lower end of the spectrum, lenders perceive you as a credit risk. And the lessor wants to protect their financial interests.

Don’t Miss: How Do I Unlock My Equifax Account

How To Improve Credit Score

Whether or not you have poor credit, it definitely pays to continuously improve your credit score. While there are online personal loans with no credit check that you can avail of, the path towards financial security and stability means getting better terms when it comes to your loans. So, how do you improve your credit score, whatever it may be? Below are some tips you may want to apply to your financial life:

Monitor Your Credit Report And Score

Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable termsbut checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest. Experian offers free credit monitoring for your Experian report, which in addition to a free score and report, includes alerts if there’s a suspicious change in your report.

Keeping track of your score can help you take measures to improve it so you’ll increase your odds of qualifying for a loan, credit card, apartment or insurance policyall while improving your financial health.

Recommended Reading: Apple Card Shopping Cart Trick

Pay Your Bills On Time

The frequency of your on-time payments is the factor that influences your scores the most.

Setting up automatic payments on your credit card bills can be a helpful way to avoid forgetting a payment, but make sure you have enough money in your accounts to cover automatic payments. Otherwise, you may have to pay fees.

What Is A Perfect Credit Score And Why Does It Matter

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

A perfect credit score is 850 specifically, thats the highest FICO score. FICO is the scoring model most commonly used to determine, in part, how trustworthy you are as a borrower and what kinds of terms lenders could extend to you.

FICO credit scores range from 300 to 850, and your score is based on information in your credit reports. Think of it as your financial report card: The higher your credit score, the more liable you are to find lenders willing to work with you and offer you lower fees. This is true across all kinds of loans, from mortgages to auto loans, credit cards and more.

You May Like: Sync/ppc On Credit Report

Why Having A Good Credit Score Still Matters And How To Check Yours For Free

It’s OK if you haven’t yet reached a 760 credit score. The national average FICO score has steadily risen over the years and hit a record high of 703 in 2019, so many are in the same boat. The good news is that, whether you have a good credit score or even an excellent one, you will most likely qualify for some of the best cards and even cards with the best rewards.

The American Express® Gold Card was voted CNBC Select’s best overall rewards card for giving cardholders 4X points per dollar spent at restaurants and at U.S. supermarkets . Plus, the option to earn 3X points on flights booked directly with airlines or on Amextravel.com. Applicants can qualify with good or excellent credit. Terms Apply.

And the Blue Cash Preferred® Card from American Express ranked as the best rewards credit card for groceries, as cardholders earn 6% cash back at U.S. supermarkets on up to $6,000 per year in purchases . This card also offers 6% cash back on select U.S. streaming subscriptions, 3% cash back at U.S. gas stations, 3% cash back on transit and 1% cash back on other purchases. Applicants can qualify with good or excellent credit. Terms apply.

To track your own credit progress, make sure you routinely check your credit score. It’s smart to monitor your credit, and your score will not be affected by doing so . You can check your score for free with most card issuers, using apps such as Discover’s Credit Scorecard and Chase’s Credit Journey, which are available to all card users.