Benefits Of A High Credit Score

- More favorable loan terms

- Lower interest rates, which can save you money

- A better chance of qualifying for loans and credit cards

The reason higher scores come with these benefits is because a high credit score shows a lender that youre good at handling your debt and are a responsible borrower. Lenders are able to offer better terms because youre seen as less of a risk.

The Easy Way To Get An 800 Credit Score

Whats easier and safer than taking out a credit card and using that to build a positive credit history? Using Grow Credit to do it for you.

The virtual Grow Credit Mastercard lets you pay off your monthly subscriptions in a single place without the temptation to go on a spending spree and pay it all back later.

This means that you can keep your credit utilization low, build your credit history, and make sure that everything gets paid off on time, every time.

Been turned down by traditional credit cards but youre looking to turn over a new leaf and get back on the credit horse?

No worries – were offering our card without any prior credit checks.

Strapped for cash? No problem. Grow Credits new products only required a secured card with a small security deposit. You can get started on improving your prospects and reaching that 800 credit score without already having stacks in the bank.

Thats just one of the many reasons NerdWallet named us as one of the best cards you can get without the need for a credit check.

All you need to do is to add your subscriptions to your card and watch as your score starts climbing.

Is Being In The 800 Credit Score Club Really That Important

Home \ \ Is Being in the 800 Credit Score Club Really That Important?

Join millions of Canadians who have already trusted Loans Canada

The 800 Credit Score Club is a term coined to describe those that have a of 800 or higher, as the name implies. Those who regularly monitor their credit score know how difficult it is to achieve a score this high. In fact, membership to the 800 Credit Score Club is so exclusive that roughly less than 1 in 6 people have a score high enough to be in the club. Furthermore, having a credit score between 800 to 900 is the highest credit score range and is considered to be perfect credit.

This is why all Canadians need to be monitoring their credit score.

Generally, the higher your credit score is, the better offers you will get in terms of your personal finances thereby saving you thousands of dollars over the course of your lifetime. However, given how difficult it is to get a credit score this high, is it really worthwhile to be a part of the 800 Credit Score Club?

Also Check: Does Leasing Affect Your Credit

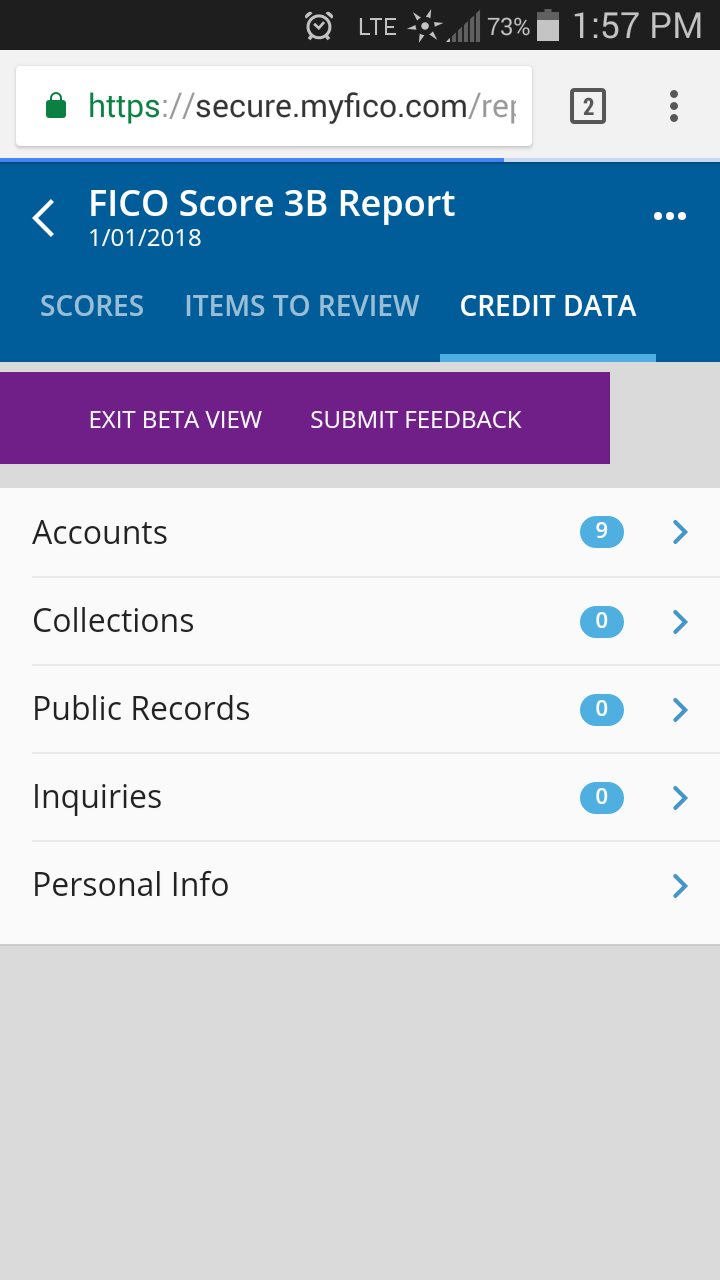

Review Your Credit Reports Regularly

One of the best ways to stay on track toward reaching the 800 club is to review your credit score and reports regularly. Not only does it give you the chance to see how your habits impact your credit, but it can also give you the chance to spot inaccuracies or even fraud, which could damage your credit score.

You can get a free copy of your credit reports through AnnualCreditReport.com, weekly through April 2022, then once every 12 months after that. You can also view your credit report information using free credit monitoring tools.

If you notice something is wrong or outright fraudulent, you can dispute the information with the credit bureaus and have it corrected or removed.

How To Get Your Credit Score To 800 Or Higher: Complete Guide

Do you know your credit score? The three major credit bureaus, Equifax, Equestrian, and TransUnion, compile information from credit reporting agencies to calculate your credit score.

Our credit score determines our level of creditworthiness. When we want to take on debt, such as a car loan, mortgage, or a credit card facility, lenders look at your credit score to assess their risk in loaning you money.

If you have a credit score under 500, the chances of you obtaining any credit facility are slim. If a lender does decide to take a chance on you, then the facility will undoubtedly come with unfavorable terms, such as high-interest rates. This strategy helps banks to discourage you from taking on debt that you cant afford to repay.

However, if you have a credit score over 750, then lenders view you as a prime customer, offering you the best APR rates, and rewards programs to encourage you to use the facility. People who have a credit score of 800 or more are in the best financial position to apply for new credit facilities. Banks see these clients as low-risk, and they are willing to open any credit facility the customer requires.

So, how do you get your credit score over 800? Follow this brief guide of tips to help you reach the upper-echelon of creditworthiness.

Don’t Miss: Conns Pre Approval Letter

Youll Qualify For Lower Interest Rates And Higher Credit Limits

With an 800-plus credit score, you are considered very likely to repay your debts, so lenders can offer you better deals. This is true whether youre getting a mortgage, an auto loan, or trying to score a better interest rate on your credit card.

In general, youll automatically be offered better terms on a mortgage or car loan if you have an exceptional credit score . If you have an existing loan, you might be able to refinance at a better rate now that you have a high credit score. Like any refi, crunch the numbers first to make sure the move makes financial sense.

Credit cards are different, and you might have to ask to get a better deal, especially if youve had the card for a while. If your credit score recently hit the 800-plus rangeor if youve never taken a close look at your terms beforecall your existing credit issuers, let them know your credit score, and ask if they can drop the interest rate or increase your credit line. Even if you dont need a higher limit, it can make it easier to maintain a good .

Habit : They Apply For New Credit Selectively

People with excellent credit scores are selective about applying for new credit. New accounts can lower your age of credit. Also, when you apply for credit, it results in a hard inquiry to your credit report. Too many credit inquiries or multiple credit inquiries within a short time frame can damage your credit score.

Most people with an 800 credit score say they apply for new credit accounts no more than twice a year and many apply far less frequently.

Annette Harris, owner of Harris Financial Coaching, said that she and her husband have each maintained credit scores above 800 for the past five years. They apply for new credit about once every three years, typically only for credit cards that offer rewards points.

When we apply for credit cards we are very selective and ensure there is no annual fee associated with the card and that the interest rate is below 13%, Harris said.

Also Check: Navy Federal Auto Loan Reviews

How Do You Get An Excellent Credit Score

This post may contain affiliate links. Which means we may earn a commission if you decide to make a purchase through our links. Please read our disclosure for more info.

You have no credit and you want to build one so you can apply for a credit line or loan. Or you may have a good score already, but you wonder, can you get a perfect or exceptional credit score? What score is excellent credit? What does it take to achieve a score of 850? And what perks could you enjoy with that?

In Over Your Head Find Your Best Personal Loan Option Can Help

If youre in the situation where you think a personal loan might make sense to consolidate credit cards, pay off student loans, or take care of some much-needed home repairs, the folks over at iCash Loans make it easy to get the best offers in under 2 minutes.

Even as little as a hundred bucks.

You could possibly save thousands a year and you have nothing to lose in checking! It doesnt even ding your credit score to look at the offers!

to see how much you can borrow! Apply in seconds and often, you can get the funds in your bank within 24 hours.

While I have years of successful financial & budgeting experience and run several million dollar businesses and handled the accounting, P& L and been responsible for the financial assets of them, I am not an accountant or CPA. Like all my posts, my posts are opinions based on experience, observations, research, and mistakes. While I believe all my personal finance posts to be thorough, accurate and well-researched, if you need financial advice, you should seek out a qualified professional in your area.

Don’t Miss: Report Death To Credit Bureaus

Monitor And Manage Your Exceptional Credit Score

A FICO® Score of 800 is an accomplishment built up over time. It takes discipline and consistency to build up an Exceptional credit score. Additional care and attention can help you keep hang on to it.

Whether instinctively or on purpose, you’re doing a remarkable job navigating the factors that determine credit scores:

Utilization rate on revolving credit. Utilization, or usage rate, is a measure of how close you are to maxing out credit card accounts. You can calculate it for each of your credit card accounts by dividing the outstanding balance by the card’s borrowing limit, and then multiplying by 100 to get a percentage. You can also figure your total utilization rate by dividing the sum of all your card balances by the sum of all their spending limits .

| Balance | |

|---|---|

| $20,000 | 26% |

If you keep your utilization rates at or below 30% on all accounts in total and on each individual accountmost experts agree you’ll avoid lowering your credit scores. Letting utilization creep higher will depress your score, and approaching 100% can seriously drive down your credit score. Utilization rate is responsible for nearly one-third of your credit score.

Time is on your side. Length of credit history is responsible for as much as 15% of your credit score.If all other score influences hold constant, a longer credit history will yield a higher credit score than a shorter one.

Does Paying Off Collections Improve Credit Score

The short answer is yes, but you have to handle it the right way.

When you have debt in collections, that means that someone other than who you originally borrowed the money now owns your debt.

Usually, these are companies that specialize in buying debt for pennies on the dollar.

In other words, if you originally owed $1,200 to a hospital, but never paid, eventually they will likely sell that so-called bad debt to a collection agency.

Most likely they would sell that $1,200 debt for $400 or less. So if the collection agency can badger you into paying even half of what you originally owed , they make a profit.

What they dont care about, however, is you or your credit score.

If you just send them a check, or give them your bank account and routing numbers, they will take the full amount you originally owed, often with late fees, penalties, and interest tacked on.

And while they will likely mark the debt as paid, they will do nothing about the collection notices on your credit report that are keeping your score down.

So, its imperative that you not give them a cent until they agree in writing to remove all entries to this debt on your credit report with all credit reporting agencies within 30 days of getting your payment.

Then, and only then, mail them a money order or cashiers check in the agreed-upon amount .

They may say all kinds of things during the negotiation phase .

Read Also: Does Speedy Cash Report To Credit Bureaus

Did I Cover Everything You Wanted To Know About How To Increase Your Credit Score To 800

In this post, we reviewed how to increase a credit score to 800 and the top things you can do to quickly raise your credit score.

We also looked at how the scores get calculated, what areas impact the score the most. And we also looked at some of the myths out there about boosting credit scores quickly.

We also reviewed some of the best tips for not hampering your credit score right before a big purchase. Most importantly we now understand whats possible and that its entirely possible to increase a credit score to 800 without having to pay a company to do it for you.

Whats your credit score?

Small Credit Changes Matter For Your Interest Rate

Is having a credit score of 820 significantly better than having a score of 780 when it comes to how mortgage lenders look at someone? Not necessarily.

Because of how credit scores are grouped by lenders, some changes in credit arent going to affect your eligibility or rates. While a score of 820 is certainly better than 780, lenders will look at the two qualifying home buyers as credit equals because they fall in the same credit score range.

In many cases, the size of the down payment is the only thing that is going to determine a difference in available mortgage rates for home buyers with comparable creditworthiness.

However, keeping a high credit score is still important.

Each grouping of credit scores has specific mortgage rates assigned by different lenders. This means that you will be offered a lower mortgage rate if you are in a better credit score group. But this grouping method can frustrate some home buyers.

A credit score of 779 is going to be grouped differently than a credit score of 780. Even though they are just one point away, the credit score of 779 is going to be offered higher interest rates while the score of 780 will get the same mortgage rates as a score of 820 would.

This means that raising your credit score by one or two points can make a huge difference.

Read Also: Affirm Required Credit Score

Maintain Good Habits And Be Patient

If you feel like youre doing everything right and your credit score hasnt yet passed 800, you might simply have to wait. Fifteen percent of your credit score comes from the length of your credit historywhich means that even if you have been practicing responsible credit habits since you opened your first credit card, it might take a while for those habits to earn you an exceptional credit score.

It might also be hard to achieve an 800 credit score until you have a mix of credit under your name. Were not saying you should take out a mortgage or a car loan just to get your credit score over 800, but if the only credit accounts on your file are credit cards, you might struggle to reach that 800 credit score. If thats the case, dont worryhaving excellent credit is just as good, and youll receive nearly all of the benefits that come with a near-perfect credit score.

My Credit Score Is 800 Now What

by The Ascent Staff | Updated July 21, 2021 – First published on Nov. 16, 2018

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Having a credit score of 800 or higher puts you in an elite tier of borrowers, given that only about 20% of people have a credit score in this range. People who have scores above 800 enjoy extraordinary credit card perks, low loan rates, higher borrowing limits, and other financial benefits that aren’t offered to people who have lower credit scores.

You May Like: 739 Credit Score Mortgage Rate

The Components Of Your Credit Score

Contents

There are two types of credit scores. FICO is the most common credit score used by lenders to assess your creditworthiness. Your FICO score consists of a three-digit number between 300 and 850. VantageScore is a new credit rating system, designed to help consumers that do not have a long enough payment history with creditors to determine a FICO score.

Most lenders assess your FICO score before opening a credit facility in your name. Credit reporting agencies notify the credit bureaus on all of the activity on your credit accounts. The bureaus take this information and create your FICO score using the data. Your score may differ from bureau to bureau, depending on the data they receive from credit reporting agencies.

When it comes to the data involved in creating your credit score, the bureaus rely on the following factors.

Amounts outstanding This criterion shows all of your current outstanding debt, and how many loans you have in your name. This factor accounts for 30-percent of your credit score.

FICO scores dont take into account your employment history, age, income, zip code, race, or gender. Its a blanket score that lenders utilize to gauge your financial health, regardless of your personal information.

The Benefits Of A High Credit Score

Simply put, the higher your credit score, the better offers and interest rates youll get.

For example, if you have a score of 700 youre sitting in the good range for most lenders. This means that youll be accepted for a wide range of loans and credit cards.

Achieving a credit score of 800 puts you firmly in the excellent range, and will only increase your options.

Not only will you be accepted for the vast majority of loans and credit cards, but your squeaky-clean track record will often qualify you for lower interest rates on whatever you take out.

In other words, the higher your score, the less youll have to pay back when borrowing because youve proven that youre a safe option for lenders to get their money back.

Also Check: How Long Repo Stay On Credit