Its Not Available To New Applicants

The Wells Fargo Secured Credit Card stopped accepting applications as of December 2019. According to a Wells Fargo representative, there are no plans to reopen the card to new applicants or offer a new Wells Fargo secured credit card.

Currently, the only Wells Fargo-issued credit card geared toward those who are looking to build their credit is the Wells Fargo Cash Back College Card. That card is designed for students who have a source of income, however.

» MORE:See NerdWallets best secured credit cards

Does A Fico Score Alone Determine Whether I Get Credit

No. Most lenders use a number of factors to make credit decisions, including a FICO® Score. Lenders may look at information such as the amount of debt you are able to handle reasonably given your income, your employment history, and your credit history. Based on their review of this information, as well as their specific underwriting policies, lenders may extend credit to you even with a low FICO® Score, or decline your request for credit even with a high FICO® Score.

Is Wells Fargo The Best Mortgage Lender For You

Competitive rates and rising customer satisfaction scores are a testament to Wells Fargos popularity as a mortgage lender.

And while its hard to ignore the banks spotty track record, there may be a silver lining. The bank is now under intense scrutiny from customers and regulators. Its making a serious effort to improve and data shows that for many, its succeeding.

So if Wells Fargo can offer you a competitive mortgage rate, its definitely worth your consideration. You can check your personalized rates right here.

Read Also: How Long Does A Delinquency Stay On Your Credit Report

Some Wells Fargo Customers May See Credit Score Drop Due To Account Closures

by Dana George | Published on July 9, 2021

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

An unknown number of Wells Fargo customers recently received a disheartening letter.

There’s a bit of a breakup brewing. Wells Fargo isn’t talking right now, but they recently sent a Dear John letter of sorts to customers carrying personal lines of credit.

These loans, heavily advertised as the perfect way to pay for home improvements or pay off high-interest credit cards, were popular with customers for several reasons:

What Numbers Do Mortgage Lenders Look At

Lenders use credit scores to determine a borrowers level of risk.

Three credit bureaus Equifax, Experian, and TransUnion calculate an individuals credit score. The higher your credit score, the better interest rate youre likely to get which also means youll have a lower monthly mortgage payment. Before you apply for a mortgage, its a good idea to check your credit score and review your credit report to make sure everything is correct.

Dont Miss: How Long Is A Mortgage Rate Good For

Don’t Miss: What Credit Score Do I Need For Amazon Visa

How To Maintain Your Credit Score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

Whats A Credit Report

A credit report includes information about your past and existing credit agreements, such as credit card accounts, mortgages, and student loans, and lists inquiries about your credit history. It outlines how much you owe creditors, how long each account has been open, and how consistently you make on-time payments. Credit reports also list related public records, such as collections or bankruptcy filings.

Read Also: When Does Usaa Report To Credit Bureaus

What Are The Different Categories Of Late Payments And Do They Impact Fico Scores

A history of payments is the largest factor in FICO® Scores. FICO® Scores consider late payments in these general areas how recent the late payments are, how severe the late payments are, and how frequently the late payments occur. So this means that a recent late payment could be more damaging to a FICO® Score than a number of late payments that happened a long time ago. Late payments are listed on credit reports by how late the payments are. Typically, creditors report late payments in one of these categories: 30-days late, 60-days late, 90-days late, 120-days late, 150-days late, or charge off . Of course a 90-day late is worse than a 30-day late, but the important thing to understand is that people who continually pay their bills on time tend to appear less risky to lenders. However, for people who continue not to pay debt, and their creditor either charges it off or sends it to a collection agency, it is considered a significant event with regard to a score and will likely have a severe negative impact.

Types Of Personal Loans Offered By Wells Fargo

Wells Fargo doesnt disclose a definitive list of what loan funds can be used for, nor does the bank specify any restrictions for its personal loans. In general, personal loans from Wells Fargo could be used for the following purposes:

- Debt consolidation

- Covering expenses like medical bills and auto repairs

Also Check: How Do I Unlock My Credit Report

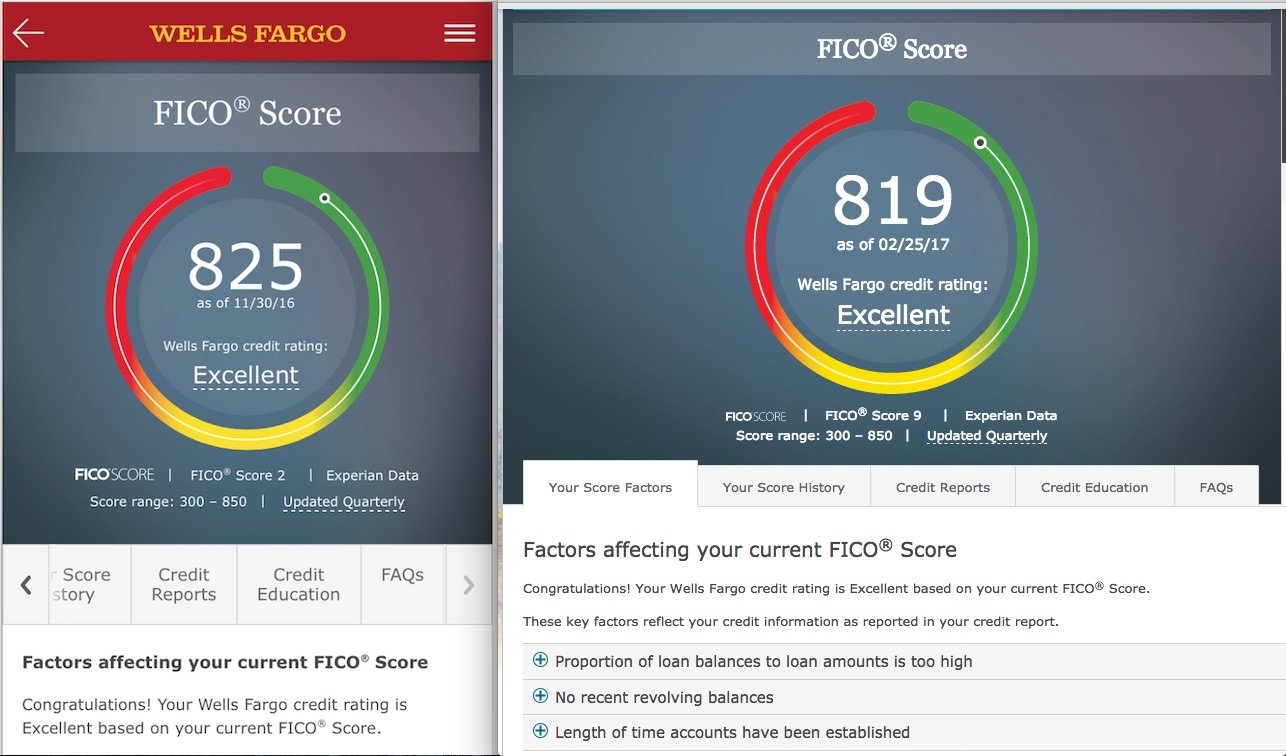

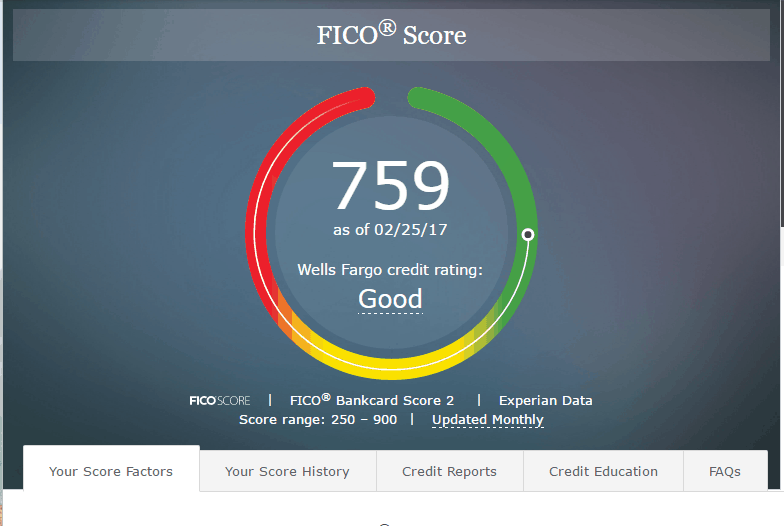

Trying To Raise Your Credit Score

A higher score may give you more options and better rates if you ever need a car loan, mortgage, or home equity line of credit. Even if you dont have immediate plans to apply for financing, good credit may help you in other ways, like lower insurance premiums, renting an apartment and certain employers even run credit checks on job applicants prior to hiring them. Focusing on developing good long-term credit habits is an investment in yourself. Here are some specific actions you can take that may help to improve your score over time.

Security Measures For The Wells Fargo Mobile App

Wells Fargo offers an Online Security Guarantee, which gives customers added protection against unauthorized account access. To ensure the security of Wells Fargo Mobile users, the bank has taken further safety measures:

- Mobile transmissions are safeguarded by 128-bit secure sockets layer to prevent unauthorized access.

- Account numbers are never shared and are referred to by nicknames.

- Account information and other sensitive information is never stored on your phone.

Don’t Miss: Usaa Credit Score For Mortgage

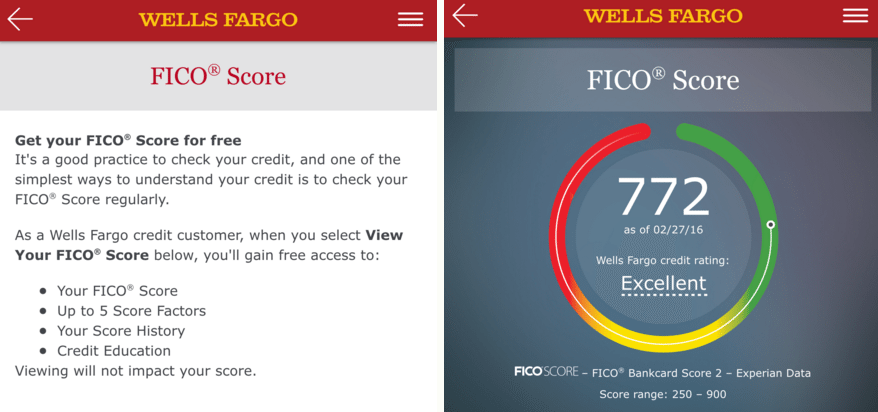

Wells Fargo Credit Cards Mobile App Review

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The Wells Fargo app gives customers a quick overview of their accounts and makes it easy to make payments, turn cards on or off and manage rewards. Just like on the banks website, you can toggle between different accounts and easily explore different rewards options.

The apps navigation often isnt intuitive, but if you use it for the same purpose each time, such as making a payment or reviewing transactions, its easy to find your way.

» MORE: See NerdWallets Best Wells Fargo credit cards

What Other Factors Can Affect A Mortgage Application

Below are additional issues that can come up when applying for a mortgage. If youve had bad credit and also fall into one of the following categories then youll need expert advice thats tailored to your financial situation to find a specialised lender:

- Buy to Let the rules and deposit amounts for Buy to Let properties can be different from a typical residential mortgage.

- Higher Loan to Value- If youre a first-time homeowner, or simply havent got a large deposit to contribute towards finding a mortgage, then you will need a higher LTV.We can find specialist lenders to help you.

- Unique Properties Mortgages for unique properties are considered higher risk which generally means fewer lenders.This term covers listed buildings, high rise buildings, properties of non-standard construction and properties that are uninhabitable.

- Older borrowers Older borrowers can struggle because many mortgage lenders can apply a maximum age at the end of the term or cap applications at a certain age.Some have no restrictions on end of term age and its therefore important to find the right lender for your needs.

- Large loans if youre taking on a large loan then your affordability, income and credit history may make finding a lender more restrictive.

Ask us a question

We know everyones circumstances are different, thats why we work with mortgage brokers who are experts in all different mortgage subjects.Ask us a question and well get the best expert to help.

Also Check: Credit Score For Amazon Prime Credit Card

Things To Know About The Wells Fargo Secured Credit Card

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Experian: Straight From The Bureau

Experian is one of the larger international credit bureaus and will provide you a full picture of your credit score on a monthly basis if you subscribe to its service. Experian will also help you examine what may be hurting your credit score and how to take actions to recover. The downside is that you only receive the report from Experian, just one of the three major bureaus.

Recommended Reading: Will Getting Married Affect My Credit Score

Avoid Closing Old Credit Accounts

Your instinct might be to close old credit accounts you arent using to avoid having too many items on your credit report. But doing so can actually do more harm than good. The length of your credit history also affects your credit score, and the longer your credit history, the better. By closing old credit accounts, you could inadvertently reduce the length of your credit history, thereby lowering your credit score.

You Can Request A Credit Limit Change

With secured credit cards, you make an initial deposit that becomes your credit limit. If you ever close the card or upgrade to an unsecured card, youll get that deposit back.

The Wells Fargo Secured Credit Card requires a deposit of $300 to $10,000. You can request credit limit increases and decreases in $100 increments. If your credit limit is decreased, youll get a refund for the difference within 30 days. You cant have a credit limit lower than $300.

To qualify for a credit line increase, you cant just overpay your balance any money you pay over the amount due will count toward your next months bill. You have to apply, get approved and make an additional deposit to fund a credit line increase.

Don’t Miss: How To Remove Hard Inquiries From Credit

How To Send Money Via Wells Fargo Wires

Wire transfer via Wells Fargo enables users to send money to domestic and international locations in a straightforward and effortless way. To send a wire, users will need the name and address of their recipient, the name of the recipients bank, and a valid U.S. mobile number or secure ID device. From there, you might need to have additional information ready, depending on the location youre transferring money to.

For sending a domestic wire, youll need the routing number for your recipients bank and the number of their bank account.

To send a Wells Fargo international wire transfer, you should have the SWIFT/BIC for your recipients bank and their International Bank Account Number .

In case you dont know the ABA/RTN number or the SWIFT code or have other questions related to one of your accounts, you can ask customer service to help you out and give you the instructions.

Once youre all set, simply sign on to Wells Fargo Online, tab over to Transfer & Pay, and go to the Online Wire Transfers section. Now, make sure to add your recipient, choose the amount youd like to fund the account with, and add the details we have listed before. Check if all is well and click on the Send button.

A typical transaction lasts anywhere from one to five business days.

Wells Fargo To Shut Down All Personal Credit Lines Heres Why That Can Hurt Your Credit Score

Wells Fargo said in a customer letter that it’s shutting down all personal lines of credit. AP

Wells Fargo is eliminating all personal lines of credit in the next couple of weeks, according to a customer letter reviewed by CNBC.

The credit lines, which generally run between $3,000 and $100,000, were marketed as a way for consumers to consolidate high interest credit card debt, pay for home improvements or avoid overdraft fees on checking accounts that were linked to the credit lines.

Consumers who have outstanding balances will have to make required minimum payments, the six-page letter said, and the bank will no longer offer new credit lines.

Importantly, Wells Fargo noted in the letter, the account closures may have an impact on consumer credit scores.

Wells Fargo told NJ Advance Media it was simplifying its product offerings.

We made the decision last year to no longer offer personal lines of credit as we feel we can better meet the borrowing needs of our customers through credit card and personal loan products, spokesman James Baum said. We realize change can be inconvenient, especially when customer credit may be impacted.

We are providing a 60-day notice period with a series of reminders before closure, and are committed to helping each customer find a credit solution that fits their needs, he said.

Last year, Wells Fargo stopped writing new home equity lines of credit, CNBC said.

Recommended Reading: How Long Repo Stay On Credit

This Card Is Not Accepting New Applications

As of fall 2021, the Wells Fargo Secured Credit Card was not accepting new applications. See our best secured credit cards for other options.

If you have bad credit or no credit at all, the Wells Fargo Secured Credit Card is a potential path to building your credit history.

However, youll need to look into other secured credit card options if you dont already have this card, as it isn’t available any longer. If you already carry the Wells Fargo Secured Credit Card, though, here are five things to know about it.

» MORE:What is a secured credit card? How is it different from an unsecured card?

Become An Authorized User

You might be surprised that becoming an authorized user on someone elses credit card is an excellent way to boost your credit score to qualify for your own credit card. When you become an authorized user, the other persons years of credit history and on-time payments for that card will appear on your credit report.

Just make sure you become an authorized user on a card with a history of timely payments, so its payment history will actually boost your score instead of bringing it down. And if the other user gives you access to a credit card, use it responsibly, since your spending will affect their credit as well as your own.

Don’t Miss: Does Paypal Credit Report

How Do Public Records And Judgments Impact Fico Scores

Public records are legal documents created and maintained by Federal and local governments, which are usually accessible to the public. Some public records, such as divorces, are not considered by FICO® Scores, but adverse public records, which include bankruptcies, are considered by FICO® Scores. FICO® Scores may be affected by the mere presence of an adverse public record, whether paid or not. Adverse public records will have less effect on a FICO® Score as time passes, but they can remain in your credit reports for up to ten years based on what type of public record it is.

What To Look For In Your Consumer Credit Report

Here are a few factors lenders look at when examining your personal credit report:

Your business credit report will contain a lot of the same information as your consumer credit report but will be specific to your business’s credit track record.

If you have a strong understanding of what lenders look for in your credit report and take the necessary steps to maintain a positive credit rating and a high credit score both personal and business you can increase your chances of getting approved for financing.

Recommended Reading: How To Get Inquiries Off Of Your Credit Report

How To Sign Up For Wells Fargo Mobile

Getting the Wells Fargo Mobile app is easy. Simply follow these steps:

In order to use Wells Fargo Mobile, you must have an account such as checking or savings with Wells Fargo. Youll also need to create an online profile, as a username and password are required to log into the app.

Follow these instructions to create an online profile:

Once youve created your online profile, go to your downloaded Wells Fargo app and enter your username and password to begin using the app.

Read: How to Know If Your Bank Is Giving You a Good Deal