How Can I Convince My Landlord To Let Me Rent With Bad Credit

Here are seven ways you can overcome your bad credit and still get that rental you re looking for:

Improving Your Credit Score When Renting A Home

One attractive thing about credit scoring systems is they place more weight on recent activity than older stuff. So consistently good behavior can quickly push scores up.

Of course, you have to be realistic. Its going to take many years for you to get from a FICO score of 579 or less to 740 or more . But any improvement makes you more attractive to landlords. And it should generally help you to borrow more cheaply and easily when youre ready to buy a home as well.

For a quick hit, you need to do three things:

You may not have the money to completely achieve the first two. Youll likely give your score a boost when you make any improvement.

What Is The Minimum Credit Score To Rent An Apartment

Technically, there isnt a mandatory minimum credit score to rent an apartment. There isnt a law that says a person has to have a particular score or any rules that prevent landlords from setting the minimum anywhere theyd like.

As long as landlords apply the minimum credit score they choose to all applicants equally, landlords can generally select any cutoff point. However, that doesnt mean there arent some norms.

Usually, the minimum FICO credit score to rent an apartment falls somewhere between 620 and 650.

However, some landlords may be open to scores of 600 or lower, while others may consider 700 to be the lowest qualifying score.

Most landlords use FICO credit scores to determine if an applicant qualifies for an apartment. The typical categories for those scores are:

- Exceptional: 800 to 850

- Fair: 580 to 669

- Poor: 300 to 579

That can be a bit confusing for some applicants. After all, 620 and 650 are both in the fair range, so they may wonder why a landlord isnt open to renting to a person with a 580 FICO score. Its completely up to the landlord. They dont have to follow the brackets they just have to select a minimum and apply that requirement equally.

Don’t Miss: Is Chase Credit Score Accurate

Will A Higher Credit Score Get You Perks

When youre buying a home, a 760 or higher credit score can save you thousands of dollars in interest over the years, because it will help you get the lowest interest rate.

Related: The Credit Score You Need to Buy a House

But a stellar credit score isnt likely to help you get lower rental rates. Rental rates are based on the market value and the individual or companys urgency to rent, says Scalzo.

On the upside, excellent credit scores will help you keep your funds liquid, because you wont have to put as much down to move in.

Even if you have a credit score in the high 700s or above, its not likely a landlord will offer a reduced security deposit thats less than one months rent, says Sarah Hill, CEO of Perfect Strangers, a New York City company that will connect you with roommates and rentals. Dont get your hopes up, but if youre a strong applicant, you may be able to get a reduction in monthly rent by $50 to $100. The key to this is to make the request when applying, she says.

Hey, it doesnt hurt to ask, right?

What Credit Score Is Needed To Rent A House

- Post category:

We may get commissions for purchases made through links in this post.

Everyone knows you need a good credit score to get a mortgage but what about renting? What credit score is needed to rent a house and how do landlords check that? Were going to cover these questions, as well as what else landlords are looking for in a credit check. Well even talk about what to do if you want to rent a place but have a bad credit score. Lets dive right in.

When you apply to rent a house, potential landlords want to know that you will be a responsible tenant. That means paying the rent on time and taking reasonable care of the property. To help them determine this, they typically run a credit check. In addition to credit score, landlords also look at the entire credit report. They also typically do criminal and sexual offender background checks, residence and eviction histories, and employment verifications and histories. According to most sources, while the specific minimum required FICO credit score will vary with the landlord, typically you can expect it to be between 600 and 620.

You May Like: Syncb/ppc Closed Account

Pay On Time And Stay Within Your Limits

Lenders want to know they can rely on you to make regular repayments. A missed payment is likely to negatively impact your credit score.

Your payment history in the last 12 months will be most important to lenders. If youve missed payments in the past, but have since become more reliable, your credit score might not be affected as much as you think.

And spending near, or over, your every month is going to give the impression youre struggling to manage your finances. So, try to keep within your limits.

Be Willing To Settle For Less

If you have bad credit, the apartment you want and the apartment you can currently get approved for might be very different. For example, you might have to move to a part of town that you normally wouldnt or live in an apartment thats much smaller and with fewer amenities than youd prefer. But doing so could help you fix your credit and maybe even save some extra money in the process due to cheaper rent.

Read Also: Why Is There Aargon Agency On My Credit Report

The Millionacres Bottom Line

The fact that landlords are imposing higher credit score requirements could be a good thing for residential real estate. Ultimately, it’s on you individually to come up with a system for vetting tenants from a financial perspective. And that system can include demanding whatever credit score you need to get comfortable.

The Credit Score Is A Window Into Ones Soul

Just like how employers screen the first cut of applicants based on grades, landlords do the same with credit scores. If youre one of those job applicants who purposefully omits their GPA on their resume, like the seven applicants who included a report but had no score, youre going to be looked at with suspicion.

Your other criteria will be highly scrutinized to the point where the landlord/employer will find reasons not to choose you.

Dont provide a credit report without a credit score. If you do, it will drive your landlord NUTS! Spend the time to find out what your credit score is before you even bother applying.

Landlords dont have time to go through every single line-item in your credit report. They want that credit score and any explanations you care to add.

The credit score is the first thing landlords look at in a tight rental market.Having a credit score is MUCH better than having a credit report with no score. Dont let landlords start wondering what else you may be hiding!

Finally, if you dont want to provide your credit score or credit report, thats fine as well. Just know that your landlord has every right not to accept you as a tenant.

Nobody is forcing anybody to do anything on both sides. If you want a tenant bad enough as a landlord, you may let things slide. If you want the apartment bad enough as a tenant, youre going to do everything possible to prove you are a credit worthy person.

Also Check: Speedy Cash Repayment Plan

What Is A Renters Credit Score

If youre planning to rent an apartment, one thing you need to prepare yourself for is a credit check.

Your would-be landlord or the property management company will want to a peek at your credit to make sure youre financially responsible.

While some landlords may check your FICO score or VantageScore, others may prefer to use a renters credit score instead.

Before you fill out a lease application, heres everything you need to know about rent reporting and credit scores.

Proof Of Income Or Rent Receipts

If a tenant has a good reason for a low credit score, you can take a closer look at their current financial situation through proof of income or rent receipts.

For proof of income, your tenant can provide pay stubs or bank statements to show you they have financial stability and will be able to pay rent on time. If the tenant was recently renting, they can show you rent receipts from where they are/were currently renting so you can get a better idea of their rental history.

Recommended Reading: What Credit Score Is Needed To Buy A Car At Carmax

How A Renter’s Credit Score Might Help

Your renters credit score can help to offset past mistakes you may have made credit-wise.

For example, lets say you left an old medical bill unpaid because you didnt have the cash to cover it. The account was sent to collections and its been sitting on your credit report ever since.

If you have a positive history of paying your rent on time, that could take some of the sting out of the black mark caused by the collection account.

Your lender may look more favorably at your application if youve shown that youre able to keep up with your rent.

A renters credit score could also help with establishing your credit history if you dont have any loans or lines of credit in your name.

If youre fresh out of college, for example, and youre hoping to become a homeowner one day, having a positive renters score could make it easier to qualify for a mortgage down the line.

Learn Why Landlords And Property Managers Often Run Credit Checks On Potential Tenantsand Ways To Help Improve Your Score

Your credit scores can be important when youâre looking to rent an apartment. Thatâs because the landlord or property manager may pull your credit as part of the screening process. Your credit history can show them how youâve managed money in the past and help them determine whether you might be a responsible tenant.

A credit score in the 600s typically places you in either the âfairâ or âgoodâ credit score range and could be a starting point for some landlords and property managers. Meeting their minimum requirements doesnât necessarily guarantee approval. But knowing what they look for could help you position yourself as a great rental candidate.

You May Like: When Do Companies Report To Credit Bureau

What Is A Good Credit Score For Renting

So, if your renter has a score of 670 or higher, thats a very good credit score for most rentals. Most landlords are looking for a score somewhere between 600 650 since renters dont have the credit history of making mortgage payments to boost their credit score.

Tips To Improve Your Credit Score:

While you may get an apartment with a poor credit score with a little extra effort but ultimately you have to resolve to improve your credit score. There is no point in doing that much struggle every time you need to shift to a new apartment. Get it to fix once and forever.

What you need to learn here is that there is no fast remedy to the issue and it would require patience along with effort. Just keep doing the small and positive steps towards your goal. If you have a loan to settle, make a plan to pay it. Make installments or take someones help to settle that loan.

Consider the Following Tips:

- Do not take balances against credit score.

- Pay your payments on time.

- Try to pay more than what you need to pay as a minimum.

- Settle all of your utility bills in full.

- Pay what you can and as early as you can. Though, it would be hard for you to settle all your loans at once but paying what you can help you increase your credit score.

- The best strategy is to avoid carrying balances against credit scores. If you have a high credit utilization ratio, it hurts your cause.

- It is better to not close your old cards. People often do this mistake when they seek to improve credit scores but keeping them open is way better. Older cards extend the average age of score which works in your favor.

Recommended Reading: Does Affirm Show Up On Credit Karma

The Truth About Raising Your Credit Scores Fast

While a lucky few may be in a situation where they can raise their credit scores quickly, the bottom line for most of us is that building credit takes time and discipline, especially if youre trying to rebuild bad credit. Thats because your credit scores are complex and made up of several interconnected factors .

So trust us: While some credit repair agencies may promise to raise your credit scores fast, theres no secret that will help boost your credit scores quickly.

But if you start developing healthy habits now, you can build credit over time all by yourself.

How To Check My Fico Score

Now that you know what is considered a good credit score, its time to learn how to check your rating without lowering it. Americans have the right to request a free report from the three major credit bureaus Experian, Equifax, and TransUnion. You can get three reports without extra charges every 12 months.

Depending on your bank and credit card, you can get reports every month alongside your statement. Besides these, there are also non-bank sources such as monitoring tools and websites. For example, we have services like Mint, PrivacyGuard, and IdentityForce.

Potential landlords and employers are other alternatives you can consider. They can make credit pulls for running background checks. Just make sure to confirm that they make soft inquiries because hard inquiries hurt your FICO score.

Don’t Miss: Is 766 A Good Credit Score

What Should I Expect As A First Time Renter

First-time renters will likely have to set up new accounts with utility providers and it can cost you some money upfront. One-time fees and equipment rentals are common when setting up your utilities, such as electricity to your apartment and cable/Internet. Parking can sometimes be a hassle when you live in an urban area.

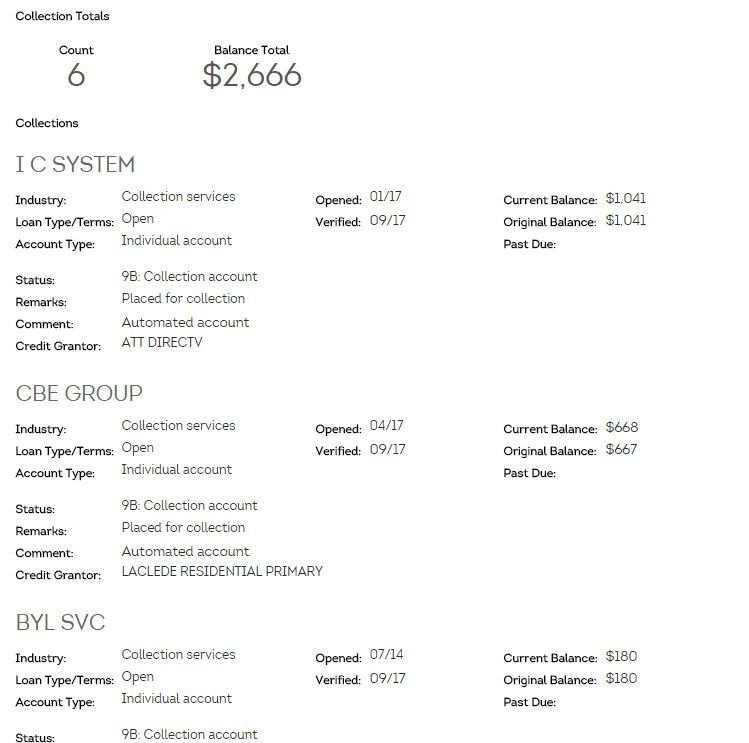

What Landlords May Look For On Credit Reports

In addition to checking credit scores, landlords also might check a potential tenantâs credit reports. Thatâs because credit reports can provide a more complete picture of the applicantâs financial history.

âMost landlords understand that a comprehensive credit report is more important than a credit score because itâs a better indicator of a tenantâs payment history,â Fluegge says. âOne bad hospital bill or a case of identity theft can send a credit score plummeting. But if thatâs the only blemish in a long credit history, the risk is minimized.â

Here are some of the things landlords might look for on a credit report:

- Payment history: Prospective landlords usually look at your payment history from the past 24 months, according to Fluegge. âIf landlords can see that a tenant has been consistently paying down their debt, itâs a strong sign that they are responsible enough to pay rent on time every month,â he says.

- Rental history: Some credit bureaus may include rental history on their credit reports. That can help landlords predict whether applicants will pay rent on time.

- Collection items and public records: âThe things most likely to be deal breakers are usually evictions, unpaid utilities and bankruptcy,â says real estate investor Gabby Wallace. âMost managers are more understanding of debt like student loans, medical bills or credit card debt.â

Also Check: Speedy Cash Collections

Ways To Rebuild Your Credit Score

Now that weve covered how long it takes to grow credit and how long it takes to recover from negative strikes, lets get into the fun stuff.

How to rebuild your credit!

First you need to know what elements make up your credit score. Weve already covered this topic in our What Credit Score Do You Start With? post, but to summarise:

-

Payment history

-

Length of credit history

-

New credit

Knowing this is a great way to know what will have the biggest effect, and thus what will be faster in rebuilding your credit score, i.e., lowering your credit utilization will rebuild credit faster than simply not taking out new credit cards .

Following on from that, lets get into the best ways to rebuild credit.

Who Is Cmr Property Management In Charlotte Nc

If it is not, CMR Property Management in Charlotte, North Carolina has some ideas. Are you placing the best tenants in your rental property and keeping your maintenance costs in check? If not, CMR can solve those problems. Our experienced team provides professional property management in Charlotte and the surrounding areas.

Don’t Miss: Unlock Experian Account