Negative Information From Public Records

Tax liens have been removed from all credit reports, as of April 2018. Before that, unpaid tax liens remained on credit reports indefinitely. Paid tax liens remained for 7 years from the date of payment .

Civil judgements no longer appear on credit reports, either. Before the law changed, records of judgements remained on credit reports for 7 years from the date filed in court. This was regardless of whether the amount owed was paid.

How Do Late Payments Affect My Credit Scores

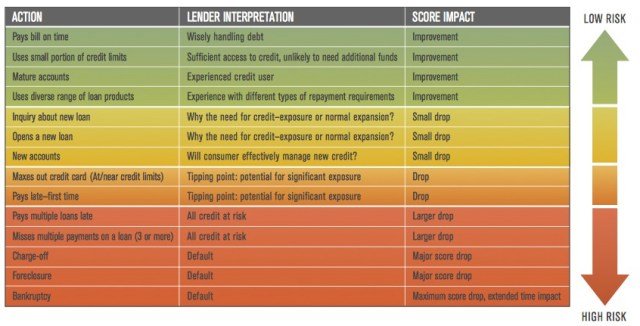

Late payments will have a different impact on each persons credit scores depending on the situation. That said, there are some general rules that can help you determine the severity of the impact.

- First off, a longer delinquency will have a greater negative impact on your scores than a shorter delinquency. Assuming everything else is equal, a 90-day late payment can hurt your scores more than a 30-day late payment.

- The number of delinquencies on your reports matters, too. Usually, more delinquencies result in a more significant negative impact to your scores.

- A delinquency will have the largest impact on your credit scores when its first reported. However, as the delinquency ages, the impact on your scores should decrease. The length of time your scores take to recover may depend on any other negative issues that might be affecting them.

Its important to remember that each credit bureau has its own way of evaluating your information and assigning you a credit score. A late payment could have a more significant impact on one score than on another, which is one reason why your scores may vary between credit bureaus.

How Do You Remove A Hard Inquiry From Your Credit Report

You can try to remove the request from your credit report by sending it to the credit reporting agency if you are sure you have not applied for a new line of credit. The authorities will verify it and remove it from your report. You can send them a second email asking them to provide proof that you have applied for a credit card online.

Can I put My Electric bill in someone else Name. No it is illegal. It is legal to have a utility bill only when someone must be an adult who lives in the apartment as you or some how he/she connected with the home rental or ownership or your spouse.Can Some Put My Name On a Utility BillIt depends if you gave someone your permission to use your name to get the service. Then the bill is yours and you will have to make a way to catch up. If th

Also Check: How Accurate Is Creditwise Credit Score

How Long Does Negative Information Stay On Your Credit Report

The length of time negative information can remain on your credit report is governed by a federal law known as the Fair Credit Reporting Act . Most negative information must be taken off after seven years. Some, such as a bankruptcy, remains for up to 10 years. When it comes to the specifics of derogatory credit information, the law and time limits are more nuanced. Following are eight types of negative information and how you might be able to avoid any damage each might cause.

How Long Do Collections Stay On Your Credit Reports

The short answer: Accounts in collection generally remain on your credit reports for seven years, plus 180 days from whenever the account first became past due.

The long answer: Once the original creditor determines your debt is delinquent and sells it to a collection agency, the collection account can be reported as a separate account on your credit reports.

Assuming the collection information is accurate, the collection account can stay on your reports for up to seven years plus 180 days from the date the account first became past due.

Confused? Lets look at an example:

- Your account becomes late on

- After 180 days of nonpayment, your creditor charges it off on

- The original delinquency date is Jan. 1, 2018, but the account appeared on your credit report 180 days after that date. So the account should fall off your credit report by

Recommended Reading: What Is Cbcinnovis On My Credit Report

Removing Negative Items After Seven Years

Check your credit report to learn when negative items are scheduled to be deleted from your credit report. When the seven years is up, the credit bureaus should automatically delete outdated information without any action from you.

However, if there’s a negative entry on your credit report and it’s older than seven years, you can dispute the information with the credit bureau to have it deleted from your credit report.

How Long Does A Cable Bill Stay On Your Credit Report

At this point, your cable company charges the collection agent. This collection invoice can remain on your credit report for seven years plus 180 days from the invoice’s due date in March. This is something that many people hate: whether you paid for the collection or not, it can remain in your file for that time.

You May Like: Paypal Credit Report To Credit Bureaus

How Do You Close A Yahoo Account

Close your Yahoo account. Go to the “Cancel Yahoo Account” page , enter your password in the box to verify your identity, then click “Cancel This Account” to close your Yahoo Mail account. You must know your password to close your account.

Collections on credit reportHow does a collection get on your credit report? If you haven’t paid your doctor’s bill or if your credit card bill hasn’t been paid, a debt bill may appear on your credit reports. This usually happens when the original company writes off its debt as a loss and sells it to a collection agency.How do you pay collections on your credit report?Pay your debt. When you receive written confirmation from

How Long Do Negative Items Stay On A Credit Report

We assume you’re asking this question because you recently reviewed your credit report only to find quite a few negative items listed on it. These negative items are dragging your credit score down and you want to know how long these are going to be listed on your report.

It does depend on the type of negative information but here is a breakdown of how long different types of negative information will remain on your credit report:

- Late Payments: 7 years

- Collections: Generally 7 years, depending on the age of the debt being collected.

- Public Records: Generally 7 years, although unpaid tax liens can remain indefinitely.

Read Also: Does Opensky Report To Credit Bureaus

Is There A True Free Credit Report

Yes, there is a free government credit report. The Fair Credit Reporting Act requires every credit reporting agency to provide you with a free copy of your credit report.

Personal capital reviewIs personal capital safe and legitimate company? Personal Capital is a safe and legit wealth management company that offers free financial planning software as an incentive to open an account with their financial advisory service. It has a strong reputation, growing and longevity to be considered a legitimate and viable competitor in the AUM market.Is Personal Capital legitimate?Personal Capital is

Full Credit Report Services

Remember

You can apply for your credit record as often as you like without harming your chances of getting credit.

You can get free 30-day trials of more comprehensive credit checking services from Experian and Equifax. These include your full credit report.

However, you normally have to give your credit or debit card details when you sign up to the free trial. Money will be taken from your account unless you cancel in time.

Read Also: Cbcinnovis Inquiry On My Credit Report

Collection Agencies Dont Always Play By The Rules

Collection agencies can sometimes be pushy, and some may even violate the Fair Debt Collection Practices Act, which prohibits debt collectors from using abusive or deceptive practices in an attempt to collect from you.

If you suspect youre being harassed or treated unfairly, its important to know your legal rights. We recommend consulting with a legal professional as a matter of course, but you can start by checking out our guide to your debt collection rights.

Positive And Negative Information On Your Credit Reports May Affect Your Credit Scores But There Are Time Limits To Keep In Mind

Ever heard the saying that knowledge is power? When it comes to your credit, that can absolutely be true. So letâs start by asking a few questions and gaining some knowledge. What exactly is a credit report? What kind of negative information can be on it? And how long does it stay?

Essentially, you can think of a as a statement thatâs filled with information on your credit activitiesâthings like your history of making on-time payments. Your reports can also contain negative information that could impact your credit scores. And some negative information could stay on your reports for up to 10 years. Read on to learn more.

Read Also: Paypal Working Capital Log In

How Long Does An Unpaid Collection Remain On A Credit Report Form

In general, paid and unpaid fees will remain on your credit report for a set period of seven years. If your debts aren’t paid within those seven years, creditors or collection agencies will call you to tell you about your debt, and there aren’t many ways to remove fees from your credit report.

Late payments on credit report

Negative Information From Late Payments

- Late Payments: You must be at least 30 days late on a payment for it to show up on your credit report. Information about payments that are late by 30 days or more will remain on your credit file for 7 years from the date creditors report them to the credit bureaus. People often get concerned that a payment thats just a few days late will be noted on their credit reports, but thats not the case.

- Charged-Off Account: When you are 120 days behind on a loan payment or 180 days late on a credit card, your lender will be required to write the debt off its books , and your account will be classified as Not Paid as Agreed on your credit reports. This information will remain on file for 7 years, starting from when the delinquency that led to the charge-off is first reported to the credit bureaus.

For example, if your account was reported as late to the credit bureaus in September 2020 and it charged-off in December 2020, the late payments and charge-off record would stay on your credit report until September 2027.

You can read more in our Q& A about how long late payments stay on your credit report.

Don’t Miss: How To Get Credit Report Without Social Security Number

Hire A Credit Repair Service

A reputable company like may be a viable solution if your report is riddled with inaccuracies that further complicate the repair process. can help you with the following items:

- Cleaning up credit report errors

- Disputing inaccurate negative entries

- Handling creditor negotiations

If you decide to hire a credit repair service, know that laws govern how they operate and what they can do. The establishes the following regulations governing credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the service

- They cannot receive payment for the performance of any service until said service has been entirely performed

- There must be a written contract detailing the services to be performed, the time frame during which these services will be performed, and the total cost for those services

- They cannot promise to remove accurate information from a credit report before the term set by law

- The consumer will have three days in which to review the contract and cancel without penalty

File A Dispute With The Credit Reporting Agency

Initiate a claim directly with the credit bureau by writing a dispute letter. The purpose of this letter is to notify them that you believe certain information in your credit file is inaccurate.

The Fair Credit Reporting Act requires creditors to report accurate information about every account. This means they have a legal obligation to review, investigate, and respond to your claim. This process is free and can take up to 30 days to complete.

You can begin a dispute with any one of the credit bureaus through their websites or via mail. The leading credit reporting agencies are Equifax, Transunion, and Experian. Its essential to have documentation and to be precise about the information you are challenging.

Each of the three major credit bureaus has an online section dedicated to walking consumers through the process of disputing a claim online. It would be best to dispute the entry with each credit bureau to make sure the removal is complete across the board. After receiving the initial claim, the credit bureau will contact the source of the erroneous information and dispute it on your behalf.

How to file a dispute letter:

Don’t Miss: What Is Syncb Ntwk On Credit Report

How Long Something Can Stay On Your Credit Report By Type Of Information:

| Types of Information | |

|---|---|

| N/A | Child support & tax liens |

Below, you can learn more about the various types of information that you might find on a credit report and when each is likely to leave. But before we get into further specifics, its important to note that there is NOTHING you can do from hiring a credit repair service to even paying off amounts owed to decrease the length of time that legitimate information will remain on your credit reports. If any information on your credit report is incorrect, however, you can dispute it with the credit bureau that generated your credit report and have it removed.

Impact Of Identity Theft On Your Credit Report

Identity theft occurs when someone steals your personal information and uses it to apply for new lines of credit. If these new accounts go into default, they will appear on your credit report and hurt your score.

Cleaning up your credit after identity theft can take anywhere from a day to several months or even years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. Monitoring your credit report will help you to stay on top of potential fraudulent charges.

Also Check: Does Barclaycard Report To Credit Bureaus

Negative Information From Collection Accounts

Collection accounts remain on your credit reports for a period of 7 years, which begins on the date the delinquency that led to the collections account is first reported to the credit bureaus.

For context, accounts that you do not pay as agreed whether they are charged-off credit accounts or unpaid medical bills, for example are often sold to collection agencies. These accounts are classified as collection accounts on your credit reports. Credit accounts sent to collections should be listed as a continuation of the charged-off trade lines that have been on your reports all along , while medical bills generally only show up once they enter collections.

You can learn more from Q& A on how long collections stay on your credit report.

How Long Does An Unpaid Collection Remain On A Credit Report Tax

Before that, unpaid tax liens will remain on the credit report for 10 years and paid tax liens will remain on the credit report for 7 years. What is withholding tax? Withholding is a claim filed by the Internal Revenue Service in accordance with the government’s right to collect money from a taxpayer who has not paid taxes.

Also Check: How To Get Car Repossession Off Credit Report

How Long Do Inquiries Stay On A Credit Report

Inquiries don’t fall neatly into either the positive or negative information categories. Inquiries are either neutral or negative to your credit scores, but do not indicate mismanagement or the default of a credit obligation, and don’t always result in a lower credit score.

Inquiries are simply a record of access into your credit reports by a third party, like a lender. Inquiries will remain on your credit reports for up to two years, and are considered either “soft” or “hard.”

A soft inquiry results when you or someone else views your credit report for non-lending purposes, such as a credit card preapproval. Soft inquiries don’t affect your credit scores. A hard inquiry will appear as a result of applying for credit or debt. Hard inquiries are visible to anyone who views your credit reports, and too many can lower your credit scores.

Can You Dispute A Collection With The Credit Bureaus

You can absolutely dispute a collection if you think its erroneous. Formal disputes must be filed individually with each credit bureau and can usually be done online through each credit bureaus website. You should also dispute the information with the company that provided the information.

can help you dispute errors on your TransUnion® credit report. We can also help you file a dispute with Equifax directly if you see an error on your Equifax® credit report.

Read Also: What Is Syncb Ntwk On Credit Report