How Long Do Student Loans Remain On A Credit Report

If your loan delinquency is reported to the credit bureaus, it will remain on your credit report for seven years. The exception to this is a Federal Perkins Loan , which is a low-interest federal student loan for undergraduate and graduate students who have exceptional financial need.

This type of loan will remain on your credit report until you pay it off in full.

Request For A Free Credit Report From The Three Major Credit Bureaus

If you want to file a dispute, its important that you have the latest copy of your credit report. Dont worry because you dont need to pay anything to have this copy because you are entitled to one free copy every year from TransUnion, Experian and Equifax- the three major credit reporting bureaus. Until April 2021, you can even get a free weekly credit report so you can better monitor your financial health.

For you to request a free copy of your credit report, visit annualcreditreport.com.

If you do not have internet access, you can also call by phone:

Consequences Of Missing A Student Loan Payment

If the student loans are past the due date, this is what to expect:

-

After 30 days – The creditor can charge up to 6 percent of the missed payment amount as late fees.

-

After 90 days – The creditor is allowed to go to the credit bureaus at this point, and they often do. Late payments are reported directly to the bureaus on student loans.

-

After 270 days – A federal student loan goes into default. This triggers various new penalties, like wage garnishment, tax refund seizure, and collection costs that the person must pay back.

You May Like: What Credit Score Do You Need For Affirm

Make Copies For Your Records

Before dropping your dispute letters in the mail, make copies of them for your files.

Do the same with all of your documentation, but be sure to keep the originals and send the copies after all, items can get lost in the mail. Keeping the originals will give you peace of mind, and ensure you have everything you need if you have to resend the letter and documentation.

To avoid the possibility of your letter being lost without your knowing it, send your disputes through certified mail with a return receipt requested. Upon receipt, the return request postcard will be mailed back to you, providing proof that the document was received and on what exact date.

Also Check: Zebit Report To Credit Bureau

Loans Listed As Delinquent

If your loans are in forbearance or deferment, its especially important to monitor your credit. Accounts could be wrongfully listed as delinquent when, in actuality, you had the loan servicers approval to pause your payments. Errors about your loan status typically occur due to a mistake by your servicer. They likely missed your payment status and submitted the delinquency by accident.

Read Also: Which Credit Score Does Carmax Use

File A Dispute With The Credit Reporting Agency

Initiate a claim directly with the credit bureau by writing a dispute letter. The purpose of this letter is to notify them that you believe certain information in your credit file is inaccurate.

The Fair Credit Reporting Act requires creditors to report accurate information about every account. This means they have a legal obligation to review, investigate, and respond to your claim. This process is free and can take up to 30 days to complete.

You can begin a dispute with any one of the credit bureaus through their websites or via mail. The leading credit reporting agencies are Equifax, Transunion, and Experian. Its essential to have documentation and to be precise about the information you are challenging.

Each of the three major credit bureaus has an online section dedicated to walking consumers through the process of disputing a claim online. It would be best to dispute the entry with each credit bureau to make sure the removal is complete across the board. After receiving the initial claim, the credit bureau will contact the source of the erroneous information and dispute it on your behalf.

How to file a dispute letter:

Can You Dispute Student Loans On Your Credit Report

The Fair Credit Reporting Act requires consumer reporting agencies to report accurate information. It gives you the right to dispute student loan errors on your credit report. The Consumer Financial Protection Bureau estimates that one in five consumers has an error on their credit reportâcredit report errors are not rare.

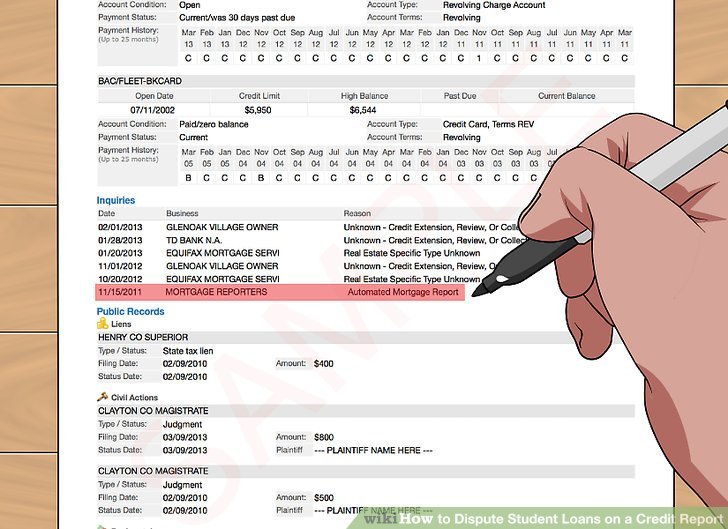

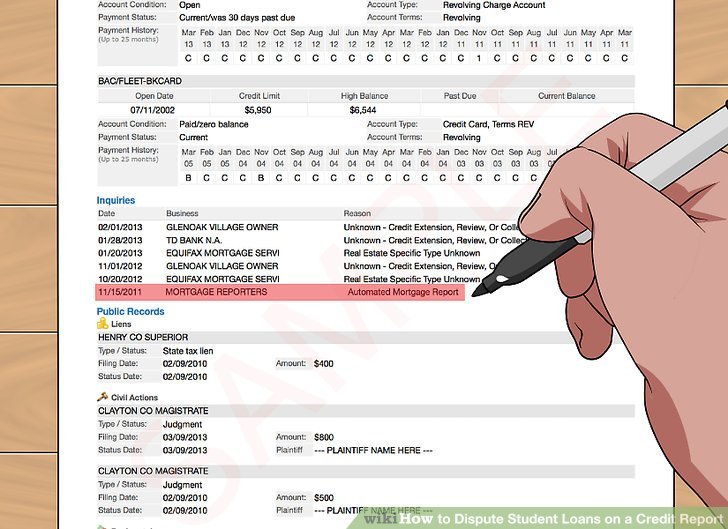

Common mistakes that appear on credit reports include:

-

Loans paid in full reported as unpaid

-

Wrong payment dates

-

Multiple credit inquiries that should have been combined

-

Dismissed liens, judgments, and lawsuits mistakenly remain as active

-

Negative entries remain that are over seven years old

As you can see, many different kinds of errors appear on credit reports Recently, errors have occurred because of backlogs related to the Covid-19 pandemic. The 2020-2021 coronavirus pandemic brought with it changes to payment requirements on school loans and an increase in credit report errors. Credit bureaus must investigate disputes, but to dispute an error, you must start the investigation and provide proof for your claims. Credit report errors wonât be fixed unless you take action.

Also Check: Does Paypal Credit Report To Credit Bureaus

Write To The Credit Reporting Company

Tell the credit reporting company, in writing, what information you think is inaccurate. Heres a sample dispute letter. Include copies of documents that support your position.

In addition to providing your complete name and address, your letter should clearly identify each item in your report you dispute, state the facts and explain why you dispute the information, and request that it be removed or corrected.

You may want to enclose a copy of your report with the items in question circled.

Send your letter by certified mail, return receipt requested, so you can document what the credit reporting company received. Keep copies of your dispute letter and enclosures.

Read Also:

Which Credit Report Errors Aren’t Worth Disputing

Small errors that dont affect your score like a misspelled former employer name or an outdated phone number dont hurt anyones assessment of your creditworthiness and aren’t worth disputing.

And sometimes a negative mark might surprise you but is not an error. If its accurate, don’t use the dispute process. Instead, try to resolve the problem directly with the creditor. For example, if you accidentally missed a payment, contact the creditor, arrange to pay up and ask if it will rescind the delinquency so it no longer appears on your reports.

The credit agencies are not obligated to investigate “frivolous” claims.

Read Also: What Credit Score Do You Need For Amazon Prime Visa

Can Credit Repair Remove Student Loans

Credit repair is a service offered by numerous companies and is the process of fixing inaccurate credit history reports that appear on your credit report. Credit repair canât remove student loans that are correct on your credit report. You can dispute errors on your credit report for free. Be mindful of scams when it comes to companies offering credit repair.

How To Write A Goodwill Letter To Your Lender

If youve a missed or late payment reflecting on your credit youd like removed, the first step is to communicate with your lender about getting back into good standing with your account.

Once thats done, ask your lender for a goodwill adjustment to remove the negative reporting from your credit reports via phone with a customer service representative. If that doesnt go far, write your goodwill letter via snail mail or email to the customer support department for your lender.

The best advice I can give for writing this letter is to be honest, sincere and definitely polite. Make sure to include:

- Name, address, phone number, email and your account number

- Explain why youre writing and what caused the error

- Tell them what you did to correct the issue so it wont happen again

- Explain how this negatively affects you

- Ask for a goodwill adjustment to have it removed

- Tell them youre grateful for their consideration

- Also include supporting evidence if applicable

Again, guard your heart because creditors arent required to consider your request. You might not even get a response, even if they do adjust it for you! If you havent gotten a response or noticed a change on your credit reports within a month or two, you can follow-up by phone, email or snail mail.

Read Also: How To Make Your Credit Score Go Up Fast

How To Dispute Student Loans On Your Credit Report

Youll have a hard time removing student loans from your credit report if the negative information is legitimate. But there may be instances when the details are inaccurate. In these cases, you can dispute the information with your creditor or the credit reporting agencies.

If you want to start with your loan servicer or lender, heres how to dispute delinquent student loans or loans in default:

- Write a dispute letter: Its best to complete this process in writing, so you have a paper trail you can refer back to in the future if needed. Write a letter to your servicer notifying them of the inaccuracy and requesting that they remove it from your credit reports.

- Gather supporting documentation: Before you send your letter, gather some documentation to support your claim. This can include bank statements or emails from the servicer showing you made on-time payments or any other reason why you believe the delinquency or default notation was made in error.

- Wait for a decision: Once you submit your letter, it may take a couple of weeks to get a response. If you dont hear back in two or three weeks, contact the servicer to follow up on your letter.

If youre having a hard time dealing with your loan servicer or youd simply rather not deal with them, you can also file a dispute directly with the credit reporting agencies. You can typically do this online, but still, make sure you provide supporting documentation for your claim.

Pay Off Outstanding Collection Accounts

Second, getting collections removed from your credit report also helps. Keep in mind that while paying off a collection account doesnt mean its automatically removed from your credit report, some credit scoring models might exclude a collection account from appearing on your credit report if it is paid in full.

Don’t Miss: Does Capital One Report To Credit Bureaus

Write A Letter That Concisely Explains Your Case

The letter to your lender are going to be almost like the one you sent to the reporting bureau. Identify the error, why it must be corrected, and inform them that youve filed a dispute with a reporting bureau.

- Use this sample letter as a template: https://www.consumer.ftc.gov/articles/0485-sample-letter-disputing-errors-in your-credit-report-information-providers.

- Your loan service is that of the company that manages and accepts payments toward your loan account. If a replacement service purchased your loan and both accounts appear on your credit report, send a letter to both companies.

Dont Miss: How To Get Credit Report Without Social Security Number

How To Dispute Student Loans On Credit Reports

If you checked your credit report and found inaccurate info about a student loan there, you can take action to remove it and improve your credit history. Read on to learn how.

Student loans, like other forms of debt, are reflected on your credit report. Missing a single student loan payment can hurt your credit score, which is why its important to dispute inaccurate information on your credit report and stay on top of your monthly payments.

If you miss a student loan payment to a lender by a single day past the due date, the loan becomes delinquent. Luckily, it doesnt mean the delinquent status will immediately go on your credit report. You have 90 days to pay before the loan servicer reports it to the three major credit bureaus .

At that point, if you still havent made the payment after 90 days, the missed payment becomes part of your credit history. This time period is more generous than the 30 days before other late payments affect your credit report.

However, having longer to pay doesnt mean you should put off making payments. Aside from risking delinquency on the loan, you may also incur late fees and interest charges. And if you fail to resolve the delinquency, your loan has the potential to go into default, which means you have failed to pay the lender according to the payment agreement you made.

Don’t Miss: Syncb/ppc Credit Inquiry

How To Dispute A Credit Report Error In 10 Steps

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

* * *

Programs For Military Service

Military service opens up many different opportunities for student loan forgiveness. If you obtained loans before enlisting, the Servicemembers Civil Relief Act may reduce the interest rate on your loans while youre on active duty. You can also defer your student loan payments while youre on active duty.

- Military College Loan Repayment Program. This program is an enlistment incentive for new recruits, so if youve already attended school and taken out loans, this wont be helpful for you. Under the CLRP, the military will repay a portion of your eligible student loans, with a maximum repayment amount of $65,000. Each branch of the military has their own maximums, so reach out to your local recruiting office for specifics.

You May Like: Does Removing An Authorized User Hurt Their Credit Score

Include Copies Of Documents That Support Your Case

You might embody different issues, it might embody fee data or loan statements that affirm your account isnt overdue. Ensure to ship copies as an alternative of authentic paperwork.

For occasion, in case your report reveals that you simply missed student loan funds, embody test copies or bank statements to show that you simply made the funds in query. If your report lists extra loans than youve got, present loan statements that present your precise variety of loans.

If The Credit Bureau Does Not Correct The Error

You may not get the result youre hoping for at the end of a credit dispute investigation. If thats the case, you can ask the credit bureau to include the statement of your dispute in your file and in future reports. That way, it will remain on record that you have disputed an item that is still on your credit report, though you will likely have to pay a fee for this service.

In an extreme case, you might opt to hire a lawyer who specializes in credit disputes to fight the inaccuracy on your report.

Read Also: Is 672 A Good Credit Score

Documentation To Provide For Your Dispute

In addition to the above, you’ll need to provide:

-

Proof of identity

-

Your Social Security number and date of birth

-

A copy of government-issued identification

-

Your current address and past addresses going back two years

-

A copy of a utility bill or bank or insurance statement that includes your name and address

Can I Get Student Loans Removed From My Credit Report

The length of time a student loan remains on your credit report will depend on the type of loan and your payment history. But even when your student loan debt is no longer reported on your credit report, youâll still owe the debt.

Private student loans are treated differently than federal student loans. Unpaid private student loans should be removed from your credit report after seven years. A private student loan lender is treated differently than a federal student loan. A dispute can be made as it would with any other creditor.

Certain federal student loans, such as a Perkins student loan, could stay on your credit report until itâs paid. If youâve paid your student loan and itâs still showing on your credit report, you should start the above dispute process to protect your credit.

Federal student loans follow you through retirement age. Even Social Security benefits can be garnished for failure to repay. Federal loan actions are guided by the Higher Education Act of 1962 and the Fair Credit Reporting Act . Many factors go into deciding whether a federal student loan can be removed from your credit history. Credit bureaus are required to report accurate information, so they will keep reporting the new information and your old loan could pop up under a new account.

Don’t Miss: What Credit Score Does Carmax Use