How Do You Apply For The Apple Card

If you have an iPhone, applying for the Apple Card is easy. Simply open the Wallet app, tap the plus sign and select Apply for Apple Card. Confirm or update your personal information with Apple, then review and accept the terms and conditions.

If your application is accepted, the card is instantly added to your Apple Wallet meaning you can begin making purchases right away. You can then request a titanium Apple card that will arrive later in the mail.

If your application is denied, Apple may invite you to participate in its new Path to Apple Card program. This unique program gives denied applicants detailed information regarding the reasons their application was denied, as well as tasks they can complete to help them improve their credit. If you complete the Path to Apple Card program successfully, youll have the option to reapply for the Apple Card.

Changes For The Spark Cash: Wont Report To Personal Credit

Effectively immediately, newSpark Cash Plus for Business cards will not report to your personal credit report, as originally learned by HelpMeBuildCredit and then confirmed to me personally by a Capital One spokesperson.

Note, however:

- Existing Spark Cash cards will still continue to report your business line to a personal report.

- All Spark Miles cards, for now, will continue to report to your personal credit.

- All Capital One cards, including these, may pull all three credit bureaus when opening an account. As far as I know, thats not changing

- This only applies to accounts in good standing. If your account is not in good standing , it will still report to your personal credit profile.

Its unfortunate that existing Spark Cash cardholders wont get the new benefit, but one possible strategy would be to open a new Spark Cash card now even if you already have one or a Spark Miles. You are allowed to have two of the same Spark card.

You can earn the cash on your new Spark Cash Plus and you can convert those into miles online. Or cash out as cash. Thats a benefit of having both Capital One Spark cards the ability to cash out at full value or convert to miles.

Its great to see that Capital One is hearing that people do care about this distinction and is moving to be more in line with all other issuers .

Also See:

Coowners Have Equal Rights

Apple Card Family CoOwners share their credit lines for a combined limit. CoOwners build credit as equals, can manage the account together, and can set limits for Participants. A CoOwner must be in the same Family Sharing group, and if they dont already have their own Apple Card, theyll need to apply for one.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

How Do You Earn Rewards With The Apple Card

When you make certain types of purchases with your Apple Card, you earn Daily Cash. These cash back rewards are applied to your account every day, and you can decide whether to use your Daily Cash to make purchases, send money to friends or family or make a one-time payment toward your Apple Card balance.

Heres how the reward structure works:

- Earn 3 percent cash back when you buy Apple products using Apple Pay.

- Earn 3 percent cash back when you make purchases with select retailers, including Duane Reade, Exxon, Mobil, Nike, T-Mobile, Uber, Uber Eats and Walgreens, using Apple Pay.

- Earn 2 percent cash back when you use Apple Pay to make purchases elsewhere.

- Earn 1 percent cash back on all other purchases.

Cardholders who apply through Jan. 31, 2021, can earn $50 bonus Daily Cash by opening an account and spending $50 or more in purchases within your first 30 days at Exxon or Mobil gas stations or convenience stores via your Apple Card in the Apple Pay app . Apple often gives new cardholders the opportunity to earn $50 bonus Daily Cash, so make sure you take advantage of it.

Possible Issue W/ Apple Card

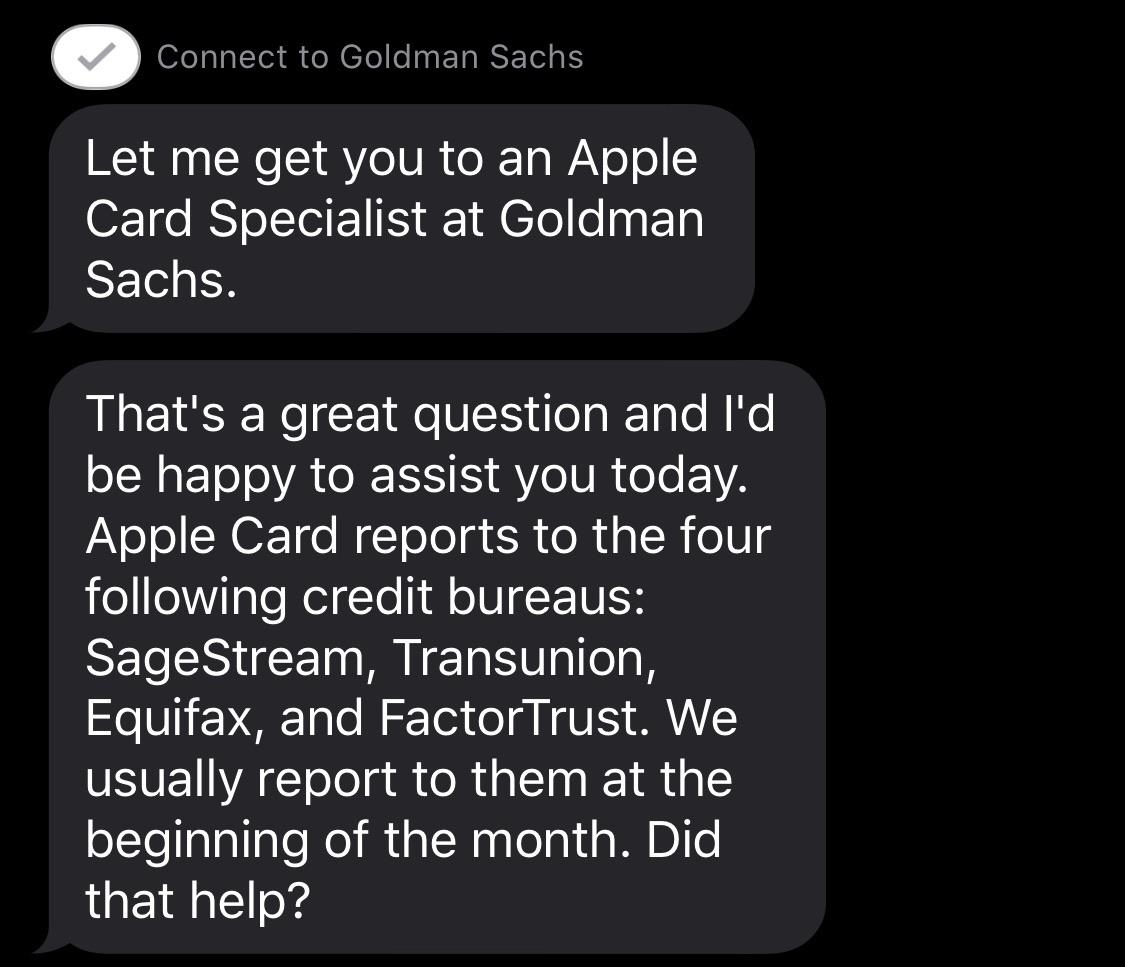

I contacted Goldman Sachs today about my Apple Cards trade line not being reported to the credit bureaus after two months of use its reporting now… the update was almost instant.

I also noticed a problem with GS reporting policy. My Apple Card shows a due date of December 31st but will change to November 30th on some days then change back to December 31st.

I spoke with a rep from GS about this issue and she confirmed that my statement due dates are due on the 31st of the following month, so lets say I charged $25 on December 1st, the statement due date would be January 31st.

That sounds little strange to me but Im cool with that because I could potentially carry balance longer without occurring interest and still pay in full at the end of the cycle but heres the catch, GS will still report any balance regardless of the due date on the 19th of each month according to company policy.

This could be damaging to somebodys credit utilization rate a balance being reported before the due date.

I spoke with two reps about this, one via chat and another via phone, and both of them confirmed this as being accurate.

Is this happening to anyone else?

Recommended Reading: What Is Syncb Ntwk On Credit Report

How Daily Cash Can Be Used

Your Daily Cash balance, which is transferred to your Apple Cash card can be used for Apple Pay purchases, sent to friends or family using the Apple Cash feature in Messages, or transferred over to your bank account.

Apple Cash can be transferred to your bank account at no cost, a process that takes between one and three days. There’s also an Instant Transfer feature that will cost one percent of the total money being sent. The Instant Transfer fee has a minimum of $0.25 and maxes out at $10. Transfers can be initiated in the Wallet app after linking a bank account to Apple Cash.

Apple Card* Vs Blue Cash Preferred Card From American Express

Even if you dont mind using Apple Pay, the Blue Cash Preferred® Card from American Express may be a more rewarding fit if you spend a good chunk of your budget on groceries, gas and transit. It carries an annual fee of $0 introductory annual fee for the first year, then $95 . In return, the card offers the following rewards: Earn 6% cash back at U.S. supermarkets on up to $6,000 per year in purchases , 6% cash back on select U.S. streaming subscriptions, 3% cash back at U.S. gas stations and on transit and 1% cash back on other eligible purchases. Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit.

Don’t Miss: How To Remove Repossession From Credit Report

Re: Apple Card Reporting

I’m aware that they include the financed amount for Apple products in the utilization, I’m just not seeing any updated balance for September. I read a few posts about people experiencing this late last year/early this year but was wondering if they were still having delayed or inconsistent reporting.

If Your Application Is Declined Because Your Identification Information Couldn’t Be Verified

Make sure your name, address and other information provided on your Apple Card application is correct. If you find inaccurate information, re-enter the information as needed.

If you are asked to verify with an ID, follow these steps:

After you complete these steps, submit your application again. If your application is declined again for the same reason, contact Apple Support.

Your credit score won’t be impacted if you’re declined, or don’t accept your offer. Your credit score might be impacted if your application is approved and you accept your offer.

You can apply for Apple Card again, but you might receive the same decision.

If you want to receive a different decision on your application when you apply again, you should review your credit report to see if you have conditions that might result in a declined application and then check for these common errors in your credit report.

*If the information on your ID doesn’t match the information you entered for your Apple Card application, try to apply again after you update your ID.

You May Like: How To Remove Repossession From Credit Report

Apple Card Family Sharing

Apple May 2021 debuted an Apple Card Family feature, which allows for spouses to share a single Apple Card account, with each person serving as a co-owner in order to build credit.

Apple Card Family also lets parents share an Apple Card with their children for making purchases, with optional spending limits and parental controls to help children learn smart financial habits. All spending by the family is tracked with a single monthly bill.

Up to five people can be added to an Apple Card account for sharing purposes, with sharing handled through the Wallet app. All users must be part of the same Family Sharing Group, and be 13 years of age or older.

Co-owners must be 18 years or older, and will have a combined spending limit and the ability to see each other’s spending. Existing Apple Card customers will be able to merge their Apple Card accounts if they have two cards, resulting in a higher shared credit limit with the lower APR of the two accounts. Apple Card Family launched in May, but merging accounts won’t be available until July.

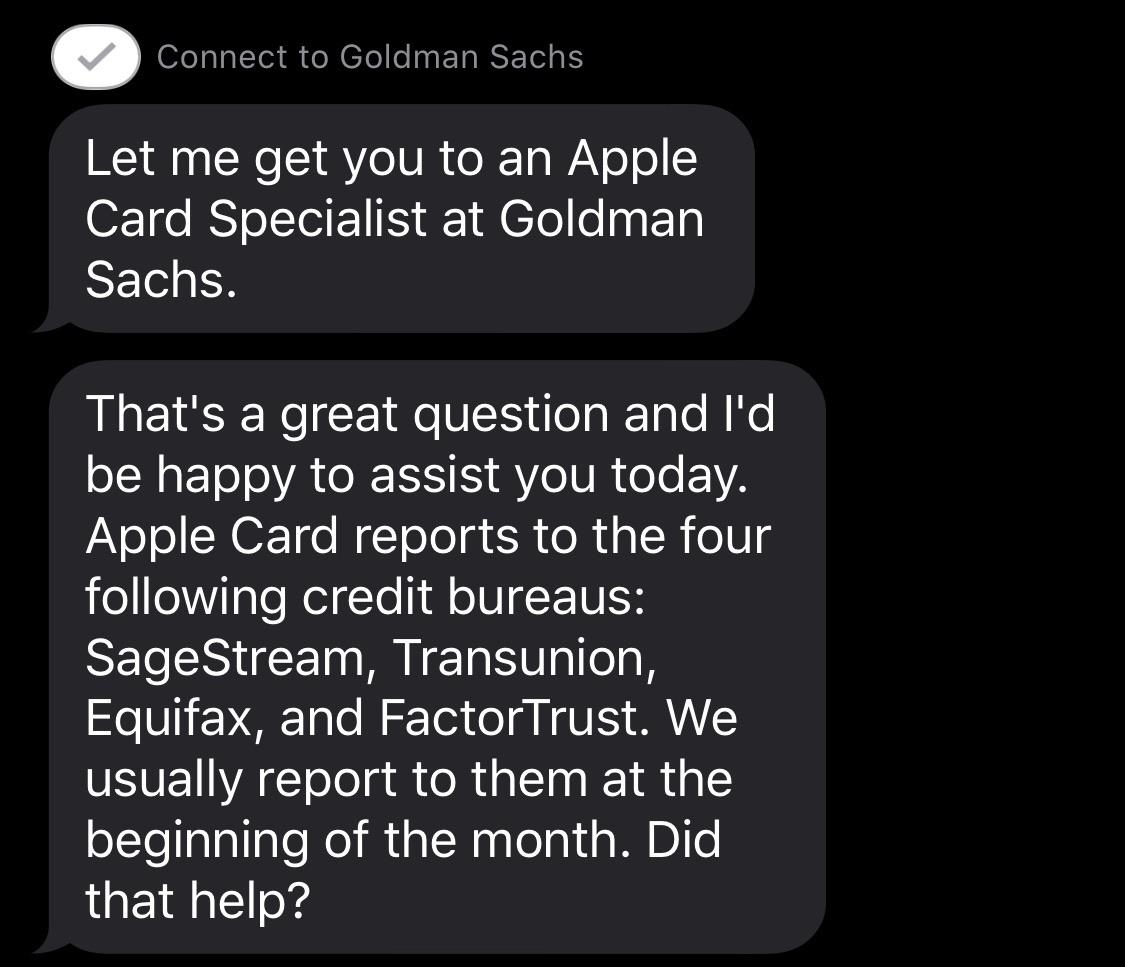

Apple Card Now Reporting To All Major Credit Bureaus

HomeApple Card Now Reporting to All Major Credit Bureaus

When it initially launched, one of the strange features of the Apple Card was that it only reported to one credit bureau: TransUnion. Now, however, the card appears to be reporting to all three major credit bureaus regularly. Heres what you need to know about the Apple Card and its reporting changes to the major credit bureaus.

Also Check: Bp/syncb Pay Bill

How Credit Is Reported For Apple Card Account Participants

Participants 18 years or older can opt in to be credit reported and build credit history.6 Participants will be reported to the credit bureaus as Authorized Users, which means they can spend on the account but are not required to make payments.

If you’re added as an Apple Card participant

- If a participant opts in to be credit reported, the Apple Card account will appear on their credit report.

- Participants inherit all positive and negative credit reporting from the account owners Apple Card account.

- The account owners payment history and account age is reported on the participants credit report.

If youre removed as a participant from an Apple Card Family account

- Account owners, the participant themselves, or Goldman Sachs can remove a participant at any time.

- Upon removal, Goldman Sachs will stop reporting the participant on that account to the credit bureaus.

- The participants credit history with Apple Card remains on their credit report unless the account is closed for a specific reason, such as an account owner filing for bankruptcy.

If youre a participant and want to open your own Apple Card account

Is 2699 A Good Apr

A good APR for a first credit card is anything below 20%. The best low interest first time credit card is the Bank of America® Cash Rewards Credit Card for Students because it offers introductory APRs of 0% for 15 months on purchases and 0% for 15 months on balance transfers, with a regular APR of 13.99% 23.99% .

Also Check: Syncb Credit Inquiry

Why Does It Matter

This is a big negative, because businesses tend to charge a lot. You may pay it off each month but a business is likely to have relatively higher utilization than a person.

Personally, I charge a lot on my business cards and always pay in full, but I dont put much on my Spark card for this reason.

If I use half of my credit line to pay for large business expenses, I dont want my personal credit score to suffer as a result. After all, they arent personal expenses.

Whats The Mystery Behind Which Bureaus Are Used By Card Issuers

Ulzheimer, the credit-reporting expert, says he understands why some card issuers might balk at divulging which credit bureaus they rely on.

I can see some card issuers being hesitant to disclose which bureau they use for card underwriting because consumers are often coached to apply with a lender that pulls the credit report where their score is the highest. Its a rudimentary way to game the system, to some extent, he says.

This isnt national security. But they are certainly not required to disclose that information to a potential applicant, Ulzheimer adds.

A card issuer typically picks one report from one bureau when deciding on a credit card application, he says. Why? Pulling reports from all three credit bureaus for every application would be too costly.

Ulzheimer says a card issuer chooses a bureau based, in part, on what type of agreement it has with that bureau. These contracts almost always include a commitment to buy a certain number of reports from a bureau, he says.

Weve seen reports of Chase, for example, pulling from each of the three major credit bureaus depending on the borrowers home state, Opperman says.

In some cases, a card issuer might pull a report combining data from more than one bureau, although Opperman says this isnt a common practice among card issuers.

Weve seen reports of Chase, for example, pulling from each of the three major credit bureaus depending on the borrowers home state.

Melinda Opperman, president, Credit.org

Also Check: Does Paypal Credit Report To Credit Bureaus

Apple Card* Vs Citi Double Cash Card

The no-annual-fee Citi® Double Cash Card is a Forbes Advisor top pick for a cash back card for its easy-to-earn, easy-to-redeem structure. With this card, youll earn a net 2% cash back on every purchase1% when you make a purchase and another 1% when you pay the bill. Your earnings can be used as a statement credit, taken as a direct deposit, mailed to you as a check or converted to Citi ThankYou points.

Like most credit cards, you can opt to load it into your phones digital wallet and it doesnt have to just be on the Apple ecosystem. One potential snag: Minimum redemptions start at $25 on the Citi Double Cash and theres no minimum redemption on the Apple card.

Is The Card For You

Although the Apple card offers some unique features that can help motivate cardholders to stay on top of their debt, the rewards program can easily be bested by other cards. Theres a bushel of other no-annual-fee rewards cards that offer welcome bonuses, intro APR offers and other perks. Choose one of those options over this bad apple.

To view rates and fees of the Blue Cash Preferred® Card from American Express, please visit this page.

Also Check: Ntwk Credit Card

When Do Banks Report To Credit Bureaus

Beyond finding out what credit bureaus your credit card issuers report to, knowing when they report is also a valuable bit of information. Unfortunately, there is no set day of the month when your credit card habits are reported to the three major bureaus.

Reporting times depend on the bank. Most credit card issuers report to credit bureaus every month, but some may report quarterly bi-monthly or even weekly.

However, using the once-a-month average makes it easier to gauge when your credit card balance is reported to either Experian, Equifax, or TransUnion . Most banks will report on the statement balance closing date. This closing date refers to the minimum payment due date on your credit card statement, as well as the grace period .

Does Financing A Phone Build Credit

Smartphone prices around the world are always increasing, making purchasing a cell phone in cash difficult. so, if youre like many people in the United States, youve probably considered financing a phone. We often get asked: Does financing a phone build credit? We will answer this question in much detail below.

Recommended Reading: Is 517 A Good Credit Score

Should You Get This Card

If youre someone who uses an iPhone and other Apple devices and you pay for many of your purchases with Apple Pay already, this card could be a valuable addition to your wallet. If you dont often spend with merchants that accept Apple Pay at checkout, think twice before you apply youll need to use the mobile payment method to maximize this cards rewards.

While it is possible to use the card without an eligible iPhone or iPad, you wont be able to do much. If you dont add your Apple Card to your eligible device, youll be limited to only making eligible purchases online and in-store at Apple using your line of credit. Adding the card to your iPhone or iPad unlocks the ability to spend at other merchants, as well as features that make this card valuable, like earning rewards, managing your account and payments through the Wallet app, pay for Apple products interest-free using monthly installment plans, and more.

The Apple Credit Card is best for people who already use an iPhone or other Apple device regularly and plan to spend more with Apple in the future, since youll earn the highest rewards rates on Apple purchases and anything else you buy using Apple Pay. Anyone else should probably consider another cash back credit card. The Citi Double Cash Card, for example, offers similar 2% cash back rewards on every purchase you make, regardless of whether you pay with a mobile wallet or not.