How Do Collection Reports Impact Your Credit Score

While a collection report usually causes serious damage to your credit score, how much it impacts it depends on which credit scoring model you use to calculate your score. It also depends on whether the collection account is paid or unpaid. For example, FICO Score 9the latest version of the FICO credit scoring modeldoesnt report paid collection accounts.

Earlier versions of this credit scoring model, however, do include paid collection accounts. If a lender uses an earlier model to assess the likelihood you can repay a loan, its likely that it will see a lower credit score if you have a paid collection account listed on your credit reports.

Is It True After 7 Years Credit Report Is Clear

The majority of negative information stays on credit reports for seven years or less. Your Equifax credit report stays updated for seven to 10 years, depending on which type of bankruptcy youve gone through. Accounts were closed for up to ten years so that Equifax paid them as they were taken into account on your credit report.

Does Paying Off Collections Increase Your Credit Score

Yes, as mentioned, paying off collections can sometimes improve your credit score, although only in newer scoring models.

How much your score will increase after you pay off your collection depends on your credit history. The better your score was to begin with , the worse the collection account will have hurt it, and the more your score will improve once you pay the collection account off. 11

You May Like: Do Evictions Show On Your Credit Report

Determine How Long A Charge

The charge-off account will be deleted 7 years from the date of the first missed payment that led to the delinquent status. Its also referred to as the original delinquency date. If a creditor transfers or sells the charge-off account to a collection agency, the original delinquency date that determines how long the charge-off remains on credit reports does not change.

Here is an example of the charge-off lifecycle:

- 1/1/18: You become 30-days late on a payment to your credit card issuer and never further payments.

- 7/1/18: At 180-days past-due, the credit card issuer closes your account and marks it as a charge-off.

- 1/1/25: The charged-off account must be deleted from your credit report by this date.

Recommended Reading: Speedy Cash Collections

So How Long Will It Be On My Report

A collection action will remain on your credit report for seven years from the initial date of the action itself. That means if you enter collections for a loan on January 1st of 2018, that collections action will appear on your report until 2025! Your credit score will also take a fairly substantial hit.

Companies generally treat all debts the same. That is the case whether they are medical, home or other types of loans.

The have recently augmented how they handle medical debts in their credit scores. That means your score will not drop as much as would another type of debt.

This is because both lenders and credit bureaus understand that, whether consumers can pay back the money or not, they are highly likely to take on medical debt. However, the collection action will still remain on the credit report.

Donât Miss: Does Speedy Cash Report To Credit Bureaus

Read Also: 830 Credit Score Mortgage Rate

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Long Does Debt Stay On Your Credit Report

How long a collection stays on your credit report depends on the type of loan you have. Derogatory items may stay on your credit reports for seven to 10 years or more, according to the Fair Credit Reporting Act. But heres the good news: As those items age, negative items have less of an impact on your credit scores.

Heres how long you can expect derogatory marks to stay on your credit reports:

| Hard inquiries |

| 10 years |

Also Check: Can Landlord Report To Credit Bureau

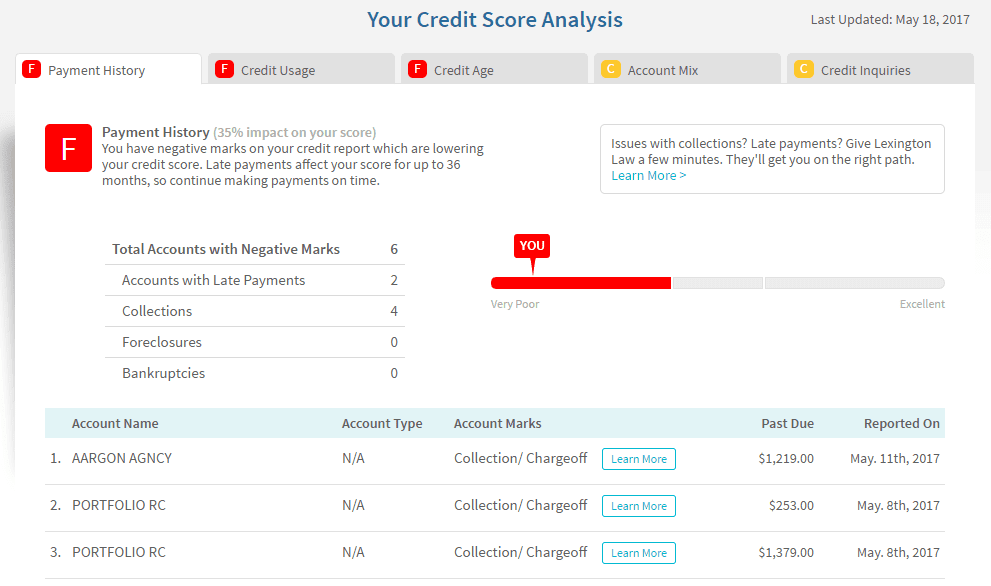

How Do Collections Affect Your Credit Scores

A collection account is a negative item that can hurt your credit scores. But the impact on your score can depend on the type of credit score and whether you’ve paid off the collection.

For example, the latest FICO® Score and VantageScore® models ignore paid collection accounts, while previous score versions may count paid collections against you.

But when you’re applying for a loan with a lender that uses older scoring modelssuch as a mortgage lenderpaying down your collections could still be important. Credit scores aside, the lender may review your credit history, and having unpaid collections could make it more difficult to qualify. While even paid collection accounts are negative, they may be viewed more positively by lenders than an account that remains unpaid.

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

You May Like: Opensky Payment Due Date

How Long Do Paid Off Credit Accounts In Good Standing Stay On My Report

A credit account that was paid off on time and is in good standing will remain on your credit account for 20 years after the last day it was active. Often, people mistakenly believe that old credit accounts are bad information and do not want then on their reports. In fact, this is the exact type of information that you want to appear on your credit report. Old accounts, which were paid off on time, show potential future lenders that you can responsibly handle credit. A long and positive credit history is created by using credit and taking on loans.

Does Removing Hard Inquiries Improve Your Credit Score

Yes, having hard inquiries removed from your report will improve your credit scorebut not drastically so. Recent hard inquiries only account for 10% of your overall score rating. If you have erroneous inquiries, you should try to have them removed, but this step wont make a huge difference by itself.

Read Also: When Does Usaa Report To The Credit Bureaus

Should You Pay Charged

The outstanding balance on a charge-off account is still your debt, and you are legally responsible to pay itto the original creditor or the agency that buys the debt. Furthermore, lenders who see unpaid charge-offs or collections may question your willingness and ability to repay future debts. Some will likely consider any charge-off grounds for declining a credit application, but some lenders will view paid charge-offs more favorably than unpaid accounts.

You May Like: What Credit Score Does Navy Federal Use For Auto Loans

How Long Does Positive Information Stay On Your Credit Report

Positive information on credit reports includes types of loans youve held, length of a loan, amounts of loans, and repayment history. However, you must manage debt responsibly for this information to reflect as positive. Essentially any account paid as agreed, both active and closed, provide positive information.

This could show creditors you pay regularly and on time, and that you can manage many types of loans. Positive information can stay on your credit report forever. Usually, credit bureaus will stop showing positive information after 10 to 20 years.

The credit bureaus of Canada are TransUnion and Equifax. They each have unique reporting practices. They hold information for slightly different time lengths.

Recommended Reading: When Does Capital One Report To Credit Bureau

Student Loan Delinquency Or Default

Late student loan payments can start to hurt your credit after 30 days for private student loans and 90 days for federal student loans, and those delinquencies stay on your credit report for seven years.

Federal student loans go into default if you dont make a payment for 270 days. And the government has strong debt-collection powers: It can garnish your wages, Social Security benefits or tax refunds. With private student loans, your lender can term you in default as soon as youre late, but it has to take you to court before it can force repayment.

What to do: If youve paid late but havent defaulted, consider switching to an income-driven repayment plan, putting your loan in deferment or forbearance, or asking your lender for a modified payment plan.

If youve defaulted on your federal student loans, the government offers three options: Repayment, rehabilitation and consolidation.

Everything You Wanted To Know About Debt Collection

There are many forms of debt collection. Examples of collection accounts include unpaid cellphone bills, medical bills, and even that library book you forgot to return in some cases. In all of those examples, the one thing that they share in common is that they can hurt your ability to get credit at decent interest rates unless removed from your credit report.

When it comes to debt collectors, there are two primary ways the creditors attempt to collect the money owing to them. One way is that the original creditor might try to contact you. Another way is that a collection agency may try to contact you.

When a collection agency reaches out to you, its for older debt that the original creditor did not collect in most cases.

It can actually be better to deal with the collection agency instead of the original creditor. Thats because when the collection agency is attempting to collect from you, its usually for pennies on the dollar. That means it puts you in a better position to negotiate.

Don’t Miss: Affirm Credit Score Requirements

If You Determine The Debt Is Yours

There are a few ways to take care of a debt in collections, including paying it off in full, establishing a payment plan and settling the debt for less than what is owed. If you disagree with the exact amount owed, straighten that out with the debt collector first. Be prepared to provide documentation proving your case.

In all cases, request written confirmation that you have satisfied the debt. Once the debt is resolved, you may be able to remove the collections account from your credit report before the seven-year mark.

What Is The Difference Between A Charge

Both a charge-off and a collection signify a negative occurrence on your credit score. Paying off a charge-off can stop it from being sold to a collection agency, preventing both negative marks from impacting your score. Ultimately, a charge-off is simply between you and the original lender, while the collections note means that it now involves a third-party agency.

Read Also: Remove Transunion Inquiries

Read Also: Stoneberry Credit Karma

What Happens To Your Credit Score When Derogatory Marks Fall Off Your Report

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

If a negative item on your credit report is older than seven years, you can dispute the information with the credit bureau and ask to have it deleted from your credit report.

Review Your Credit Report As Soon As Possible

This can help you figure out whether the debt is indeed yours. Fraud and identity theft are real risks that could assign debts to your report that arent actually yours.

If you think there has been an error, follow guidelines from the Financial Consumer Agency of Canada for reporting the problem.

Using a service such as is a great way to perform these checks, since the inquiry is considered soft and wont further penalize your credit scores.

However, some debts in collection may not be on your credit report. Always ask a debt collector for written proof of your debt so you can verify that its yours.

Also Check: Does Opensky Report To Credit Bureaus

How Often Should You Check Your Credit Score

You should check your credit score regularly to check for errors, but make sure that you are doing so through soft inquiries so that your score isnt dinged. Many banks offer free credit monitoring to their customers check with yours to see if you can enroll in their service and get alerts whenever your score changes.

How Long Can A Collection Stay On Your Credit Report

Collections will stay on your credit report for 7 years from the Date Of First Delinquency

Collections will stay on your credit report for 7 years from the Date Of First Delinquency . In layman’s terms, this is the date of the first missed payment at which the account was never paid again. Once this period ends, they’re removed permanently.

So to recap:

Recommended Reading: What Does Serious Delinquency Mean On Credit Report

What If The Collection Account Is An Error

If the collection account is an error, you can dispute it with the credit bureaus. Each of the three major credit reporting bureaus TransUnion, Equifax, and Experian allow you to file a dispute online. You can also file a dispute with collection agencies by phone or mail. The credit agency will attempt to validate the claim. It may take some time, but if the collection account is indeed erroneous, it will be removed.

Paid Or Not Paid Collections

A common assumption people often make is assuming that paying off a collection will instantly remove collections from your credit bureau.

Its important to remember that a collection entry wont disappear from your credit bureau even if you settle it and pay it off.

That means when a lender, whether its a credit card company or the bank, sees a collection entry on your credit bureau, it will likely impact their decision of whether to lend to you or not.

Even if your credit account application is approved, your interest rate will likely be higher than someone without a collection entry on their credit report. That being said, its certainly worthwhile to take the necessary steps to get rid of a collection entry on your credit report.

When theres a collection entry on your credit report, chances are pretty good that there are some late payments associated with it. This is likely due to the fact that you were late on your payments.

There is often a separate entry for this debt, apart from the collection entry. There are steps you can take to remove the late payments from your credit report too.

Also Check: Itin Credit Report

When Do Collections Automatically Fall Off Your Credit Report

Generally speaking, collection accounts automatically fall off your credit report 7 years after theyre first added to your credit report. 1

Most collections appear on your credit report after the debt has been charged off, which usually happens once you have a payment thats 120180 days overdue. 2This means that, if you measure from when you missed your first payment on the delinquent account, the associated collection account can remain on your report for a maximum of 7 years and 180 days.

The date that starts the 7-year countdown will remain the same, regardless of whether your collection account is transferred or sold from one debt collection agency to another.

At A Glance: How Credit Scores Factor In Collection Accounts

|

VantageScore |

||

|---|---|---|

|

Ignores medical collection accounts that are less than six months old Weighs unpaid medical collection accounts less heavily than other types of collection accounts |

Ignores small-dollar nuisance accounts that had an original balance of less than $100 Treats medical collection accounts, including those with a zero balance, like other collection accounts |

Ignores paid collection accounts Weighs unpaid medical collections less heavily than other types of collection accounts |

Also Check: Remove Credit Inquiries In 24 Hours