Tips To Get A Perfect Credit Score

The first thing to keep in mind is that obtaining a perfect credit score takes time.

Its rather easy to remove negative items from your credit report and get a better score, but a perfect score is another story.

Now, assuming you dont have any negative items on your credit report like late payments or a collections account, lets get into the more advanced credit behavior youll need to learn and put into practice.

Keep in mind that all of the steps outlined below are based on my personal experience, not random advice Ive read on the internet.

What Is The Highest Credit Score You Can Have

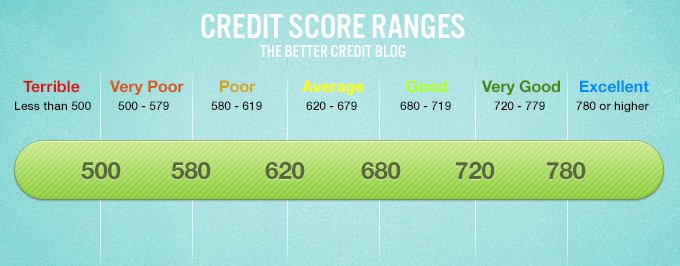

The highest credit you can have is 850. However, only a small percentage of Americans have ideal credit. However, many of them have credit ratings that are considered good or very good in the eyes of lenders or lenders. Here’s a closer look at the models, areas, and how credit scores are calculated.

Improving Your Credit Score Range

So now you know where your three-digit number falls in the credit score ranges. If you already have excellent credit ranging from 780 to 850 congratulations.

Your only job now will be to keep doing what youre doing to maintain stellar creditworthiness.

If you have very good credit, you may want to figure out how to optimize your score even more to achieve an even-better three-digit number. Keep reading to learn ways to fine-tune your credit life.

For everyone else, you probably have a little work to do to get into a better credit score range.

Like I said above, dont worry if your credit score has parked itself at the lower end of the spectrum. Ill show you exactly where to start working to achieve the best credit possible.

You can improve your credit score in no time if you dedicate some time to learning about how credit repair works.

You May Like: Opensky Available Credit

Is 719 Credit Score Good Or Bad

Short Answer: If you have a 719 Credit Score, it will fall in Good credit score category. You know most insurers and lenders when see you have a good credit score then you will be low risk for them, so this is enough to get most of the competitive loan terms and rates. Keep in mind they will give the best offer to those who have an excellent credit score.

How To Fix A 719 Credit Score

In summary your credit score determines your ability to borrow. Its important that you manage it. If you have 719 credit score then your focus should be on driving it higher. To do this follow these simple tips:

- Pay down your debt If you have debts but also have savings then you need to ask yourself do you need all that cash in the short term? Could it be used better if it was spent on paying down debt? This would be an excellent use of your funds in a low interest rate environment and would have the beneficial affect of moving your 719 credit score even higher.

- Get a credit report Like everything else in life mistakes can happen in any area and that includes the record of your debt repayments. Its possible to get a credit report to see if all the information that lenders have on you is correct. If it is not and there are records which indicate that you missed a payment which you never missed, or you applied for finance at an institution you have never even heard of then you need to correct that. Correcting those errors will also drive that score towards excellent.

- Avoid short term debt Before you take on short term debt do a simple mental exercise. Consider an item you wish to buy, look at the price, now ask yourself what the real price is if you use short term finance given the high interest rates that can apply. In some cases, this can mean that the item will cost you twice as much as the list price. At that price is it still something that you wish to buy?

Read Also: Protectmyid Deluxe Reviews

Credit Score: Personal Loan Options

With a credit score between 700 and 749, youre just one step away from the top rung of the credit score ladder. Working to improve your 719 credit score means getting the best personal loan rates possible. However, interest rates with a score in this range are still ideal. Theyll very from fourteen to sixteen percent, often falling on the lower end of that spectrum.

What Is The Difference Between Fico Score And Vantagescore

Two companies dominate credit scoring. The FICO score is the most widely known score. Its main competitor is the VantageScore. Generally, they both use a credit score range of 300 to 850.

FICO and VantageScore pull from the same data, weighting the information slightly differently. They tend to move in tandem: If you have an excellent VantageScore, your FICO is likely to be high as well.

Don’t Miss: Carmax Bad Credit Loans

Is 678 A Good Credit Score

- Standard Definition: Yes A lot of people think good credit starts at a score of 660 and ends at a score of 719.

- WalletHubs Rating: No Based on the rate at which people with 678 credit scores get approved for credit cards that require “good credit” or better, we believe you actually need a credit score of 700-749 to have good credit.

Of course, lenders always have the last word. And they neither define good credit the same way, nor disclose exactly what they consider it to be. So even if your 678 credit score does count as good credit by in some cases, it wont in others. And thats reason enough to improve your credit score so as to erase all doubt.

Below, you can learn more about what your 678 credit score means as well as what you can do to take it to the next level.

How To Get A Good Credit Score

Good credit habits, practiced consistently, will build your score. Heres what you need to do:

-

Pay bills on time. This is important because payment history has the largest impact of all the factors in your score. A missed or late payment can do tremendous damage to a credit score and it can stay on your credit report for up to 7 years.

-

Try to keep your credit card balances well below your credit limits aim for, and lower is better. High utilization dings your score, but the damage will fade when you’re able to reduce your balances and the lower utilization shows up on your credit reports. You also may be able to lower utilization by getting a higher credit limit or becoming an authorized user on a lightly used card with a large limit.

-

Keep credit accounts open unless there is a compelling reason, such as high fees or poor service, to close them. Keeping older accounts open helps your average age of accounts, which has a small influence on your score. Also, closing an account cuts into your overall credit limit, driving up your credit utilization.

-

Avoid making several credit applications in a short time frame. Credit checks for the purpose of credit decisions can cause a small, temporary dip in your score, and several in a short time can add up. That’s why it’s important to research credit cards before you apply.

-

Monitor your credit reports and dispute information you believe is incorrect or too old to be included .

You May Like: How Often Does Capital One Report To The Bureaus

Rewards Should Match Your Spending Patterns

If youre not a frequent traveler, it will make little sense to get a card that provides generous travel rewards. As you probably wont take advantage of them, itll be just another credit card.

Also, look very carefully at any qualifications for the rewards. Many credit cards in the good credit score to excellent credit score range make their most generous rewards offers on select categories. If you use those categories normally, it will make sense to take the card. But if you dont, you wont earn the rewards.

Summary: Financing A Car With A 719 Fico Score

It is when applying for loans that the distinction between an excellent and good credit score truly comes to fore. For example, when applying for a loan that is more than how much you earn, then you will need a credit score of at least 680 and it is not different when it comes to an auto loan.

It is practically impossible to secure some loans without a very good credit score. Imagine the interest on a $200,000, 30-year, settled rate contract. If you have a credit score of 760 to 850, you will have to pay an interest rate of 3.083 percent according to FICOs interest number cruncher as of October 2012.

Don’t Miss: Is 611 A Good Credit Score

Sound Of The Brave By Diesel A Masculine Essence As Vibrant As It Is Powerful

The Diesel brand is renowned for its avant-garde side and limitless daring. Particularly appreciated by young people, she does not hesitate to bring a rock n roll touch to the world of luxury. However, this is precisely how Diesels new Sound of the Brave perfume was developed in 2021. Imagined as a hip-hop piece, it does not hide its determination and encourages the wearer to display its true face and punching the table. Like the rest of Diesels The Brave family, its for those who live bravely, strive to achieve their dreams, succeed with determination, and never give up!

You Can Get A Car Loan With A Low Credit Score

To be clear, you can get a car loan with a low credit score. Although the subprime mortgage market has virtually disappeared since the financial crisis about a decade ago, the subprime auto loan market has exploded in recent years. Roughly 1 of every 4 car loans made in the U.S. is made to a subprime or deep-subprime borrower.

While the exact definitions of these terms vary depending on who you ask, the Consumer Financial Protection Bureau, or CFPB, defines subprime as borrowers with credit scores of below 620 and deep subprime as borrowers with scores below 580.

You May Like: Usaa Free Credit Report

Do Pay Down Your Credit Card Debt

Your credit utilization rate, also referred to as credit utilization ratio, is a significant factor in determining your credit score.

You must keep your credit utilization below 30%. Below that 30%, further improvements will earn you only a few points. But a few points is a lot in these circumstances. By coincidence, 30% is also the proportion of your score that credit card balances influence.

Is 650 A Good Credit Score Rating

As you mentioned earlier, a credit rating of 650 is not the best on the credit spectrum. You need at least 700 or more to get good credit. You have good credit, which means you can get a loan or credit, but it will be difficult to get your rental home and personal loans.

Whats a good credit score to buy a carWhat’s the lowest credit score you can have to buy a car? A credit score of 660 or higher should get you a car loan at a good interest rate, but borrowers with a score of only 600 or even 500 have options.Can I buy a car with a poor credit score?Yes really! You can buy a car with bad credit, but you may have to pay a higher annual rate or need a family member or friend as collateral. Yes really! You can

Also Check: How Can You Get A Repo Off Your Credit

Poor Credit Score: 550 649

This grand score is on account of several late or pending payments, numerous defaults on products from different lenders. This score can also be due to bankruptcy which is a scar that will remain on your record for a whole decade. Getting a new credit is near to a miracle for such individuals. It would be advisable for them to look up a professional finical advisor that will aid them in repairing their credit.

Recommended Article:

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

Also Check: Is 517 A Good Credit Score

What Score Is Considered A Good Credit Score Ratings Chart

Here’s the short answer: Most credit rating models follow a credit rating range of 300 to 850, with 850 being the “best” rating you can get.

What is a good credit score for a home loanWhat does my credit score need to be to get approved for a mortgage? To qualify for an FHA-insured mortgage, also known as a regular mortgage, you typically need a credit score of around 680 .What credit score is needed to buy a

Whats In A Credit Report

A credit report includes:

- Who is examining your credit. Any inquiries by lenders or others about your credit is recorded as well.

- Any judgments against you, such as bankruptcy.

- Personal information about you, such as your addresses , Social Security number and your previous employers.

- A section for comments by you, in the event you have disputed the report specifics in the past.

Read Also: How To Delete Hard Inquiries

Can I Get A Personal Loan Or Credit Card W/ A 719 Credit Score

Like home and car loans, a personal loan and credit card isn’t very difficult to get with a 719 credit score.

You donât need to apply for a secured card with Discover or Capital One, who may make you pay $500-$1000 just for a deposit.

You can get even better terms on your personal loan or credit card by repairing your credit and waiting a few short months until your score improves.

A 719 score means you likely have a few-no negative items on your report. Removing any outstanding negative items is usually the quickest way to fixing your report.

We recommend speaking with a friendly credit repair expert online to help guide you through this process. Your consultation is completely free, no-pressure, and will set you on the right path toward boosting your score.

How To Get Your Free Credit Report

If you want to see your most up-to-date credit score for free, you can now get a free credit report each week from TransUnion, Equifax, and Experian by visiting annualcreditreport.com.

Free weekly reports will be available through April of 2021 in response to the coronavirus pandemic. After April of 2021, youll still be eligible for one free credit report from all three major credit bureaus every year.

You can also track your credit through free credit monitoring services like Credit Karma or Credit Sesame. These wont show your actual credit score, but theyll give you a good approximation based on your payment history, credit utilization rate, and mix of accounts.

One of your credit card accounts may offer free FICO scores or free Vantagescore. Check on the app or website to find out.

| 500 |

Read Also: Experian Credit Ranges

What Are Some Tips For Improving Your Credit Score

Here are 10 ways to improve your credit report: Check your credit report regularly. Discard any incorrect information that appears on your credit report. Pay your bills on time every month. Avoid debt. Consider a secured credit card. Diversify your loan portfolio. Keep the oldest credit account active.

Learn About The Average Credit Score In The Us Including By Age And State

The average FICO® credit score in the U.S. was 710 in 2020. Thatâs according to data from an annual study by Experian®.

The Experian 2020 Consumer Credit Review uses FICO scores nationwide to determine averages by age, state and more. FICO is a credit-scoring company that provides some of the most commonly used scores in America. Read on for more of the studyâs findings and see what they mean for you.

Read Also: Bp Visa Syncb

Lenders Might See A Lower Credit Score Than You Do

Perhaps you monitor your credit with free credit score apps from the major credit bureaus, so you know exactly what youre working with when you apply for a mortgage.

But then you talk to a mortgage loan officer, and they tell you theyre seeing a lower score than you thought you had.

In fact, this happens pretty often.

Most people arent aware that they have dozens of credit scores. And the score you see from your bank or credit reporting service is just one of them.

Its common for your mortgage credit score to be lower than the score you see on other platforms. This is because lenders use a tougher scoring model.

Its also pretty common for your mortgage credit score to be lower than the score you see on other platforms.

Thats because mortgage lenders often use a tougher credit scoring model. A home loan is a lot of money, and lenders want to be extra sure youll be able to pay it back.

So, if your score is a little lower than you thought, dont be surprised.

Also, dont be discouraged! Youre still likely to qualify for most loans with a score slightly below 700. And there are plenty of ways to raise your score a few points, then try for a mortgage again.