Change In Credit Score When The Credit Report Is Updated

The credit score will change as your credit report gets updated. Say, for instance, you make timely loan payments in this case, your credit score will increase. But if you default several times, your credit score will fall. Since lenders have different thresholds based on the type of credit you want, your home loan application could be accepted with the same Experian score and rejected for a personal loan.

My Third Experian Boost

Im not a Boost addict, I swear. This time, Ive done it for you, dear reader. Before I started writing this article, I decided to boost again because I had some data to add. I was paying for the Internet with a card I hadnt connected yet. Plus Experian now lets you report your Netflix payments.

Boosting my FICO score while binging Bridgerton? Yes, please.

So Ive boosted again. This time, Ive added all of my credit card accounts, just to be sure every eligible payment will count toward my score. I didnt expect much, but I wanted to get the most out of the service.

My score has increased by 13 points, taking my score to the next credit tierfrom fair to good.

Now my FICO score is at 680, and in total, Experian Boost has raised my score by 22 points. Its less of a boost than other users report. But without it, it could take me another year to reach good credit. Now that years of fair credit are officially behind me, I may qualify for some of the most exciting credit cards , and Im considering refinancing my car loan.

Does Credit Karma Hurt Your Score

Many people think that signing up for Credit Karma credit monitoring will hurt their credit score. Yet, theres nothing to worry about. Checking your score on Credit Karma will not hurt your credit rating.

The checks that Credit Karma carries out are known as soft inquiries, which dont impact your credit in any way. The sort of inquiries that do affect your credit score is known as hard inquiries, which is when a lender will check your credit as part of a review for a financial product application of some nature. Credit Karma monitoring does not fall into this category, so it wont impact your credit score.

Read Also: How Many Points Is A Collection On Your Credit Report

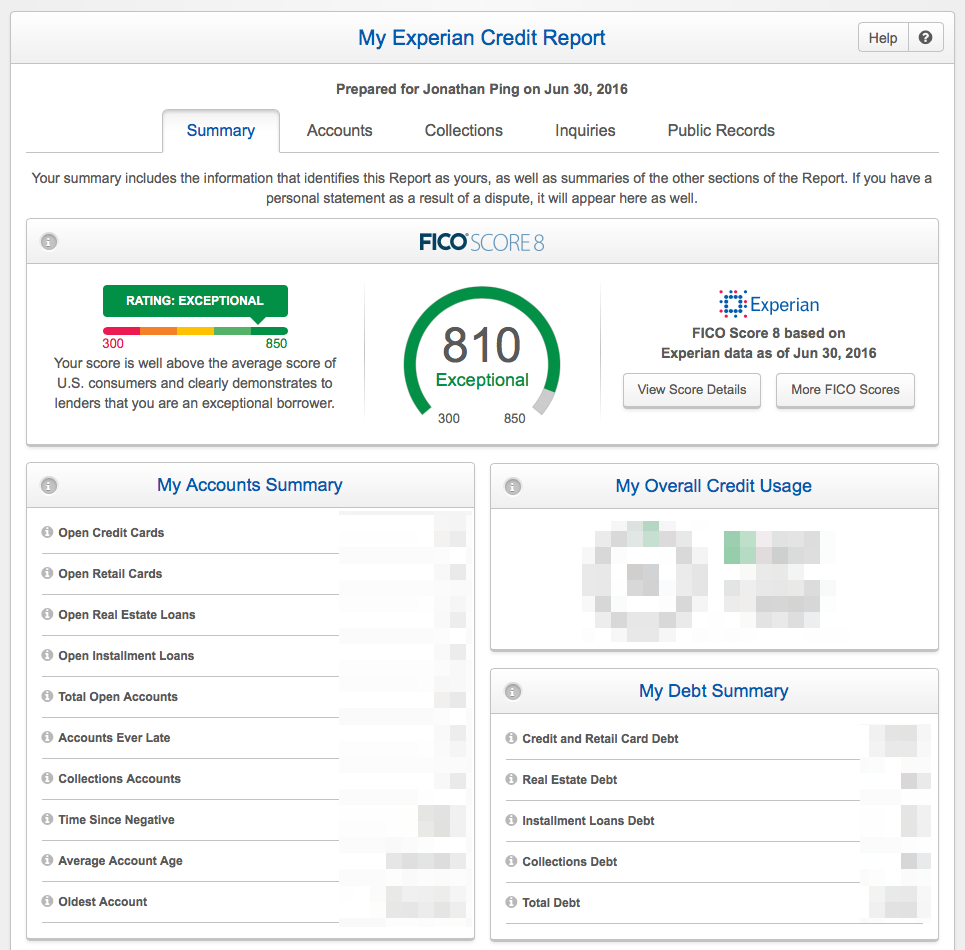

How Can You Get Your Experian Credit Scores

If youd still like to access your Experian credit score, you can find it for free in several places.

Experians free CreditWorks Basic service updates your credit score every 30 days. Experian also operates freecreditscore.com, another place where you get your free Experian FICO score once a month.

Some banks and credit card issuers, like Discover, also offer complimentary Experian-based FICO® credit scores.

And if youre willing to pay, Experian and FICO both offer premium services through which you can access your credit scores on a more regular basis. These services offer other benefits, too, such as access to your credit reports and credit- and identity-theft monitoring and support. But we believe strongly that you should never have to pay to access your credit scores or credit reports.

Ways To Help Maintain And Improve Your Credit Scores

Remember: Itâs normal for your credit scores to fluctuate a little. And credit scores can change significantly over time. But you can maintain good credit scores and even improve your scores by regularly practicing responsible financial habits.

Here are some ways you can maintain and improve your credit scores:

Speaking of applying for credit: Want a better idea of whether you might be approved? Pre-approval or pre-qualification can help you find out whether you might be eligible for a credit card or a loan before you even apply.

With Capital Oneâs pre-approval tool, for example, you can find out whether youâre pre-approved for some of Capital Oneâs credit cards before you submit an application. Itâs quick and only requires some basic information. And checking to see whether youâre pre-approved wonât impact your credit scores, since it requires only a soft inquiry.

Don’t Miss: What Shows Up On A Credit Report

How To Check Your Experian Credit Score For Free

As you are entitled to check your Experian credit score for free once every year, you can do the same through Experians official website itself. All you must do is fill in some basic information, provide the necessary documents, and validate your identity by answering a few questions regarding your credit profile.

What Is An Experian Report Number

An Experian Report Number is a 15-digit numerical code which is unique to every Experian credit information report. It can be found on the top-right corner of every Experian credit information report. It is the reference number that the credit reporter holder must keep in handy at the time of raising a credit report-related query or dispute with an Experian official.

You May Like: Does Klarna Show Up On Credit Report

Factors To Focus On To Improve Your Credit Score

If you were to check your credit score every day, no matter which credit scoring system was used, it would be normal to see the score move up and down a bit. Rather than worrying about these small fluctuations, your focus should be on long-term score improvement.

Fortunately, no matter which scoring system is used, you can promote credit score improvements by cultivating good habits around a set of factors that influence all credit scores.

Those factors are:

How Quickly Will Paying Off Debt Affect My Credit Score

You were finally able to zero out that credit card balance, thanks to a holiday cash gift and income from your side hustle. Go you!

A week later, you check the credit score posted on your credit card statement â and it doesnât look any different. How long should it take for your credit score to go up after paying off debt?

That depends. Again, it can take up to 45 days for a creditor to give that info to a credit reporting agency. Try not to obsess over seeing the number change right away. Instead, wait at least one month to check, and prepare to wait up to an extra couple of weeks. If youâre not able to pay back your debt as quickly as youâd like, check out a as an alternative to building your credit.

Read Also: Who Is Checking My Credit Report

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

Remember When It Comes To Your Credit Scores Updating

- Although updates to your credit score usually occur at least once a month, this frequency could vary depending on your lenders and unique financial situation.

- It’s normal for your credit score to change over time based on your financial behavior.

- It’s up to each individual lender to decide if and when they will report information as well as which of the CRAs they report to, if any.

- Be sure to request a new copy of your credit score in order to see any changes.

Also Check: Does American Express Report To Credit Bureaus

Does Your Credit Score Update Every Month

Your credit score probably will update every month, since creditors could be reporting as often as every 30 days.

If you use more than one form of credit â for example, student loan plus credit card plus mortgage â then youâll likely have information reported each month. As noted, any time new information is received â a credit card bill paid, a car loan approved â the credit reporting bureaus recalculate your score.

How often is your credit score updated? Could it be updated daily? Possibly, if creditors send new information every single day of the month. For most consumers, thatâs unlikely.

Monitor Your Credit For Free With Creditwise From Capital One

Whether youâre trying to maintain your credit or improve your credit scores, itâs important to monitor your credit regularly. Why? Because monitoring your credit can help you see exactly where you standâand how much progress youâve made.

is one way you can monitor your credit. With CreditWise, you can access your free TransUnion credit report and weekly VantageScore 3.0 credit score anytimeâwithout hurting your score. And with the CreditWise Simulator, you can explore the potential impact of your financial decisions before you even make them.

You can also get free copies of your credit reports from all three major credit bureaus. Call 877-322-8228 or visit AnnualCreditReport.com to learn more. Keep in mind that there may be a limit on how often you can get your reports. You can check the site for more details.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

The CreditWise Simulator provides an estimate of your score change and does not guarantee how your score may change.

Recommended Reading: How To Check Credit Report On Privacy Guard

What About Collections Accounts

If the debt you paid off was one that had gone to a debt collector, you might or might not see a change in your score. It depends on the credit scoring model being used.

Some credit scoring models exclude collections accounts once theyâve been repaid. In that case, you might see a credit score change in 30 to 45 days.

And if another credit scoring model is being used? The debt will stay on your credit report for seven years as a âPaid Collection.â Thatâs not ideal. However, your future lenders would likely rather see a paid-off collections account than an unpaid one. Sure, you had money issues â but ultimately, you paid what you owed.

Note: Sometimes a collections account can be removed from your credit report. Itâs worth a try.

Why Isnt Experian On Credit Karma

You may have noticed that one of the nationwide credit bureaus is missing from your Credit Karma update: Experian.

Why isnt Experian part of Credit Karma? Well, .

What does this mean?

Well, FICO and VantageScore are essentially two companies, offering different models for credit scoring. Both are widely used when it comes to making lending decisions, but they differ slightly when it comes to how credit scores are calculated and predicted via the use of a credit score simulator.

Both FICO and VantageScore use their scoring models so that your credit report is turned into an updated credit score for each of the three main consumer credit bureaus TransUnion, Experian, and Equifax.

Therefore, as Equifax and TransUnion both use the VantageScore scoring model, it makes sense to combine them. This allows for the most accurate reflection of your credit score based on the VantageScore approach.

As there is no Credit Karma FICO score check, its a good idea to access your Experian FICO Score as well. The credit bureau also has a feature known as Experian Boost. This is a tool that can potentially boost your credit score if youre making regular payments on your account for things like your mobile phone contract or your Netflix subscription. Equifax and TransUnion dont provide such a service.

Recommended Reading: When Can Bankruptcy Be Removed From Credit Report

Factors That Affect Your Experian Credit Score

Some of the factors that affect your Experian credit score are as follows:

1. Your Repayment History: The frequency with which you repay your outstanding credit obligations affects your credit score greatly. You will have a healthy credit score and it will remain healthy if you make timely payments. Late or missed loan/credit card payments, on the other hand, can cause a downfall in your credit score.

2. Your Credit Utilisation Ratio: If you have a healthy credit utilisation ratio , you will have a healthy credit score. If you go past the 40% mark, your Experian credit score can fall as a consequence.

3. Your Credit Mix: The ratio of unsecured to secured debts in your borrowing portfolio also determines your credit score. If unsecured credit makes up for a major portion of your credit portfolio, you may want to consider balancing it out with secured forms of credit.

4. Number of Hard Enquiries: If you apply for multiple loans or credit cards in a short span of time, this could spell disaster for your Experian score. Whenever you apply for credit, lenders make a hard inquiry on your credit score, which is later recorded in your credit information report. Too many hard enquiries in a short period can give the lender an impression of credit-hungry behaviour hence, you must not apply for loans and credit cards too often as it will make the lenders make multiple hard enquiries against you in a short timeframe, thus negatively affecting your credit score.

How Often Do Creditors Report Bureaus

Each creditor reports to the major bureaus according to their own schedule. Again, this usually occurs every 30â45 days.

The credit bureaus donât typically update their reports simultaneously either, since the necessary information isnât usually sent out all at once.

Your reported credit score for a given cycle is dependent on when your file is officially revised. The frequency with which youâre applying for or opening new accounts, your credit card balance fluctuation, and how youâre paying your bills will impact your score on a daily basis. The more changes in your financial activity, the more your report will require updating, which requires patience on the consumerâs end. Things like student loans or personal loans â not daily spending â or late and missed payments usually account for larger changes in credit scores.

Also Check: How To Remove Names From Credit Report

When Does Your Credit Score Update

If you check your credit score often, you may notice that it hardly remains the same. But what causes the frequent changes? It boils down to when lenders and creditors report new information to the three major credit bureausExperian, TransUnion and Equifaxthat ends on your credit report. Each time new data is reported, your score could change. Heres why.

How To Check Your Credit Score For Free

There are dozens of resources available for you to check your credit score for free, but the type of score you receive varies between a FICO® Score and VantageScore. While both are helpful for understanding the key factors that influence your credit history, FICO Scores are used in the majority of lending decisions.

The simplest way to access your free credit score is through your credit card issuer. Many card issuers provide their cardholders with free access to their FICO® Score or VantageScore. Beyond your bank, consider free resources from Experian, Discover and Capital One.

Recommended Reading: Does Xfinity Report To Credit Bureaus

Things You Need To Know About Experian Credit Score

Popularly known as one of the worlds most innovative companies as awarded by Forbes Magazine, Experian is a credit information services provider operating under two names in India Experian Credit Information Company of India Pvt. Limited and Experian Services India Pvt. Limited.

The Experian Credit Report or Experian CIR prepared by the company consists of detailed information of your credit accounts, credit cards, recent enquiries, payments, and identity information.

The Experian CIR is essential because your credit score will be derived based on the information available in this report. Your future loan sanctioning will depend upon the credit score so derived.

This guide will tell you the five most important things you need to know about Experian credit score.

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

Read Also: What Is An Acceptable Credit Score