Spectrum: Credit Check Required

Spectrum does require a credit check to open a new account. This offers a benefit though, as those with good credit may not have to pay the first month bill upfront plus installation costs. Conversely, those with bad credit may have to pay these bills upfront when signing up for Spectrum service and the costs can be quite high.

How Does Pci And Pii Compliance Protect Customers

PCI and PII means that the sensitive info you are giving the representative is being encrypted. For instance, if you are placing an order over the phone, that phone call is likely being recorded.

When you give information such as your date of birth, Social Security number, credit or debit card information, that info is disrupted . If the call were to be replayed for quality assurance or to resolve a dispute, the sensitive information would forever be masked.

Likewise, sensitive info typed into the ordering system will also be masked so that neither the representative, or anyone else, can view the data after it is initially typed.

Pro tip #2: If you are speaking with a representative, ask them if their company is PCI and PII compliant. If they say no, or they dont know what you are talking about, that is a bad sign.

Can Utility Bills Reported To Experian Impact Lending Decisions

With Experian Boost, your utility bills might be the key to unlocking new financial possibilities. Once you connect your bank account and receive your new FICO® Score, you may have an easier time getting approved for certain credit products.

An added benefit of Experian Boost is if you are eligible for an increased score, you should see a boost across all of your different FICO® Scores. FICO® Scores are the most commonly used credit scores by lenders and come in several varieties depending on who is requesting to see it. In some cases, auto lenders, bankcard issuers and mortgage lenders will use a different version of your FICO® Score to decide whether to approve you for their specific loan.

Overall, boosting your FICO® Score should help you with future lending decisions. Not only do lenders decide to issue new credit based on your credit reports and scores, but they often use this information to establish interest rates and loan terms. Having an increased score can help you get approved for more competitive credit and might help you get a reduced interest ratewhich can save you thousands of dollars over the life of a loan.

If you are unsure whether you’ve had a collection account added to your credit file, you can check by getting a free copy of your credit report from Experian. Periodically monitoring your credit reports can help you stay on top of any changes in your accountswhich may help your credit history over time.

Also Check: Capital One Rapid Rescore

How Does Credit Affect Eligibility For Phone Service

People typically think of their credit scores as impacting their ability to get loans.

Hearing that it can also impact their ability to get something like phone service might be a surprise. Still, it makes sense if you think about it.

With a loan, a lender is providing you with money up front. You promise to pay it back over time.

With phone service, the provider gives you phone service up front. You promise to pay for the service each month. In a way, the agreement for a loan and the agreement for paying a monthly phone bill are similar.

If you have bad credit, a phone provider might think you wont pay your monthly bill. That makes them less willing to offer service.

That said:

If The Debt Is Rightfully Yours Negotiate A Payoff

If Comcast proved you owed the debt or if you didnt ask for debt validation in time its time to negotiate the deletion of your negative items.

I recommend negotiating directly with Comcast Collections.

Offer Comcast one half of the balance due in exchange for Comcast removing its negative items from your credit report with all three credit bureaus.

You will probably need to haggle some on the phone. This is why I recommend starting by making a phone call in this case.

If the representative agrees to your deal over the phone, ask for a written letter that details the repayment amount and terms .

Dont make your payment until you get the letter. After you receive it, write a check and mail it out to them. Never share your credit card or bank account number over the phone.

Check back after 30 days to see if your entry was removed. Make sure all your Comcast accounts negative items are removed, including late payments and missed payments.

Don’t Miss: How To Unlock My Experian Credit Report

Comcast Debt Collection Your Detailed Guide To Remove It

The emphasis of this write-up will be on Comcasts debt collection. The truth is that Comcast debt collection can only appear when you forget to pay your bills and your debt is transferred to the collection agency. the danger of Comcast collection appearing in your credit report is that it has a way of decreasing your credit score unless you manage to get it removed. This can be done by either:

- Negotiate for it to be deleted when you make full payment.

- Use credit bureaus to dispute the account.

- Engage a reliable dispute company to remove it.

Note: The majority tends to go with option three.

How Collections Affect Your Credit

Missed payments over several months will cause a hit to your credit score. Couple that with a collection account on your credit report, and it can definitely impact your ability to qualify for new credit.

Debt collectors often buy and sell debt from one another, so this can lead to multiple collections showing on your credit reports for the same account.

When this happens, if you dont dispute the accounts, they will definitely harm your credit score.

Also Check: How To Check Credit Score Without Social Security Number

Low Income Community Considerations

Some of the providers that require strict credit checks are likely not the best option for those living in low income communities. These companies are generally not afraid to turn a customer down over their credit score and it may cause further detriment if the check impacts someone’s score even with being turned down. In these cases, prepaid service or a smaller company may be the better option.

How A Bad Credit Score Isbad

As mentioned formerly, a bad credit score is anything listed below 670. If you want to get more particular, a score varying between 580-669 is thought about reasonable, while anything between 300 and 579 is thought about bad. This is going off the FICO scoring thats most frequently used.

Not sure what your credit score is? . Its free!

Having a bad score can stop you from doing a lot of things. This includes getting authorized for much better credit cards, home loans, houses, personal loans, company loans, and more.

Plus, any loans or charge card you do get approved for will be much more costly . This is because lending institutions charge much higher rates of interest to those they deem high threat in order to offset the extra threat they feel theyre taking by loaning you cash.

How do they get more costly? By charging greater rate of interest. If you take out a $10,000, 48 month loan on a automobile with a 3.4% interest rate, youll pay about $704 in interest over the course of the loan. If you secured that exact same loan with a 6.5% rate due to bad credit, you d pay about $1,376 in interest. Thats nearly double!

Don’t Miss: How Long Does Repo Stay On Credit Report

Best Prepaid Internet And Tv Plans

- DISH offers pay-as-you-go TV packages that do not require a credit check. These no-contract plans let you turn service on or off at your convenience. The trade-off is that you must pay a higher monthly fee, purchase your equipment and prepay all fees.

- Xfinity also offers prepaid plans that do not require a credit check. Their internet plan includes up to 20 Mbps of speed, includes a $35 equipment and start-up fee, and is $45 for 30 days of service. The TV plan can be bundled with the internet for an additional $22, and you can even add premium channels such as HBO and Showtime .

- HughesNet has an option for customers to avoid credit checks that entails purchasing the HughesNet equipment of a satellite dish and a modem. The purchase cost is $350-$450 , which is a hefty investment considering that the lease fee for the equipment is $10 per month. Over the course of a two-year contract, leasing the equipment would actually save at least $100 for the average customer.

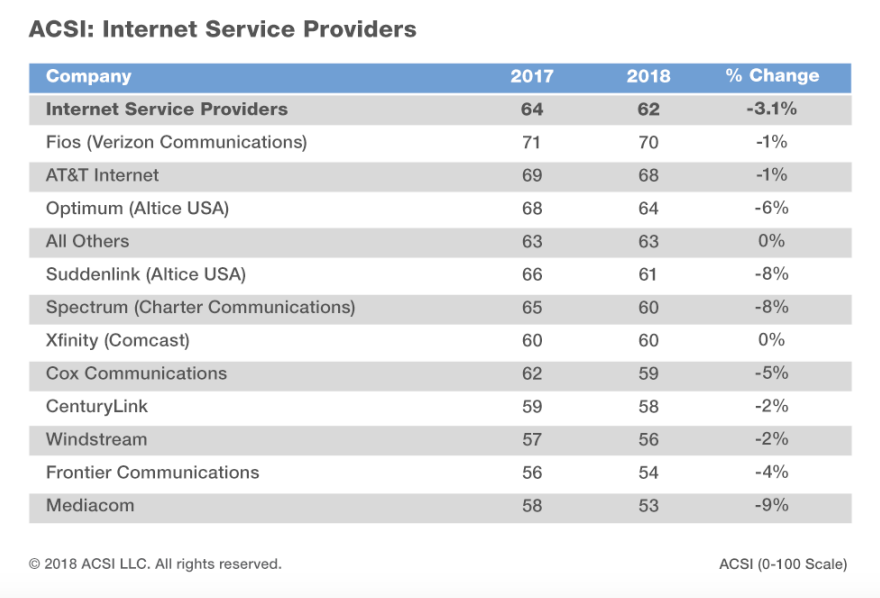

Take a look at this chart to see which providers in your area have different rules.

Establish Snail Mail Communication

If Comcast collections has called you, call the agency back and tell its representative you understand your consumer rights as outlined in the Fair Debt Collections Practices Act.

Then, let the representative know you wish to communicate only in writing from this point on. Federal law gives you this right. The company will have to adhere to your request.

As you can see, the process of stopping calls to your home and/or workplace wont be difficult.

Most consumers simply dont know they have this right.

Collection agencies know this, so some of them keep calling until they are told not to.

After you exercise your right to communicate only by mail youre ready to start the process of removing the collection from your credit report.

Read Also: Does Paypal Credit Report To Credit Bureaus

Why Does My Internet Service Provider Require A Credit Check

Its important to understand why the internet service provider is requesting your information. Internet and TV providers often request credit checks for prospective customers because they want to know how likely that person is to pay their bills each month, said Rossman.

Similar to when you sign up for a new credit card, companies want to know what type of customer you have historically been. They are trying to assess the risk associated with taking you on as a customer. And the good news, explains Rossman, is If you have a good credit score, you probably wont have to put down a deposit.

There are two main risks that providers are trying to assess for:

So, now you know why new customers undergo credit checks, but what if youre a returning customer? Youll have to undergo the credit check process again. The exception being if you had service recently and there is a local office for your provider, you can go in to see if they will reactivate your account as a courtesy.

Is It Possible To Waive Your Late Payments To Comcast

Yes, it is. Comcast recently published they will extend the data-cap waiver until the end of June. Comcast also promised it wouldnt disconnect any of its services, and that it will waive late fees. The only condition is that customers contact them and let them know they cant pay their bills during the Coronavirus outbreak. There are many ways to contact Comcast/Xfinity, including:

- Phone

|

Other online options |

DoNotPay will act as your solicitor, and it will help you by writing a letter to Comcast in which they ask for a waiver on your late fees.

Also Check: What Is Syncb Ntwk On Credit Report

Is Credit Collection Services Legit

When contacted by a collection agency, a common response is disbelief, especially if you have no recollection of the debt.

But the next question and one thats totally natural is to question the legitimacy of the collection agency.

As it turns out, Credit Collection Services is a real business that works with some of the best-known companies in America.

The company has been rated by the Better Business Bureau , giving them an A+.

The Consumer Financial Protection Bureau, along with the BBB, report over 270 and 400 customer complaints respectively.

Youll only hurt your case if you dont respond to their communications and do whats necessary to remove them from your credit report.

Am I Safe Giving My Information Over The Phone

If youre worried about giving your personal information to a representative over the telephone, there are rules in place to protect you. Companies that administer telephone sales are required to comply with the Telemarketing Sales Rule, which lists strict rules about disclosing information regarding the sale and obtaining express consent from the customer.

Most companies are also required to be compliant with PII and PCI standards, or they stand to put themselves at risk of huge legal fees . Read on to find out what these standards mean for you.

Also Check: Does Increasing Credit Limit Hurt Credit Score

Will Paying A Comcast Collection Account Delete It From Credit Reports

QUESTION. I am in the process of obtaining a mortgage. I was told I needed to clean up a few things. One thing being that I needed to pay on a Comcast collection. I did so, but I did a settlement and not paid in full. Now the collection agency ERC is refusing to remove this from my credit report. Is there anything I can do to get this removed & where do I go from here? With thanks & appreciation.

ANSWER. Unfortunately the collection agencies used by Comcast are notoriously difficult to deal with when it comes to removal. Unless your settlement included a pay for delete agreement theres not much you can do unless: There was some violation by ERC concerning your agreement to settle then you can make a complaint with the Better Business Bureau to intercede on your behalf for instance, if they promised to delete in exchange for payment or, You contact Comcast to see if they intervene on your behalf by pulling the account back and dealing directly with them since it was a partial settlement. You may have to talk to someone in charge to get this done and include the fact that you are attempting to get a mortgage. If Comcast can terminate the collection authority with ERC, they can direct ERC to delete the account.

If you are not able to accomplish any of this keep in mind a Paid collection account looks a lot better to a lender when evaluating your credit then an Unpaid collection account. The best of luck to you!

Lowering Your Comcast Bill 101

If you find your Comcast bills too expensive to handle, there are several methods you can try in order to lower the price. In some cases, the bill will be higher due to a mistake, while in others, youll need to negotiate the price with a customer service rep.

Here are some ideas on how to make paying your Comcast bills more bearable:

Recommended Reading: Paypal Credit Report To Credit Bureaus

Reach Out To These Credit Bureaus

If youre having doubts that Comcast wont do justice to this, you can reach out to the above-listed credit bureaus to investigate the information and report their findings. The good thing about these credit bureaus is that there is a possibility your odds of getting results will be increased. After the entire investigation process, theyll still report back to the Comcast collection department.

To reach out and report your Comcast Collections dispute to any of the above-listed credit bureaus, use the following links: TransUnion customer service, Experian customer service, and Equifax customer service. In some cases, youll receive the outcome of their investigation directly within 30 days of submitting your details.

Where We Got The Data

In order to provide the most accurate information possible, we employed three methods of data gathering over six hours.

First, we scoured through credit and finance forums online to see what people were reporting when it came to which credit bureau was used by their provider when they signed up for mobile phone service.

We also called the customer service agents at each of the four major U.S. mobile carriers.

We also called physical stores in New York City to see if different agents provided different answers .

Finally, we spoke to relatives and family members to gather more anecdotal evidence.

Once we put all of our data together, we were able to come to reasonable solid conclusions about which credit bureau each provider favors.

Don’t Miss: How To Unlock My Experian Credit Report

Get A Professional To Handle Comcast For You

If you dont want to deal with Comcast Collections, or if you need your credit repaired quickly, I suggest you consider hiring .

This is a professional credit repair company staffed by advisors are helpful and friendly, even if you dont reach out, an advisor will call you monthly with an update.

They know how to negotiate with collections agencies and credit bureaus because thats all they do.

This kind of professional help averages around $100 a month in subscription fees, but it can save you all sorts of time while repairing your credit score a lot faster.