Whats The Difference Between A Credit Freeze And A Fraud Alert

Whether youre the victim of a data breach or your IDs been hacked some other way, youll probably want to get in touch with each of the three major credit bureaus. Let them know what happened and tell them you want to enhance security. A fraud alert may be a good first move if no trouble is detected. It will require the credit bureau to take additional measures to prove your identity before they release your credit report on future inquiries.

If you feel theres an immediate threat, or if it looks like new attempts have been made to open new lines of credit, you may want to go with a credit freeze. Credit security freezes can halt all inquiries into your account and require a PIN for any data to be released by a credit bureau.

One key detail youll need to know right away is that both of these options only help to prevent new accounts from being opened. If your existing credit card information is compromised, fraudsters can continue to make purchases until that card is cancelled, even with a credit freeze or fraud alert in play.

Thats where credit monitoring services from a home insurer, like those we offer in conjunction with CyberScout, can help to round out your identity fraud protection strategy. Well help you repair any damage done to your good name think attorney fees, lost wages and certified mail.

Pros And Cons: Should You Use Fraud Alerts

Are fraud alerts suitable for me? Well, lets examine the pros and cons.Pros

- Free of Charge: All three types of fraud alerts are completely free of charge. No credit bureau charges for this service.

- Free Credit Reports: Depending on which type of fraud alert you place, you receive at least one free credit report from all three bureaus in addition to the one you are entitled to per year, by law. If you are eligible for the Extended Fraud Alert, you receive 8 additional credit reports from each credit bureau.

- Convenience: Initial and Active Duty Fraud Alerts can be placed and removed online from the comfort of your home. Additionally, Equifax offers the Automatic Fraud Alert feature, which saves you from manually renewing your alert every 90 days.

- Harmless: Adding fraud alerts to your credit report and receiving free copies of your report do not impact your credit score in any way.

Cons

- No Guarantee: Unfortunately, not all creditors or third parties performing credit checks will heed the fraud alerts, namely the Initial and Active Duty types. Because it is not guaranteed that they will take further steps to verify your identity, fraud alerts diminish but do not entirely preclude your likelihood of being an identity theft victim.

When To Place A Fraud Alert

Consumers should place a fraud alert on their credit at the first sign of identity theft or fraud on their account, such as an unauthorized new line of credit opened in their name, says John Danaher, president of Consumer Interactive at TransUnion.

Even though a fraud alert is placed on your credit reports, theres no guarantee the alert will stop identity theft.

Keep in mind that while a fraud alert is an important line of defense, and a red flag for lenders, it doesnt fully prevent unauthorized accounts from being opened, says Danaher.

Read Also: How To Remove Repossession From Credit Report

Fraud Alerts For Children And How To Check Your Childs Credit Report

Children are among the most common victims of identity theft. Unfortunately, many parents may not realize their childrens information has been stolen and misused until their children become adults and check their credit for the first time. Additionally, many children have their identity stolen and misused by adult family members or friends, making the issue much worse.

If your minor child has a credit report, this is a giant red flag and a good indication of child identity theft!

Simply put, you wont know whether or not your need to be concerned about child identity theft until your check to determine if your child has a credit report, and examine what information is on it. And even if you dont find any report, it may be a good idea to create one and then place a credit freeze on that report to prevent misuse in the future.

Minors aged 14-17 can contact any of the credit reporting agencies to check their own credit report. Parents of children under the age of 18 can do this at any time as well.

Fraud Alert Vs Credit Freeze

Fraud alerts and credit freezes are two options consumers have when they suspect fraud, and both are free to place and remove on your credit report. While a fraud alert advises creditors and lenders to use caution when opening new credit lines, a restricts access to your file. Lenders and other companies cannot view your credit, and new accounts cannot be opened.

If your credit report has incorrect information on it after a case of identity theft, you have rights protecting you and enabling you to fix the errors. The consumer protection attorneys at Francis Mailman Soumilas, P.C. are here to help. Get free legal help today and file a free case review, or call us at 1-877-735-8600.

Don’t Miss: Does Paypal Report To Credit Bureaus

How To Put A Fraud Alert On Your Credit Report

Regardless of which route you take, the critical step is to act quickly. As soon as you notice a sign of identity theft or fraud, contact the credit bureaus for a freeze or fraud alert.

Some common signs of identity theft include unexplained bills or statements addressed to you, sudden drastic drops in your credit score or calls from collections for debts you dont recognize.

How To Get A Fraud Alert From Experian

Experian fraud alert. You can call Experian at 888-397-3742 to request a fraud alert over the phone. Alternatively, you can request an Experian fraud alert online by following these steps: Visit Experians fraud center page.

What is ID report on credit report? Personally Identifiable Information Your name, address, Social Security Number, date of birth and employment information are used to identify you. Your PII is not used to calculate your FICO Scores. Updates to this information come from information you supply to lenders when you apply for new credit.

Also Check: How To Report A Death To Credit Bureaus

Will A Credit Freeze Or Fraud Alert Hurt My Credit Score

A credit freeze only restricts who can look at your credit reports. It doesn’t affect your score or stop you from using credit.

A fraud alert is simply an extra layer of security it doesn’t affect your credit score either. It’s easier to apply for credit if you have a fraud alert, because you don’t have to first unfreeze your credit.

What Is A Fraud Alert

A fraud alert is a warning placed on your credit record that tells potential lenders to contact you typically with a phone call and verify your identity before extending new credit. If someone tries to get a new credit card or borrow money in your name, that contact should tip you off so you can take action to stop the new account.

A fraud alert can be a good option for consumers who want to avoid having to freeze and unfreeze their credit when they want to apply for credit.

There are three main types of credit fraud alerts:

-

Fraud alert: This basic type of alert is available to any consumer. It lasts for a year and is renewable. You don’t have to have been a victim of fraud or identity theft to request one.

-

Extended fraud alert: An extended fraud alert lasts for seven years. It’s available only to consumers who have been victims of identity theft and have filed a report with either identitytheft.gov or the police. Credit bureaus will also take your name off marketing lists for credit and insurance offers for five years unless you ask to stay on.

-

Active-duty fraud alert: This alert designed for military service members lasts a year and can be renewed for the length of deployment. In addition, the credit bureaus will remove your name from marketing lists for unsolicited credit and insurance offers for two years, unless you ask them not to.

Recommended Reading: Does Klarna Hurt Your Credit Score

Fraud Alerts Vs Security Freezes

A federal law went into effect in September 2018 that gives consumers the option to freeze and unfreeze their credit with the credit bureaus. Security freezes are free and can be requested at any time.

However, note that youll have to contact each credit bureau individually and request a security freeze with each organization.

A security freeze stops any new creditors from accessing your credit report or opening a new account until you unfreeze the account. The only exceptions are:

- Requests to view your credit report for employment, insurance or tenant screening

- Some government entities, such as child support agencies

- Companies youve hired to monitor your credit report

A fraud alert reduces your riskof identity theft or fraud, but its not a guarantee. Creditors only have to make a reasonable effort to verify your identity before approving a credit application.

So, if the fraudster has enough information to surpass these identity checks, fraud can still occur with a fraud alert on your account.

In comparison, a security freeze makes fraud or identity theft nearly impossible. The majority of creditors wont open a new credit account without getting access to a report. The only exception is that a security freeze cant stop fraudsters from taking over an existing open account.

On the other hand, a security freeze means youll have to make do with your open accounts until youre ready to lift the freeze.

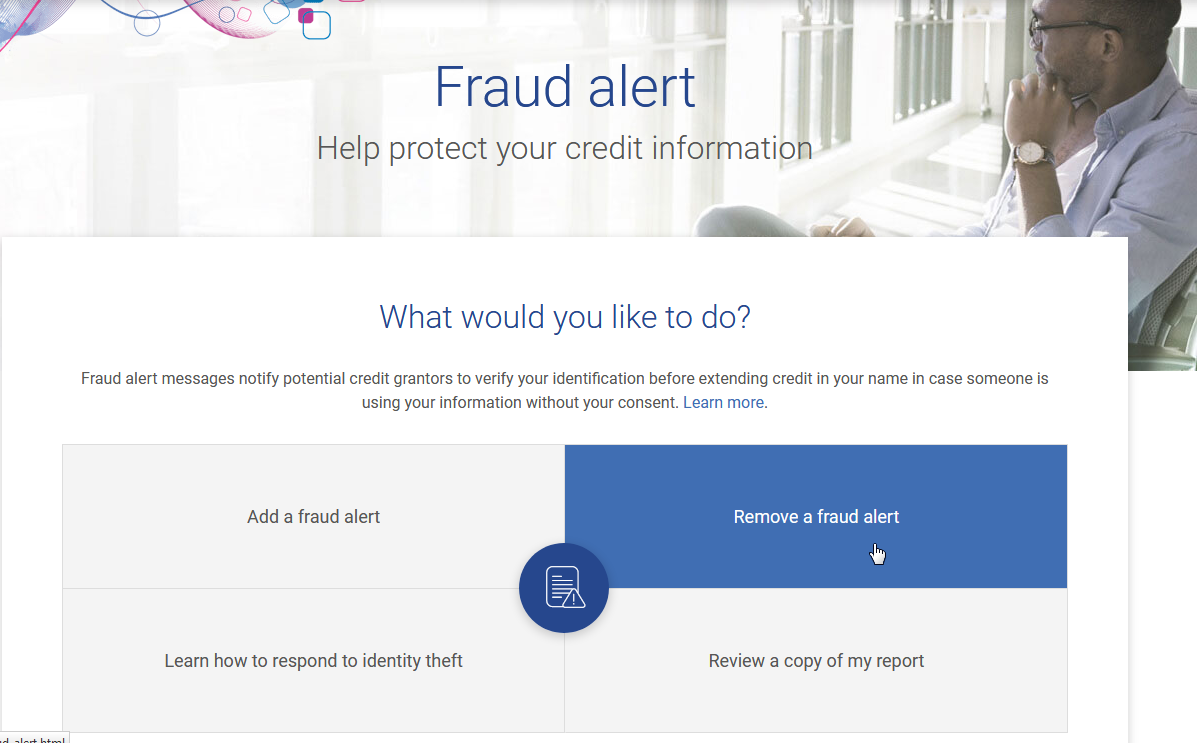

How To Remove A Fraud Alert From Your Credit Report

After one year, the fraud alert expires. You can renew the fraud alert if you feel your protection is still at risk. If you feel its no longer necessary, you can choose to remove it prior to the one-year mark. Removing a fraud alert from your credit report is similar to placing one contact one of the credit bureaus and request to remove it from your credit report.

Recommended Reading: How To Remove A Repossession From Your Credit

Put A Fraud Alert On Your Credit Report

Fraud can negatively impact your credit score leaving long-lasting effects which means protecting your credit from further damage should be high on the list of priorities if youre affected.

Contact any one of the three credit reporting agencies and request a fraud alert, says Steven Katz, former director of consumer education for TransUnions TrueCredit.com. By doing so, a fraud alert will be put on all three of your credit files.

Fraud alerts are free and, once placed, remain on your report for one year. If youd like to keep the alert longer, you can get a new one after the first year. An alert makes it difficult for fraudsters to open accounts in your name businesses must contact you before issuing any credit when a fraud alert is on your report.

Filing a fraud alert is probably the best step for someone who is unsure if they are a victim, says Katz. If nothing else, you can gain peace of mind.

If you are a victim of identity theft, you can place an extended fraud alert on your report, lasting seven years. Before placing the extended alert, youll need to complete your Identity Theft Report.

What Is Fraud Alert

A fraud alert is used to inform creditors that you may be a victim of fraud. A fraud alert can make it harder for an identity thief to open accounts in your name. The fraud alert requires creditors to verify that you are the person adding new credit accounts or changing limits on existing credit accounts by contacting you at a phone number you have provided.

There are three types of alerts you can place on your file:

- Initial fraud alert – if you suspect that you have become or are about to become a victim of fraud or identity theft

- Extended fraud alert – if you are a victim of fraud or identity theft requires a copy of the identity theft report

- Active duty military alert – if you are in the military and want to minimize your risk of fraud or identity theft while you are deployed .

Contact any one of the credit reporting companies to place a fraud alert. They will share your request with the other credit reporting companies.

Read Also: What Is Syncb Ntwk

Report The Identity Theft To The Ftc

In the United States, you can report your identity theft to the FTC by completing the online form at IdentityTheft.gov or by calling 877-438-4338 and providing as many details as possible.

You can save the report and recovery plan by creating an account through the FTCs website or printing them yourself. You should have a copy on hand if you decide to file a police report and additional copies to provide to your creditors.

Ask A Consumer Reporting Agency To Issue A Fraud Alert

Equifax and TransUnion are the 2 main consumer reporting agencies in Canada. You should contact both of them and ask them to issue a fraud alert for you. Each agency needs to be contacted separately.

A fraud alert stays on your credit file for 6 years. It costs about $5.00 per agency if you are not already a victim of identity theft. If you are already a victim, the consumer reporting agencies do not charge you for the fraud alert. The consumer reporting agencies can tell you if you are considered a victim of identity theft.

TransUnions Fraud Victim Assistance Department can help you understand how to place a fraud alert.

When a issues a fraud alert, anyone who checks your credit report will see that your identity may have been stolen. This means your creditors can then take steps to check your identity when someone tries to use your identity or accounts.

In order to place a fraud alert with Equifax, you must call them at 1-800-465-7166

For TransUnion, you can ask for a fraud alert by phone or by mail at:

P.O. Box 338, LCD 1Hamilton, Ontario

Their mail-in form is available online.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Replace Your Stolen Identification

If your Social Security card was stolen, you can request a replacement card online.

Notify the Office of the Inspector General if your Social Security number has been fraudulently used and create an account online to get a copy of your Personal Earnings and Benefits Statement, which you can check for accuracy.

If your drivers license was compromised, you can contact your local Department of Motor Vehicles to report and replace it. If someone is using your license as an identification or there is a risk someone will, the number may be flagged.

For a stolen passport, the theft should be reported to the State Department either online, by mail or by phone at 877-487-2778. You can replace a passport by making an appointment at a Passport Agency or Center or by applying for replacement at a passport acceptance facility.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Recommended Reading: Does Paypal Report To Credit Bureaus

How Credit Card Fraud Happens

- make a purchase at a place of business

- make a purchase or transaction online

- make a purchase or transaction by telephone

- withdraw money from an automated teller machine

A person can steal your credit card or credit card information by:

- going through your garbage or mailbox to find credit card statements or other banking information

- swiping your credit card through a device that copies the information stored on the magnetic stripe of your card

- hacking into the computers of companies and stealing credit card information

- installing small devices on payment terminals that record your credit card information

- phishing, that is, sending you an email that looks like it comes from a real business asking for credit card information

- asking you to use your credit card on an illegitimate website to make a purchase

Place One Of Three Fraud Alerts On Your Credit Report

These are the three types of fraud alerts that you can implement on your credit reports:

- Initial fraud alert

- Extended fraud alert

Initial fraud alert

If you suspect your wallet, financial information or credit card number has been lost or stolen, you can ask for an initial fraud alert to be placed on your credit file.

An initial fraud alert lasts 90 days. During that time, it should be more difficult for an identity thief to open accounts in your name because the alert requires a business to verify your identity before a new line of credit is approved.

You can apply for an initial fraud alert by phone, mail, or online, using the contact information above.

The CRA websites noted above will take you to where you can submit your request online or mail a written fraud alert letter.

Remember, initial fraud alerts last only 90 days, but they can be renewed. Youll have to remind yourself to do so. Otherwise, theyll expire. Also, requesting such an alert also entitles you to order one free credit report from each credit reporting agency.

Active duty alert

If youre a service member and about to be deployed, you can place an active duty alert on your credit report that lasts for one year and can be renewed for the length of your deployment.

This can be very helpful in protecting your identity while deployed, because a business will have to take extra steps before giving credit in your name.

Extended fraud alert

Recommended Reading: Syncb Inquiry