Why Do Lenders Check Your Cibil Score Before Approving Your Loan

Since CIBIL score measures your overall creditworthiness, a lender is certain to check your score when reviewing your loan application for a variety of reasons. They are:

- To check your credit history and past record

- To see whether you are capable of repaying debts

- To review your credit balance and understand the risk level of your profile

- To judge whether you qualify for the loan

- To decide on the loan amount to offer you and interest rate applicable

What Is A Credit Score

As far as your bank is concerned, your credit score is a big number above your head that tells them how much of a risk you are.

Your credit score indicates to your bank whether your past debt repayment behaviour will make you a good risk or not. Through various calculations based on your transactional records, the credit bureau will provide your bank with a three-digit number ranging between 0 and 999. Naturally, the higher the better, and a high credit score rating is one of the most valuable personal finance assets you can have.

Learn And Grow Your Credit Score

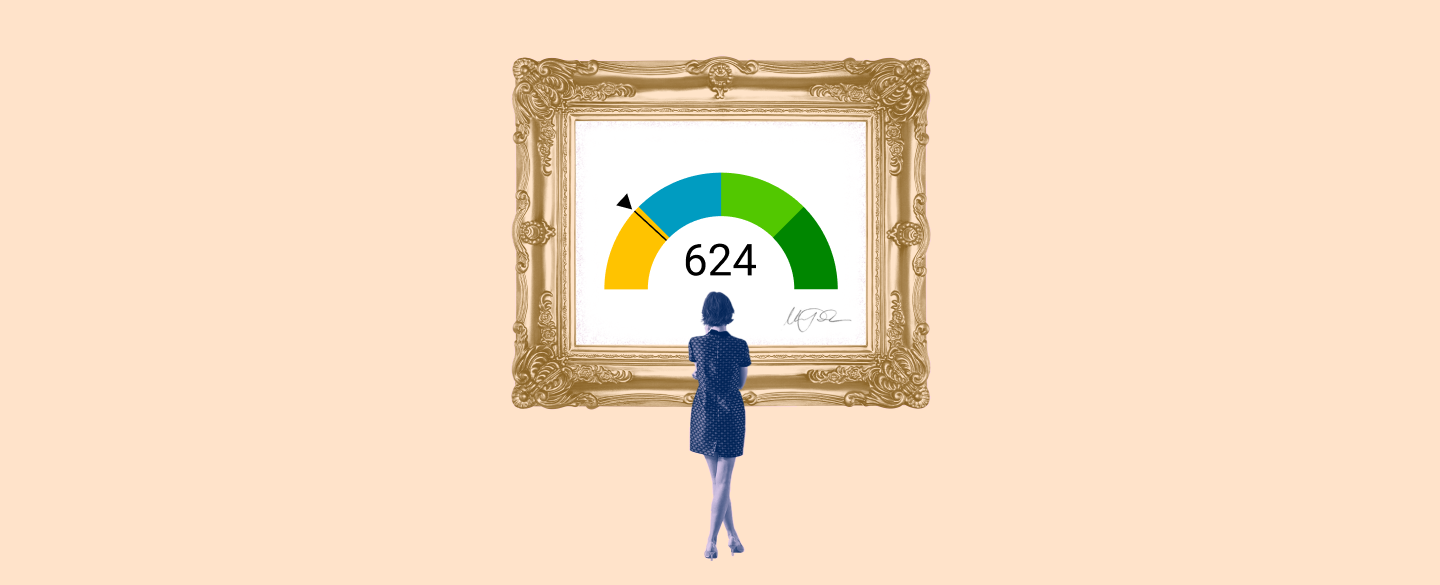

While everyone with a FICO® Score of 624 gets there by his or her own unique path, people with scores in the Fair range often have experienced credit-management challenges.

The credit reports of 41% of Americans with a FICO® Score of 624 include late payments of 30 days past due.

Credit reports of individuals with Fair credit cores in the Fair range often list late payments and collections accounts, which indicate a creditor has given up trying to recover an unpaid debt and sold the obligation to a third-party collections agent.

Some people with FICO® Scores in the Fair category may even have major negative events on their credit reports, such as foreclosures or bankruptciesevents that severely lower scores. Full recovery from these setbacks can take up to 10 years, but you can take steps now to get your score moving in the right direction.

Studying the report that accompanies your FICO® Score can help you identify the events that lowered your score. If you correct the behaviors that led to those events, work steadily to improve your credit, you can lay the groundwork to build up a better credit score.

Don’t Miss: How To Boost My Credit Score 50 Points

How Does Outstanding Debt Affect Your Credit Score

The amount of outstanding debt impacts your credit score. Lenders normally check this in the form of the credit utilisation ratio. This refers to the amount of money you are using out of the total credit available to you. The higher the ratio, the lower your credit score. However, this doesnt mean debt is bad for you. In fact, you will be able to build your credit score only when you take on debt. The key is to pay it off in a timely fashion and not go over your credit cards or bank accounts limit.

Smart Tips To Improve Your Cibil Score

- Dont be a co-signer for a loan unless you dont need to borrow around the same time

- Avoid acquiring too many debts over a short period of time

- Ensure you repay all your EMIs and credit card bills on time

- Use debt consolidation loans as and when necessary so that your dues arent handed over to a debt collection agency

- Be cautious about borrowing loans without a proper repayment plan in place

- Always negotiate your rate of interest with lenders to keep your costs down

- Dont borrow the entire amount you receive a sanction for

- Choose a shorter loan tenor to repay your loan fast and at a lower interest payment

- Talk to a CA or financial planner to get help on saving taxes and managing your money more efficiently

- If you dont have any credit history, borrow a small personal loan and repay it on time to build a credit score

Now that you know everything about your CIBIL credit score, be smart about your financial practices. Try to keep your CIBIL score high and youll be able to access funds on your terms.

Additional Read:What is CIBIL and what does it have to do with your credit score?

Taking your credit score and financial profile into consideration, Bajaj Finserv brings you pre-approved offers for personal loans, home loans, business loans and a host of other financial products. Not only does this simplify the process of availing financing, but also helps you save on time and effort.

*Terms and conditions apply

Don’t Miss: Syncb Verizon

What About Transunions Credit Score

TransUnion uses the VantageScore® 3.0 model, but the above way of looking at it still applies: two different lenders may have completely different opinions on what a good-enough TransUnion score is. And since lenders may use several different sources of information to evaluate an applicants creditworthiness, one lender may view two separate applicants differently, even if those applicants have the exact same TransUnion score under consideration.

Rebuilding Your 624 Credit Score

A Credit Repair company like Credit Glory can:

An industry leader like Credit Glory can guide you through this process. Give them a call @ , or chat with them, today â

Recommended Reading: What Is Leasingdesk

Where To Go From Here

Its important to pay down your balances and keep your credit utilization under 30%. Its also wise to have several different types of credit accounts that include a mix of installment and revolving credit.

Of course, you also want to focus on making timely payments from here on out. Even one late payment can be very damaging to your credit.

Length of credit history also plays an essential role in your credit scores. You want to show potential creditors that you have a long, positive payment history.

Building good credit doesnt happen overnight, but you can definitely speed up the process by making the right moves.

Give Lexington Law a call for a free credit consultation at and get started repairing your credit today! The sooner you start, the sooner youll be on your way to having excellent credit.

Categories

Lexington Law Credit Repair Can Help

Watch on

A credit repair service can remove negative items from your credit reports. Lexington Laws past clients have seen an average of 10.2 negative items removed from their credit reports within four months. Its definitely worth it if youve got some things on your report dragging your score down.

- Most results of any credit repair law firm

- Clients saw over 9 million negative items removed from their credit reports in 2016

- More than 500,000 credit repair clients helped since 2004

- Cancel anytime

You May Like: How To Get Rid Of Serious Delinquency On Credit Report

Make A Monthly Budget

Sticking to a budget can make it easier to stay on top of your bills. If you know how much money you can afford to spend every month, paying off your credit card and other loan balances wont feel so intimidating.

Thats important because your payment history including any late payments can have a real influence on your credit scores. Paying on time every month on accounts that report to the main consumer credit bureaus is one of the best things you can do for your credit.

What Is A Bad Credit Score

Having a bad credit score may mean some lenders will be reluctant to give you a loan or other credit product, or, depending on the loan type and lender, they may charge you a higher interest rate compared to someone with a good credit score. This is generally because you would be seen as a higher risk and less likely to be able to repay the credit.

So how low does a credit score need to be to be considered bad? Equifax considers a score below 505 to be below average, while Experian views a score below 549 as below average, and Illion considers a score of 299 or under to be a low score.

Don’t Miss: Hutton Chase Reports To Credit Bureaus

Can You Pay Off Your Balance Each Month

Never apply for a loan or credit if you dont first believe that you can afford to pay off the balance at the end of each month. This may sound obvious, but youd be surprised at how many people apply for credit or loans without asking themselves this question.

Ask yourself how you will use the credit card. Will you carry a balance, or can you indeed pay it off each month? Will you pay it off some months and not in others?

Roughly three fifths of all Americans who possess a credit card have a balance on that card. Despite this, you may want to pay off your balance at the end of each month so you can definitively avoid additional interest charges.

How To Read Your Cibil Report Or Credit Report

The credit report is a detailed document that highlights your entire credit history and record. It includes your personal information, contact information, employment history, credit limit on various credit cards, credit balances, and dates on which you opened various accounts. This credit report is viewed by various parties or organisations.

Some common parties who may view your credit report are as follows:

- Lenders like banks and non-banking financial companies

- Landlords

Given that it is a comprehensive document with multiple sections, it is important for you to know how to read your credit report. This will help you understand your report better, and even check to see if it does justice to your credit history.

Don’t Miss: Notifying Credit Bureaus Of Death

How Can I Get A Good Credit Score

To get a good credit score, you need to know first what your credit score is. It might already be good! You can find out what your credit score is by signing up for your Free Credit Report with TotallyMoney. It only takes a few moments, wonât harm your credit rating, and doesnât cost a penny. If you already know what your credit score is, and it could do with improving, you need to convince lenders that youâre a responsible borrower and that you can you can be relied upon to pay back what you owe. For more on how to get a good credit score, read our guide: â11 tips on how to improve your credit score.â

How To Improve A 627 Credit Score

Its a good idea to grab a copy of your free credit report from each of the three major credit bureaus, Equifax, Experian, and TransUnion to see what is being reported about you. If you find any negative items, you may want to hire a credit repair company such as Lexington Law. They can help you dispute them and possibly have them removed.

Lexington Law specializes in removing negative items from your credit report. They have over 18 years of experience and have removed over 7 million negative items for their clients in 2020 alone.

They can help you with the following items:

- hard inquiries

- bankruptcies

You May Like: What Is A 524 Credit Score

Is Your Credit Score High Enough To Buy A House

If your credit score is above 580,youre in the realm of mortgage eligibility. With a score above 620 you shouldhave no problem getting credit-approved to buy a house.

But remember that credit is only onepiece of the puzzle. A lender also needs to approve your income, employment, savings,and debts, as well as the location and price of the home you plan to buy.

To find out whether you can buy ahouse and how much youre approved to borrow get pre-approved by a mortgagelender. This can typically be done online for free, and it will give you averified answer about your home buying prospects.

Popular Articles

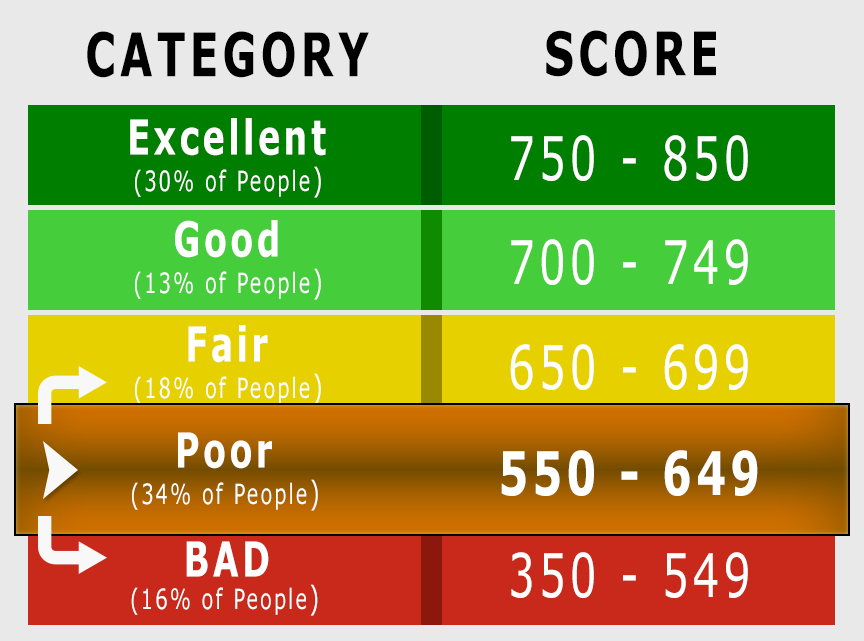

What Are The 5 Levels Of Credit Scores

FICO calculates credit scores and categorizes the scores into five levels:

- Exceptional: 800 to 850

- Very good: 740 to 799

- Good: 670 to 739

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Steve Bucci has been helping people decode and master personal finance issues for more than 20 years. He is the author of Credit Management Kit For Dummies, Credit Repair Kit For Dummies, Barnes and Noble Debt Management, co-author of Managing Your Money All-In-One For Dummies and Debt Repair Kit For Dummies . Steve is an experienced expert witness in identity theft, credit scoring, and debt-related cases. He has been a presenter at the FICO InterACT Global Conference, the Federal Reserve and the International Credit Symposium at Cambridge University in the UK.

Essential reads, delivered straight to your inbox

Stay up-to-date on the latest credit card news from product reviews to credit advice with our newsletter in your inbox twice a week.

Also Check: Coaf Hard Inquiry

Can I Get A Car / Auto Loan W/ A 624 Credit Score

Trying to qualify for an auto loan with a 624 credit score is expensive. Thereâs too much risk for a car lender without charging very high interest rates.

Even if you could take out an auto loan with a 624 credit score, you probably don’t want to with such high interest.

There is good news though.

This is completely avoidable with a few simple steps to repair your credit.

Your best option at this stage is reaching out to a credit repair company to evaluate your score and see how they can fix it.

Can You Get A Credit Card With A 627 Credit Score

Credit card applicants with a credit score in this range may be required to put down a security deposit. Applying for a secured credit card is probably your best option. However, they often require deposits of $500 $1,000. You may also be able to get a starter credit card from a credit union. Its an unsecured credit card, but it comes with a low credit limit and high interest rate.

If you are able to get approved for a credit card, you must make your monthly payments on time and keep your balance below 30% of your credit limit.

See also:7 Best Secured Credit Cards

You May Like: Zebit Approval Odds

Length Of Credit History

The remaining three pieces are not weighted as heavily, but they are still important. At 15% for FICO and considered less influential with VantageScore is credit history, which is not to be confused with your payment history. This measures the length of your oldest credit line and the average age of your accounts, so try to keep your oldest accounts open if possible.

Can I Get A Home Loan With A Credit Score Of 627

The minimum credit score is around 620 for most conventional lenders.

However, for those interested in applying for an FHA loan, applicants are only required to have a minimum FICO score of 500 to qualify for a down payment of around 10%. Those with a credit score of 580 can qualify for a down payment as low as 3.5%.

See also: 9 Best Mortgage Loans for Bad Credit

Read Also: Does Aarons Build Your Credit

Lots Of Hard Inquiries

Hard inquiries can hurt your credit score. Hard inquiries are when you authorize someone to view your credit report to apply for a new loan, mortgage, or credit card.

Just one hard inquiry can lower your credit score by five points. When your credit score is already in the Fair or Very Poor category, this is a big deal. Hard inquiries impact your score for a full 12 months after the inquiry.

With a credit score of 624, its important that you dont make too many hard inquiries, especially in a short period. Try to improve your credit score before making any more hard inquiries if you can help it.

Mortgage Overlays: Credit Requirements Vary Bylender

A mortgage overlay isan additional mortgage guideline imposed by a lender, which goes beyond theloans official minimum standard.

For example, FHA allows FICO scores as low as 500, but some lenders set their minimums at 620.

According to FannieMae, the majority of mortgage lenders apply mortgage overlays. The most commonoverlay relates to credit scores.

About half of lenderssurveyed apply overlays to the minimum credit score requirements of a mortgageloan. Your 500 FICO score, therefore, may not get you FHA-approved, even if theFHA allows it.

This is why its smartto re-apply for a mortgage if youve recently been denied. Your loan may havebeen turned down, but that could be because of an overlay. Theres a chance you could be approved by a lenderwith looser guidelines.

Apply at a differentbank, you may get better results.

How mortgage lenders pull credit

When you apply for amortgage, lenders pull a credit report from all three credit bureaus on you.Their decisions to lend, and the terms of your loan, depend on theresult of those reports.

Lenders qualify youbased on your middle credit score.

For example, if your scores are 720, 740, and 750, thelender will use 740 as your FICO. If your scores are 630, 690, and 690, thelender will use 690 as your FICO.

When you apply with aspouse or co-borrower, the lender will use the lower of the two applicantsmiddle credit scores.

Also Check: Brksb/cbna