How To Use Affirm Online

You can use Affirm to shop online or through the mobile app. Specifically, you can use Affirm to make purchases:

- At partner store websites

- Through Affirm.com

- Inside the Affirm mobile app

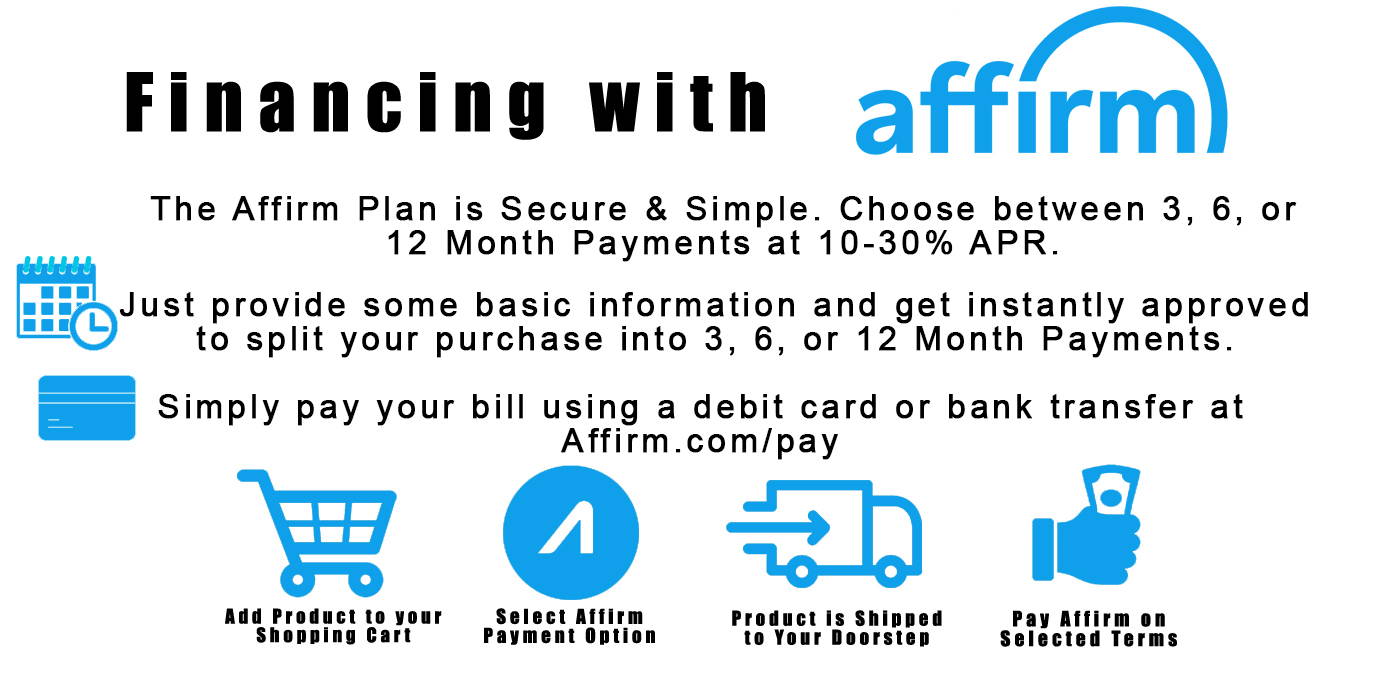

You would simply shop for the items you want, then add them to your cart. When you’re ready to pay, you’d choose Affirm as your payment option at checkout. Affirm then allows you to choose your payment terms and complete the purchase.

Affirm Vs Credit Card

The benefit of using Affirm for credit purchases instead of a credit card is that Affirm does not charge late fees, hidden fees or compound interest. They do charge an interest rate, but a user will know exactly how much theyâll be paying from the start. With a credit card repayment, late fees are charged for missed payments and unexpected interest payments can increase the price of the loan. Late fees, hidden fees and interest are also common contributors to credit card debt.

Affirm also reports on time payments to Experian, while other service providers do not do this. This gives you the opportunity to improve your credit score, as long as you do not make a late payment.

Minimum & Maximum Purchase Amounts

Affirm doesn’t state a minimum purchase size on its website for consumers. Instead, it’s up to merchants who partner with Affirm to set minimum purchase guidelines. Affirm’s business website mentions a minimum of $50.

Affirm’s website mentions a maximum purchase of $17,500. But again, the actual amount you’re able to finance with a point of sale installment loan from Affirm can vary based on the merchant.

Also Check: How To Improve Your Credit Score In 30 Days

What Credit Score Is Needed For Affirm

Affirm Credit Score For Approval. Affirm reports that you’re “more likely to be approved” for their financing with a score of 640 or higher. There are user reports of being approved with a score as low as 600. Ensuring your revolving balances are low and that you have less than six inquiries will help.

More Info About Affirm

Affirm is an online lender that allows consumers to purchase goods on credit. When making a purchase, consumers choose their repayment options, such as monthly payments.

Affirm was founded in 2012 and launched its consumer app in 2017. In the past several years, the company has partnered with Walmart, Shopify, Zen Cart, and BigCommerce. Consumers can use Affirm as a payment method through any of the partner sites.

You May Like: Does Drivetime Report To Credit Bureaus

Does Affirm Have Any Credit Limit In Place

Affirm does not list a maximum credit limit. The spending limit you are eligible for depends on the specific retailer you apply to. To provide customers with the highest spending limit possible, Affirm uses an algorithm that examines many factors including:

-

How long youâve had an Affirm account

-

Repayment history with Affirm

Affirm May Be A Good Option If You:

Are offered a zero-interest loan: Some Affirm merchants like Amazon, Peloton and Neiman Marcus offer zero-interest financing. As long as you make your payments on time, you can break down your purchase into installments for no additional cost.

Need to fund a large expense: If theres a big-ticket item you need to purchase , but cant afford it outright, Affirm is a way to get your item now and pay later. Since it offers longer terms than other BNPL providers, your monthly payments could be very affordable.

Dont qualify for a credit card: Qualifying for a BNPL plan could be easier than qualifying for a credit card, especially for borrowers who dont have an established credit history. According to the company, Affirm never conducts a hard credit check and considers other data besides your credit score when deciding whether to approve or deny you for a loan.

Don’t Miss: Do Utility Bills Affect Credit Score

Does Affirm Hurt Credit Score

975 Views

Affirm will perform a soft credit check. This wont affect your credit score or show up on your credit report. There is no minimum credit score to use Affirm. Loan approval depends on your credit score, your payment history with Affirm, how long youve had an Affirm account and the merchants available interest rate.

Just so, Does Afterpay build credit?

Afterpay will not help you build your credit history because it does not report its loans to the credit bureaus. While this is helpful to get approved, its lack of reporting of your positive payment history will not help your credit either.

Is Klarna legit? Is Klarna safe? Putting aside the issue of taking on unnecessary additional debt, Klarna is safe in the way it takes payments and stores customers details.

Similarly, Does PayPal credit affect credit score?

Yes, applying for PayPal Credit affects your credit score. PayPal is partnered with a bank called Synchrony Bank, which will review your application and then complete an audit. This hard check will appear on your credit report for 2 years and could lower your credit score by a few points.

Read Also: Navy Federal Auto Loan Reviews

Affirm Is Straightforward About What You Will Pay

Affirm promises you wont be hit with any hidden fees or prepayment penalties. For instance, if you come into an unexpected windfall and decide to use it to pay off your Affirm loan, Affirm is cool with that. They wont charge you a fee for denying them the additional interest.

Affirm wont even hit you with a late fee if youre late with a payment. They will, however, probably not opt to give you another loan in the future. They also do not offer extensions on your loans, so be sure you pick a term long enough so your monthly payments arent a burden.

Affirm is also an alternative to personal loans that offer fixed repayment terms and, in some cases, better interest rates than credit cards for borrowers with excellent credit. Affirm is attractive because it may offer you financing at the point-of-sale, whereas a personal loan takes between 24 hours and a week to get approved.

You May Like: Is 586 A Good Credit Score

Also Check: How To Make Your Credit Report Better

Maytag Appliance Financing Options With Affirm

Get the appliances you need with the flexibility of a payment plan. Choose Affirm at checkout and receive your loan qualification decision in real time.

*Your rate will be 0% or 1030% APR based on credit, and is subject to an eligibility check. Payment options depend on your purchase amount, and a down payment may be required. Payment options through Affirm are provided by these lending partners: affirm.com/lenders.

Is It Hard To Get Approved For Furniture Financing

Bad credit can make it tough to finance a furniture purchase. If youre willing to shop around, however, you can find reasonable financing deals from retailers, loan marketplaces, and credit card issuers so you can get the furniture you need. Compare personal loan rates from multiple lenders in minutes.

You May Like: How Long Do Late Payments Stay On Your Credit Report

Do Affirm Loans Help Your Credit

In theory, Affirm loans could help your credit when you make timely payments. That said, one important factor for your credit sore is your credit utilization ratio. What makes your credit score happy is when you have a lot of credit available to you, but you havent used a lot of it. For example, having a couple of credit cards with over $10k in available credit, but a low balance that you regularly pay off each month. That would give you a good credit utilization ratio. On the other hand, if you have a lot of credit extended to you and you have high balances on that credit, that can actually harm your score. On top of that, when you actually pay off your loan with Affirm, you are essentially closing off a line of credit extended to you, which could in theory harm your score.

How Returns Work When Using Affirm

If you have an issue with a purchase or need to return an item, Affirm advises customers to contact the merchant directly. You’d then have to follow the store’s policies for returns.

In terms of what happens to your Affirm loan after making a return, there are a few possibilities. For instance, Affirm can cancel your loan completely if the merchant has finalized the return. If the amount that’s returned to you is more than the loan, then Affirm can return this overpayment to you.

But the result may be different if the merchant only issues a partial refund or issues store credit in lieu of a refund. In that case, you would still be responsible for paying any remaining balance due on your Affirm loan, even if you’ve returned the item you purchased.

If you’re not able to resolve a return or refund issue with a merchant, you can initiate a dispute with Affirm. If you win the dispute with the merchant, Affirm will refund the full amount of the purchase along with any interest paid. But if the dispute goes in favor of the merchant, you’d still be responsible for paying your Affirm loan in full.

You May Like: Is 796 A Good Credit Score

Affirm Provides Instant Funding For Online And In

Affirm is a buy-now-pay-later company that was launched in 2012 by Paypal co-founder Max Levchin. These days, it seems to be just about everywhere, offering you the option right during the checkout process to split your purchase up into several payments over time.

Business is booming, too. Revenue was up by 55% in Q2 2021 compared to Q2 2020. Affirm is meant to be quick and easy, which means it’s a good idea to ensure you’re not paying for convenience in the form of higher costs.

Affirm Reviews And Complaints

Affirm has a mixed online reputation as of November 2020. It scores slightly over 1 out of 5 stars on the Better Business Bureau, based on over 160 customer reviews. Several customers cited unprofessional staff and trouble closing an account as the main source of complaint.

It does better on Trustpilot, scoring 4.6 out of 5 stars based on more than 3,375 reviews, with some shoppers complaining about customer service while others complimented the service for an efficient overall process.

Don’t Miss: How To Get A 720 Credit Score In 6 Months

Buy Now Pay Later Services Offering No Hard Credit Checks

Disclosure: This post may contain affiliate links, meaning we get a commission if you decide to make a purchase through our links, at no cost to you. Please read our disclosure for more info.

Buy now pay later no credit check loans are increasing in popularity. Youve probably seen it on your favorite retailers websites. When you checkout theres the option to buy now and pay later, allowing you to pay in four equal installments and usually for no interest or fees and with no hard credit check.

If you have no credit or bad credit, these can seem like a great optionbut only if you know how they work, and which companies are the best options for those in search of no-credit-check online financing.

In This Post:

Also Check: How Long Does A Dismissed Bankruptcy Stay On Credit

Affirm Makes It Easy To Go Into Debt

Lets talk a little about how Affirm works.

You have to download the app or go to Affirms website to create an account. Account holders have to be at least 18 and be a permanent resident or citizen of the U.S. You hand over your personal infolike your cell number, email address and the last four digits of your Social Security number. And you have to agree to receive texts from Affirm. Oh, and dont forget, you need a decent credit score too.

Affirm works with thousands of sites and stores. In fact, as of August 2021, even some Amazon customers can go this route. As youre checking out, you just select Affirm as your payment method.

Then you pick if you want to pay for the item for three, six or 12 months . Once you select the financing option and click to purchase the item, Affirm pays the company, and then you have to pay Affirm the amount of the purchase, plus interest.

And lets talk about that interest. Remember, Affirm is banking on you paying as much interest as possible so they make more money. The idea of paying off an item in lots of little payments may seem so much more manageable to your budget. It feels like a good idea. But the longer you take to pay, the more you pay. Trust us: Thats nota good idea for your budget .

Side note: Affirm checks your credit to make sure youre eligible for the loan. The check itself wont affect your credit score, but late payments can. Well cover that gem more in a moment.

Read Also: Do Medical Bills Affect Your Credit Score

Affirm Review: Why You Should Stay Away

7 Min Read | Aug 16, 2022

Online shoppers, guess what? Theres a new bad guy in town. This wolf in sheeps clothing claims to make your life easier, but what theyre really selling is an easier way to go into debt.

Whos this wolf? Affirm. Dont be fooled by their promises of spending freedom. Theyre telling you to spend money you dont have, but you know better than that. Lets find out exactly why you should stay away.

Features Of Shopping With Affirm

- Extra security. Because you don’t provide a credit card number for purchases made through Affirm, you benefit from an extra layer of protection against identity theft or fraud.

- Flexible payback terms. Depending on how much you can afford to pay each month, choose payback terms of three, six or 12 months using online payments, debit cards or checks.

- No prepayment penalties. Save money and improve your credit score by paying back your loan early with no added fees.

- No late fees. Don’t worry about getting dinged with a late fee if you miss a payment. However, while you might not take a hit financially, missing a payment could negatively affect your credit score.

- Builds credit. Taking out a loan and repaying it on time improves your credit score.

- Take out multiple Affirm loans at once. Each Affirm application is evaluated as a separate, closed-end transaction, so you can have several Affirm loans open at once.

- Soft credit pull. Applying for Affirm financing won’t hurt your credit score since it uses a soft credit check, which doesn’t affect your credit. However, any purchases you make using Affirm can affect your credit score.

- Get payment reminders. Affirm will send you email and text reminders about upcoming payments.

- Manage your account on the go. Affirm’s easy-to-use mobile app lets you make payments and manage your account from any device, anywhere.

Recommended Reading: Do Remarks Affect Credit Score

How Does Affirm Approve Borrowers For Loans

Affirm will ask you for a few pieces of personal information your name, email, mobile phone number, date of birth, and the last four digits of your social security number. Affirm uses this information to verify your identity and to make an instant loan decision. Affirm will base its loan decision not only on your credit score but also on several other data points about you. This means you may be able to obtain financing from Affirm even if dont have an extensive credit history.

Full Review Of Affirm

Affirm offers buy now, pay later payment plans for online and in-store purchases when you shop at select partners, including Amazon, Walmart, Nordstrom and Best Buy.

Its zero-interest, pay-in-four loan is similar to those offered by other BNPL providers like Afterpay and PayPal. It also has longer monthly payment plans that may charge interest.

If youre shopping for something you dont need, NerdWallet recommends paying for it with cash. But if you need to fund an essential purchase, a BNPL plan can help you break it up into more manageable chunks. Just make sure the loan comes with zero interest or a low enough rate that you can comfortably afford the monthly payments.

Also Check: Is 692 A Good Credit Score

What Does The Affirm Process Look Like

The process for using an Affirm loan is simple.

Shop your favourite stores, including Apple, Sephora, or Oakley. When you are ready to check out, select Affirm as your payment option of choice.

Use your mobile phone to enter some personal information and then select the payment plan that works for you. Affirm will outline all of the loan terms including APR, interest charges, your installment payments, and the total loan amount.

If you qualify for the payment plan, you can confirm and make your purchase.

What Does The Affirm Loan Cover

Your Affirm payments will be applied to the cost of your device and accessories, as well as your initial Cricket service charge. Subsequent monthly service charges for wireless plans and features cannot be paid through Affirm. Instead, they must be paid directly to Cricket by credit or debit card, Cricket Refill Cards, Service Payment Cards, Apple Pay, Google Pay, Samsung Pay, or cash. Read more about bill pay methods.

If you fail to pay Cricket for your monthly service plan, you may experience an interruption in service.

Cricket Protect and Cricket Protect Plus device coverage can not be purchased using Affirm. If you have Cricket Protect in your shopping cart and select Affirm at checkout, Protect will automatically be removed from your cart. You can add Cricket Protect or Cricket Protect Plus within seven days after activation using My Account.

Affirm cannot be used to sign up for Cricket Auto Pay.

Also Check: Is An 850 Credit Score Possible

Can You Have 2 Afterpays At Once

Yes you can, Afterpay will monitor your account. If you are up to date with your payments you have the option to have multiple orders running simultaneously. In the case that you have overdue payments or too many scheduled payments Afterpay will decline your application and provide you with the reason.

Dont Miss: Which Business Credit Cards Do Not Report Personal Credit