Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you dont pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

Negative Information In A Credit Report

Negative information in a can include public recordstax liens, judgments, bankruptciesthat provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

How To Get My Experian Credit Report

You can access your credit report from Experian via email or by post by placing a request for the same. Every request should be supported with a copy of the Request Form, identity and address proof, and a contact number. It can take up to ten working days to receive your report.

An easier and faster alternative is signing up with ClearScore and getting your free Experian credit report emailed directly to you, along with useful tips to improve credit score.

Recommended Reading: How Personal Responsibility Can Affect Your Credit Report

Remember When It Comes To Your Credit Scores Updating

- Although updates to your credit score usually occur at least once a month, this frequency could vary depending on your lenders and unique financial situation.

- Its normal for your credit score to change over time based on your financial behavior.

- Its up to each individual lender to decide if and when they will report information as well as which of the CRAs they report to, if any.

- Be sure to request a new copy of your credit score in order to see any changes.

Also Check: Does American Express Report To Credit Bureaus

Ram Credit Information Is Now Experian

Our logo and company name has changed from RAM Credit Information to Experian. By combining RAMCIs data expertise and local knowledge together with Experians world leading capabilities, we will better serve consumers and businesses in Malaysia. Established more than 125 years ago, Experian is a global leader in consumer and business credit reporting and services and has a long history of investment and commitment to Malaysia.

Also Check: Does Paypal Credit Report To The Credit Bureaus 2019

You May Like: Does Snap Finance Report To Credit Bureaus

Benefits Of Obtaining Your Experian Credit Information Report

If you obtain your Experian credit information report, you will find out exactly where you stand in terms of loan eligibility. Also, since Experian credit reports are detailed records of your credit behaviour, you will be easily able to report any inconsistencies, discrepancies, or potentially fraudulent transactions or instances of identity theft.

If left unchecked, these anomalies can bring your Experian credit score down, making it difficult for you to get a loan or credit card in the future. If you do spot such anomalies, you must report the same to Experian so that you can prevent them from causing a downfall in your creditworthiness.

+ Ways How To Gift Audible Credits

12 September 2022

5+ Easy Ways Why Is My Experian Score Higher Than Credit Karma. They are able to give you access to your score for free. On the customer review site consumeraffairs, some people have reported that their credit karma score is quite a bit higher than their fico scores.20 whether . Because of this, each of the three credit reference . Some lenders report to all three major credit reference agencies, but others report to only one or two. Credit karma uses a different scoring system than the one mortgage lenders use.

For one, lenders may pull your credit from different credit bureaus, whether it is experian, equifax or transunion. On the customer review site consumeraffairs, some people have reported that their credit karma score is quite a bit higher than their fico scores.20 whether . Which is more accurate for your credit scores? That’s because both fico and vantagescore .

Read Also: When Do Credit Cards Report Balances

What Factors Affect An Experian Business Credit Report

A credit score contains score factors that explain how items on your credit report affect your credit score. Each credit reporting agency calculates business credit scores differently by using its own unique methodology. According to Experian, your business credit score is based on:

- Number of trade accounts, balances outstanding, payment history, cash flow, credit utilization, and trends over time.

- Public Records How recent and frequent your liens, judgments, and bankruptcies with the amount of money involved are.

- Demographic Information Years registered, Standard Industrial Classification code, North American Industry Classification System code, and size of business.

There are a few more factors according to Experian:

- The number of lines of business credit you have applied for in the last nine months.

- The number of lines of business credit opened in the last six months, as well as the number of lines of business credit used.

- Number of collections or tax liens in the past seven years.

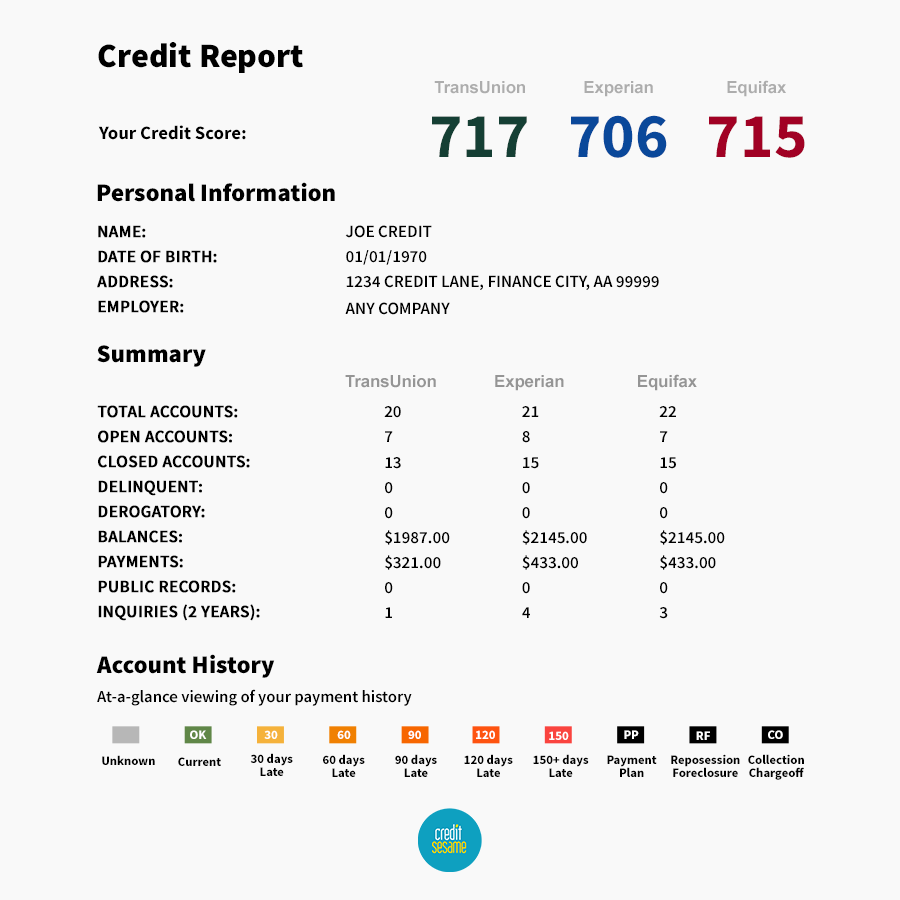

What Is Considered A Good Fico Score

A good FICO® Score starts at 670. If your score is above 740, you can generally expect lenders to offer you better-than-average interest rates. As you move closer to the top score of 850, you’ll more likely qualify for the lowest interest rates and the most premium credit card offers.

On the flip side, a score of 570 to 669 is considered fair, while 300 to 569 is considered poor. You can still qualify for loans and credit cards with a lower FICO® Score, but you may be required to pay higher interest rates, make a bigger down payment or pay additional fees. Even landlords may require a credit check before they will rent you an apartment. So a lower credit score could put you at risk for securing a place.

Read Also: How To Remove A Default Judgement From Credit Report

How To Establish And Build Business Credit

Start establishing a business credit history by legally registering your business and getting an employer identification number from the IRS. Open business bank accounts, leases, utility services and other accounts in your businesss name, rather than your own.

You can begin to build business credit by making moves such as getting a business credit card and requesting trade credit from suppliers, then making your payments on time. For these payments to help your business credit score, youll need to work with companies that report to business credit bureaus. Not all of them do, but companies are often willing to do so if you ask.

As with personal credit, paying your creditors on time is key to improving your business credit score. You should also check your business credit score regularly, making sure the information in your credit report is correct and current.

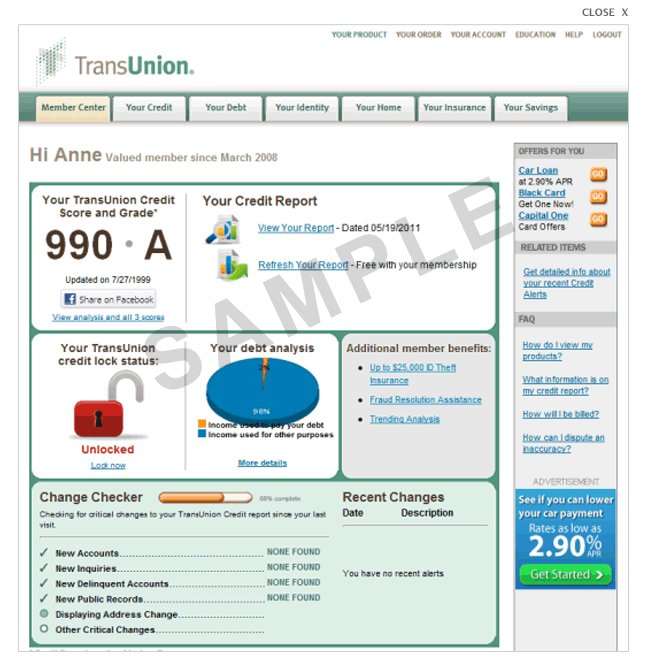

How To Check If My Credit Report Is Frozen

Quick Answer

Through December 31, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

Freezing your credit reports can be a good way to prevent a fraudster from using your information to open a credit account in your name. However, you want to remember to unfreeze your reports before you apply for a loan, credit card or rentalotherwise, your application could be denied because the lender can’t review your credit.

Recommended Reading: Do Debit Cards Affect Credit Score

How Experian Go Works

If youre interested in the program, you can sign up for a free account here. When creating a new account, youll be asked to authenticate your identity using a government-issued ID, Social Security number and a photo of your face.

Technically, there are two parts to how this all works: Experian Boost and Experian Go. Launched in 2019, Experian Boost lets you add cell phone, utility or video streaming bill payments directly to your Experian credit report. Experian Go allows users to create new credit reports from scratch, and offers personalized recommendations for which accounts to add, using Experian Boost.

Theres no difference between an Experian Go-generated report and the traditional reports that Experian already offers, according to a company spokesperson: To a lender, it will look just like any other Experian credit report.

Based on the results of a targeted soft launch of Experian Go in October, Experian says that 15,000 users were able build a credit report within minutes. The company says that for those that used Experian Boost, the average starting FICO Score was 665, which is considered a fair score. Experian did not immediately respond to a request for additional information.

What Do Lenders See On Your Credit Report

What you see on your credit reports may be slightly different from the things lenders who are reviewing your credit might see. But generally, if a lender is reviewing your credit, they might see your:

- Personal information, such as your name, current address and previous addresses.

- Credit and loan accounts, including information about your payment history.

- Employment history.

Recommended Reading: How To Raise Credit Score To 800

What Freezing Your Experian Credit Report Wont Do

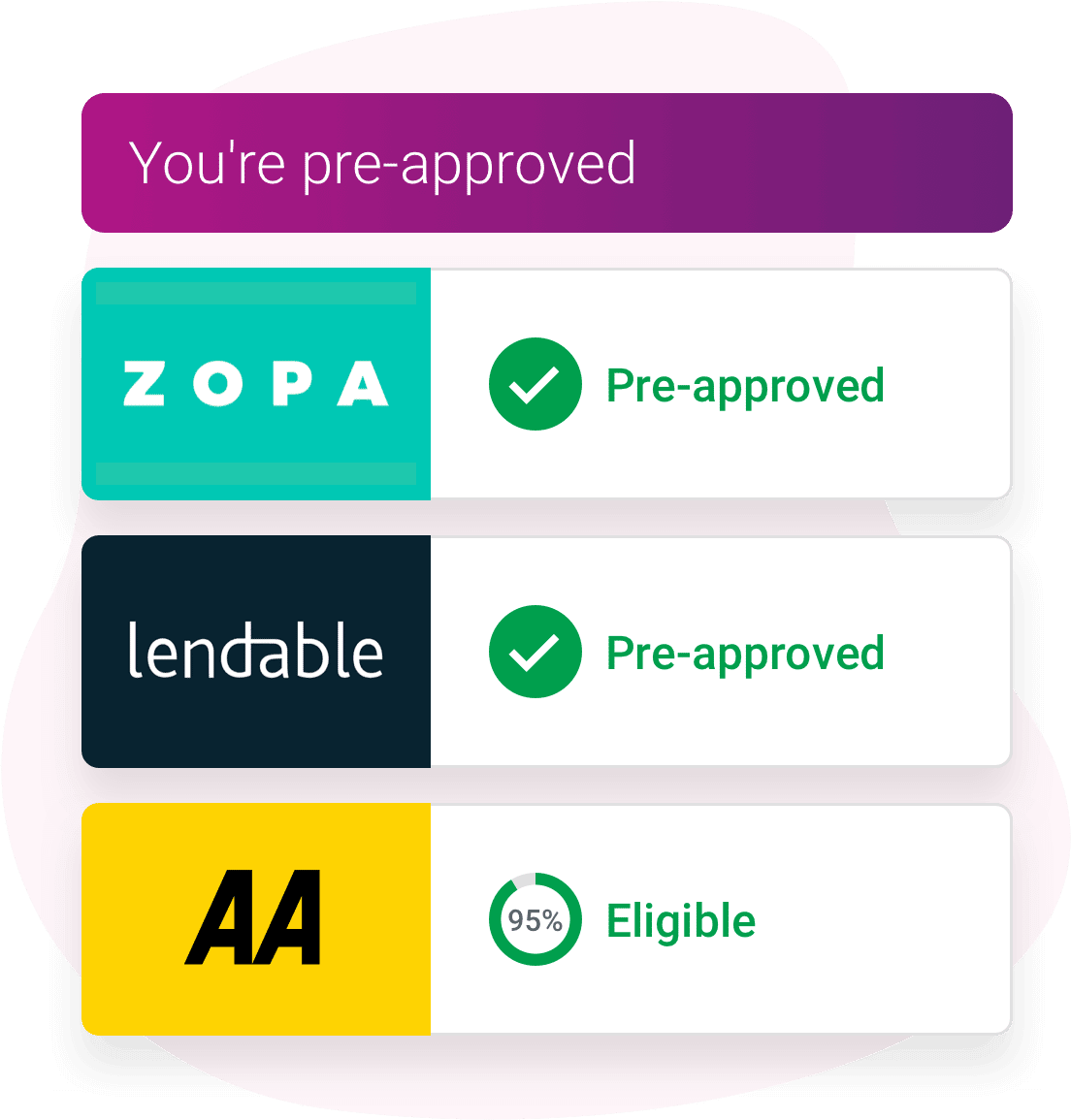

Most companies wont be able to access your Experian credit information while you have a freeze in place. The exception is companies that you already have an account with and collection agencies that are collecting a debt on behalf of one of your previous creditors. Companies can also access your credit report information, in aggregate form, to prescreen you for credit offers.

You can stop receiving prescreened credit card offers by calling 1-888-567-8688 or visiting optoutprescreen.com.

Recommended Reading: Zzounds Credit

Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

Read Also: How To Get A Tri Merge Credit Report

Understanding Your Experian Credit Score

Experian is a globally recognised credit information company that has its operations in multiple countries. In India, it started its operation in 2010. It is the only credit information company that licensed by Credit Information Companies Act 2005 .

As per guidelines issued by the RBI and Credit Information Companies Act of 2005, Experian provides credit score and credit report to both consumers and lenders.

Does Your Credit Score Update Every Month

Your credit score probably will update every month, since creditors could be reporting as often as every 30 days.

If you use more than one form of credit â for example, student loan plus credit card plus mortgage â then youâll likely have information reported each month. As noted, any time new information is received â a credit card bill paid, a car loan approved â the credit reporting bureaus recalculate your score.

How often is your credit score updated? Could it be updated daily? Possibly, if creditors send new information every single day of the month. For most consumers, thatâs unlikely.

Don’t Miss: What Credit Report Do Lenders Use

Does Checking My Credit Report Hurt My Credit Score

Checking your credit report is a soft credit check so it doesn’t affect your credit score. A soft credit check occurs when you check your own credit report or a creditor or lender checks your credit for pre-approval. A hard credit check occurs when a company checks your report when you apply for a line of credit.

Annualcreditreport.com is the only website legally authorized to fill orders for your free annual credit report. Any other website claiming to offer free credit reports” could be falsely claiming to be part of the free annual credit report program. Be mindful of websites trying to trick you with subtle differences.

What Are The Different Credit

VantageScore and FICO are companies that offer different credit-scoring models. Both are widely used in lending decisions, but they differ a little in how they calculate credit scores.

VantageScore and FICO use their scoring models to turn your credit reports into credit scores for each of the three main consumer credit bureaus Equifax, Experian and TransUnion.

Also Check: How To Get Free Copy Of Credit Report

How To Lift A Freeze

You can lift a freeze on your credit report online, or by contacting each credit bureau by mail or phone. The online options may be the easiest and fastest.

To unfreeze your TransUnion or Equifax credit reports, you’ll log in to each account and choose to temporarily or permanently lift the freeze. With a temporary thaw, you select the start and end dates for the thaw.

Experian takes a different approach. You can manage your Experian credit report through the Security Freeze Center without creating or logging in to an account. Instead, you’ll use your personal information and the PIN you were emailed when you froze your Experian credit report to temporarily or permanently remove a credit freeze.

If you don’t remember your PIN, you can retrieve your PIN by verifying your identity through the Security Freeze Center. Or, you can verify your identity as part of the thaw request rather than using a PIN.

Additionally, Experian lets you create one-time-use codes you can use to give a single creditor access to your Experian credit file. It could be a good way to let a creditor check your report without having to thaw it entirely. Be sure to ask the creditor before relying on these codes, however, since some creditors might not have systems in place to use them.

Are You And The Prospective Lender Looking At The Same Score

There’s likely been a time you’ve gone to check your credit score in one place, to later be surprised when the lender pulls a different credit score in deciding your approval for new credit. In addition to you and the lender possibly looking at different credit scoring models, you both may also be looking at different credit scoring versions within each model.

The two main credit scoring models lenders use are FICO® Score and VantageScore®, both which typically range from 300 to 850. Both scoring models are calculated using your payment history, your amounts owed , your length of credit history, your credit application frequency and your credit mix. Both models also have different versions, such as FICO Score 8 versus FICO Score 3 or VantageScore 3.0 versus VantageScore 4.0, for example. There can be different scores for different types of lending, such as mortgage versus auto loans, as well.

“There are literally hundreds of different credit scores,”Rod Griffin, senior director of public education and advocacy for Experian, tells Select. Lenders, however, are not required to let potential borrowers know what credit scores they’ll be evaluating, he adds. Before applying for credit, it’s worth asking a prospective lender to see if they’ll tell you which credit score they’ll check when deciding whether or not to approve you.

Regardless, it’s smart for consumers to check both their FICO and VantageScore before applying for credit to get a good idea of where they stand overall.

Read Also: How To Request Free Credit Report

What Is An Experian Business Credit Report

On the Experian Credit Information Report, or Experian CIR, you can find information such as your credit history, personal information, business information, accounts, public records, credit score, and more. The data in the Experian CIR is collected through all the banks, financial institutions, and other lenders registered with Experian. Lenders use this data to decide whether you or your business are creditworthy. Additionally, by keeping track of your credit report, you lower the chances of identity theft and fraud.