Personal Loans For Credit Score Under 671

While it is not guaranteed, one with fair credit may be a potential candidate for a personal loan. Of course, it will be more difficult for one with fair credit to receive a personal loan than for one with good or excellent credit. Fortunately, one with a 671 credit score may still be able to qualify for unsecured loans with affordable rates and payments. Still, those with fair credit will have generally higher interest rates for loans than their good and excellent credit counterparts, but some lenders may provide greater flexibility.

Average Credit Score By Income

The higher ones income level, the higher their average credit score tends to be.

While debt-to-income ratio doesnt play a direct role in determining one’s credit score, it does have an indirect one. One of the factors lenders consider when modeling an individual’s credit risk is their credit utilization the percentage of total available credit a consumer is using month to month.

To improve one’s credit score, credit utilization should generally be kept below 30%. The lower one’s income is, the more a consumer may rely on their credit for their expenditures.

Another way income may play into credit utilization, and ultimately one’s credit score, is by determining one’s . Credit issuers look at borrowers incomes when deciding on the amount of revolving credit that should be issued.

The lower one’s income, the lower their line of credit is likely to be.

In turn, by having significantly lower credit limits, it becomes easier for lower-income individuals to eat up a larger portion of what’s available, increasing their credit utilization.

The graphic belows shows that median credit scores are highly correlated to income.

For context:

- Low income: Up to 50% of the area median income

- Moderate income: Greater than 50% and up to 80% of the area median income

- Medium income: Greater than 80% and up to 120% of the area median income

- High income: More than 120% of the area median income

Credit Score Mortgage Lenders

Below is a list of some of the best mortgage lenders for borrowers that have a 671 credit score. All of the following lenders offer conventional and FHA loans, and can help you determine what options might be available to you. If you would like some assistance finding a lender, we can help match you with a lender that offers loan options to borrowers with a 671 credit score. To get matched with a mortgage lender, please fill out this form.

Don’t Miss: How Long Bankruptcy Stay On Credit Report

Credit Score: Is It Good Or Bad

A FICO® Score of 671 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good range. A large number of U.S. lenders consider consumers with Good FICO® Scores “acceptable” borrowers, which means they consider you eligible for a broad variety of credit products, although they may not charge you the lowest-available interest rates or extend you their most selective product offers.

21% of U.S. consumers’ FICO® Scores are in the Good range.

Approximately 9% of consumers with Good FICO® Scores are likely to become seriously delinquent in the future.

How To Turn A 676 Credit Score Into An 850 Credit Score

There are two types of 676 credit score. On the one hand, theres a 676 credit score on the way up, in which case 650 will be just one pit stop on your way to good credit, excellent credit and, ultimately, top WalletFitness®. On the other hand, theres a 676 credit score going down, in which case your current score could be one of many new lows yet to come.

Everyone obviously wants his or her credit score to be on an upward trajectory. So whether you need to turn things around or increase the pace of your improvement, youd better get to work. You can find personalized advice on your WalletHub credit analysis page, and well cover the strategies that everyone can use below.

You May Like: How Is Your Credit Score Determined

Can You Get A Credit Card With A 657 Credit Score

Credit card applicants with a credit score in this range may be required to put down a security deposit.Applying for a secured credit card is probably your best option. However, they often require deposits of $500 $1,000. You may also be able to get a starter credit card from a credit union. Its an unsecured credit card, but it comes with a low credit limit and high interest rate.

If you are able to get approved for a credit card, you must make your monthly payments on time and keep your balance below 30% of your credit limit.

See also:7 Best Secured Credit Cards

Recognize That Your Rates Can Increase

Currently, credit card companies cannot raise your credit rate for at least one year after you have opened your account, unless any of the following circumstances apply:

- A six month introductory rate exists

- You are late paying your bill by sixty days

- You have a card with a variable rate that is tied to an index and that index increases

You need to recognize that your credit rates will increase in the future, at least after the initial twelve months, and you need to establish with your potential creditor exactly when your rates will increase, by how much, and if there is anything you can do to lower your rates.

You May Like: How To Dispute A Credit Report And Win

The Three Credit Reporting Agencies And Different Types Of Credit Scores

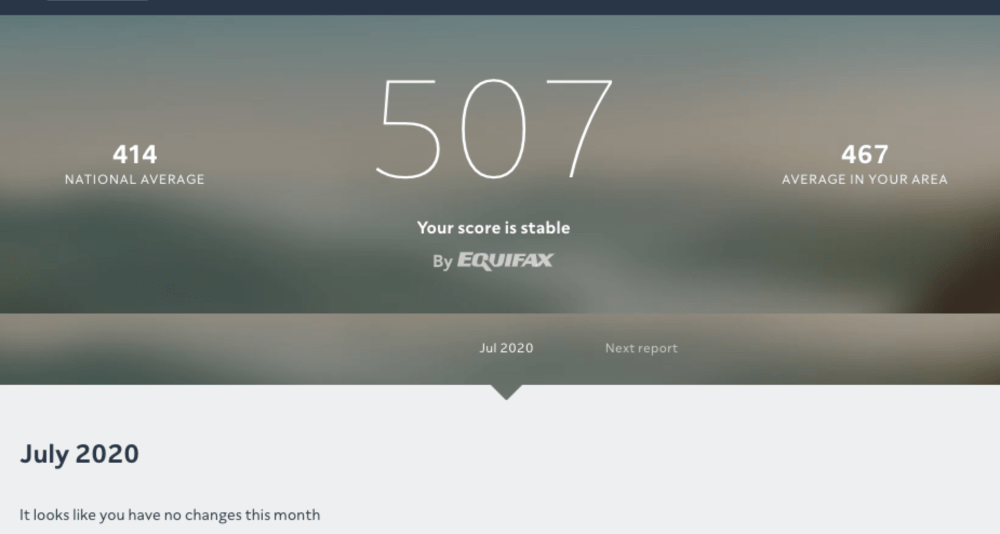

Equifax, Experian, and TransUnion are three major credit reporting bureaus. Each credit agency provides you with a credit score, and these three scores combine to create both your 671 FICO Credit Score and your VantageScore. Your score will differ slightly among each agency for many reasons, including their unique scoring models and how often they access your financial data. Monitoring of all five of these credit scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

Capital Credit Union Hours

1. Holiday Schedule Capital Credit Union Independence Day, Monday, July 4th Labor Day, Monday, September 5th All Employee Training Day, Monday, October 10th Thanksgiving Day, Thursday, November 24th. Friday 7:00 a.m.-7:00 p.m.: Saturday 7:00 a.m.-1:00 p.m.. Mailing Address. Capital Credit Union. PO Capital Credit Union in

Read Also: When Do Late Payments Drop Off Credit Report

What Credit Score Do I Need For A Car Loan

A FICO® credit score above 670 is generally considered good. FICO credit scores are the industry standard and are used by more than 90% of lenders when making

A FICO credit score of 671 is officially classified as Good, though just barely, as the good credit score range stretches from 670 to 739.

FICO Credit Score Ranges · Good Credit : This is a good credit range to be in, but you wont get the very best rates on loans or

Can I Get A Personal Loan Or Credit Card W/ A 671 Credit Score

Like home and car loans, a personal loan and credit card isn’t very difficult to get with a 671 credit score.

You donât need to apply for a secured card with Discover or Capital One, who may make you pay $500-$1000 just for a deposit.

You can get even better terms on your personal loan or credit card by repairing your credit and waiting a few short months until your score improves.

A 671 score means you likely have a few-no negative items on your report. Removing any outstanding negative items is usually the quickest way to fixing your report.

We recommend speaking with a friendly credit repair expert online to help guide you through this process. Your consultation is completely free, no-pressure, and will set you on the right path toward boosting your score.

Also Check: How To Remove A Default Judgement From Credit Report

Credit Score Is It Good Or Bad How To Improve Your 671 Fico Score

Before you can do anything to increase your 671 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to identify what needs to be improved, you should probably be aware of all the things that count and dont count towards your score.

Can I Get A Rewards Credit Card With Fair Credit

You may struggle to get approved for a cash back or travel rewards credit card with fair credit. While you might be able to find a card that earns a limited amount of cash back on purchases, the most-rewarding credit cards generally require good or excellent credit.

If a top-notch rewards card is your ultimate goal, dont be discouraged. You may be surprised by how much good, persistent habits can affect your credit scores.

And thats one nice thing about credit cards. Even the ones that arent the absolute best can help you build credit by reporting your account activity to the three major credit bureaus. This information makes its way into your credit reports and ultimately can impact your credit scores. So, as long as you make on-time payments and follow the other credit-building tips outlined above, you can put yourself in a position to qualify for a better credit card in the future.

Compare offers for on Credit Karma to learn more about your options.

Don’t Miss: Does Stoneberry Report To Credit Bureau

Usda Loan With 671 Credit Score

The minimum credit score requirements for USDA loans is now a 640 . Therefore, with a 671 credit score, you will satisfy the credit score requirements for a USDA loan.

Other requirements for USDA loans are that you purchase a property in an eligible area. USDA loans are only available in rural areas, as well as on the outer areas of major cities. You can not get a USDA loan in cities or larger towns.

You also will need to show 2 years of consistent employment, and provide the necessary income documentation .

What Does Not Count Towards Your 671 Credit Score

There are many things that people assume go into their 671 credit scores but that actually dont. Examples include how much money you earn, your age, your marital status, your child support payments , how much money you have donated to charity, where you work or live, or your employment history.

None of these things or anything like them do anything at all to your credit score, so instead, focus on the five primary factors that we outlined and discussed above.

Now that you know what counts towards your overall credit score and what does not, you should know exactly what you need to pinpoint in order to enhance your score. For example, maybe one reason your credit score is low is because youve opened several new accounts of credit.

Regardless, its important at this stage for you to positively identify what it exactly is that is lowering your credit rating. Once you have identified what that is, you can start to formulate a plan.

Read Also: When Does Bank Of America Report To Credit Bureaus

Is A Credit Score Of 671 Good

671 is a good score thru the eyes of a mortgage lender. Anythingover 620 will get you a conventional rate or the street rate youhear offered on the radio or tv. There are a number of differentcredit scores. Since you did not indicate what credit score you arereferring to I am assuming you are referencing your FICO score. Youhave 3 FICO scores, 1 for each of the major credit bureaus. The score measures thelikihood you will repay your debt. You can help increase your scoreby paying on time and reducing your debt. The score is also used bylenders for loan decisions and interest rate assignment. The FICOscore ranges from 300 to 850. The minimum FICO score lenders liketo see is 723. The national average is about 678.

How To Earn A Good Credit Score:

If you currently have a credit score below the “good” rating, you may be labeled as a subprime borrower, which can significantly limit your ability to find attractive loans or lines of credit. If you want to get into the “good” range, start by requesting your credit report to see if there are any errors. Going over your report will reveal what’s hurting your score, and guide you on what you need to do to build it.

You May Like: What Is The Highest Credit Score Possible

Capital One Quicksilverone Cash Rewards Credit Card

The Capital One QuicksilverOne Cash Rewards Credit Card is one of the most popular credit cards for a 650 credit score, and it also comes with a rewards program.

You’ll earn 1.5% cash back on every purchase you make with this card, so you won’t have to worry about keeping track of different purchase categories.

The card also rewards good credit behavior: Your account will be reviewed automatically for credit line increases in as little as 6 months.

On the downside, this card does charge an annual fee, though it is a low one at $39.

How To Find The Best Credit Cards If Your Fico Score Is 650 To 699

When you reach a FICO score between 650 and 699 your credit card options start to open up considerably.

One type of card that is less relevant after you reach this credit score range is a secured credit card. These cards are more suitable if your credit score is below 650, and especially when its below 600.

But in the average credit score range, you should be able to qualify for unsecured cards with very little effort. What you wont find available to you are unsecured cards with the best terms on the market. For example, you wont qualify for the lowest interest rates, nor will you be eligible for the cards with the most generous rewards programs. But you can still get a card with an adequate credit limit, and at least some cash back rewards. And if you pay your balance off monthly as we will recommend throughout this guide the high interest rate wont matter so much.

Read more:How to Use a Credit Card Responsibly

Don’t Miss: Is 644 A Good Credit Score

Vantagescore Credit Score Ranges

Launched in 2003, VantageScore is a joint venture between the three major credit reporting agenciesEquifax, TransUnion and Experian. Although FICO Scores are the most popular choice among lenders, VantageScore credit scores deserve your attention too.

VantageScores use a 300 to 850 credit score range. Just like FICO Scores, the higher your credit score on the VantageScore scale, the lower the risk you represent to lenders.

Don’t Open Too Many Accounts At Once

FICO and VantageScore look at the number of credit inquiries, such as applications for new financial products or requests for credit limit increases, as well as the number of new account openings. Making these kinds of inquiries frequently dings your credit, so only apply for what you really need in order to avoid damaging your score.

If you want a new card, but you’re not sure you’ll qualify, you can submit a pre-qualification form online. You can submit as many pre-qualification forms as you want, as they won’t impact your credit score.

Read Also: How To Request A Copy Of My Credit Report

Set Up Autopay Or Calendar Reminders

If you struggle to remember to pay your bills each month , there’s an easy fix: autopay. If you’re not sure you’ll be able to pay your bill in full, you can set it so you just pay the minimum. And the same goes with your utilities: Most major providers will let you set up autopay that withdraws automatically each month from your checking or savings account . In the case of student loan companies, some give you a discount on your interest rate if you set up autopay.

If you don’t want to use autopay, another easy option is setting up a payment reminder. Many banks and card issuers will let you schedule reminders through their websites, including sending you email reminders or push notifications . You can also set up Google or Outlook calendar invites or make a note of the due date on a physical calendar. It doesn’t really matter what notification system you use so long as you pay on time.

The sooner you start paying on time, the sooner your score will begin to improve. And just as a bit of motivation, older credit penalties, such as late payments, matter less as time passes. So start now and stay consistent.

What Does A 671 Credit Score Get You

| Item |

|---|

| 88% |

As you can see, most people who are at least 35 years old have a credit score of 650 or higher. And even younger folks nearly have a majority. This just goes to show that people with 650 credit scores come in all shapes and sizes, with diverse backgrounds and differing financial obligations.

As a result, the grades for each component of your credit score, which you can find on the Credit Analysis page of your free WalletHub account, might not exactly match those of another individual with a 650 score. But the sample scorecard below will give you a pretty good idea of what a 650 score is made of.Sample Scorecard 671 Credit Score:

- Payment History: C = 98% on-time payments

- B = 10% – 29% utilization

- Debt Load: A = Debt-to-income ratio below 0.28

- Account Age: B = Average tradeline is 7 or 8 years old

- Account Diversity: C = 2 account types or 5 – 9 total accounts

- Hard Credit Inquiries: A = Fewer than 3 in past 24 months

- Collections Accounts & Public Records: A = 0 collections accounts and public records

These are by no means the only credit-score grades capable of producing a score of 650, nor will they necessarily result in that exact rating. However, this is representative of the type of scorecard someone with a 671 credit score can expect: plenty As and Bs, but no failing grades to be found.

Read Also: Is 730 A Good Credit Score