Vantagescore And Fico Are The Two Main Credit

But even if you have pretty good credit habits, dont be surprised if you check your scores and find that youre below 850.

Perfect credit scores can seem to be inexplicably out of reach. Out of 200 million consumers with credit scores, the average FICO score is 704. And FICO says that as of April 2019, just 1.6% of Americans with credit scores had perfect FICO scores.

What Is The Benefit Of Knowing What The Highest Possible Credit Score Is

Knowing what the highest possible credit score is helps you understand where you fall on the range of credit scores. It allows you to measure by how much you need to improve your credit score. If youre like most Americans, you probably have a lot of room to improve your credit score before you reach the highest credit score.

Getting The Highest Credit Score Possible

When youre familiar with what the highest credit score is, how to achieve it, and how to maintain it, youre putting yourself in a better financial situation. Your credit score impacts your ability to make big purchases like a home or car, and it also impacts smaller things like whether or not you have to put a deposit down when applying for utilities or a cell phone.

While getting a perfect score of 850 may be a long shot, getting a score in the Good or Excellent range is certainly attainable and, if you follow some of the steps outlined in this article, youll be well on your way to financial freedom.

Don’t Miss: Which Credit Report Is Most Important

Whats The Highest Credit Score In Canada

In Canada, your credit scores usually vary from 300 to 900. The higher the score, the better. High scores might indicate that youre less likely to neglect your repayments if you take out a loan.

Below youll see a general breakdown of credit scorevarieties and what every range suggests in terms of your general ability toqualify for disposal or credit requests, like a loan or mortgage.

Note that the ranges will vary slightly depending on the lender. The simplest way to know where your scores stand is to check your . Below is the credit score range in Canada:

- 800 900 Highest Credit Score

This is considered the highest credit score in Canada, and not many Canadians get here as over 70% of Canadian Families owe one or more forms of debt. However, a certain number of individuals and businesses had achieved this flawless state of credit score.

- 720 799 Excellent Credit Score

Youve got excellent credit, although not the highest.You should expect to possess a range of credit choices to choose from therefore, continue your healthy money habits.

- 650 719 Good Credit Score

This can be thought of to be a sensible range tolenders this range is the generally accepted average credit score for theaverage Canadian. However, you will notqualify for all-time low-interest rates available however, keep your credithistory robust to help build your credit health.

- 600 649 Average Credit Score

- 300 599 Poor Credit Score

Tips For Reaching Your Highest Possible Credit Score

Even if a pristine credit score isnt realistic for you, its still important to strive for the best credit score you can. Here are some tips to help you:

Also Check: How Do You Get A Copy Of Your Credit Report

Dont Cancel Cards Needlessly

As you can see, both models look favorably on consumers who have longer credit histories and lower credit utilization ratios.

Unfortunately, you cant magically create 10 years of credit history. What you can do is choose one or two credit cards to keep active and never cancel. Not only will this help you build a longer credit history, but it can also help you keep your credit utilization rate low, since more active credit cards in your name means more available credit.

Percent Of Adults Who Check Their Score Monthly

Data regarding how many adults check or dont check their scores will vary from study to study due to the nature of the sample population. Research offered by CreditCardInsider.com found that only 21 percent of their respondents check their credit score on a monthly basis9.

This low number can be supported by data in other studies, such as a LendingTree survey that found only 33 percent of adults checked their score within the past year in 202010.

Recommended Reading: Who Looks At Your Credit Report

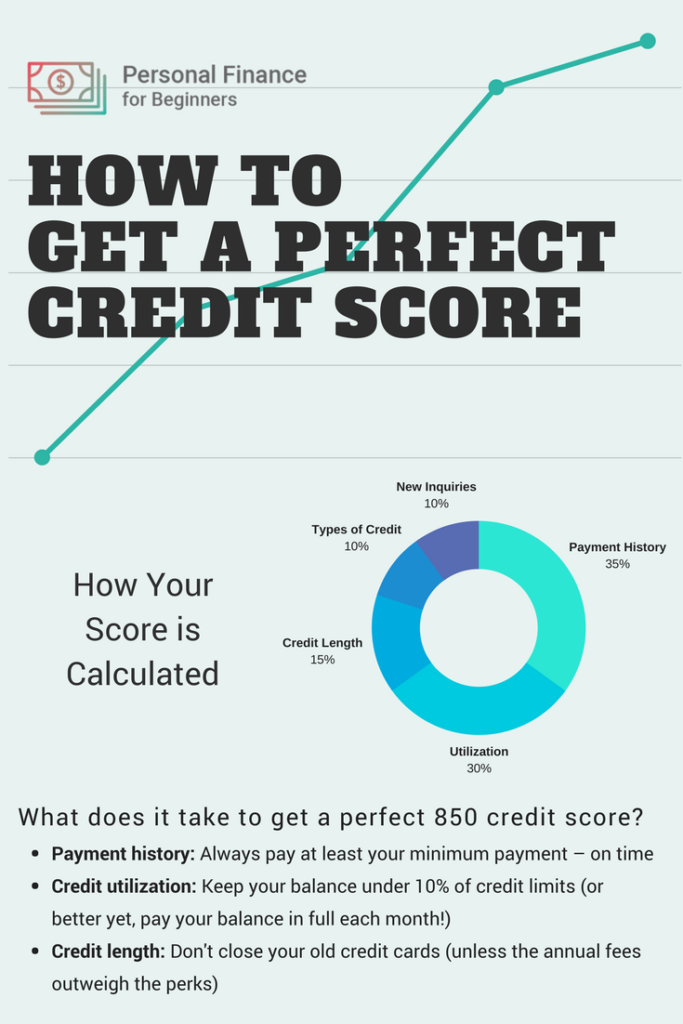

How Your Credit Score Is Determined

All the leading credit rating agencies rely on similar criteria for deciding your credit score. Mostly, it comes down to your financial history how youve managed money and debt in the past. So if you take steps to improve your score with one agency, youre likely to see improvements right across the board.

Just remember that it may take some time for your credit report to be updated and those improvements to show up with a higher credit score. So the sooner you start, the sooner youll see a change. And the first step to improving your score is understanding how its determined.

Here are some of the factors that can harm your credit score:

- a history of late or missed payments

- going over your credit limit

- defaulting on credit agreements

- bankruptcies, insolvencies and County Court Judgements on your credit history

- making too many credit applications in a short space of time

- joint accounts with someone with a bad credit record

- frequently withdrawing cash from your credit card

- errors or fraudulent activity on your credit report thats not been detected

- not being on the electoral roll

- moving house too often

New Credit: Limit Your Applications

Applying for a new credit card or loan will lower your credit score for a couple of reasons.

First, applying for new credit leads to whats known as a hard inquiry. Thats when a lender or company conducts a check into your credit to determine whether youre a suitable risk. A hard inquiry usually lowers your score a few points.

The second reason is that opening a new account shortens the average length of all your credit accounts and thus reduces your credit history score.

Once you start using a new credit card, if you make all your payments on time and keep your credit utilization low, your score will rebound.

But choose your applications wisely. You will hurt your score with multiple hard inquiries by applying for too many cards too quickly.

When it comes to a mortgage or car loan, you get a little bit of leeway so you can shop for rates without the hard inquiries damaging your credit. Multiple inquiries for a new auto loan or mortgage count as just one hard inquiry if they are conducted in the same time period. FICO and VantageScore both define that period as two weeks.

Don’t Miss: What Raises Your Credit Score

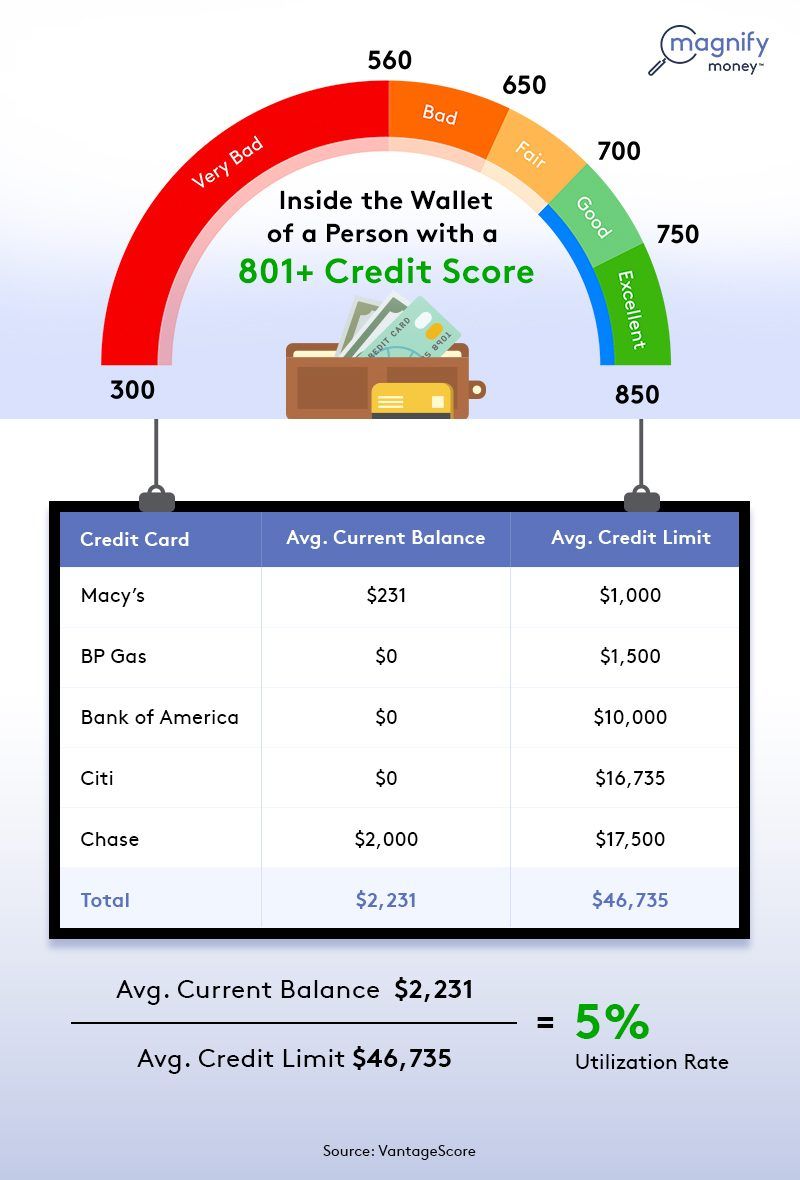

Perfect Score Vs Average Score: Credit Profiles

People with perfect FICO® Scores carry debtthey just do it differently from those further down the scoring scale. U.S. consumers with perfect scores have more tradelines, or credit products, but less average debt than those with the average FICO® Score, which in the fourth quarter of 2018 was 701.

People with FICO® Scores of 850 carried an average 6.4 credit cards compared with the national average of 3.8 credit cards. When it came to credit card debt, however, Americans with perfect FICO® Scores owed less than half the U.S. average: an average $3,025 compared with the national average of $6,445.

In every other debt category except mortgage and personal loan, people with perfect scores had more open tradelines but less debt than their counterparts with average scoresunderscoring the value of being able to manage debt while having numerous credit accounts.

Benefits Of Knowing The Maximum Credit Score

As we mentioned before, knowing the maximum credit score is important because it gives you a framework for whats possible and it helps you understand how much improvement you need to make in order to break into that Excellent threshold.

If youre like most of the U.S. population, you have some room for improvement. Lets look at some of the ways you can improve your credit score.

Read Also: Is Fico A Credit Score

Access To The Best Credit Cards

A good credit score not only gets you the best interest rates on your credit cards, but it also opens you up to some of the best credit cards in the industry. These cards will have superior rewards, great perks and other benefits normal credit card issuers don’t offer.

You can also get access to special offers, including 0% balance transfer credit cards or low-APR introductory offers, like 1.9% for 18 months.

What Is The Highest Achievable Fico Score

A FICO score is used by creditors and lenders to determine the overall of any individual consumer. Individuals with higher ratings are considered to have greater creditworthiness. Each score is calculated using a proprietary tool developed by the Fair Isaac Corp , and each of the three major credit bureaus in the United StatesExperian, Equifax, and TransUnionrely on Fair Isaac’s technology to calculate a FICO score for any borrower.

Recommended Reading: What Is The Government Free Credit Report Website

Dont Make Too Many Credit Applications

When you apply for a credit card or loan, the lender will check your credit history through a hard credit inquiry, which will appear on your personal report. FICO suggests that you can lose up to 5 points on the credit chart for every inquiry. Try to limit the number of applications you submit to improve your score.

Keep Your Credit Utilization At Or Below 30%

Its also key to keep your credit utilization ratio low. Your is the percentage of your available credit currently being used. Using a high percentage of your available credit could indicate that you are overextended and may be more likely to miss payments.

A good utilization ratio is generally considered at or below 30%. Keeping your balance at or below 10% may help you get your score up to 760 even faster. That means a credit balance of lower than $1,000 balance for a $10,000 credit limit. In the case of higher achievers, they would have a balance of $400 for the same credit limit amount. Keep in mind your credit utilization ratio is calculated based on the overall credit you have across all your credit cards.

Read Also: How To Get Inquiries Removed From Credit Report

Characteristics Of Consumers With Excellent Credit

According to a report by FICO, users with the highest credit scores generally have a few things in common, like: 2

- An average credit account age of 11 years

- A below 6%

- Below $3,000 in debt across their revolving accounts

FICOs report also noted that:

- Less than 35% had applied for new credit in the past year

- 96% had never missed a payment

As one would expect, the two biggest takeaways are that perfect scorers make on-time payments and borrow responsibly. For example, their low credit utilization rates indicate that they dont max out their credit cards.

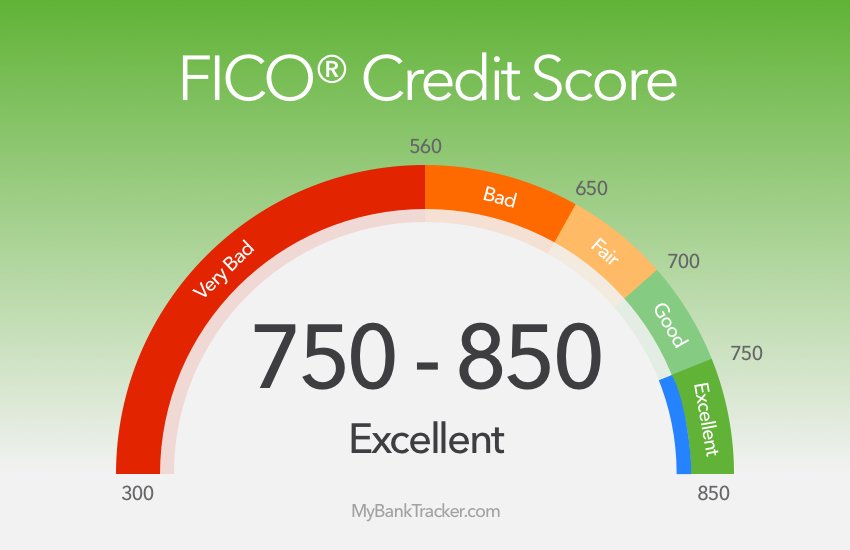

The Higher The Credit Score The Better To An Extent

- You dont need the highest credit score possible

- To get approved for credit cards and other loans

- Usually anything at or above 760

- Is treated the same, so perfection isnt necessary

Put simply, if you have a credit score above 800, youve got what is considered an excellent credit score and youll likely be approved for all types of credit, from credit cards to mortgages to student loans and so forth, assuming you have the credit history to back it up.

Even a FICO score above 760 should be sufficient to get the best terms on the credit cards and loans you apply for, so theres kind of a point where it no longer matters how high your credit score is.

Theres no need to keep actively improving your credit. Its merely for bragging rights at that point, or perhaps a buffer if you experience a late payment or your utilization rate increases suddenly.

Indeed, there are no extra benefits for having an 850 credit score, aside from it being kind of cool. People have done it though, and will continue to do it. Dont ask me how though, it seems rather elusive.

Personally, I doubt Ill ever get an 850 score and that doesnt bother me one bit. Because I open credit cards fairly regularly, Ill probably never have the perfect credit age to bump my score to that level, even though I make all payments on time and stay well below my credit limit.

Don’t Miss: Will Getting Another Credit Card Help My Credit Score

How To Get An 800 Credit Score And Above

You don’t need a perfect credit score, but if you’re looking to achieve an 800 credit score or higher, there are some concrete actions you can start taking now. Keep in mind, though, that it takes a long credit history and no derogatory marks on a credit report to establish and maintain a high credit score.

As you work toward improving your credit, here are some tips to help you get started:

How An Excellent Credit Score Can Help You

An excellent credit score can help you receive the best from lenders and give you a higher chance of being approved for credit cards and loans.

Many of the best cards require good or excellent credit. If you want to benefit from competitive rewards, annual statement credits, luxury travel perks, 0% APR periods and more, you’ll need at least a good credit score. And if you have an excellent credit score, you can maximize approval odds.

For instance, if you’re looking to earn generous rewards on groceries and dining out, the American Express® Gold Card offers cardholders the chance to earn 4X Membership Rewards® points when you dine at restaurants and shop at U.S. supermarkets but you’ll need good or excellent credit. Terms apply.

And if you want to finance new purchases or get out of debt with a balance transfer card, such as the Chase Freedom Unlimited®, you’ll also need good or excellent credit.

Take note that even if your credit score falls within the excellent range, it’s not a guarantee you’ll be approved for a credit card requiring excellent credit. Card issuers look at more factors than just your credit score, including income and monthly housing payments.

Check out Select’s best credit cards for excellent credit.

Don’t Miss: How To Check Credit Score Without Hurting It

What Is Your Credit Score Why Is It Important

Your credit score may be defined as a rating that reflects your creditworthiness. Think of your as a batting average. If your batting average is above 50, then it means that you have a consistent scoring record of 50, and you are a good player. Similarly, when your credit score is high, it shows that you have borrowed and repaid credit responsibly in the past.

Your credit score is important because it showcases how dependable or risky you are as a borrower. Thus, it directly impacts how eligible you are for a loan, what the lender will offer you as a loan amount, and the rate of interest you will be charged. Your credit score allows lenders to judge the potential risk in lending you money. Your credit score is critical when it comes to unsecured or collateral-free loans and can affect your eligibility for personal loans to a great extent.

While you as an individual have a score, even businesses are given credit scores. For a business, the CIBIL score impacts how creditworthy a lender will find the company. A business credit score could also impact its ability to attract investment.

Additional Read: Save 45% on personal loan EMI

Why Is Understanding The Highest Credit Score Important

If youre like most of the U.S. population, your credit score falls somewhere under 621. In fact, you can see from the chart below that 38 percent of people under 30 years old have a score less than 621. That said, 29 percent of people under the age of 30 are doing a bit better with a score of 621 to 680. When you consider that only 2 percent of people in this age group are actually achieving a 780 score or above, its clear that theres lots of room for improvement if having the highest credit score is the goal.

Understanding the credit ranges and what the highest credit score is can give you the motivation and knowledge needed to improve your credit score and, therefore, improve your financial ability to get better interest rates on everything from mortgages to credit cards.

Recommended Reading: Is 757 A Good Credit Score