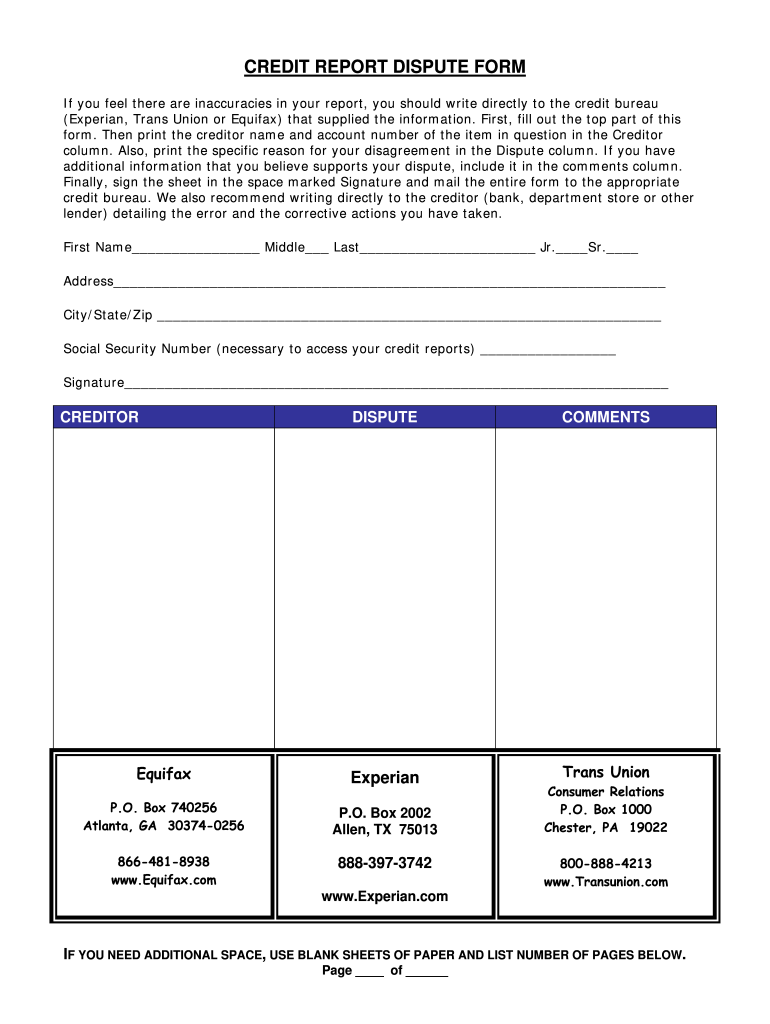

How Do I Correct Or Dispute Inaccuracies On My Credit Reports By Mail

If you see information on your credit reports you believe is incomplete or inaccurate, a good first step is to contact the lender or creditor directly. This is especially helpful if the information involves your name or address. Updating your personal information with lenders and creditors can help ensure the information reported to the three nationwide credit bureaus Equifax, Experian and TransUnion is correct.To file a dispute by mail, you may need to provide copies of documentation. Please to review documents that may be required. You can send your request and copies of documents to the three nationwide credit bureaus at the following addresses:Equifax Information Services, LLC

How Do I Submit My Dispute

To submit a dispute to a credit reporting company, contact the credit reporting company who has the inaccurate information on your credit report. You may submit a dispute with each of the credit reporting companies over the internet or by mail.

Online:

- P.O. Box 2000

- Chester, PA 19016

You may also submit documents in support of your dispute. Documents may be uploaded for online disputes or submitted by mail. When mailing documents, please only submit copies of documents and not originals. Documents will not be returned to you following the investigation.

To submit a dispute with a business:

- Contact the business directly. The contact information for that business should be included on your credit report or monthly billing statement.

The Federal Trade Commission’s website has more information on correcting your credit report, and the Consumer Financial Protection Bureau’s website also provides additional information on disputing information on your credit report as well.

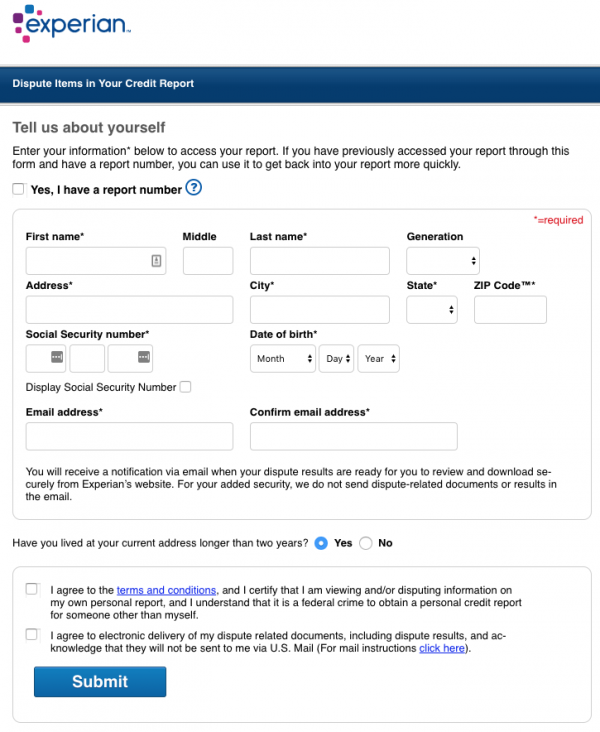

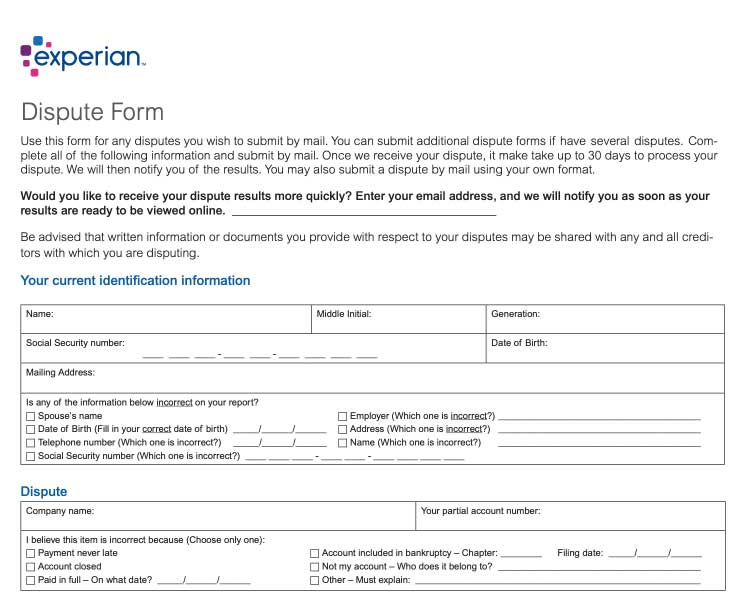

Dispute By Mail Or Phone

It’s fast, free and easy to manage a dispute online, but if you’d prefer to dispute by mail or phone you’ll find instructions below.

To complete a dispute by mail, provide as much of the following information as possible:

- Personal Information: Name, DOB, Address, SSN

- Name of company that reported the item youre disputing and the partial account number

- Reason for your dispute

- Any corrections to your personal information

Send your documents to:

Please note: We accept either standard or certified mail.

Read Also: How To Remove Repossession From Credit Report

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Ordering Your Credit Report

The first step, of course, is actually ordering copies of your credit reports from the 3 major bureaus. You can do this for free once a year at AnnualCreditReport.com.

Note: I highly recommend reading this post on avoiding credit report scams and fees first!

Make sure you type the address into your address bar as there are many fakes out there! Once youve gone over the reports and identified the mistakes, you can contact each bureau directly.

Its worth noting that you should never pay a credit repair service to do this for you, as you can do the exact same thing yourself at no cost.

These companies cannot erase legitimate bad marks, and most will simply dispute accurate negative information. They will take your money regardless of the outcome as well.

Read Also: How To Remove Repossession From Credit Report

How Insurers Use Medical History Reports

When you apply for insurance, the insurer may ask for permission to review your medical history report. An insurance company can only access your report if you give them permission. The report contains the information you included in past insurance applications. Insurers read these reports before they’ll approve applications for:

- life

- disability insurance applications.

How To Dispute Your Equifax Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Its smart to review your credit reports regularly to double-check the information being submitted by lenders, credit card issuers, public agencies and sometimes landlords.

Federal law gives you the right to see the data that the three major credit bureaus Equifax, Experian and TransUnion have collected. Use AnnualCreditReport.com to request the free reports youre entitled to. Errors in your credit reports can cost you points on your credit scores, so fixing mistakes is worth the effort.

If you find an error in your Equifax report for example, a late payment you believe was made on time you can dispute it.

Also Check: Does Paypal Credit Report To Credit Bureaus

What Happens After You Dispute Information On Your Credit Report

Tip

If you suspect that the error on your report is a result of identity theft, visit IdentityTheft.gov, the federal governments one-stop resource to help you report and recover from identity theft.

If the furnisher corrects your information after your dispute, it must notify all of the credit reporting companies it sent the inaccurate information to, so they can update their reports with the correct information.

If the furnisher determines that the information is accurate and does not update or remove the information, you can request the credit reporting company to include a statement explaining the dispute in your credit file. This statement will be included in future reports and provided to whoever requests your credit report.

Review Your Credit Reports For Errors

Your are based on information provided by companies to the three major credit bureausExperian, Equifax and Transunion. To identify which credit reports contain errors, you have to review each report separately. You can do this by visiting AnnualCreditReport.com. Due to Covid-19, you can view all three of your reports for free weekly through April 20, 2022.

You May Like: What Is Syncb Ntwk On Credit Report

Wait For The Debt To Expire

Under federal law, a debt remains on your credit report for a period of seven years from the date of issue ). Therefore, if the debt collector is persistent whenever the debt is disputed, the individual will have to wait the full period for it to go off their credit report. Most likely, an additional dispute will be required to be placed as they do not automatically get deleted after the seven year period.

Choosing How To Dispute Errors On Your Report

The most important distinctions about disputing by mail are that it takes much longer and increases the risk of identity theft.

Rod Griffin, Director of Public Education, Experian

Youd hope the resolution of your dispute would be the same no matter which process you use but there could be a reason for using one of the options over the other.

For instance, Jeremy Golden, a consumer law attorney with Golden & Cardona-Loya, LLP in Chula Vista, California, recommends that people keep copies of the disputes they send to the bureaus. To this end, you may not want to initiate the dispute by phone. Instead, use the online systems or send your letters by certified mail.

Online is certainly faster because you get the dispute into the credit bureaus systems much faster, says credit expert John Ulzheimer, formerly of FICO and Equifax. However, he cautions that the online list of options you can choose from wont necessarily match your situation. In that case, a written dispute sent via the mail is a better option because it gives you more of an opportunity to free hand your dispute and logic behind why youre challenging the item.

David Blumberg, senior director of public relations for TransUnion wrote us and said, Consumers do not waive any rights by disputing online vs. by mail. The only difference we would note between the two is that mail disputes take longer.

Also Check: Sync/ppc On Credit Report

How You Can Check Your Credit Reports

You can get a free copy of your credit report from each major credit reporting agency every 12 months at AnnualCreditReport.com.

Get Free Weekly Credit Reports During the Coronavirus Crisis

Equifax, Experian, and TransUnion are offering free weekly online credit reports, so that you can manage your credit during the COVID-19 crisis.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Does Klarna Run Your Credit

Dispute The Information With The Credit Reporting Company

If you identify an error on your credit report, you should start by disputing that information with the . You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute. You can also use our instructions

If you mail a dispute, your dispute letter should include:

You may choose to send your letter of dispute to credit reporting companies by certified mail and ask for a return receipt, so that you will have a record that your letter was received.

You can contact the nationwide credit reporting companies online, by mail, or by phone:

Receive An Answer From The Credit Bureau

Hopefully, when the credit bureau responds the letter will entail that the items were removed from the report. If so, there is nothing left to do and the outstanding balance should have already been removed and there may be an immediate improvement in the individuals overall FICO score.

If the outstanding balance was not removed the individual will need to contact the current holder of the debt in the next step.

Also Check: 672 Credit Score

Choosing Where To Get Your Credit Report

The first step in reviewing your credit report is ordering a copy. You can get free copies of your credit reports from a variety of sources, including companies like Credit Sesame or Credit Karma*. You can also request a free copy of your report from each of the bureaus once every 12 months at AnnualCreditReport.com, by downloading and mailing a request form, or by calling the number associated with the site, 1-877-322-8228.

Experian also gives you free access to your credit report online, while TransUnion and Equifax sell access to their credit reports.

Arbitration Clauses with Some Purchased Reports

As a result, you might not be able to sue or join a class action lawsuit against the bureau.

However, registering or buying a product from one of the credit bureaus could require you sign an arbitration clause and/or class action waiver. As a result, you might not be able to sue or join a class action lawsuit against the bureau.

The arbitration clause may extend to your right to sue the bureau if the incorrect information in your credit report isnt corrected, which might be a reason to consider getting your credit report from a different source. You also might be able to send an opt-out letter to the bureaus saying you dont agree to the arbitration clause, but you may need to do this within 30 to 60 days of creating your account. Remember, this isnt legal advice consult an attorney as needed.

What If My Credit Dispute Letter Is Rejected

Was your letter intended for repairing your credit rejected by the credit bureau? You do have some options available that might help you repair your credit. One of the more common next steps is to file an appeal with the Consumer Financial Protection Bureau .

If you decide to file an appeal with the CFPB, you should include all the supporting evidence that you sent to the bureau originally. In addition, include the bureaus response.

You should also include a detailed account of why you disagree with the bureaus findings, as well as any additional evidence that might be helpful beyond what you included with the original submission.

If the bureau took too long to process their response, you should be sure to let the CFPB know, and include any supporting evidence. Again, this is why its so important to use certified mail and retain all records and receipts.

Finally, its worth your time to write a statement summarizing your dispute. Explain exactly what happened and why you believe the item to be erroneous. The statement would be included with your credit report, and while it wont help your poor credit score, it may provide just enough insight and clarity about the flagged item to help sway a would-be lender to make a favorable decision.

About Rick Miller

Rick is a former US Army Aviator, West Point graduate, and Darden MBA. He owns and operates a successful Real Estate Investment firm, and he enjoys spending time with his wife and three children in Hartford, CT.

You May Like: Can A Repossession Be Removed From Credit Report

Errors To Look For On Your Transunion Credit Report

According to a study by the FTC, 1 in 5 credit reports contains errors. So, theres a good chance your credit report may include incorrect information. A few issues to be on the lookout for that could be dragging your credit down:

- Accounts you dont recognize

- Incorrect account names and numbers

- Incorrect loan or credit limits

- Issues with payment history

- Unauthorized credit inquiries

- Negative accounts that have hit the 7-year credit reporting timeline mark and should no longer be there

Get A Free Credit Report

Under federal law, 15 § 1681j, all three bureaus must provide a credit report that is free of charge to a resident of the United States.

AnnualCreditScore.com The only website that offers all three bureaus with no credit card required.

To get a credit report, a consumer must provide their:

- Full Name

- Mailing Address

- Housing Status

- Date of Birth

- Social Security Number and

- Undergo a Personal Verification Test .

Once the report is available, any and all account marks, collections, and debt will appear along with the FICO score .

You May Like: Does Speedy Cash Report To Credit Bureaus

What Information Do I Need To Provide When Submitting A Dispute

Types of information you should be prepared with:

- Your full name, including middle initial and suffix, such as Jr., Sr., II, III

- Social Security Number

- Current address

- All addresses where you have lived during the past two years

Depending on how you submit your dispute , you may also be asked to provide the following additional information:

- Email address

- A copy of a government issued identification card, such as a driver’s license or state ID card

- A copy of a utility bill, bank or insurance statement

You should list each item on your credit report that you believe is inaccurate, including the creditor name, the account number and the specific reason you feel the information is incorrect.

You may also submit documents to support your dispute. Depending on the type of information disputed, the following documents may be helpful in resolving your dispute:

- Police reports or an FTC Identity Theft Report, showing that an account was the result of identity theft

- Bankruptcy schedules showing that an account was included in or discharged in bankruptcy

- Letters from creditors showing how an account should be corrected

- Student loan disability letters showing that a student loan has been discharged due to disability

- Cancelled checks showing that a collection account has been paid

- Court documents regarding public records

Whats The Difference Between Credit Report Dispute Methods

Getting denied a loan, job, or apartment because of information on your credit report can be disappointing. Getting denied because of information on your credit report that isnt correct is downright aggravating. Thats why its important to review your credit reports for errors regularly. Were going to dig into these topics in more detail, but remember: Clearpoint does not lend money, offer legal advice, or consult on tax or credit repair matters.

One of your legal rights under the Fair Credit Reporting Act is that the information in your credit report must be correct, complete, and verifiable. Negative information, such as a late payment or bankruptcy, also must be removed within seven to 10 years .

When you see something thats incorrect, incomplete, unverifiable, or outdated, you can file a dispute with the credit bureaus or data furnisher to get your report corrected. Weve covered the basics of the before. Here we will discuss what is perhaps a surprising, and less frequently discussed, topicthe differences between phone, mail, and online credit disputes. Well also touch on the differences between types of credit reports.

You May Like: Does Paypal Working Capital Report To Credit Bureaus