How Do I Fix Inaccuracies On My Credit Report

If you see something on your report that you believe is inaccurate, it may be a good idea to contact the business that reported the account, as they are the ones who can provide you more details. Your other option is to start a dispute with the credit reporting agency that issued the credit report. To start a dispute with TransUnion, visit transunion.com/disputeonline and well start an investigation.

Get Your Credit Score And Report For Free

If you’ve ever applied for credit or a loan, there will be a credit report about you.

You have a right to get a copy of your credit report for free every 3 months. It’s worth getting a copy at least once a year.

Your credit report also includes a credit rating. This is the ‘band’ your credit score sits in .

Usually, you can access your report online within a day or two. Or you could have to wait up to 10 days to get your report by email or mail.

Contact these credit reporting agencies for your free credit report:

Since different agencies can hold different information, you may have a credit report with more than one agency.

Some credit reporting agencies may provide your credit score for free check with them directly.

Alternatively, you can get your credit score for free from an online credit score provider, such as , Finder or Canstar. This usually only takes a few minutes.

Typically, you agree to their privacy policy when you sign up, which lets them use your personal information for marketing. You can opt out of this after you sign up.

Avoid any provider that asks you to pay or give them your credit card details.

Does Checking My Credit Report Hurt My Credit

No, checking your credit report does not hurt your credit. And checking your credit score doesn’t hurt your credit either. These actions are considered “soft pulls” which don’t affect your credit score. Actions, such as applying for a credit card, which require a “hard pull,” temporarily ding your credit score.

Learn more: Check your odds of getting approved for a credit card without hurting your credit score.

Recommended Reading: 688 Credit Score Auto Loan

Other Ways To Get A Free Credit Report:

The free annual credit report is available to everyone in the United States. However, in addition to that, you can also get a free credit report directly from a credit reporting agency if youve been denied credit.

You have 60 days from the time you are notified of the denial to request your credit report. Your request must also be with the credit reporting agency that was used to check your credit.

If you are ordering a free state report, or you are getting a free credit report due to any of the other factors weve talked about, youll need to contact the nationwide credit reporting agencies directly. Equifax and TransUnion make it easy to order these free credit reports online, but to get your free Experian credit report, you may need to call.

The contact information and links for each are here:

- Free Experian Credit Report call 1 866 200 6020 to confirm eligibility and get your credit report by mail or use this link.

- Free TransUnion Credit Report order online through this link.

Remember: Keep track of when you order your credit reports and from which bureau so that you know when youll be eligible to order your next credit report for free.

Getting Your Credit Reports

You can get a free report once every 12 months from each of the three nationwide consumer credit reporting companies through AnnualCreditReport.com. You can request all three of your reports at once, or you can space them out over the course of the year. That means if you order a report from one of the companies on March 1, you can’t get another free annual credit report from the same company until March 2 next year.

Please note, that there may be situations where you can obtain additional copies of your credit report for free such as the application of certain state laws, when you have been denied credit or in certain situations involving fraud.

You can visit the Consumer Financial Protection Bureau’s website for more information on how you can obtain your credit report for free.

Don’t Miss: How To Get A Car Repossession Off Your Credit

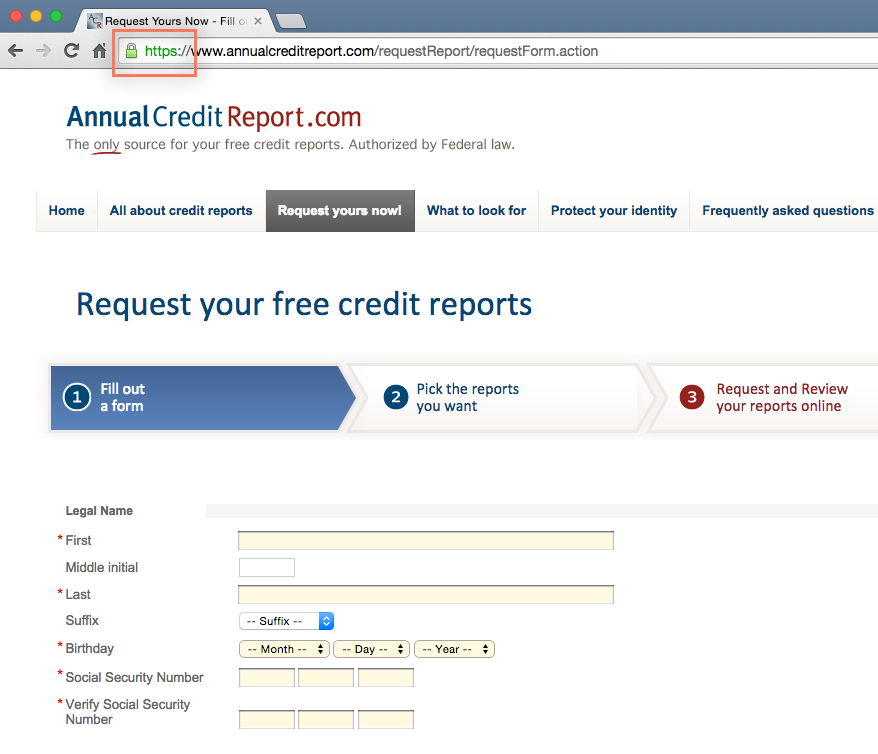

How Do I Order My Free Credit Reports

If you are getting your annual free credit reports, you can order them online through AnnualCreditReport.com.

This website will let you order all three of your free credit reports at once, with no obligations and no hidden fees. You may have to provide some personal information to confirm your identity before ordering, but you will not be charged if you use this site.

Please note that if you use these free credit reports to file a dispute with the credit reporting agencies, they have 45 days to investigate your dispute instead of the typical 30-day timeframe.

Option : Get Instant Access To Your Free Credit Report By Phone

The second fastest way to obtain a free copy of your credit report is to call each of the credit reporting agencies toll free numbers. If you call these numbers, a computer will ask you some questions about your personal information so that it can verify your identity. Then the automated system will mail you a copy of your credit report. It can take up to 3 weeks for your credit report to arrive by mail. You can obtain your free credit report by calling the numbers below:

- Equifax – 1-800-465-7166

- TransUnion – 1-800-663-9980

You May Like: Can Someone Check Your Credit Without Permission

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Submit Your Request In Person:

Equifax has four office locations where you can request a free copy of your Equifax credit report in-person and receive a printed copy of your credit report after your identity is confirmed. Copies of the request form you will need to complete are available onsite.

You need to bring with you at least two forms of identification, including 1 photo identification and proof of current address. Also, you must provide the original copies of your chosen identification – photocopies and electronic versions are not accepted at the office. Examples of acceptable documentation include:

- Driver’s License

- Utility Bills

Acceptable Supporting IDs:

- Birth Certificate Issued in Canada

- T4 slip

- Citizenship and Immigration Canada Document IMM1000 or IMM1442

- Social Insurance Number Card issued by Canadian Government

- Certificate of Naturalization

Providing your Social Insurance Number is optional. If you provide your S.I.N., we will cross-reference it with our records to help ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

Recommended Reading: Do Evictions Show Up On Credit Report

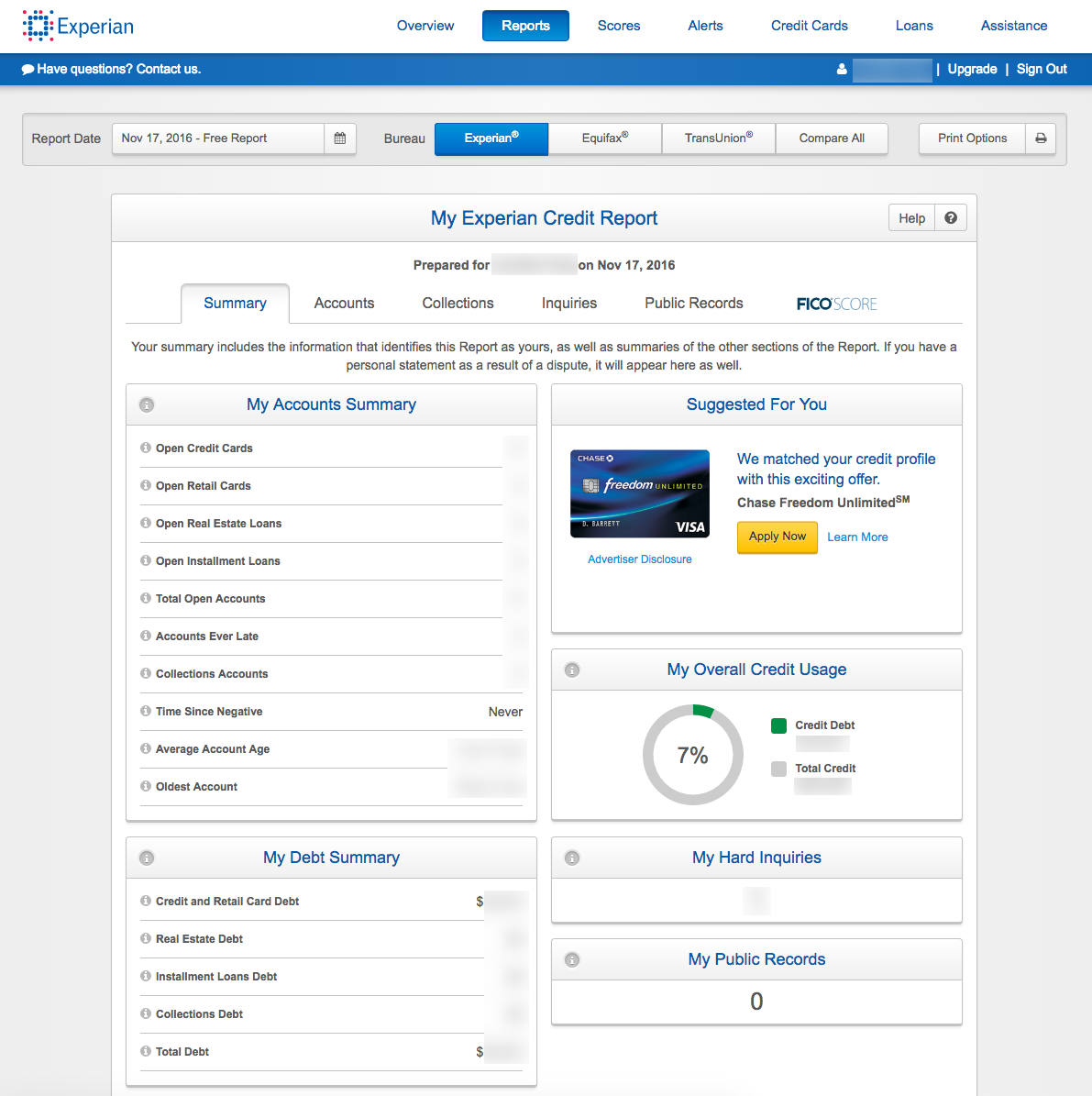

What Is Your Free Credit Score

Your credit score is the single most important financial score youll ever get. Yes, its even more important than matric aggregate, body fat count, or golf handicap, since credit providers use this credit score when deciding whether or not to extend credit to you. So be sure to maintain a good track record!

Your Experian credit score is calculated via a credit bureau check, using information from your full credit profile. Experian evaluates all of your accounts, your negative and positive information, and your payment history to assign you a credit score of 0999. The higher your credit score is, the better your credit profile, and the lower your risk will be of defaulting on an account or loan would be.

There Are Ways To Get A Free Credit Report Without The Strings

As a consumer, you have the right to see your credit report without having to pay for it. But, while its not hard to find a website promising a free credit score, it can be a challenge to find a website that gives you a truly free credit score without asking for your credit card number. If you want to see your credit report before you actually have a credit card, this can be a catch-22.

You shouldnt have to give up your credit card number for something thats supposed to be freeand, the good news is, you don’t have to. There are a few ways you can get a free credit score without entering your credit card number.

Read Also: How To Check Credit Score Usaa

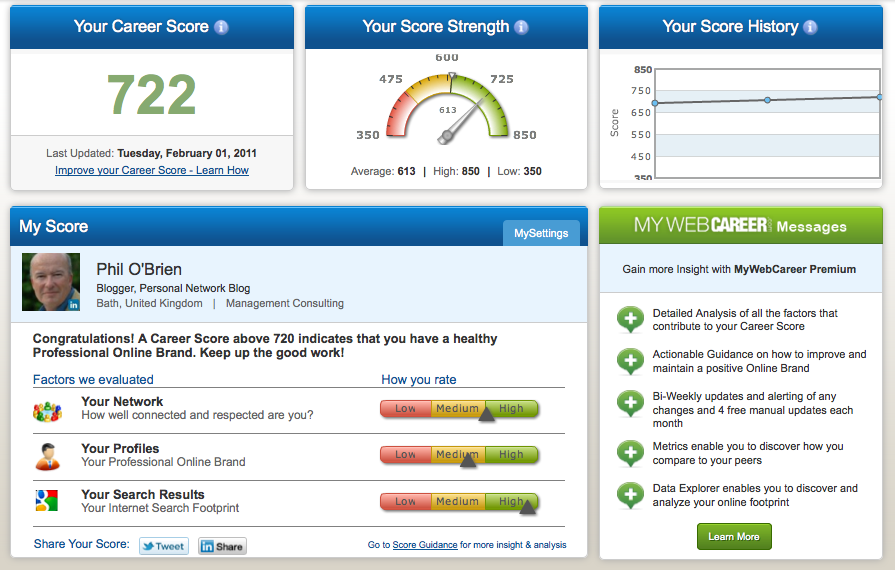

Checking And Understanding Your Credit Score Just Got Easier

There are no limits to how often you can check your credit score. The CreditView Dashboard gives you the power to:

View your score anytime.

Your score1 is updated once per month upon log in and checking it will not affect the score.

Use the Score Simulator.

This tool estimates what your score could be if you make certain changes.

Review your progress.

Use the Score Trends Graph to view up to 12 months of your credit score history.

Access credit education.

Learn credit basics, how to raise your score and more.

How Do I Get A Copy Of My Credit Reports

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies . You can request a copy from AnnualCreditReport.com.

You can request and review your free report through one of the following ways:

- Mail: Download and complete the Annual Credit Report Request form. Mail the completed form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

You can request all three reports at once or you can order one report at a time. By requesting the reports separately you can monitor your credit report throughout the year. Once youve received your annual free credit report, you can still request additional reports. By law, a credit reporting company can charge no more than $13.00 for a credit report.

You are also eligible for reports fromspecialty consumer reporting companies. We put together a list of several of these companies so you can see which ones might be important to you. You have to request the reports individually from each of these companies. Many of the companies in this list will provide a report for free every 12 months. Other companies may charge you a fee for your report.

You can get additional free reports if any of the following apply to you:

Recommended Reading: Itin Number Credit Score

Should I Order Reports From All Three Credit Bureaus At The Same Time

You can order free reports at the same time, or you can stagger your requests throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Because each credit bureau gets its information from different sources, the information in your report from one credit bureau may not reflect all, or the same, information in your reports from the other two credit bureaus.

Can My Bank Give Me A Credit Report

Providing the financial institution with your FICO Score, which is widely available in business lending, allows your credit score to be used in more ways than you might expect. As one example of the cooperative efforts made by the three largest credit reporting agencies to create VantageScore, it is one of the main credit scores.

Recommended Reading: How To Get Public Record Off Credit Report

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

How To Get Free Credit Reports From Each Of The Three Credit Bureaus

The Fair Credit Reporting Act requires each of the three credit bureaus to provide consumers with one free credit report per year. Federal law also entitles consumers to receive free credit reports if any company has taken adverse action against them. This includes denial of credit, insurance or employment, as well as other reports from collection agencies or judgments. But consumers must request the report within 60 days from the date the adverse action occurred.

In addition, consumers who are on welfare, unemployed people who plan to look for a job within 60 days and victims of identity theft are also entitled to a free credit report from each of the credit bureaus.

You May Like: Is 590 A Bad Credit Score

Free Annual Credit Report

Review your credit report often to make sure the information is accurate. If you see something on your report that you didnt do, it could mean youre the victim of identity theft.

You can get one free credit report each year from each of the three nationwide credit bureaus. The website annualcreditreport.com is your portal to your free reports.

Note: when you leave that website and move to the company website to get your free report, the company will probably try to get you to sign up for costly and unnecessary credit monitoring services.

You can also get your credit reports by phone by calling 1-877-322-8228. Under North Carolina law, credit monitoring services are required to tell you how you can get credit reports for free.

To keep track of your credit during the year, request a free report from a different credit bureau every four months. You can also pay for additional copies of your credit report at any time.

Why Don’t My Free Credit Reports Include Credit Scores

Your credit report and your credit score are not the same thing. Your credit report contains information that a credit reporting company has received about you. Your credit score is calculated by plugging the information in your credit report into a credit score formula. You may have multiple credit scores based upon who provided the score, and whether the company providing the score used their own scoring model or used a model available from a third party.

Federal law gives you the right to ask for a copy of your credit report from each nationwide credit reporting company every year for free. However, the law does not require the credit reporting companies to provide a free credit score.

Don’t Miss: Coaf On Credit Report

Option : Get Instant Online Access To Your Credit Report And Score

Both Equifax and TransUnion are now providing online access to your credit report for free. Equifax is also including a credit score as part of this free package. We’re not sure how long this offer will last, but it’s worth taking advantage of if you’re looking for either your credit report or your score. Here is where you can access Equifax’s free online credit score and report and TransUnion’s free online credit report. If either of these options don’t work for you, don’t worry. It doesn’t mean you’ve done anything wrong, it just means that you’ll have to try one of the other methods listed below. It’s possible that for some reason the information you entered doesn’t perfectly match the credit reporting agency’s records.

Do I Have To Pay For My Credit Report

It depends. There are many free credit report resources available, but there are several that also charge fees. With so many free resources available, there really isn’t any need to pay for your credit report. Just make sure you access your credit report through a verified site, such as those listed in this guide and sites that start with “https.”

Also Check: Affirm.com Walmart

What Is A Credit Report

When you make a payment on a credit card or loan, the business that gave you the loan or credit keeps a record of how much and often you pay, as well as the credit limits and loan balances. Those businesses and other sources may report your credit, loan and payment history to one or more credit reporting companies. The credit reporting companies each combine the information they receive about your different credit, loan and payment activities into a credit report. The credit reporting companies prepare credit reports for people in the U.S. Since not all businesses report to all three credit reporting companies, the information on your credit reports may vary.

A credit report is an organized list of the information related to your credit activity. Credit reports may include:

- A list of businesses that have given you credit or loans

- The total amount for each loan or credit limit for each credit card

- How often you paid your credit or loans on time, and the amount you paid

- Any missed or late payments as well as bad debts

- A list of businesses that have obtained your report within a certain time period

- Your current and former names, address and/or employers

- Any bankruptcies or other public record information

Under Federal law, you are entitled to receive one free copy of your credit report from each credit reporting company every 12 months. For more information visit the Consumer Financial Protection Bureau’s website.