How Long Can A Debt Collector Pursue An Old Debt

Each state has a statute of limitations about how long a debt collector can pursue old debt. For most states, this ranges between four and six years. These statutes govern the amount of time that a debt collector can sue you, but there is no limit to how long a collector has to try and collect on a debt. If you are being contacted about a debt that you believe is not yours or is outside the statute of limitations, do not claim the debt instead, ask the company to validate that the debt is yours.

What Is Pay For Delete

Pay for delete refers to the process of getting a debt collector to remove collection account removed from your credit report. Its a point you can use during a debt settlement negotiation, as you settle a debt for less than you owe. You agree to pay a certain amount of money in your settlement. In exchange, the collector agrees to remove the collection account from your credit report. In some cases, a collector may require a debt to be paid in full to agree to remove the account.

Wait For Accounts To Drop Off

If you choose not to take steps to remove closed accounts, you’ll be happy to hear that these closed accounts won’t stay on your credit report forever. Depending on the age and status of the account, it may be nearing the credit-reporting time limit for when it will drop off your credit report for good. If that’s the case, all you might have to do is wait a few months for the account to fall off your credit report, and then for your credit report to update.

Most negative information can only be listed on your credit report for seven years from the first date of deliquency.

If the closed account includes negative information that’s older than seven years, you can use the credit report dispute process to remove the account from your credit report.

No law requires credit bureaus to remove a closed account that’s accurately reported and verifiable and doesn’t contain any old, negative information. Instead, the account will likely remain on your credit report for ten years or whatever time period the credit bureau has set for reporting closed accounts. Don’t worrythese types of accounts typically don’t hurt your credit score as long as they have a zero balance.

Read Also: Free Karmascore

How To Remove Collections From A Credit Report Canada

Note that the tips included here assume that a collections account assigned to you is accurate. If you find a collection account on your Canadian credit report that isnt yours or that has incorrect information, youll want to dispute it with the credit bureau thats reporting the information before doing anything else.

If you want to remove accurate collections from your credit report in Canada, follow these steps:

- Ask for debt validation. Once you are contacted by a debt collector, send them a letter requesting that they validate the debt. Ask them to verify the name of the original creditor, the amount owed and whether the debt is still within the statute of limitations for your province. Debts that are outside the statute of limitations are no longer considered collectable.

- Request pay for delete. Pay for delete is essentially an agreement in which you ask the debt collector to remove a collection account from your credit report in exchange for payment. Whether they agree to this usually depends on how old the debt is, how much is owed and your past account history. Keep in mind that if youre asking for pay for delete, its with the expectation that youll pay the full amount owed, including the original balance as well as interest and any fees charged by the collection agency.

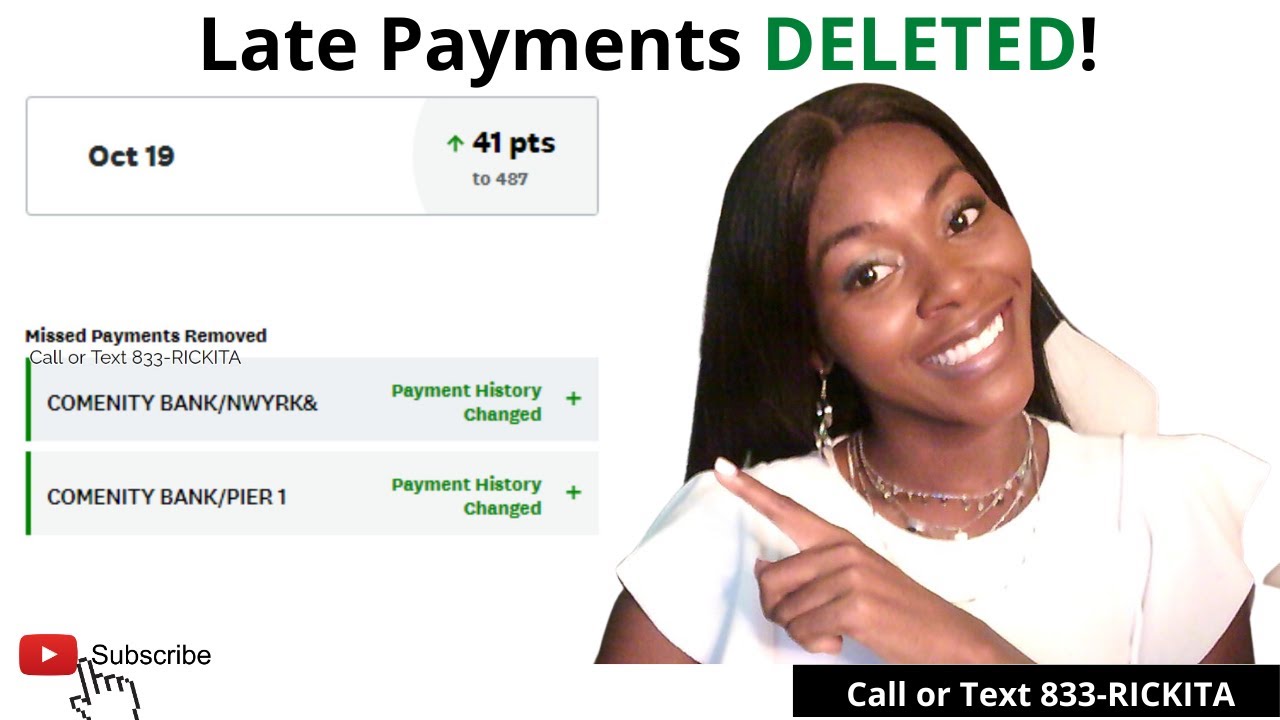

Write A Goodwill Letter

No luck with direct contact or a written dispute? A goodwill letter is another tool in your arsenal to nix those late payments from your credit report.

These letters are ideal in situations where you missed payments and are now in good standing. is already in collections, a pay for delete arrangement may be your best bet. More on that shortly)

In a nutshell, a goodwill letter is a written request to the bank, credit card issuer, or other creditor asking that they remove the late payment from your credit report.

Theres no guarantee that theyll remove the negative mark, but its worth a shot. Plus, you can plead your case again if they reject your request the first time around.

When drafting up your letter, be honest about why you were delinquent. For example, if you hit a rough patch because you became unemployed or dealt with medical issues, put that information in there. Or maybe your account was compromised, or there was a glitch in autopay, so the payment was returned or didnt go through.

Regardless of your reasoning, be as specific as possible and reiterate that the entry does not reflect your true character. It just resulted from a financial rough patch, and that youve worked hard to get back on track.

Also Check: Comenity Bank Credit Bureau

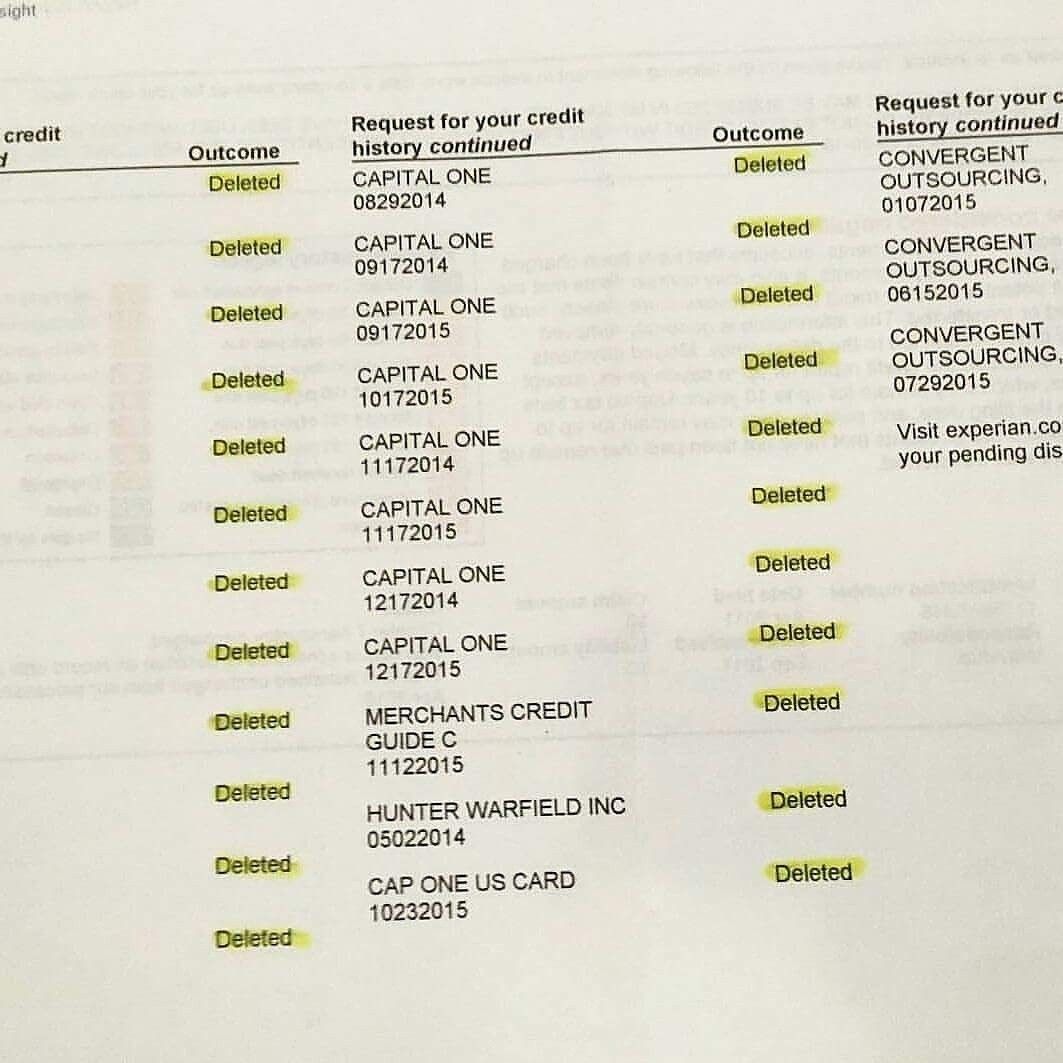

Removing Collection Accounts From A Credit Report

Whether your attempts to pay for delete are successful can depend on whether youre dealing with the original creditor or a debt collection agency. As to the debt collector, you can ask them to pay for delete, says McClelland. This is completely legal under the FCRA. If going this route, you will need to get that in writing, so you can enforce it after the fact.

What to keep in mind, however, is that pay for delete with a debt collector may not remove negative information on your credit history that was reported by the original creditor. The creditor may claim that its contract with the debt collection agency prevents it from changing any information that it reported to the credit bureaus for the account. That said, some debt collection agencies take the initiative and request that negative account information be deleted for customers who have successfully paid their collection accounts in full.

Before taking this step, consider how collection accounts may be impacting your credit score. The FICO 9 credit scoring model, for instance, doesnt factor paid collection accounts into credit score calculations. So if youve paid off or plan to pay off a collection account, then you may not need to pursue pay for delete if your only goal is improving your credit score.

How To Remove Negative Items From A Credit Report

A version of this blog post on How to Get Items Removed From Your Credit Report was originally published by our content partner Money. They are a digital magazine and a resource for personal finance news and information.

Having a good credit score is an important part of most peoples lives. It lets lenders know how trustworthy you are with borrowing money. This can include everything from asmall business loan to a big financial commitment like a home mortgage.

Yet, in 2020, most people still have no idea how their credit score works and the importance of having the correct information on their credit report.

Here are some things to keep in mind next time you think about your credit score.

Also Check: Capital One Rapid Rescore

Will My Credit Score Increase If A Collection Account Is Removed

Since payment history accounts for 35% of your FICO score, your score might build if a collection account is removed. However, how much it increases will depend on other items listed in your credit report. For example, if this negative account is the only one listed on your credit report, removing it could boost your score more than if you had several other collection accounts on your report.

Is Pay For Delete Legal

The Fair Credit Reporting Act governs credit reporting laws and guidelines. Anything that a debt collector, creditor, or credit bureau does regarding a credit report will be based on the FCRA, says Joseph P. McClelland, a consumer credit attorney in Decatur, Ga.

Technically, pay for delete isnt expressly prohibited by the FCRA, but it shouldnt be viewed as a blanket get-out-of-bad-credit-jail-free card. The only items you can force off of your credit report are those that are inaccurate and incomplete, says McClelland. Anything else will be at the discretion of the creditor or collector.

Also Check: Carecredit Credit Score Requirements

How To Get Something Off Your Credit Report

According to the Federal Trade Commission, no one can legally remove accurate and timely negative information from a credit report.

But, if the item is questionable or doesnt quite tell the entire story, you have the right to file a dispute and request an investigation with each credit bureau thats reporting it. You also have the right to file a dispute if an account results from fraud or identity theft.

How To Remove All Negative Items On Your Credit Report

Life can be rough, but fixing your bad credit shouldnt be. This article will explain how to remove negative credit report entries from your credit report that do not belong there, for FREE, which will in return boost your credit score. This is not something that happens over night it will take time and patience.

For some, with extensive issues, you will have to send quite a few letters over many months. Be prepared to spend time and effort on this project. It is, after all, a project, and this project will change your financial life for the better.

Many of the items listed on credit reports of American consumers are inaccurate. This gives you the right to not only dispute these credit report errors, but question how they arrived to their conclusion if they fail to remove them.

Lets discuss how you can remove all of these credit report errors on your credit report that do not belong to you.

Rule #1: Do NOT use one of those credit dispute letter templates that you can easily find on the internet. The major credit bureaus can and will cease any investigation you request, as they will deem the investigation frivolous.

Be sure to write your own and print it out or, better yet, hand write the letter in pen to send it out. You want the investigation to start out on the right foot, so be sure to take your time on this and make it as legit as possible. Templates are a no-no.

Also, youll have proof that you disputed the credit report errors as well. More on that below.

Read Also: How Can I Check My Credit Score With Itin Number

Dispute With The Business That Reported To The Credit Bureau

Now, you can completely bypass the credit bureau and dispute directly with the business that reported the error to the credit bureau, e.g., the credit card issuer, bank, or debt collector. You can make the dispute in writing, and the business is required to do an investigation just like the credit bureau.

When the business determines that theres indeed an error on your credit report, they must notify all the credit bureaus of that error so your credit reports can be corrected.

What Goes Into Your Credit Report

This is your first line of defense Knowing what information goes into your credit report can provide you an idea of your financial health and also identify if youve been the victim of identity theft.

To find out if the information on your credit report is correct, the three main credit reporting agencies allow you to obtain a copy of your credit report once a year.

Due to the current COVID-19 pandemic, all three credit reporting agencies are now offeringfree weekly online reports through April 2021 this should be your first step.

Next, you have to find out what information makes up your score and what factors can improve or negatively affect it. Finally, ask how you can improve your score. Usually, that information is provided to you as a list of risk factors when obtaining a copy of your credit report.

Rod Griffin, Senior Director of Public Education for Experian, said risk factors tell you exactly what you need to work on in your credit report to make those scores better.

Read Also: When Does Comenity Bank Report To Credit Bureaus

How To Get A Collections Stain Off Your Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Collections accounts generally stick to your credit reports for seven years from the point the account first went delinquent.

But you may want them off sooner than that unpaid collections can make you look bad to potential creditors. And while newer versions of FICO and VantageScore credit scores ignore paid collections, many lenders still use older formulas that count even paid collections against you.

Here are steps to remove a collections account from your credit report:

Do your homework

Dispute the account if there’s an error

Ask for a goodwill deletion if you paid the collections

An unlikely option: Pay for delete

Look For Errors And Dispute Them

Once youve reviewed your potentially negative items, first make sure there arent any mistakes. There are a handful of different types of errors you should look for on your report:

- Accounts that dont belong to you

- Negative items that have expired but havent yet dropped off the report

- Personal information errors

- A paid off account thats still listed as unpaid

If you do find an error, youll first want to notify the creditor. The Federal Trade Commission makes the process really easy with this sample letter. Fill in the blanks, then send the letter to the creditor, along with any documentation supporting your dispute. Theyre obligated to investigate the items in question, usually within 30 days. If they agree that theres an error, its their job to notify all three credit bureaus so they can fix your report. You can also request to have them send notifications to any agency thats pulled your report within the past six months.

If they dont think theres an error, you can at least ask for a notification of dispute to be included on future reports. You can also dispute with the bureaus directly, and they make it fairly easy. Experian, for example, lets you directly dispute those errors using their online form.

Also Check: When Do Closed Accounts Fall Off Credit Report

Can I Get A Paid Collection Account Off My Credit Report

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

A paid-off collection account will come off your credit report eventually, but it’s not usually possible to get this account taken off your credit report proactively. You can ask your creditor to take the account off your report – either as a condition of your full payment or as a matter of good will – but no creditor is obligated to honor this request. This article will go into detail about how an account that has been sent to collection can affect your credit score, how a “pay for delete” letter works, and what you can do if the collection account on your credit report is there by mistake.

Having a collections account noted on your credit history can have a negative impact on your finances. Maybe the negative item has dropped your credit score too low to get a good interest rate on a car loan, or maybe the reminder that you werenât always able to pay your debts on time is making new creditors hesitant to lend you credit at all. Having this account on your credit report isnât doing you any favors, but youâve worked hard and youâve paid off the collection account , so now what?

Get All Three Of Your Credit Reports

Your three credit reports from consumer reporting agencies Equifax, Experian and TransUnion are not identical.

The old debt in question might be listed in some credit reports but not others. To find out, get a copy of all three of your reports. Federal law entitles you to request a free copy of each report once every 12 months. You can download them for free at AnnualCreditReport.com.

Once you find out which bureaus are listing the debt, contact them. Your credit report will include contact information and dispute instructions. Equifax, Experian and TransUnion will give consumers free weekly credit reports until April 20, 2022.

Why this is important: If youre only looking at the copy of your credit report from one credit bureau, you may be missing inaccurate information that is on another report.

Who this affects most: Mistakes with credit reports can happen to anyone with old debt on any of your credit reports.

You May Like: Credit Score For Affirm Approval

Ask To Have Negative Entries That Are Paid Off Removed From Your Credit Report

You may have a series of late payments on your credit report, or perhaps an old collection account that’s since been paid off still shows up. If this is the case, ask to have them removed.

This step may take more time and effort on your end, but it could be worth it. Triggs suggests speaking to the collections agency, debt buyer or original creditor to remove a paid-off account from your credit report.

“You’d most likely have better results using this method with collection agencies or debt buyers versus the original creditor,” he says.

Try to convince them to not only show the account as paid, but to remove the account altogether, which could have a much bigger impact on your credit score. “Having even a paid collection account or paid charge-off on your credit report could deter creditors in issuing you future credit at all,” Triggs says.