Credit Score: Personal Loan Options

With a credit score between 700 and 749, youre just one step away from the top rung of the credit score ladder. Working to improve your 715 credit score means getting the best personal loan rates possible. However, interest rates with a score in this range are still ideal. Theyll very from fourteen to sixteen percent, often falling on the lower end of that spectrum.

How To Find The Best Credit Cards If Your Fico Score Is 700 To 749

If youre in this credit score range, the best credit cards arent hard to find. Nearly all types of cards will be available to you.

At this credit score range, it will be less a matter of finding cards you qualify for, and more about selecting the ones you like best.

Whats more, traditional factors, like annual fee and interest rate become less important. Credit cards in the 700 to 749 range offer the kinds of perks that can actually enable you to come out ahead in using the card. That is, the rewards and benefits will be higher than the annual fee, and even the interest expense if you make a habit of not carrying an outstanding balance.

This guide will offer nine different credit cards if your FICO Score is 700 to 749. You can simply choose the card that offer the best combination of rewards and benefits for you.

How To Earn A Good Credit Score:

If you currently have a credit score below the “good”rating, you may be labeled as a subprime borrower, which can significantly limit your ability to find attractive loans or lines of credit. If you want to get into the “good” range, start by requesting your credit report to see if there are any errors. Going over your report will reveal what’s hurting your score, and guide you on what you need to do to build it.

Recommended Reading: Does Klarna Report To The Credit Bureaus

Pay All Your Bills On

If your credit score is over 700, youre probably doing this faithfully. At the same time, you should be aware that a single late payment could have a serious negative effect on your credit rating.

Set up automatic debits for any recurring payments you have. You should do this even with rent and utility payments. Though they wont report to credit bureaus in the normal course, they will report unpaid balances. Automatic debits will eliminate that possibility.

Nomortgageinsurance Loans And Down Payment Assistance

One last strategy to consider is a portfolio loan from a bank or mortgage lender.

These are specialty loans for which lenders set their own rules so they dont have to follow requirements set by regulators like Fannie Mae and Freddie Mac.

That means they often have special perks, like:

- Down payment and closing cost assistance to help you cover your outofpocket costs

Thus, a portfolio loan might be a great option if you have a 700+ credit score but have a tough time with other mortgage requirements, like making a down payment.

Read Also: Syncb Bp

Blue Cash Preferred Card From American Express

Earn up to 6% cash back on everyday expenses with the Blue Cash Preferred® Card. Right now, the card offers 6% cash back on groceries and streaming services, 3% cash back on transportation expenses and gas and 1% cash back on other purchases. Along with that, the card has an intro APR of 0% for the first 12 months and users can earn a $300 statement credit if they spend $3,000 in purchases in the first 6 months. After the first year, users must pay an annual fee of $95. To get this credit card, youll need to have a credit score of about 700 or higher.

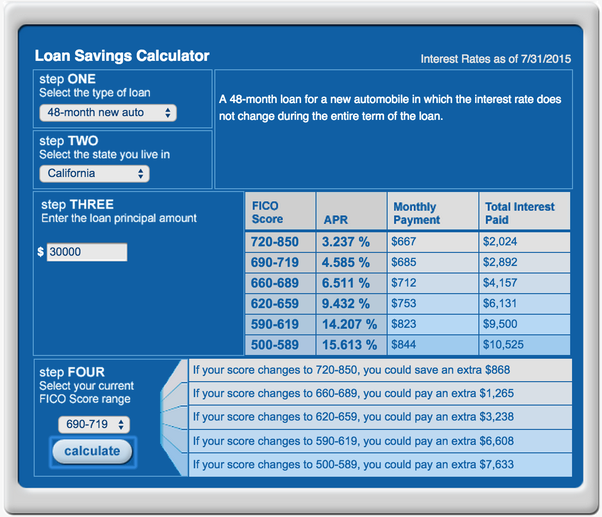

Shopping For The Best Rates On Loans And Credit Cards For A Credit Score Under 715

If you are ever on the market for high-priced items, such as home appliances, it is very common for people to walk into the store and get offered a discount or an otherwise excellent financing deal.. .but only if they open up a credit card account with that store.

Why do stores offer these credit cards? The reason why is because theres usually a high interest rate or multiple fees that go along with them. Those rates and fees can be found on the small fine print of the credit card deal, but of course, the store doesnt tell you.

A golden rule of credit cards is that you should only apply for credit that is a necessity for your financial life. When applying for a credit card from a retail store, youre probably only going to use it once, twice, or three times maximum. You could just as easily be using an existing credit card that you already have.

Heres why this is so critical: applying for multiple credit cards within a few months of each other will be very harmful to your overall credit score. Never apply for a credit card that you dont need.

Now, when you do decide to apply for credit cards and loans in general, there are a few factors that you will want to remember, including:

Recommended Reading: How Long Is A Repo On Your Credit Report

Where To Go From Here

Its important to pay down your balances and keep your credit utilization under 30%. Its also wise to have several different types of credit accounts that include a mix of installment and revolving credit.

Of course, you also want to focus on making timely payments from here on out. Even one late payment can be very damaging to your credit.

Length of credit history also plays an essential role in your credit scores. You want to show potential creditors that you have a long, positive payment history.

Building excellent credit doesnt happen overnight, but you can definitely speed up the process by making the right moves.

Give Lexington Law a call for a free credit consultation at and get started repairing your credit today! The sooner you start, the sooner youll be on your way to having excellent credit.

Categories

What Can You Do With A 715 Credit Score

A Good credit score of 715 means youre in line to enjoy certain financial benefits. While you wont obtain rates and fees as low as someone with an Exceptional credit score, a 715 credit score still allows you to secure personal and property loans, apartment rentals, reasonable car insurance premiums, and even some of the best rewards-based credit cards available today.

Consult the below details for even more information on the opportunities available to you with a Good credit score of 715.

- Personal loans help consumers address financial needs such as a home renovation or an emergency medical bill as they arise.

- While you might not be able to land the lowest-possible loan rate, a Good credit score helps unlock personal loans with reasonable fees when you need them.

You May Like: Itin Credit Score

What Credit Score Is Needed To Buy A House

Ah, the dreaded . Its one of the biggest criteria considered by lenders in the mortgage application process three tiny little digits that can mean the difference between yes and no, between moving into the house of your dreams and finding yet another overpriced rental. But despite its massive importance, in many ways the credit score remains mysterious. If you dont know your number, the uncertainty can hang over you like a dark cloud. Even if you do know it, the implications can still be unclear.

Is my score good enough to get me a loan? Whats the best credit score to buy a house? What’s the average credit score needed to buy a house? Whats the minimum credit score to buy a house? Does a high score guarantee I get the best deal out there? And is there a direct relationship between credit score and interest rate or is it more complicated than that? These are all common questions, but for the most part they remain unanswered. Until now.

Today, the mysteries of the credit score will be revealed.

How Your Credit Score Is Determined

All the leading credit rating agencies rely on similar criteria for deciding your credit score. Mostly, it comes down to your financial history how youve managed money and debt in the past. So if you take steps to improve your score with one agency, youre likely to see improvements right across the board.

Just remember that it may take some time for your credit report to be updated and those improvements to show up with a higher credit score. So the sooner you start, the sooner youll see a change. And the first step to improving your score is understanding how its determined.

Here are some of the factors that can harm your credit score:

- a history of late or missed payments

- going over your credit limit

- defaulting on credit agreements

- bankruptcies, insolvencies and County Court Judgements on your credit history

- making too many credit applications in a short space of time

- joint accounts with someone with a bad credit record

- frequently withdrawing cash from your credit card

- errors or fraudulent activity on your credit report thats not been detected

- not being on the electoral roll

- moving house too often.

You May Like: Credit Score 588

A 715 Credit Score Overview

One of the most essential determinants of your future is your credit score. It could be the deciding factor in whether you are able to obtain a loan for a new house or continue to rent. Moreover, it can have an impact on the interest rates on your auto, housing, and school loans. The higher your credit score, the lower the interest rate youll have to pay when borrowing money.

Even more crucially, your 715 credit score is one of the most essential markers of your financial responsibility, therefore its critical to understand whether its good or poor. When you register for a new loan or credit card, your credit report will be reviewed. Furthermore, prospective landlords and employers will check your credit before making a decision. The worse your credit score, the more likely it is that you will be required to submit a significant deposit before signing a new lease or opening a new account. Your credit score may even result in career prospects being lost.

How To Build Your Credit

Here are some basic steps to help build your credit score:

- Always make payments on time.

- Pay down debts.

- Reduce the number of hard inquiries on your credit report.

- Avoid opening many new loans all at once.

- Keep your first credit card open so you can take advantage of the long credit history.

Great credit opens the door to financial opportunities, better interest rates and more. You can work to improve your credit score and get to a higher credit range. You took the first step today by learning what can improve your credit score. Now, you only have to start implementing these new financial habits.

Your best credit score is an accurate & fair one start working to repair your credit with Lexington Law

Read Also: Is 575 A Good Credit Score

How Good Is A 700 Credit Score

Mortgage lenders tend to group , and applicants within one range receive the same interest rates. On a scale of 300 to 850, a 700 credit score usually falls into the good range.

Having a credit score of 700 is advantageous because:

- It can help you qualify for the loan. Most conventional and government-backed mortgage programs require a credit score of at least 640. So with a score of 700, youll be able to check off that requirement.

- You could have room to negotiate for better terms. Because you have a good credit score, lenders might be willing to negotiate the mortgage rate and other loan terms to compete for your business.

- A good score can lead to lower interest rates. Thats because credit scores help lenders predict risk, and a higher score lets them know youre likely to make payments on time.

Learn More: What Is a Mortgage Rate and How Do They Work?

How Much Credit Limit Can I Get With 700 Credit

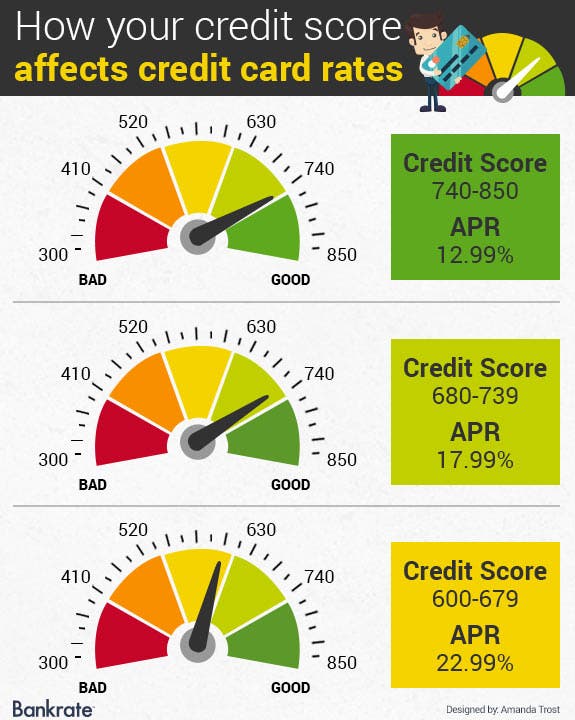

Using Ted Rossman, senior industry analyst at Bankrate, you will likely need to have a credit limit similar to the average credit limit of $4,200 if you are in the 700 club. There are certain income requirements and other debt limits that vary. Credit card interest rates range from 16 percent to 18 percent, according to Rossman.

Recommended Reading: Does Affirm Help Credit Score

What Is A Bad Credit Score Range

Bad credit score = 300 549: It is generally accepted that credit scores below 550 are going to result in a rejection of credit every time. If your score has fallen into this range, improving your score is going to take some work.

Filing for bankruptcy can bring a score down to this level. Statistically, borrowers with scores this low are delinquent approximately 75% of the time. But if you continue to make your payments on time, your score should improve. There are certain types of loans, like home loans, that are hard to get with a score in this range, but there are still options for getting a mortgage with bad credit.

How To Earn An Excellent/exceptional Credit Score:

Borrowers with credit scores in the excellent credit range likely haven’t missed a payment in the past seven years. Additionally, they will most likely have a credit utilization rate of less than 30%: meaning that their current ratio of credit balances to credit limits is roughly 1:3 or better. They also likely have a diverse mix of credit demonstrating that many different lenders are comfortable extending credit to them.

Also Check: Does Usaa Do A Hard Pull For Credit Increase

What Factors Affect Your Credit Score

Your credit score is comprised of five factors: payment history, amounts owed, length of credit history, new credit, and credit mix.

If your FICO Score is 700 to 749, youre probably perfect or near-perfect in the payment history category. At worst, you may have one or two 30-day late payments in your distant past, but nothing recent.

In this credit score range, is likely to be a bigger factor. Its the amount you owe on your credit cards, divided by your total credit card limits.

For example, if you owe $5,000 in credit card debt, and you have $20,000 in credit card limits, your credit utilization ratio was 25%. Any number below 30% is considered good.

Is Your Credit Score Average For Your Age

Given that younger borrowers may not have a long history of credit to drive their credit score up, it shouldn’t be surprising that average credit scores for American borrowers improve throughout their lifetime. As borrowers mature, they also become more aware of the factors that drive credit score improvement and are motivated to increase their scores to allow home purchases and other large investments that require loans or lines of credit.

Don’t Miss: Does Qvc Do A Credit Check

How To Check Your Credit Score

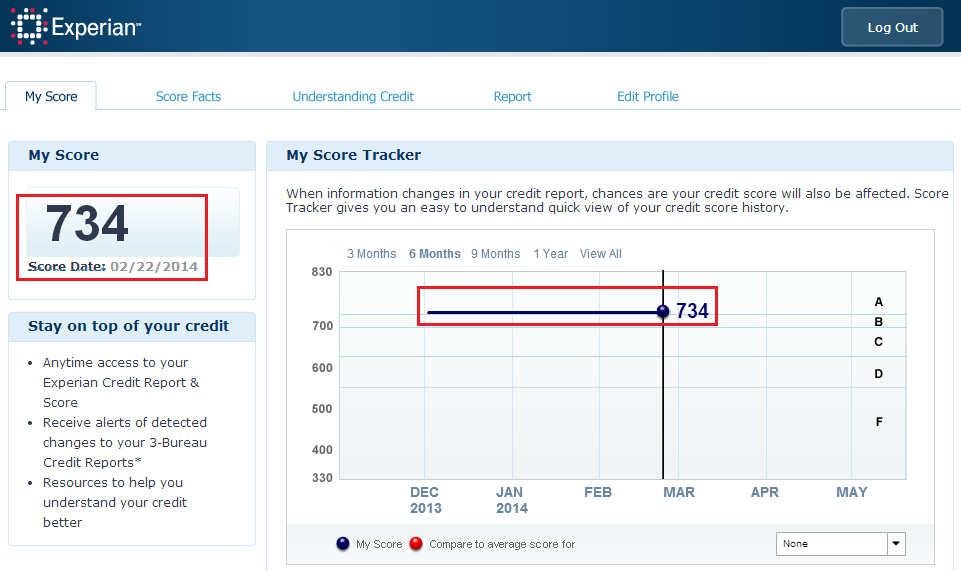

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

The Different Types Of Credit Scores

The three main credit bureaus are Equifax, Experian, and TransUnion. Each bureau gives you a score, and these three scores combine to create both your 715 FICO Credit Score and your VantageScore. Your score will differ slightly among each bureau for a variety of reasons, including their specific scoring models and how often they access your financial data. Keeping track of all five of these scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

Don’t Miss: When Does Self Lender Report To Credit Bureaus

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.