How To Avoid Credit Card Delinquency

The best way to avoid delinquency on credit cards is to manage your debt responsibly. Here are some suggestions:

- Set up autopayIf you have numerous monthly bills and struggle to keep track of them, then setting up autopay with your bank or credit union can help ensure that you never miss a payment.

- Prepare your budgetIf you were able to take advantage of debt deferment or forbearance during the 2020 economic crisis, then youll need to get ready to pay more to cover those debts. Try to set aside enough to pay more than the monthly minimum on your credit cards.

- Stop using credit cardsFeel like youre underwater on your bills? Put away your credit cards so you dont rack up more debt and dig yourself into a deeper hole. Once you have stopped using your cards, you could also consider taking out a personal loan to pay off what you owe with one easy monthly payment. Just be sure not to run up more bills.

- If youre getting behind on payments, then reach out to the creditor right away. Alerting them to your situation will make them more likely to work with you on a solution.

Finding Original Delinquency Dates

Under the FCRA, you’re entitled to a free credit report from the three credit bureaus — Experian, Equifax and TransUnion — once a year. As you review the reports, locate the accounts in question. Each account should list a “date of first delinquency.” Use this date to determine when the reporting drop-off dates start and end. If you find any inaccuracies, file a formal dispute with the appropriate credit bureau. Each report should provide instructions or contact information for the dispute process.

References

Ways To Scrub A Collections Stain Off A Credit Report

Your credit scores take a hit if you fall behind on payments to a creditor, and again if an account is sent to the creditors collection department or sold to a third-party collector. You may be able to repair some damage to your scores by resolving a collections account on your credit reports.

Collections accounts generally stick to your credit reports for seven years from the point the account first went delinquent. You may want them off sooner than that unpaid collections always hurt your scores. And while newer versions of FICO and VantageScore credit scores ignore paid collections, many lenders still use older formulas that count even paid collections against you.

There are a few ways to get a collections account off your credit report, depending on your relationship with the creditor and the account status.

First, do your homework

Get information on the debt from two places: your credit reports and your own records.

You can get a free credit report every 12 months from each of the three major credit reporting bureaus by using AnnualCreditReport.com. Some personal finance websites offer free credit report and score information.

Gather your own records for details on the account, including its age and your payment history.

Between the two, verify these details:

- Account number

- Account status

- The date the debt went delinquent and was never again brought up to date

Once you have the details straight, you can decide which approach works for you.

Recommended Reading: Does Klarna Help Build Credit

How Credit Card Delinquency Works

Credit card delinquency occurs when a cardholder falls behind on making required monthly payments. While being 30 days late is generally considered delinquent, it typically takes two months of delinquent payments before the information is reported to credit reporting agencies. If an account is reported delinquent, then the event can have a negative effect on your credit score and curtail your ability to borrow in the future. However, once you have a thorough understanding of delinquency, dealing with it is actually quite straightforward.

Ways To Remove Old Debt From Your Credit Report

Having an accurate and up-to-date credit history without old collections or delinquent accounts is important when youre applying for loans or other new credit.

If youve noticed old debts on your credit report, its best to act as soon as possible to remove these items. Here are a few steps you should take.

Also Check: Minimum Credit Score For Carmax

Use A Free Credit Monitoring Service

Apps such as and will show your VantageScore, which resembles your FICO score, any time you want to see it.

More importantly, you can set these apps to send a notification or a text message anytime someone applies for new credit in your name.

This provides a great first line of defense against identity theft.

A lot of credit card issuers will now show your FICO score on their apps or online platforms.

Discover, for example, offers this service. In this case, a big drop in your FICO could warn you about inaccuracies or fraud.

How Long Does A Derogatory Account Stay On Your Creditreport

Derogatory accounts will generally stay on your creditreport for seven years but can show for as long as 10 years for some accountsand in some states. This will usually depend on the laws in your state and thetype of debt.

Bankruptcies, the granddaddy of debts, will stay on yourcredit report for up to 10 years in most states while foreclosures and studentloans will drop off after seven years. Tax liens and simple late payments willgenerally drop off after seven years.

Its important to understand when the clock starts tickingon different types of derogatory accounts and how that affects when they dropoff your credit report. This is usually the date the late payment or other badmark was added to your credit but can also be the date of your last payment orwhen the collection agency took over. If you make a payment plan with thecollection agency or they file a change to the debt, that might start the clockover and it could be another seven years before it drops from your report.

Check your credit report and score with TransUnion credit monitoring. Get a 30-day free trial here.

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus

Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your credit report. The NFCC can provide debt counseling services, help review your credit reports, work with lenders, and help create a debt management plan free of charge.

As always, be wary of predatory credit organizations or companies. Make sure to find a reputable counseling agency and keep a lookout for any red flags, like hidden fees or lack of transparency.

When looking for a credit counselor, the Federal Trade Commission advises consumers to check out each potential agency with:

- The Attorney General of your state

- Local consumer protection agencies

- The United States Trustee program

Strategies That Wont Help Remove Negative Information

So now you know four strategies for getting negative entries off your credit file.

Sometimes, though, it helps to know what wont help remove negative information.

If youre searching for credit repair answers, know that these things wont help fix your credit:

- Paying Off Old Stuff: A lot of people think debt collectors will remove negative information from their credit if they can just pay off the charge-offs, past-due balances, and collection accounts. In reality, paying off these accounts will not help your credit. Lenders will still see you had trouble paying off previous accounts.

- Bankruptcy: Filing bankruptcy could help restore your financial health by reorganizing or dissolving old debts. But it wont help your credit score. In fact, the bankruptcy will pull down your score for up to 10 years. Plus, the road to bankruptcy is paved with late payments, missed payments, and collection accounts all of which will remain on your credit report along with the bankruptcy.

- Closing Delinquent Accounts: A closed account wont look any better to prospective lenders than an open account. In fact, closing accounts could hurt your score since FICO places value on older average ages for credit accounts.

Also Check: Zzounds Payment Plan Denied

How Many Days Late Before It Is Reported To The Credit Bureau

Others may wait until you close your account to report them. Once you are 90 days late or more, it affects your credit even more.

At this point, it can be turned into a charge-off if the creditor decides to sell the outstanding balance to a collection agency. However, even if you are already 90-plus days late on a payment, its still a good idea to pay to avoid additional harm in the form of a charge-off, collection, or repossession.

No matter how much you owe, delinquent accounts have the same effect. To the credit reporting agencies, a late payment of $50 is just as bad as one of $5,000. Knowing this, if you have to choose which bills to pay first, it may be wise to pay the less expensive ones first.

Goodwill Adjustment With Phone Call/letter

You can try for a goodwill adjustment on two fronts: by phone and by mail. Some people try just one or the other, while some try both. Occasionally, people report success from calling and sending multiple letters over time, but we cant verify this.

Whether youre on the phone or writing a letter, remember that youre at fault here and asking forgiveness. Your tone should reflect that. Be polite, thankful, and conscientious. Above all, dont get angry or demanding.

Here are some examples to get you started on the phone or with your goodwill letter. If you get a positive response from the lender, try to also get it in writing.

Phone

You can use this script to start the conversation about removing your late payment. Be sure to have your explanation for why you were late at the ready. If you dont have a perfect payment history, youll have to adjust this slightly to reflect your actual situation.

For credit cards, call the number on the back of your card to speak with the issuer, or check out our listing of backdoor credit card company phone numbers.

Late Payment Goodwill Adjustment Sample Phone Script

Hello, my name is . I recently made a late payment on my account, which was a total accident.

As you can see, my payment history is perfect other than this one mistake. I ended up paying late because . The late payment is also showing up on my credit reports and its done a lot of damage to my credit scores.

That should get the ball rolling in the right direction.

Also Check: Aargon Agency Inc Las Vegas

Negative Credit Report Entries That Impact Your Score The Most

Accurate items will stay on the credit report for a determined period. Fortunately, their impact will also diminish over time, even if they are still listed on the report. For example, a collection from a few years ago will bear less weight than a recently-reported collection. If no new negative items are added to the report, your credit score can still slowly improve.

Re: Removing History Of Delinquency From Credit Report

Welcome to the forums. If your negatives are over ten years old I am thinking they should have fallen off. Even a Chapter 7 is gone after ten years. Some negatives are gone after seven. I have some 30 day lates due to fall off next year when they are seven.

Have you pulled a recent credit report? That would be a good place to start. Then come back to the forum and let’s talk about it.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Sample Letter: Credit Bureau Late Payment Dispute Request

You can use this sample letter to dispute information in your credit report. Just insert the appropriate information, like your name and address, the credit bureau name and address, and specific details in the body of the letter. If youre disputing more than one item, youll need to adjust the language to refer to multiple accounts.

Only include copies of documents, not the originals. If you choose to provide a copy of your credit report, circle the delinquent account in question.

Send your dispute request by certified mail, with a return receipt requested, so youll be sure that they receive it.

Enclosures:

Send A Letter To The Reporting Creditor

You also want to send a similar letter to the creditor whos currently reporting the debt.

To do this, either reframe your credit bureau letter with copies of your documentation to the creditor or simply send a copy of the same letter with copies of any documents included. Avoid making statements that could restart the debt clock if the statute of limitations has not expired.

As with the credit bureau, send the letter certified with a return receipt requested. The creditor has 30 days to investigate your claims and respond.

Why this is important: Depending on who your creditor is, it may be faster to work directly with it to get your old debt off your credit report.

Who this affects most: Those with older debts with more established companies will benefit from contacting the original creditors. You may find it easier to work with larger, more established creditors than with smaller collection agencies.

Also Check: Why Is There Aargon Agency On My Credit Report

Ask For A Goodwill Deletion

If you have a paid collection listed on your report, you can simply ask the debt collector or original collector to remove the collection. This usually involves sending the debt collector or collection agency a goodwill deletion letter explaining your mistake, asking for its forgiveness and showing them how your payment history has improved.

With this option, theres no guarantee your collection will be removed from your credit report, but its worth a shot. If the account is removed, it may help you qualify for better terms on personal loans, mortgages and credit cards.

Look For Negative Information In Your Credit History

You may not even know if you have a derogatory account in your credit history. So you should start by getting your free credit report.

You can get your from many different services. But by law, each of the three major reporting bureaus has to give you a free credit report each year. And during the coronavirus pandemic, consumers are entitled to free weekly reports through April 2021, via AnnualCreditReport.com, the official U.S. government website.

When you open your credit report, you can find a list of all derogatory accounts. These include any account with a late or missed payment.

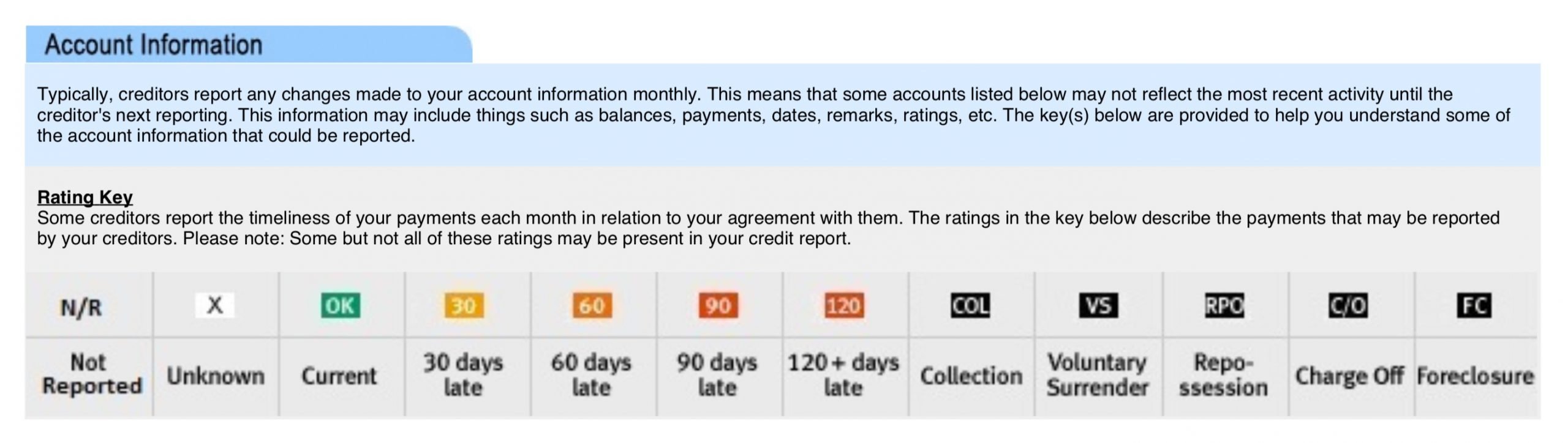

Below is a sample screenshot showing a credit card account that has a 30-day late payment from July 2011. You can see that its a derogatory item from the color some reports show yellow and red boxes and we know that it is a 30-day late payment because the box says 30 in it.

Image: Eric Rosenberg

Look through your credit report and make a list of all negative information. Then compare to your records to make sure everything there is accurate.

If its not accurate, getting it removed is imperative. And if it is accurate, its harder to remove, but still possible.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Offer To Sign Up For Automatic Payments

In some instances, a creditor may agree to delete a late payment if you agree to sign up for automatic payments.

This plan works well if youve had trouble making payments in the past but arent significantly delinquent on your account. Youll have better luck negotiating this deal if you can show that youre financially able to make your payments.

It also helps if youve overcome whatever financial hurdle held you back from making payments in the past. Like requesting a goodwill adjustment, this is also ideal for longer-term customers.

Paid In Full Accounts

Youre probably familiar with the terms paid in full and settlement. Some people use these terms interchangeably, but they have different meanings.

A paid-in-full account means youve paid the entire amount owed and interest. If you had no missed payments, the paid-in-full account will remain on your credit report for 10 years. It will help improve your credit score, and it will show lenders that youre a responsible borrower. That will make you an appealing applicant if you decide to apply for a loan.

Read Also: Does Cashnetusa Report To Credit Bureaus

How Long Does A Collection Account Stay On A Credit Report

The Fair Credit Reporting Act lays out that the collection has to stay on your credit report for up to seven years from the date of default on the original account. This is to give lenders a clear picture of your financial behaviour so they know the risks of lending you money.

However, on a credit report, a paid collection can still stay on your credit report for up to seven years, regardless of whether the account has a $0 balance.

After seven years, the paid collection will automatically drop off your credit report.

Multiple Collection Agencies Same Debt

If your credit report looks as Experian describes, with the old collection accounts accurately reporting as closed, there may not be much you can do besides wait seven years for the collections to fall off your credit report.

However, if the original creditor and/or multiple collection agencies report the same debt as if they are all separate open collection accounts, that may be an error that you need to dispute with the credit bureaus.

Recommended Reading: Mprcc On Credit Report

If A Collection Is On Your Report In Error Dispute It

You may have a collections account on your credit report that shouldnt be there. Maybe its too old to still be reported, or the collection itself is incorrect.

Too old to be reported: Delinquent accounts should fall off your credit report seven years after the date they first became and remained delinquent. But that doesnt always happen. For debts that linger longer than they should, file a dispute with any credit bureau that still lists the debt.

If a credit bureau has made a mistake on your report if you dont recognize the account or a paid account shows as unpaid, for example gather documentation supporting your case. Then, file a dispute by using the credit bureau’s online process, by phone or by mail. The bureau has 30 days to respond.

Collection is incorrect: If you think the error is on the part of the debt collector, not the credit bureau, ask the collector to validate the debt to make sure its yours. Note that you have 30 days from the date the collector first contacted you to dispute the validity of the debt. If the collector cant validate, the collection should come off your reports. Follow up to make sure.