Student Loan Default: Seven Years

Failure to pay back your student loan remains on your credit report for seven years plus 180 days from the date of the first missed payment for private student loans. Federal student loans are removed seven years from the date of default or the date the loan is transferred to the Department of Education.

Limit the damage: If you have federal student loans, take advantage of Department of Education options including loan rehabilitation, consolidation, or repayment. With private loans, contact the lender and request modification.

What Is The Impact Of Multiple Credit Enquiries On The Credit Score

Multiple credit card/personal loans applications over a short period of time can easily turn your good score into a bad one quickly. Multiple enquiries, in addition to having a negative impact, influence rejections too.

Rejections on applications can adversely damage your score and your credit file. Therefore, if your score stoops below-par level, it can be due to the combined effect of multiple enquiries and ensuing rejections.

To avoid the insidious fallouts, you should carefully look at the lender’s terms and eligibility criteria, and refrain from seeking multiple credit cards/loans one after the other.

Pro Tip: To avoid such a huge knock off, you should wait for a minimum of 90 days between credit card applications.

How To Remove Hard Inquiries & Other Negatives

While all negative marks and their credit score impacts are subject to age limitations, some accounts may fail to be automatically removed from your credit report. In other cases, out-waiting negative accounts may be an unappealing option, especially if you intend to apply for new credit in the near future. Whatever the reason for needing items removed from your credit report, you may have options for addressing any issues.

Specifically, all accounts on your credit report must, by law, be fair and accurate representations of your credit. That means any information on your credit report that is expired, incorrect, or unsubstantiated can be disputed with the credit bureaus for removal. For many, the easiest way to deal with disputable credit report items is to hire a reputable credit repair company, such as our top-rated picks, to act on their behalf.

- Most results of any credit repair law firm

- Clients saw over 9 million negative items removed from their credit reports in 2016

- More than 500,000 credit repair clients helped since 2004

- Cancel anytime

- Helped with over 7.5 million removals on members’ behalf since 2012

- Free access to your credit report summary

- Three-step plan for checking, challenging and changing your credit report

- Online tools to help clients track results

- Quick pace: Sky Blue disputes 15 items monthly, track your progress 24/7

- 90-day 100% money-back guarantee

Recommended Reading: Comenity Bank Credit Bureau

How Long Do Hard Inquiries Stay On Your Credit Report Timeline

So, how long do credit inquiries stay on your report?

Typically, hard inquiries will stay on your credit report for 24 months. However, according to Experian, hard pulls generally stop affecting your credit score after 12 months. So, while lenders can still see these inquiries after this period of time, you dont have to worry about them dragging down your credit score after a year.

This timeline applies to any type of credit, including credit cards, business loans, personal loans, mortgages, student loans, etc.

Its also important to note that all hard inquiries made within 45 days only count as one hard pull, so you dont have to worry too much about your credit score when shopping for loan rates as long as you do it within that timeframe.

How Much Does A Hard Inquiry On Your Credit Report Hurt

For people with extensive credit histories, a single credit application and hard inquiry has no effect or a fairly minimal one.

If youve lost points because you applied for a lot of credit in a short time span, take heart. Credit applications are not a major factor in calculating your credit scores.

VantageScore describes recent credit behavior and inquiries as less influential. Applications for new credit account for 10% of FICO scores.

But people who have short credit histories or few accounts may see a bigger change.

If youre trying to build credit, every point counts, and pulling back on new applications for a few months should restore lost points. Particularly if you are taking out a mortgage, wait until after closing to apply for new credit.

Multiple hard inquiries can put a serious dent in your credit, particularly if you are new to credit, and its an easy mistake to make. Say youve just rented an apartment. The leasing agent may check your credit. And then you may apply for financing for furniture. Then you decide you want a card with travel rewards, so you apply for a couple of those. That could be four credit inquiries within a short period, and it could result in a lower score.

Statistics cited by FICO show that people with six or more recent inquiries are eight times as likely to file for bankruptcy as those with none, and scoring formulas reflect that.

In the meantime, focus on the two things that have the most powerful effect on your scores:

Also Check: Which Credit Bureau Does Comenity Bank Use

How Do Multiple Credit Inquiries Affect Your Score

Can multiple credit inquiries have a negative effect on your credit score? It depends on what kind of credit youre shopping for.

If youre rate shopping to find the best interest rate on something like a mortgage or an auto loan, the major credit bureaus and FICO understand that youre likely to have multiple credit inquiries on your account. Thats why multiple inquiries for the same type of credit are considered as a single inquiry if they occur within a specific time span. Older FICO scoring models consolidate inquiries made within two weeks, while the newest FICO score gives consumers 45 days to shop around for the best rates and terms.

If you apply for multiple credit cards in a short time period, each application will add a new hard credit inquiry to your credit report. This could make a big difference in your interest rates if you are on the border between good credit and excellent creditand its one of the reasons why its a good idea to wait at least 90 days between credit card applications.

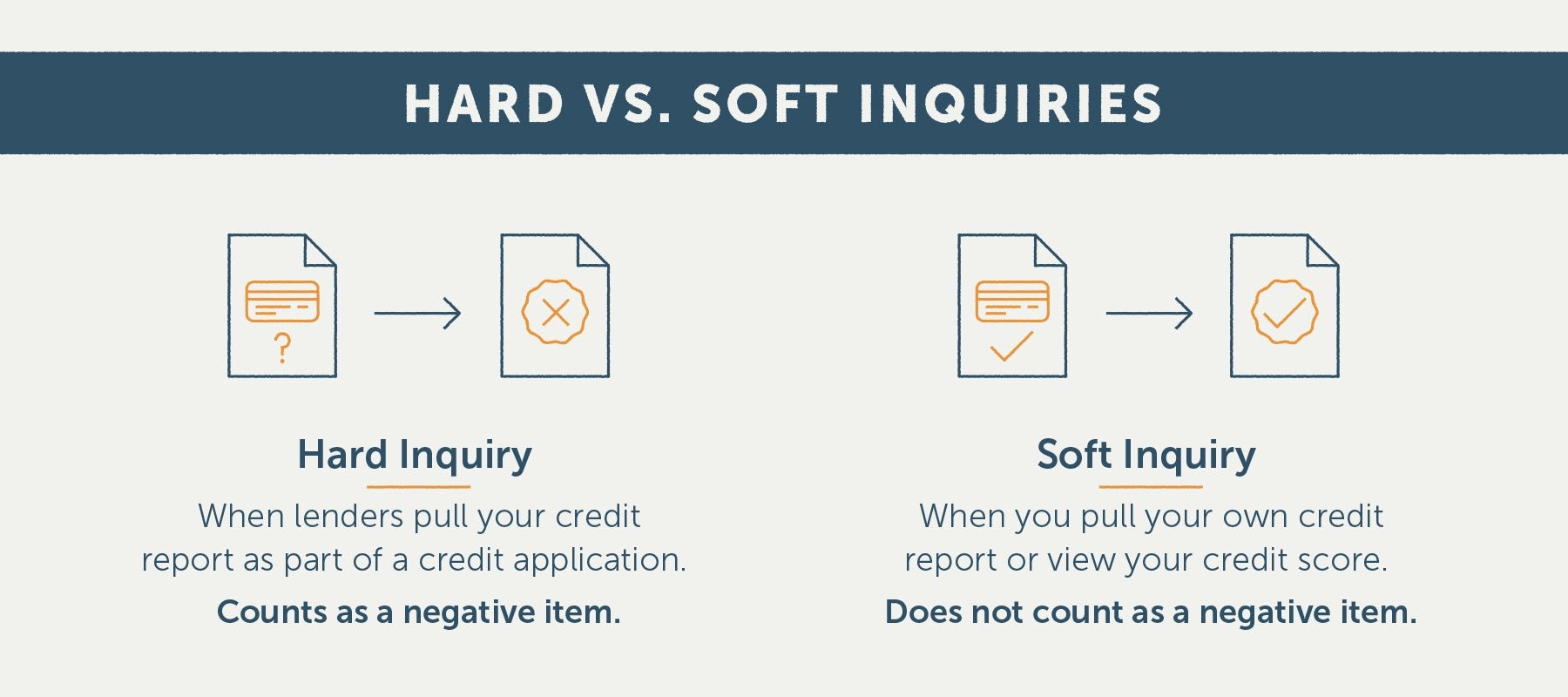

What Is A Soft Inquiry

Soft inquiries typically occur when a person or company checks your credit as part of a background check. This may occur, for example, when a credit card issuer checks your credit without your permission to see if you qualify for certain credit card offers. Your employer might also run a soft inquiry before hiring you.

Unlike hard inquiries, soft inquiries wont affect your credit scores. Since soft inquiries arent connected to a specific application for new credit, theyre only visible to you when you view your credit reports.

Recommended Reading: What Does Your Credit Score Tell Lenders About You Brainly

How Many Credit Inquiries Is Too Many

The effects of one or two credit inquiries on your credit score wont necessarily have to be significant. People that have no other negative marks on their credit reports might not even see a difference. However, the more of them you have, the higher the odds of a lender characterizing you as a high-risk client.

Even though every lender has their own criteria for determining how many inquiries are too many, six is usually considered unacceptable. That being said, some bad-credit lenders are willing to overlook even that many hard checks.

What Is A Hard Inquiry

Hard inquiries occur when a potential lender reviews your credit history to determine whether theyll let you open a new account. Hard inquiries occur when you apply for credit, such as in the following examples:

- Auto loan

Transferring a balance of credit card debt might also incur a hard inquiry in your file.

Don’t Miss: Ccb Mprcc

How Long Does Information Stay On My Equifax Credit Report

Reading time: 3 minutes

Highlights:

-

Most types of negative information generally remain on your Equifax credit report for 6 years

-

Closed accounts that were paid as agreed remain on your Equifax credit report for up to 10 years after they were reported as closed by the lender

-

Hard inquiries may remain on your Equifax credit report for 3 years

When it comes to credit reports, one of the most frequently asked questions is: How long does information stay on my Equifax credit report? The answer is that it depends on the type of information and whether its considered positive or negative.

Generally speaking, negative information such as late or missed payments, accounts that have been sent to collection agencies, or a bankruptcy stays on credit reports for approximately six years. Here is a breakdown of some the different types of negative information and how long you can expect the information to be on your Equifax credit report:

Here are some examples of “positive” information and how long it stays on your Equifax credit report:

- Active accounts paid as agreed. Active credit accounts that are paid as agreed remain on your Equifax credit report as long as the account is open and the lender is reporting it.

- Closed accounts paid as agreed. If the last status of the account is reported by the lender as paid as agreed, the account would stay on your Equifax credit report for up to 10 years from the date it was reported by the lender as closed to Equifax.

Hard Inquiry Vs Soft Inquiry

Sometimes a service provider such as a utility company or a landlord for an apartment rental will run a credit check on you, even if they’re not offering a line of credit. This is known as a soft inquiry or a soft pull. They do this to see how responsibly you manage your finances. For example, a landlord might not want to rent an apartment out to someone with a past record of defaulting on their debts.

There are several key differences between a hard inquiry and a soft inquiry. Most notably, a soft inquiry doesn’t show up on your credit report. It also doesn’t affect your credit score.

|

Hard inquiry |

Soft inquiry |

|

Hard inquiries stay on your credit report for two years and factor into your credit score for one year. |

Soft inquiries don’t show up on a credit report and don’t affect your credit score. |

|

Soft inquiries are used for pre-approved offers like employment or an apartment rental. |

|

|

Hard inquiries provide a comprehensive history of your credit. |

Information provided on a soft inquiry is a summary of your credit history. |

Also Check: Does Wells Fargo Business Credit Card Report To Bureaus

Does Your Credit Score Go Up When A Hard Enquiry Drops Off

Yes, your credit score does go up when a hard enquiry on your credit file gets dropped off.

There are two ways for a hard enquiry to get dropped off â You can either get the hard enquiries dropped off from your report by proving inaccuracies in the enquiries or you can wait for the hard enquiry to fall off itself, which usually takes around two to five years.

How Long Does A Credit Check Take

Nowadays, most lending institutions have automatic systems to run credit checks for them. These systems can finish a check in less than five seconds. Of course, if you want to conduct a credit check on yourself, it will take a bit longer. First, youll need to request your report at annualcreditreport.com by entering your name, address, social security number, and date of birth in an online form. Once you take care of that, you should be able to access your report right away.

Third parties that are checking your credit without the help of an automatic system – e.g., landlords – may have to wait 2 to 10 days to get your reports.

Also Check: Syncb/ntwk

How To Minimize The Effect Of Hard Credit Inquiries

When youre buying a home or car, dont let a fear of racking up multiple hard inquiries stop you from shopping for the lowest interest rates.

FICO gives you a 30-day grace period before certain loan inquiries, like those for mortgage or auto, are reflected in your FICO® credit scores. And FICO may record multiple inquires for the same type of loans as a single inquiry as long as theyre made within a certain window. This window is typically about 14 days.

While some lenders can rely on scoring models that give you more time to shop without incurring an additional hard inquiry, you may want to stick to 14 days to do your comparison shopping, since you likely wont know which scoring model a lender relies on to generate your score.

How To Minimize The Number Of Hard Inquiries You Have

Hard inquiries aren’t bad to have even if they may cause a slight temporary dip in your credit scores but it can be good practice to know how to minimize the number of inquiries on your credit report.

Below, CNBC Select rounded up some general guidelines to keep track of your hard inquiries:

- Don’t apply for several credit cards within a short timeframe. Experts generally recommend only applying for a credit card every six months.

- Only apply for credit cards you would actually benefit from using.

- Make sure you check your credit score beforehand . You can do so for free with most card issuers, using apps such as Discover’s Credit Scorecard and Chase’s Credit Journey .

- Before applying for a credit card, shop around with prequalification tools, which allow you to check your likelihood of qualifying for a card without damaging your credit.

Read Also: Does Care Credit Build Your Credit

How Does A Hard Inquiry Affect Your Credit Score

A single inquiry isnt going to hurt your credit score. In fact, even a couple hard checks probably wont have a measurable impact on your credit score.

So, how many hard inquiries are too many? Well, once you hit three hard pulls within 12 months, youll start to see a small hit on your credit score. After that, additional hard credit checks will have an even bigger impact.

Your score with each of the credit bureaus and your overall FICO score could decrease by enough to notice enough to affect the interest rates youd get on some loans.

But, normally, hard pulls dont have a huge impact on your credit score, and you really shouldnt worry too much about them as long as you authorized the hard checks.

If youre trying to improve your credit score, youre better off disputing inaccurate entries, removing collections and late payments, and getting into the habit of paying all your bills on time.

Also, paying down your debt with credit card companies, student loans, and car loans will help bolster your credit file a lot more than worrying too much about hard credit pulls. Thats just the way credit scoring works.

And if you do pay down a line of credit or credit card consider keeping the account open having available credit that you arent using will improve your good credit with most scoring models.

Examples Of Hard Credit Inquiries And Soft Credit Inquiries

The difference between a hard and soft inquiry generally boils down to whether you gave the lender permission to check your credit. If you did, it may be reported as a hard inquiry. If you didnt, it should be reported as a soft inquiry.

Lets look at some examples of when a hard inquiry or a soft inquiry might be placed on your credit reports. Note: The following lists are not exhaustive and should be treated as a general guide.

Read Also: How Long Does Repo Stay On Your Credit

How Do Hard Inquiries Affect Shopping For Loans

When you’re shopping around for the best rates on a mortgage, auto loan or other large loan, you may apply with several lenders, which will cause a separate hard inquiry from each one to appear on your credit report. But that doesn’t mean your credit score will plummet, as most credit scoring models weigh multiple inquiries for mortgage or auto loans as one inquiry if they are made within a certain time period . In fact, the newest scoring models from FICO® and VantageScore® completely ignore multiple inquiries for mortgage and auto loans within a short period of time. So you can shop for that dream car or home without worrying about your credit scores.

However, multiple hard inquiries for other types of credit, such as credit cards or even personal loans, aren’t treated the same way, and may cause lenders to suspect you’re having financial difficulties. Applying for a credit card, an auto loan, a home equity loan and a personal loan within the span of a month, for instance, could be a signal you’re in need of money or are taking on too much new debt too fast, and pose a risk to lenders that you won’t be able to pay it all back.

If you’re making a major purchase, you shouldn’t necessarily let the fear of hard inquiries stop you from shopping around for the lowest interest rates. However, you should take steps to ensure that hard inquiries don’t negatively affect your credit.

What Is A Hard Credit Check

A hard credit check is when a lender pulls your credit report because youve applied for new credit, such as a credit card, a car loan, a home loan or an increase to an existing line of credit. Hard credit checks can affect your credit score because seeking new credit can make you seem like more of a risk to lenders, who may worry about your ability to pay back the debt.

Also Check: 1?800?859?6412