States With The Highest Credit Scores

The five states with the highest credit score averages all have an average income above $50,000. These factors can contribute to the higher credit scores by making it easier to make payments on time and borrow less overall. Federal Reserve Bank of New York Data shows also shows the states with the top five highest credit scores have the some of the lowest default rates. The top five states have credit card default rates under 7 percent and auto loan delinquencies under 3 percent.

| State |

|---|

Source: Experian State of Credit 2017

Alternative Data And Your Credit Score

While your payment history and credit utilization accounts for 35% and 30% of your FICO Score calculation, TransUnion found that Americans that disclose their rent payments boost their VantageScore by an average of nearly 60 points . Moreover, borrowers with the lowest credit scores, no credit score, or those considered subprime were the primary beneficiaries when rent payments were included in their credit profiles.

For example, after disclosing their rent payment history, roughly 9% of Americans with no credit score saw their VantageScore debut at an average of 631â which places them in the âfairâ credit bracket. Likewise, 12% of Americans with established credit scores saw an increase in their credit scores after disclosing their rent payments.

On top of that, TransUnion revealed that 60% of participants might receive an immediate uplift in their credit scores in the same month as their rent payment disclosures. As a result, alternative data is a unique way to increase your perceived creditworthiness.

Improve Your Credit With This Free Feature

Raising your credit score can be done in a number of ways, from reducing spending to paying on time, but there’s also an alternative that doesn’t require much work on your part: *Experian Boost. This is a free feature that lets you get credit forpositive, on-time utility, telecom and streaming subscription payments. Late payments aren’t reported with Experian Boost, though your creditors typically notify the credit bureaus when a payment is late for 30 or more days.

All you need to do is connect your bills, then you’ll instantly receive a new FICO® Score provided by Experian. This may reflect an increase, which can help boost your credit score into a higher tier. Take note that this feature only influences your Experian credit report.

Also Check: How To Get Collections Removed Off Credit Report

The Pandemic Forbearance And The Average Us Credit Score

With the CARES Act and private U.S. lenders offering loan forbearance programs, many Americans paused their debt repayments during the pandemic. For context, the U.S. Department of Education reports loans eligible for CARES Act forbearance as âcurrent.â

To that point, TransUnion found that 58% of Americans that enrolled in financial hardship programs during the pandemic increased their VantageScore. Moreover, when TransUnion analyzed the improved credit scores of 1.3 million Americans that participated, it found that short-term involvement resulted in the best credit performance.

For example:

- TransUnion found that 58% of Americans that enrolled in financial hardship programs during the pandemic increased their VantageScore.

- Americans that exited hardship programs early demonstrated a 4.8% delinquency rate in the six months after obtaining a new bank card in the fourth quarter of 2020.

- Americans that remained in hardships programs demonstrated a 4.9% delinquency rate during that same timeframe.

- Americans that avoided hardship programs showed a 5.1% delinquency rate during that same timeframe.

Also noteworthy, for Americans at or below a prime plus VantageScore , those that exited hardship programs outperformed those that remained. Conversely, the hardship mainstays exceeded those leaving the programs for Americans with a super-prime VantageScore . All in all, TransUnion found that 54% of Americans improved their credit scores from Q1 to Q3 2020.

How To Interpret Your Credit Score

There are two major credit scoring models in the U.S.: VantageScore and FICO. Both are used by lenders and issuers when reviewing applications for credit cards and loans. While your credit scores between VantageScore and FICO might be similar, they are calculated very differently.

VantageScore takes a less transparent approach, instead opting to calculate scores like so:

Don’t Miss: How To Remove Items Off Credit Report

The Credit Score Needed To Buy A House

Your FICO score plays a major role in your ability to secure a mortgage. The type of mortgage that youre looking to secure will determine what your score should be. According to QuickenLoans, these are the following credit scores you need to work with lenders14:

- Conventional Mortgage: 620

- FHA Loan With 3.5 Percent Down: 580

- FHA Loan With 10 Percent Down: 500

If you fall below these guidelines, ask yourself, how long does it take to build credit? Then, come up with a plan of action to help you work towards your goal.

Fico Score Vs Vantagescore

Many people don’t realize that there are actually multiple credit scores. These are two of the most common:

- FICO® Score uses a credit scoring model designed by the Fair Isaac Corporation.

- VantageScore is an alternative to FICO developed by Equifax, Experian, and TransUnion in 2006.

Early models of the VantageScore system scored consumers on a scale of 501 to 990. Today, both are on a scale of 300 to 850.

It’s also helpful to understand how your score compares to the average, both in the United States generally and for people within your demographic group.

The data below on the average credit scores in America will tell you everything you need to know to see where you stand when it comes to your credit.

Don’t Miss: What Credit Report Does Target Pull

Why Do Younger People Have Lower Credit Scores Compared To People In Their 50s And 60s

Young people often experience far lower credit scores compared to their older counterparts due to the lack of a significant credit and payment history. As those in their 50s and 60s have had their accounts for longer, credit bureaus have gathered enough activity to give them a more accurate credit score that reflects their credit-worthiness.

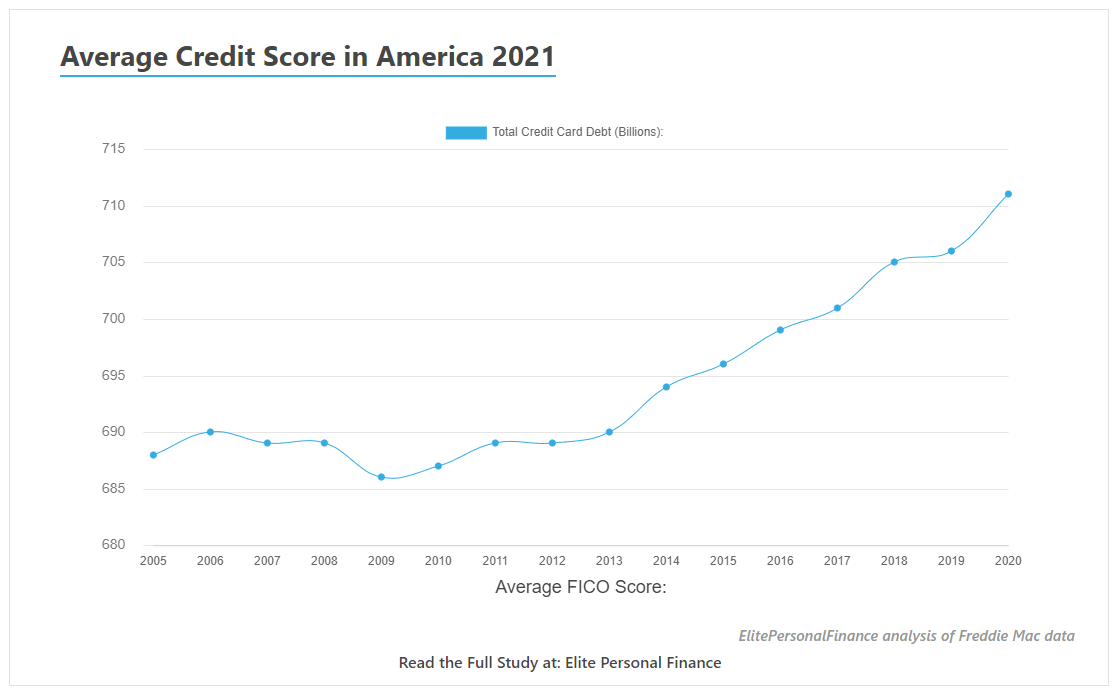

Saw Major Changes In Average Credit Scores But 2021 Could See An Even Bigger Change

The global pandemic and the government response to COVID-19 enabled millions of Americans to pay down debt, stay current on payments, and take more significant strides in improving their credit health than at any time in recent history.

However, millions of Americans have still been left behind even as average credit scores improved. If President Biden is successful in shifting the way in which credit data is collected, this could be one of the most significant shifts in the history of the U.S. financial system due to the outsized role that credit scoring plays in all consumer transactions.

You May Like: How To Raise Credit Score Without Credit Card

Your Credit Reports Always Matter

While you cant decide which credit scoring brand or which scoring model a lender is going to use when you apply for financing, you can control, in part, the information that appears on your credit reports.

Manage your credit well by making on-time payments, keeping credit card balances low, and applying for new credit only when needed and you cant help but have credit reports that will perform well regardless of the credit scoring model.

Become An Authorized User

You can also use a credit card to build credit without applying for your own card. This involves asking a family member or friend with good credit to add you as an authorized user on their card. If the primary cardholders issuer reports authorized user information to the credit bureaus, it could improve your score.

Don’t Miss: How Long Does Foreclosure Stay On Credit Report

If You Think The Uptick In Average Fico Score Is Coming From The Prime Lower Risk/higher Scoring Segments Guess Again

The upwards trend in the average FICO Score is actually most pronounced in the lower score ranges. For example, for those consumers who had a FICO Score value between 550-599 as of January 2020 , their average score has gone up from 581 as of April 2020 to 601 as of April 2021. In contrast, those consumers who had a FICO Score value between 750-799 as of January 2020 have seen virtually no movement in their average score between April 2020 and today.

Figure 2. Average FICO® Score During COVID-19 Has Increased More for Lower Scoring Population

Though it might sound obvious, the drivers of the continued improvement in the average FICO® Score are continued improvements in key metrics considered by the score: fewer missed payments, lower consumer debt levels, and reduced credit seeking behavior. Lets dive into each of these in a bit more depth:

Figure 3. FICO Scorable Population Shows Significant Improvement in Key Credit Metrics During the Pandemic

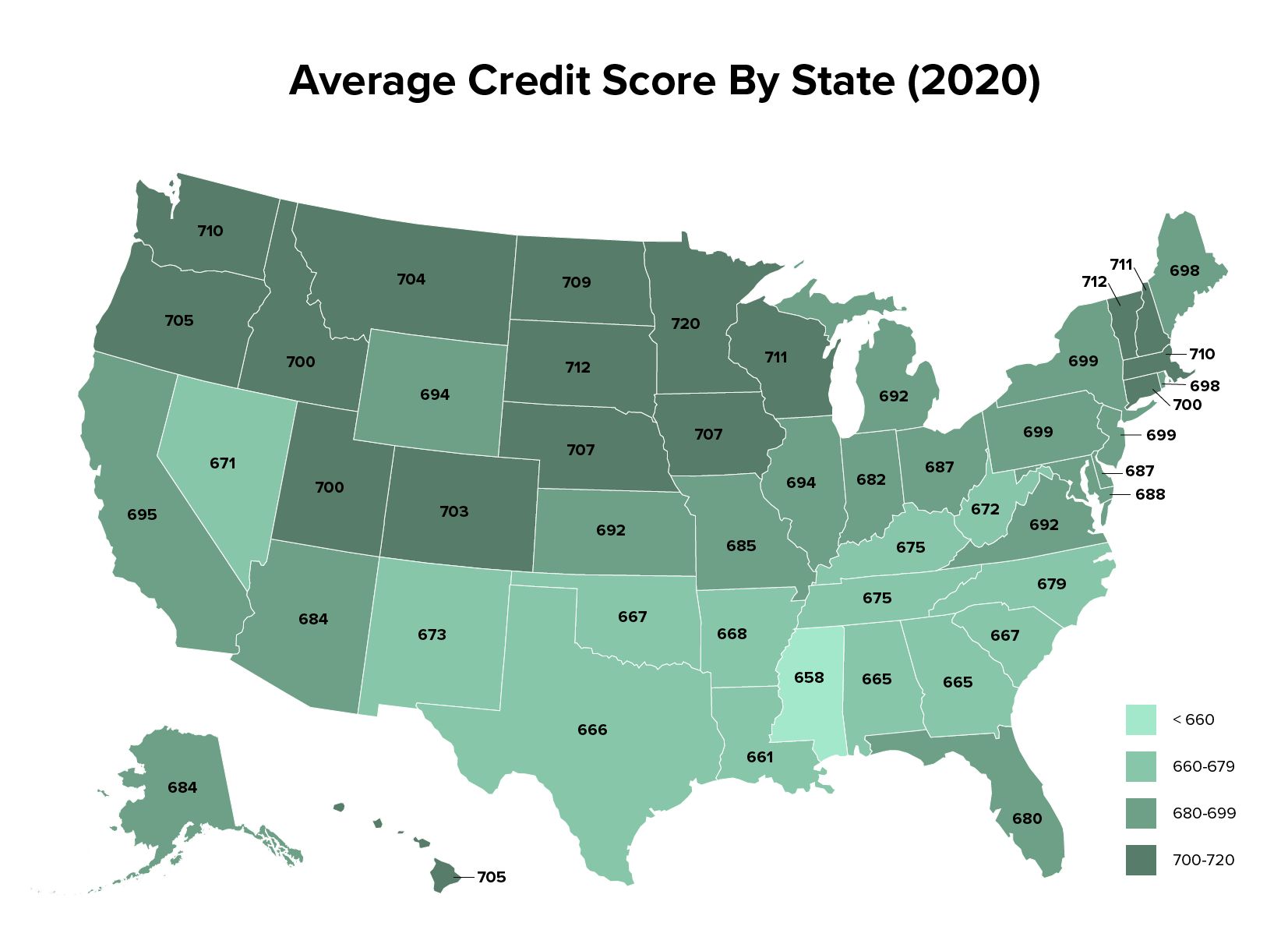

Whats The Average Credit Score By State

Where you live doesnât directly impact your credit scores. But you might still be curious about the credit score ranges in different states.

You can use the following averages to see how your credit scores compare with the average score in your state.

Average FICO Score by State in 2021

| State |

|---|

Source: Experian 2021 Consumer Credit Review

Also Check: Can You Have A Credit Score Without A Credit Card

What Are The Reasons For The Improvement

There are several reasons that could explain the recent upward trend in the credit scores of U.S. consumers. FICO speculates that consumer credit education and consumer credit awareness may be among the catalysts for the positive change. Evidence supports that theory.

It has never been easier for Americans to access free copies of their credit reports and credit scores. In fact, it doesnt really make sense to buy credit reports or credit scores any longer given the number of free sources.

FICO reveals the following information about the two factors that have also caused the average credit score to rise over the past year.

One fact is certain when your credit reports are cleaner, your credit risk goes down and your scores go up. When this happens among a broad group of consumers, the average credit score rises. Its a mathematical certainty.

Does Higher Education Mean Higher Credit Scores

Education matters, at least in regard to your credit score. We found a moderately positive correlation between a states average credit score and the percentage of the adult population in each state with a bachelors or higher. In short, the higher the proportion of a states population with a bachelors degree or higher, the higher the credit score.

A notable exception is Washington, DC: While not a state, the nations capital is home to a far higher percentage of people with a bachelors degree when compared to the rest of the US, and yet its average credit score is 703 in line with the nations average.

| % with bachelors degree or higher education | Education rank |

|---|---|

| 40 |

Also Check: What Does Transferred Closed Mean On Credit Report

Average Credit Score By Income

The higher ones income level, the higher their average credit score tends to be.

While debt-to-income ratio doesnt play a direct role in determining one’s credit score, it does have an indirect one. One of the factors lenders consider when modeling an individual’s credit risk is their credit utilization the percentage of total available credit a consumer is using month to month.

To improve one’s credit score, credit utilization should generally be kept below 30%. The lower one’s income is, the more a consumer may rely on their credit for their expenditures.

Another way income may play into credit utilization, and ultimately one’s credit score, is by determining one’s . Credit issuers look at borrowers incomes when deciding on the amount of revolving credit that should be issued.

The lower one’s income, the lower their line of credit is likely to be.

In turn, by having significantly lower credit limits, it becomes easier for lower-income individuals to eat up a larger portion of what’s available, increasing their credit utilization.

The graphic belows shows that median credit scores are highly correlated to income.

For context:

- Low income: Up to 50% of the area median income

- Moderate income: Greater than 50% and up to 80% of the area median income

- Medium income: Greater than 80% and up to 120% of the area median income

- High income: More than 120% of the area median income

Are Your Credit Scores Below Average

If you notice that your FICO scores are well below the American average credit score of 716, or youre constantly facing roadblocks to your financial goals because of your credit, it might be time to get help from a professional.

Experian states that 30% of Americans have lower than a 601, placing them in the bad rating category. In this situation, you might want to consider monitoring your credit score as you begin to make financial improvements.

Remember that even though your credit reports are free every 12 months, your credit scores are not included. Its a separate calculation that is requested when your credit is pulled by third parties such as lenders and creditors.

There are several monitoring services if youd like to check out your credit score on a regular basis, or you can pay a one-time fee to FICO to access your credit score.

You May Like: Does Perpay Report To Credit Bureaus

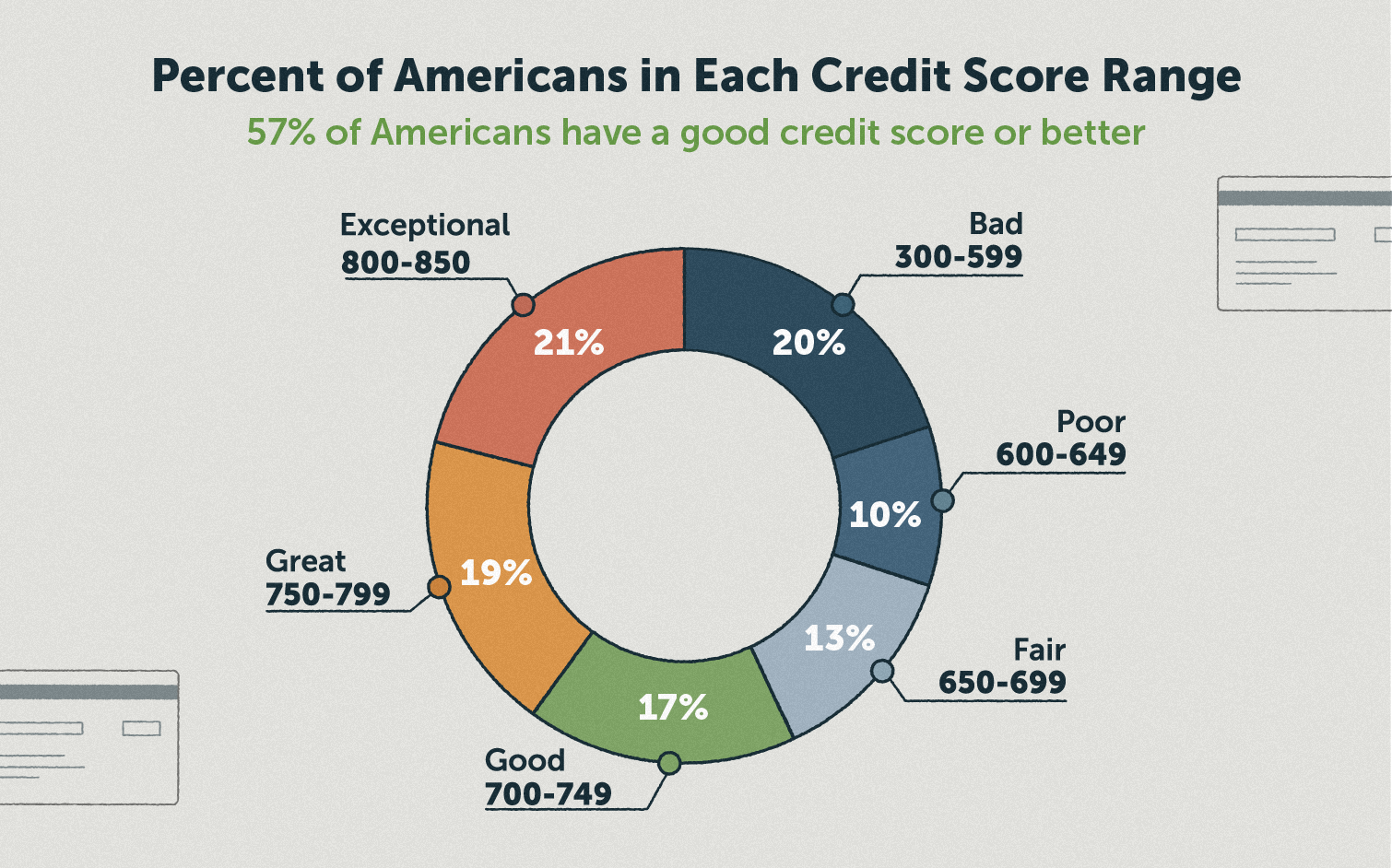

How Is Americas Credit

The average credit score of 66% of the American population actually falls within the good credit category, according to Experian.

The average credit score has risen steadily for the better part of a decade and, along with the growing number of Americans with good credit, the number of Americans with very poor credit is on the way down.

In 2010, roughly one-fifth of Americans had a credit score of 300 to 579, or very poor. As of 2019, that number has dropped to just 16%.

| 20% |

Consequences Of Bad Credit Score

Bad or lower credit scores can increase your interest rates and hurt your chances of getting approved for certain housing or loans.

Youll most likely be seen as less reliable than those with positive credit scores because of your history with making payments back in a timely manner, if at all.

Getting a loan can be especially tough. Low credit scores reflect your past ability to pay back credit payments. If they see a low credit score tied to you, they might think that you dont have the ability to pay back the loan that they will give you.

If your credit score isnt great, there are still other things that banks and lenders take into consideration. They might look at your level of income and make a determination of your reliability in that way.

Maybe theyll combine that with your age and see that you havent had a ton of time yet to grow your credit score. Whatever your credit score may be, there are other factors that are considered other than credit score.

Lenders and banks will also commonly look at your debt to income ratio. This will compare the amount of revenue that you make with your monthly debt payments.

This is a great way to see if a customer will have the money in the immediate future to pay back whatever the loan might be. So just because your credit score might be lower, dont let that get you down.

Don’t Miss: What Is A Good Credit Score In Texas

The Average Credit Score By Age State And Year

Insider’s experts choose the best products and services to help make smart decisions with your money . In some cases, we receive a commission from our our partners, however, our opinions are our own. Terms apply to offers listed on this page.

- The average American has a credit score of 714, according to data from Experian. That’s considered ‘good’ by FICO’s score ranges.

- People over 50 have average credit scores higher than the national average. Scores in some states, including Minnesota, Wisconsin, and Vermont, tend to exceed the US average, too.

The average credit score in the US is 714, according to credit reporting company Experian, calculated using the FICO scoring model.

Credit scores, which are like a grade for your borrowing history, fall in the range of 300 to 850. The higher your score, the better people with higher credit scores tend to get better interest rates on loans, have access to and lower interest rates, and could even pay less for insurance.

The FICO model of credit scoring puts credit scores into five categories:

- Very poor: 300-579

- Very good: 740-799

- Exceptional: 800-850

Based on this scoring system, the average American has a good credit score. But, the average credit score is different by demographic.

Average Credit Score In America: 2021 Report

By: Christy Bieber | Updated April 20, 2021

Amidst bad economic news in 2020, there was a bright spot. Consumer credit scores increased by leaps and bounds thanks to a reduction in late payments and an aggressive effort to reduce credit card debt.

With reduced consumer spending, thousands of dollars in government stimulus funds, and smart tactics like loan consolidation and balance transfer cards, many people got a better handle on their debt.

But there may be change afoot for credit scores, too — President Joe Biden has expressed interest in a public credit reporting agency that would take the place of credit bureaus like Experian, TransUnion, and Equifax. That would cause a huge shift in how we keep track of creditworthiness.

Until that happens, though, we’ll continue to use systems like the FICO® Score. Let’s take a look at how the average American’s credit looks in 2021.

Don’t Miss: How Do You Check Your Credit Report