Can You Erase Bad Credit Overnight

The short answer is no. Fixing bad credit is a time-consuming process that often takes months. It involves contacting credit agencies and lenders to dispute inaccurate information, and they can take up to 30 days to respond to your request. They may also ask for more documentation to validate your dispute, further prolonging the process. Additionally, note that accurate negative items cannot be deleted from your report and will remain on your record for at least seven years.

How Many Points Can My Credit Score Increase If A Collection Is Deleted

Late payments, skipped payments, and collection accounts are all factored into your credit score. Accounts that get to the collection stage are considered seriously delinquent. They will have a significant, negative impact on your credit score.

There is no fixed number of points that a credit score can increase if a paid collection is removed from your credit report. Each individuals credit score will be differently affected.

However, if the collection has lowered your score by 100 points, getting it removed from your credit report can increase your score by 100 points.

How Long Does A Collection Account Stay On Your Credit Reports

The fact is that a collection account will not be removed from your credit report just because the account has been settled or paid.

Even after a collection account has been paid, the credit bureaus are still legally allowed to continue to report the collection for up to 7 years from the date of default on the original account, thanks to the Fair Credit Reporting Act.

To put it another way, a collection account can remain on your credit reports for up to seven years from the date the original debt became 180 days past due, regardless of whether the account has a $0 balance.

MoneyHackUsing a 609 Dispute Letter

If you have an unauthorized or otherwise unverifiable collection account on your credit reports, you can submit a 609 dispute letter. This requires the credit bureaus to verify the account.

Don’t Miss: How Can A Landlord Report To Credit Bureau

Is Pay For Delete Illegal

The Fair Credit Reporting Act sets the rules for credit reporting as it applies to creditors, debt collectors, credit counseling organizations, and credit bureaus. The FCRA does not contain any language banning pay for delete, so its legal.

But before you get too excited, bear in mind that you can deploy pay for delete only on items that are incomplete or inaccurate. The FCRAs scope means you cant have accurate items removed from your credit report. If you try to use questionable techniques to remove accurate items, you may, in fact, be breaking the law.

Any pay for delete agreement you reach with a debt collector should be documented in writing in case you need to enforce the deal. Normally, you must first pay off the debt before the collector will remove the item, so a written agreement is required to ensure compliance.

Understand that without the agreement in place, the collector is under no obligation to remove items from your credit report, but theyre also not under any restriction to do so.

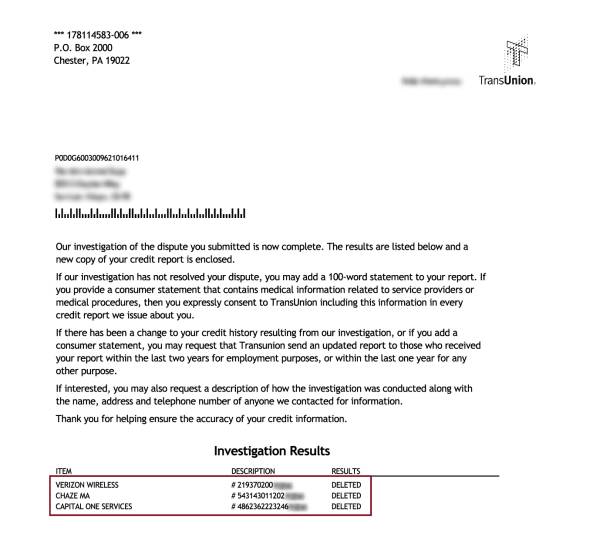

File A Dispute With The Credit Reporting Agency

Once you have your report, look through each account and see if there are creditors or accounts you dont recognize. Its also important to check whether older derogatory items are still being reported.

If you do find errors in your reports, dispute them directly with the reporting bureau through its website or by mail. This will prompt an investigation on the bureau’s part.

Bear in mind that you have to dispute the entry with each agency to make sure the removal is complete across the board.

How to file a dispute online

Each bureau Equifax, Experian and TransUnion has a section dedicated to walking consumers through the online dispute process. Once you create an account, you can file as many disputes as you need and check their status for free.

How to file a dispute letter

You can also send a dispute letter to the bureaus detailing any inaccuracies you’ve found in your credit file. When writing your letter, provide documentation that supports your claim and be precise about the information you are challenging. The Consumer Financial Protection Bureau recommends enclosing a copy of your report with the error circled or highlighted.

Depending on the information being disputed, these are some of the documents you can provide to help aid the investigation:

- Copies of checks

Include this dispute form with your letter.

Also Check: Will Checking Credit Score Lower It

Beware: What Collections Not To Dispute

You should not dispute any large valid debts that are within the statute of limitations, which youre unable to pay off, as a debtor may turn around and sue you for it.

However for smaller collection accounts or high dollar collections that are past the statute of limitations for your state, even if the debtor provides proof of the questionable debts, you cannot be sued for it.

Can A Collection Agency Report An Old Debt As New

Collection agencies cannot report old debt as new. If a debt is sold or put into collections, that is legally considered a continuation of the original date. It may show up multiple times on your credit report with different open dates, but they must all retain the same delinquency date. They should also all be discharged on the same date seven years after the original open date.

Recommended Reading: What Is Considered An Average Credit Score

How To Check Your Credit Report For Collections

Checking your credit reports regularly can help you determine whether you have any collection accounts that might be hurting your score. You can request a free copy of your Canadian credit report from Equifax Canada and TransUnion Canada in writing. If you dont have time to wait for your credit reports to be mailed out, you can purchase a copy of your credit reports from either bureau online.

Keep in mind that your credit reports and credit scores are two different things. The information in your Canada credit report is used to calculate your credit scores. If youd also like to see your scores, you can request them separately from each credit bureau for a fee.

Once you have copies of your Equifax and TransUnion credit reports, review them carefully. Look for any collection accounts and if you find them, make a note of:

- Who the debt is owed to

- The name of the collection agency, if there is one

- How much is owed

- How many payments the account is behind

Also, make sure you have the right contact information for debt collectors, which youll need for the next step. Again, some creditors will route past due accounts to their in-house collections department while others will assign or sell past due accounts to a collection agency. You need to know who to contact if you want to remove collections from your credit report in Canada.

If The Collection Has Been Paid Send A Goodwill Letter To The Agency

Even if the collection has been paid, the unpaid collection and the record of collection activity can stay on your credit report and have a negative impact for up to 7 years. Some lenders will consider this derogatory information based on the credit scoring models they use or in their underwriting process, which could negatively affect your borrowing applications.

Even with a valid, paid collection account, theres still a chance you can get it removed, and some FICO score and Vantage score models will ignore a collection thats marked as paid. You can write a letter asking the creditor or collector to remove this information as a goodwill deletion. Your goodwill letter doesnt need to have a lot of information or details. Simply identify the debt, and point out that it has been paid and that youd like them to remove it.

The debt collector is not obligated to remove factual, verified information from your credit report, although some will as a courtesy. If this method works, be sure to get written communication from the agency saying they have notified to remove any reference to the delinquent account from your history. This way, you can present this to the credit bureaus in case the agency doesnt push the update to all CRAs.

Also Check: What Credit Score Do You Need For A Credit Card

Step Two: Disputing The Debt With Federal Credit Bureaus

Once the collection agency has received your request for your debt validation letter, then lodge credit bureau disputes with each of the credit bureaus the collection account has been reported to. Instead of disputing the account online with the credit bureaus, you can use this very effective credit bureau dispute letter.

Ways To Scrub A Collections Stain Off A Credit Report

Your credit scores take a hit if you fall behind on payments to a creditor, and again if an account is sent to the creditors collection department or sold to a third-party collector. You may be able to repair some damage to your scores by resolving a collections account on your credit reports.

Collections accounts generally stick to your credit reports for seven years from the point the account first went delinquent. You may want them off sooner than that unpaid collections always hurt your scores. And while newer versions of FICO and VantageScore credit scores ignore paid collections, many lenders still use older formulas that count even paid collections against you.

There are a few ways to get a collections account off your credit report, depending on your relationship with the creditor and the account status.

First, do your homework

Get information on the debt from two places: your credit reports and your own records.

You can get a free credit report every 12 months from each of the three major credit reporting bureaus by using AnnualCreditReport.com. Some personal finance websites offer free credit report and score information.

Gather your own records for details on the account, including its age and your payment history.

Between the two, verify these details:

- Account number

- Account status

- The date the debt went delinquent and was never again brought up to date

Once you have the details straight, you can decide which approach works for you.

Recommended Reading: How To Get Experian Credit Score

Can Collections Impact Your Credit Score

Since, as mentioned, this is how future creditors determine whether you are an appealing credit risk, those collections will continue to impact your and your ability to access credit and get the best terms and lowest interest rate. While having the collection removed or disputed can help in potentially boosting your credit score, it still remains on the credit report for those 7 years.

Is It Really Possible

In theory, yes. In fact, it used to be a negotiating tactic that settlement companies would use to get consumers to pay a higher percentage of the debt owed. They would offer to remove the collection account if you agreed to pay a higher percentage of the balance owed.

However, in 1970, Congress enacted the Fair Credit Reporting Act to promote accuracy, fairness, and privacy of information in the files of consumer credit reporting agencies. The goal of the law was to protect Americans from inaccurate reporting. For instance, it allows you to correct mistakes in their credit report through the process of .

However, an offshoot of the law is that it requires data furnishers to provide accurate information to credit reporting agencies. This means lenders, creditors, and debt collectors must, by law, report accurate information. If they dont, they can lose access to consumer credit reports entirely.

Also Check: How To Find Out Why Credit Score Dropped

Reasons For A Drop In Credit Score After Paying Off A Collection Account

It is not uncommon for credit scores to drop after paying off a collection account. There are several factors as to why your credit score dropped. The first is to look at the age of the debt. The older the date of the debt, the less impact it has on your credit score. In the past, if you paid it off, it would renew the date as recent activity and create a negative impact on your credit rating.

There are many types of credit score models. With the new scoring system by Fair Isaac and Company, paying off old debt does not hurt your credit score. It distinguishes between new payments and new delinquencies versus old collection accounts.

Top Credit Repair Services For Removing Collections

can help consumers remove false information from credit reports and thus improve their credit scores. Incorrect information can include late payments that arent yours, or paid collections that are older than the seven years theyre allowed by law to be on credit reports.

Here are our top choices for the best services for removing collections from a credit report:

| $79 | 9.5/10 |

Sky Blue Credit Repair disputes 15 items five items per credit bureau every 35 days with customized disputes, re-disputes, and statute of limitation research on debt items. It also identifies untapped opportunities when reviewing credit reports to give customers practical advice on how to raise their credit scores.

Sky Blue Credit Repair offers a 90-day, 100% money-back guarantee on its $79 monthly plan.

Recommended Reading: Can Medical Bills Affect Credit Score

Need Help Removing Collections From Your Credit Report

This is where hiring a credit repair company can really make a difference. They help most people to remove collections by disputing errors with the three credit bureaus for you. This means you dont have to contact any of the credit bureaus or collection agencies yourself directly.

If you arent sure where to start regarding disputing collections, talk to one of their credit repair professionals and get your questions answered. Of course, you can do it yourself, but youre likely to have more success by enlisting professional help.

They offer a no-obligation consultation to explain what they can do to help in your particular situation.

As An Alternative Hire A Credit Repair Company

If you go this route, make sure that youre dealing with a reputable company that uses effective, nonfraudulent ways to remove items from your credit report. Check sites like the Better Business Bureau, Trustpilot, the Consumer Financial Protection Bureau or Google Reviews to make sure the services dont engage in unethical, shady practices around .

Also Check: Why Did My Credit Score Drop 30 Points

How Does Pay For Delete Work

Collections weigh down your credit score.

Exactly how much depends on the type of collection, the amount owed, and how old the collection is. Pay for delete is essentially a strategy for making collections disappear from your credit report completely.

Pay for delete is basically a negotiation with a creditor or collection agency. They are reporting an unpaid balance on your credit report. You make an offer to pay the balance off if they agree to completely delete the collection entry from your credit report.

Will they agree to do it? Some will.

In fact, a few may even agree to do it if you make a partial payment in lieu of the full balance. This can be especially likely if the collection account is particularly old, and not expected to ever be repaid.

Its even possible a collection agency will suggest pay for delete as an incentive to get you to make the payment.

As a general rule, you should not agree to this offer.

Collection agencies are notorious for making promises they dont intend to keep, just to get you to make a payment.

Send A Pay For Delete Letter To Your Creditor

Your credit score suffers when your credit report contains derogatory information . You can negotiate an items removal with a debt collector by using a pay for delete letter. It may not work, but its certainly worth a try since it is a legal request.

The gist of a pay for delete letter is an offer: Youll pay some or all of the amount you owe, after which the collector will remove the derogatory item from your credit report, sometimes known as a goodwill deletion. Thats a win-win, as an item hurting your credit score is removed, and your collector receives at least some of the money you owe.

Procedurally, you should first request a debt validation letter from the collector verifying it has accurate information about your debt. You can request the letter within 30 days of the initial contact from the collector. If the letter reports accurate debt , you can then follow up within the next 30 days with a pay for delete letter.

However, if you dont recognize or agree with the debt in question, you can request the collector to prove you legally owe the money. If it cannot provide proof, it must drop its collection account request. This wont automatically remove the item from your credit report, but you can request that as part of the dispute.

You dont have to reinvent the format for your verification request letter or a pay for delete letter. Youll find many sample templates on the internet that are freely available or sell for a nominal price.

Don’t Miss: What Credit Score Do You Need For A Discover Card

Can I Sue Cbc Credit Services For Harassment

Yes, you can sue CBC Credit Services for harassment. If you can show that theyve violated your rights under the Fair Debt Collection Practices Act, then you can collect $1,000 in statutory damages for each violation as well as payment for any damages that youve sustained as a result of their violation. CBC Credit Services will also have to pay your attorney fees and court costs.

Clean Up Your Credit Report With The Help Of Donotpay

If you want to clean up your credit report but don’t know where to start, DoNotPay has you covered in 3 easy steps:

You can also check out our other credit products, including Credit Limit Increase, Get My Credit Report, Keep Unused Cards Active, and more!

Also Check: Does Mortgage Help Credit Score