Improving Your Credit Score

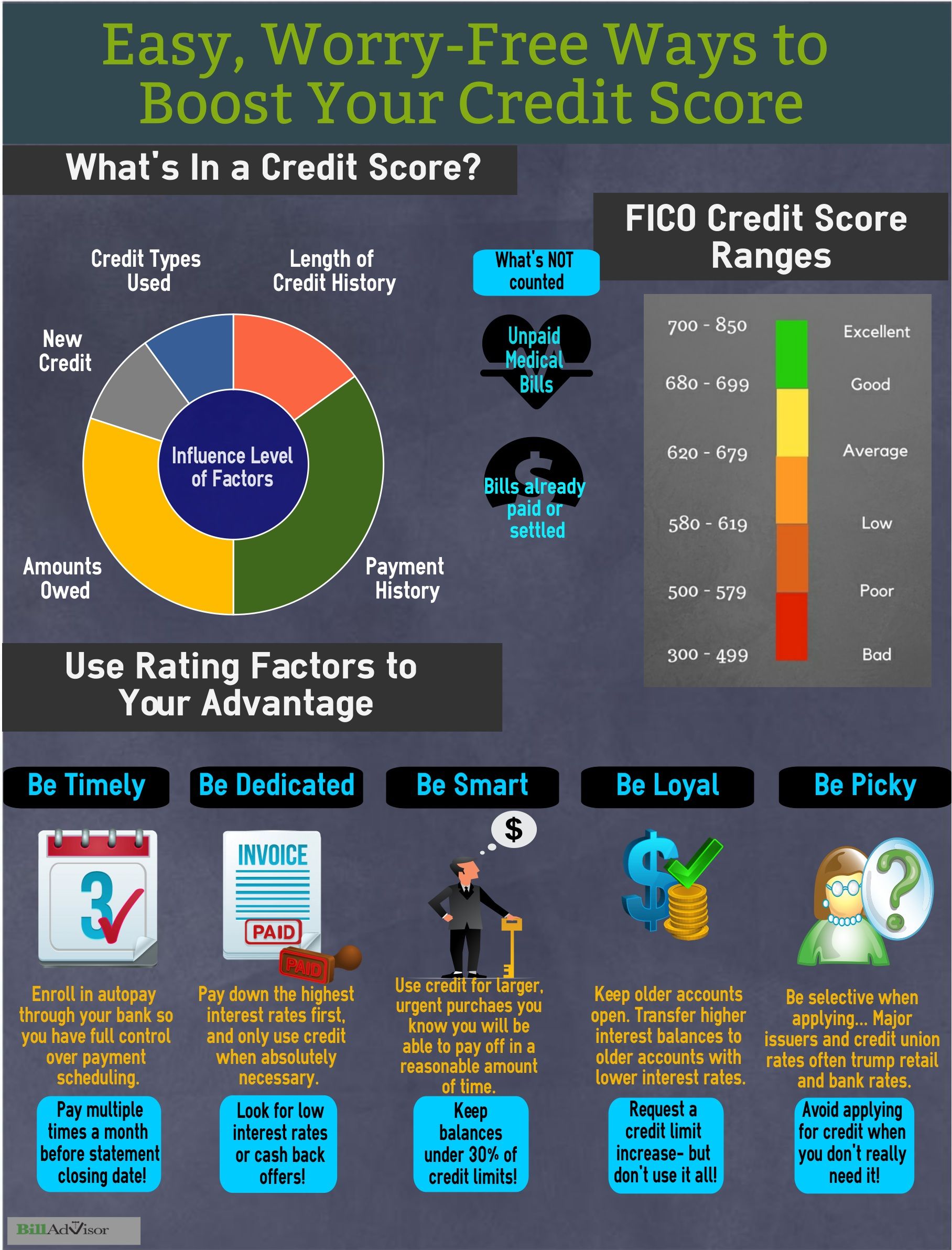

Theres a lot that goes into determining your credit score, including your repayment history, the total balances on your accounts, how long youve had those accounts, and the number of times youve applied for credit in the last year. Improving in any of these areas can help increase your score.

You can:

- Pay down your existing debts and credit card balances

- Resolve any credit issues or collections

- Avoid opening new accounts or loans

- Pay your bills on time, every time

You should also pull your credit report and check for any inaccuracies you might see. If you find any, file a dispute with the reporting credit bureau, and include the appropriate documentation. Correcting these inaccuracies could give your score a boost.

What Else Do Lenders Consider

Keep in mind that lenders may take other factors into account when considering you for a loan. For example, it may help your chances of buying a home if a lender is aware of a past financial hardship you have since recovered from. Lenders also look at factors besides your credit score to determine if theyll approve you for a loan. Some of these things include:

Positive marks in these areas may impact a lenders decision if your score is low. However, improving your credit score will give you a better chance of securing the loan you want.

How To Improve Your Credit Score

Even if your credit score isnt great, you can always improve it. The process just takes time. The most important action you can take is to pay bills on time. Late payments may stay on your credit report for seven years. Focus on your active and open accounts, as an account in collection does not have much effect on your current credit score.

Another good rule of thumb: don’t max out your available credit or eliminate a credit line. You want to preserve a little wiggle room on each of your credit cards or credit lines. Credit experts recommend that you use no more than 30% of your available credit on any one card.

If you have closed accounts, one of the best ways to re-establish credit is with a secured credit card, usually issued by a credit union or local bank. The institution will require you to maintain a set amount in an account to offset any activity on the new account.

Another strategy for how to increase your credit score is to apply for a new card with a co-signer. With a card like this, its even more important that you make payments on time. If you fall behind or miss a payment, your delinquency will negatively impact your co-signers credit.

You May Like: How To Unlock My Experian Credit Report

What Fico Score Is Used For Mortgages

The most commonly used FICO Score in the mortgage-lending industry is the FICO Score 5. According to FICO, the majority of lenders pull credit histories from all three credit reporting agencies as they evaluate mortgage applications. Mortgage lenders may also use FICO Score 2 or FICO Score 4 in their decisions as well.

When It Comes To The Homebuying Process Remember:

Your credit scores and overall financial situation can significantly impact the homebuying process. Lower credit scores may limit how much money you can borrow and could lead to higher interest rates or PMI premiums.

Before you begin the homebuying process, check your and credit scores to get an idea of our credit health, as well as to review the information being reported by lenders and creditors. You can create a myEquifax account to get six free Equifax credit reports each year.

Allow yourself enough time to address any information on your credit reports you believe may be inaccurate or incomplete. Some advance planning may make a big difference when it’s time to purchase a home.

Read Also: Does Credit Check Affect Credit Score

Assess Your Unique Circumstances Before You Decide

On the other hand, applying on your own means the lender will only take into account your income and not your partners. This means you might qualify for a smaller mortgage. Regardless of whether one partner name is on the mortgage, his or her name can still be on the title of the home.

Understanding the ins and outs of credit scores and joint mortgages will help you and your partner take this major step together and get you closer to becoming homeowners. For answers to any questions you might have about joint mortgages, give our home lending advisors a call. Theyre happy to help.

Using Credit For Home

Buying a house involves more than simply making payments on your mortgage. The simple truth is that when you own a home, you’re going to have house-related expenses. However, it’s not always possible to drop large amounts of cash on big-ticket items like new appliances, home repairs, or maintenance.

- Use a low-interest credit card: one convenient way to pay for immediate, unexpected, or emergency home costs is with a credit card. Consider getting a low-interest card that you set aside for this purpose while you build an emergency fund. Remember to apply for the card < em> after< /em> closing on your house, though, so you don’t impact your credit. This gives you the option to fund an unexpected housing cost immediately. Use a credit card for things like an emergency furnace repair or an appliance service call.

- Use a line of credit: another option for larger home expenses or repairs is a line of credit. A line of credit works like a credit card in that you can borrow up to a limit. You only pay interest on what you borrow, and then make monthly payments to pay it back. Line of credit rates are often lower than credit card interest rates, and a strong credit score could reduce your rate even further.

Also Check: What Is An Inquiry Credit Report

Other Factors Lenders Consider

Mortgage lenders don’t just look at your credit score when determining your rate, though. They’ll also consider your debt-to-income ratio how much of your gross monthly income goes toward debt paymentsas well as your down payment and available savings and investments.

So while it’s important to work on your credit score before you apply for a mortgage, avoid neglecting these other important areas of your financial situation.

Can You Get A Mortgage With Bad Credit

You can still get a mortgage even if you have bad credit, although youre likely to pay a much higher interest rate to compensate for the increased risk to the lender.

Government-backed loans, like FHA loans, specifically cater to borrowers with lower credit scores. But even if youre not certain that youll qualify, its worth offering some extra security to your lender.

For example, you might give a larger down payment or set aside extra cash reserves to show the lender you have the money to repay the mortgage loan. Or you might give proof that youve consistently paid your rent on time for an extended period.

Check Out Our Top Picks for 2022:Best Mortgage Loans for Bad Credit

You could also try writing a letter to explain your credit situation. This can be done, especially if its due to an extenuating circumstance like emergency medical bills. Be upfront in asking your lender what you can do to qualify for a loan, even if you might not meet the usual underwriting standards right away.

If youve had a bankruptcy or foreclosure in your past, there are a few rules that you simply cant get around. The exact specifics depend on your loan type.

However, in general, you have to wait for a predetermined seasoning period after the bankruptcy or foreclosure has been discharged before you can get approved for a home loan.

For bankruptcies, the seasoning period is typically between two and four years. For foreclosures, youll need to wait between three and seven years.

You May Like: How To Add Positive Credit To Your Credit Report

How To Check And Understand Your Credit Score

A free credit report does not show a lender enough information to approve you for a mortgage loan. This type of credit report shows what is called “consumer credit.” Consumer credit uses a different scoring model to rate an applicant for a retail credit card or a car loan.

Mortgage lenders pull a different set of scores to paint a more reliable picture of your borrowing habits. This is a credit report that only lenders can run, and most will do it free of charge to earn your business.

So as a borrower, you can’t tell from your free credit report whether you will qualify with a lender. And most lenders won’t pull a more comprehensive credit report until they know you are serious about applying for a loan. In the meantime, your scores help you understand where you might fall on the spectrum as a potential borrower.

Many lenders use the FICO score, which grades a consumers credit-worthiness on a 300 – 850 range.

- Poor = 579 or lower

- Very good = 740-799

- Exceptional = 800 or higher

A potential borrower with higher credit score is generally viewed as more reliable and less of a risk for lenders the borrower with a lower credit score is seen as higher risk. A better credit score also qualifies you for a lower interest rate on your loan.

The Scoring Model Used In Mortgage Applications

While the FICO® 8 model is the most widely used scoring model for general lending decisions, banks use the following FICO scores when you apply for a mortgage:

- FICO® Score 2

- FICO® Score 5

- FICO® Score 4

As you can see, each of the three main credit bureaus use a slightly different version of the industry-specific FICO Score. That’s because FICO tweaks and tailors its scoring model to best predict the creditworthiness for different industries and bureaus. You’re still evaluated on the same core factors , but the categories are weighed a little bit differently.

It makes sense: Borrowing and paying off a mortgage arguably requires a different mindset than keeping track of and using a credit card responsibly.

The FICO 8 model is known for being more critical of high balances on revolving credit lines. Since revolving credit is less of a factor when it comes to mortgages, the FICO 2, 4 and 5 models, which put less emphasis on , have proven to be reliable when evaluating good candidates for a mortgage.

Don’t Miss: How To Remove Authorized Inquiries From Credit Report

Should You Get A Mortgage Pre

A good way to know if youll receive mortgage approval before you actually apply is to get pre-approved, which most potential homeowners will do 60-120 days before they plan to purchase a home. This is when your lender examines your financial records to determine the maximum amount they would grant you, as well as the interest rate they would give you once youre approved. A pre-approval will also provide you with a better idea of what your future mortgage payments will look like, as well as how your finances will be affected by your down payment, closing, moving, and future maintenance costs.

What Do You Need To Get A Mortgage Pre-Approval?

For the purpose of the pre-approval process, youll need to provide your lenders with various documents, such as:

- Proof of identity and residency

- Proof of employment

- If self-employed, Notices of Assessment from the Canada Revenue Agency from the past two years

- Proof that your finances are suitable enough to afford future payments

- Information pertaining to your assets

- Information pertaining to your current debts and other financial obligations

Does A Mortgage Pre-Approval Guarantee Mortgage Approval?

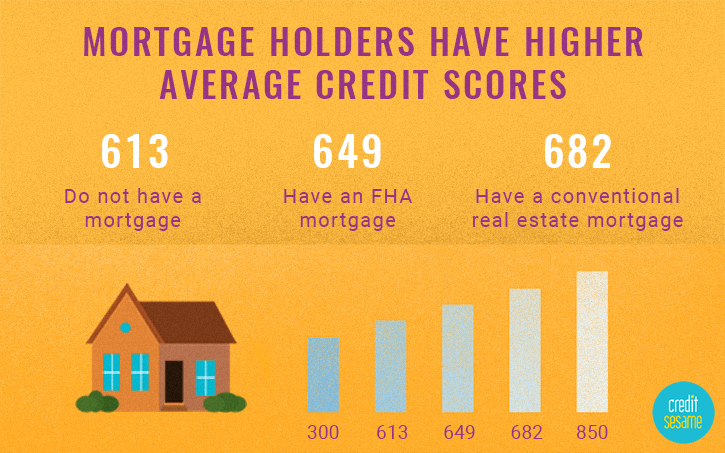

Mortgage And Credit Score Statistics

- 786 is the median credit score in the U.S. for those taking out a mortgage, according to Q2 2021 Federal Reserve Bank of New York data.

- Minnesota, New Hampshire and Vermont are home to those with the highest average credit scores in the country, while Mississippi, Louisiana and Alabama are home to those with the lowest, VantageScore reports.

- The average mortgage debt is $229,242, according to 2021 data from Experian. Generation X borrowers have the highest average mortgage debt, at $259,100.

Don’t Miss: Does A Mortgage Show On Your Credit Report

Interest Paid By Fico Score

| FICO Score |

Based on the in August 2021

If your credit score is on the lower end, even a small difference in your mortgage score can make a big difference in the cost of your home loan. You could wind up paying more than 20% more each month, which can make it harder to afford a mortgage.

Which Lenders Use Which Fico Scores

With the exception of the mortgage market, which is heavily regulated, lenders can generally choose which FICO score they use when running a credit check. However, they tend to use certain versions depending on the kind of credit for which youre applying. Heres a look at the most common FICO scores used for each type of credit.

Also Check: How Would You Describe Your Credit Rating

Bottom Line: What Is A Good Credit Score To Buy A House

Mortgage lenders generally require a credit score of at least 580 to 620 to buy a house. Lenders consider any score above 740 to be very good. But you dont actually need a good credit score to buy a house you can get a government-backed FHA loan, for example, with a credit score as low as 500. However, it can be strategic to boost your credit before you try to buy a home youll get better rates and have more options.

- ConsumerAffairs writers primarily rely on government data, industry experts and original research from other reputable publications to inform their work. To learn more about the content on our site, visit our FAQ page.

What Is A Good Credit Score

Are you wondering what is a good credit score? Find out what the average credit score in Canada is and how yours stacks up.

Many people don’t realize that their credit score is one of the most important pieces of information about them. Since financial institutions and lenders look at your credit score to determine whether to give you credit, how much to give you and sometimes the interest rate you’re offered, it’s in your best interest to keep your credit score in good standing.

Even if you’re not considering applying for a loan anytime soon, your credit score can also be a quick way to judge your character in other situations, for example, a potential landlord or employer might be concerned about a low credit score as it may imply that you have issues managing your money and that you might not pay your rent or pay it on time.

Since your credit score plays such a critical role in your life, you’ll want to ensure you keep yours in good standing.

Also Check: Is 755 A Good Credit Score

How Your Credit Impacts Your Mortgage Approval

Good credit is key to buying a home. That’s because lenders see your credit score as an indication of how well you handle financial responsibility. That three-digit number gives them an idea of how risky it is to lend to you after all, they want to make sure you pay back what you borrow, especially for a large purchase like a house. Your score could be the difference between getting an approval for a mortgage and getting turned down.

Your credit also impacts your mortgage approval another way: it might be used to help determine the rate and terms of your mortgage. If you have a higher credit score, you might get a lower interest rate or more flexible payment terms.

Can You Get A Mortgage With A Bad Credit Score

It’s possible to get approved for a mortgage with poor credit. But just because you can, it doesn’t necessarily mean you should. As previously discussed, even a small increase in your interest rate can cost you tens of thousands of dollars over the length of a mortgage loan.

If you’re planning on buying a home and you have bad credit, here are a few tips that can help you potentially score a decent interest rate:

- Think about applying for an FHA loan.

- Make a large down payment to reduce the risk to the lender.

- Get preapproved with multiple lenders.

- Consider working with a mortgage broker who may be able to match you with a specialized loan program.

- Pay down large credit card balances to reduce your .

- Work on paying down other debts to reduce your DTI.

- Consider asking someone with good or exceptional credit to apply with you as a cosigner.

There’s no guarantee that these actions will help you qualify for a mortgage loan with good terms, but they can improve your odds.

Don’t Miss: Does Xfinity Report To Credit Bureaus

The Fha 203k Mortgage Requirements

If you buy a fixer-upper home, an FHA 203k loan could be an excellent option. With the FHA 203k mortgage, you can role the cost of repairs needed for a home into one primary loan. The credit scoring requirements for an FHA 203k are the same as a standard FHA loan.

The debt-to-income ratio requirements can vary among lenders, but you can expect that your debt should be less than 43% of your income before tax.

Get Negative Items Removed From Your Credit Report

If you have numerous negative marks on your report and feel overwhelmed, you might consider hiring a credit repair company.

Take a look at our list of top ranked credit repair companies in your area to find a reputable one to work with. Theyll take the lead in disputing negative accounts with the credit bureaus and getting them removed from your credit history. Once that happens, youll automatically see your credit score increase.

Even if you dont have the bare minimum credit score to qualify for a mortgage, there are many ways to buy a house. From getting the right loan to improving your credit score, youll be able to quickly put yourself on the path to homeownership.

Recommended Reading: What Us A Good Credit Score