Consumer Credit Union Morristown Tn

Category: Credit 1. Consumer Credit Union Morristown, TN at 4918 West Consumer CU Morristown West Branch hours, phone, reviews, map at 4918 West Andrew Johnson Highway, Morristown, TN. Located in East Tennessee, Consumer Credit Union is a non-profit, cooperative savings and lending organization originally chartered by the Tennessee

Whats Does Zebit Report To Credit Bureaus

Fellas! Are you currently Doing the job to be a secretary in a corporation or Corporation? Certain, you may acquire in charge in all letters problems. And Of course, a does zebit report to credit bureaus challenge is one of a issue you need to be learn in. Even Youre not an personnel, a does zebit report to credit bureaus is very important for almost any reasons if youd like to deliver a proposal to other organization, company as well as your Trainer. Recognizing how essential does zebit report to credit bureaus needs are, we have an interest to debate it nowadays. Make sure you keep tuned and revel in studying!A does zebit report to credit bureaus is a formal and Expert doc which happens to be prepared by personalized, Corporation or business to its clientele, stakeholder, organization, Business and lots of more. This letter purposes to deliver any information and facts, ask for, authorization and several far more skillfully with The fundamental and common templates among the persons all over the globe. Both a private correspondent and enterprise need to have to build the build top quality by means of your does zebit report to credit bureaus in sake of showing your Expert small business. Then how to make it? Here we go.

Also Check: Do Credit Scores Combined When Married

How Do I Establish A Good Credit History

You can establish a good credit history by:

Paying at least the minimum payment by the due date on all your bills Keeping your balances low enough to afford the monthly payments and not overextending yourself- Dont apply for too much credit at one time because each time you apply for credit a creditor will obtain your credit report and each inquiry can impact your credit score

Recommended Reading: Aoc’s Credit Score

How To Apply For The Navy Federal Credit Union Mastercard Business Card

To apply for this card, you must have an existing business membership. If you dont, youll need to become a member first.

How long will it take to get my Navy Federal Credit Union Mastercard® Business Card?

It takes two to three business days for Navy Federal to process your application. If approved, youll get your card within seven to 10 business days.

You May Like: How To Clear A Repossession From Your Credit

Risks To The Primary Account Holder

There is a lot of trust involved in making somebody an authorized user. Because you have permission to use the credit card, you can run up debt and not be liable to the credit card issuer for payment. If the primary account holder expects you to pay them for the amount you charge, it can be difficult to force the issue if you choose not to pay.

Consequently, both parties need to be clear on the expectations regarding how you use the credit card. For example, you may only be allowed to use the card for emergencies or necessities, such as groceries and gas.

The agreement may be to check with the primary account holder before using the card. This way, you can avoid not being able to complete the transaction if the card has reached its limit, or the primary account holder simply wants a say regarding what youre buying.

Don’t Miss: What Credit Score Does Usaa Use For Credit Cards

How Navy Federal Credit Union Personal Loans Compare

| Navy Federal Credit Union |

With a minimum loan amount of $250, Navy Federal offers the lowest minimum compared to PenFed or Alliant . All credit unions let you borrow up to $50,000.

Navy Federal has more strict membership requirements than PenFed or Alliant, as you only qualify if you are active military member or a veteran, as well as an employee or retiree of the Department of Defense. Family members of any of the aforementioned groups are also eligible.

You can join PenFed if you’ve served in the military or worked at qualifying associations or organizations. You can also join by opening a savings account with a $5 minimum deposit. The easiest way to become a member of Alliant is to join Foster Care to Success, and Alliant will cover your $5 joining fee.

Navy Federal has a higher minimum interest rate than PenFed or Alliant, so you may get a better deal with one of the other credit unions.

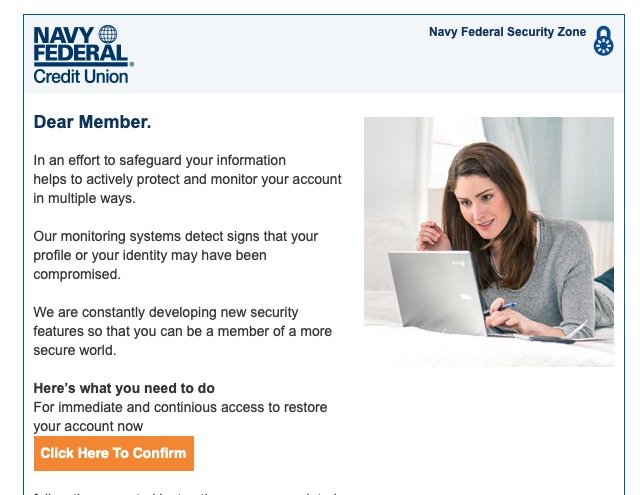

Protect Your Credit Report

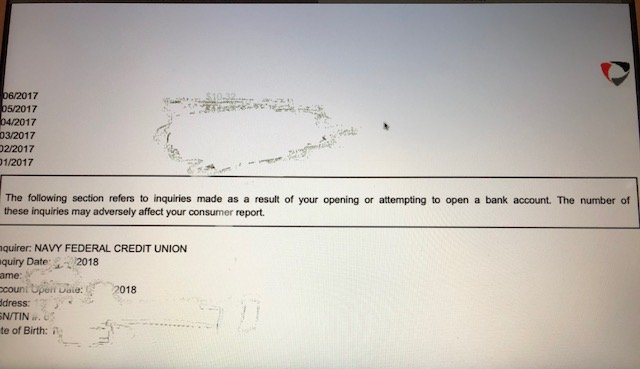

Understanding the way hard pulls affect your credit report can help you protect your credit score from hard falls. For instance, if youre rate shopping for a new loan and apply to several lenders within a short period of time, those inquiries will often only be considered one hard pull and may lower your credit score slightly but not much. However, if your credit search stretches out longer than a month and a half or you credit shop every few months, your score could eventually suffer because it may appear that creditors are rejecting you. Those hard credit pulls can stay on your report for up to 2 years.

Its not hard to keep track of whats going on with your own credit report. The major credit bureaus TransUnion, Equifax and Experian are required to give you free credit reports and address any mistakes or evidence of identity theft. You can get your free copies at www.annualcreditreport.com.

Stay in control of your personal finances and credit history by checking your credit report at least once a year, contacting creditors listed on the report to ask questions about inquiries that arent familiar, and only applying for credit you need and can afford. If youre a Navy Federal Credit Union member, you can easily monitor, manage and take control of your credit score with the free Mission: Credit Confidence Dashboard.

Recommended Reading: Care Credit Approval Credit Score

As Long As I Pay Off My Payment Plan How Is It Any Different From Other Retailers Plans

Unlike other retailers, zZounds payment plans are always interest-free, and we dont require you to apply for a new credit card. For us, its not about making a buck off interest or getting you to spend more money its about making it possible for musicians to invest in their dream gear now while spreading their payments out over several months.

You May Like: How Accurate Is Credit Karma Score

Risks To The Authorized User

Some credit card issuers will only report positive account history to authorized users credit reports while others may also report negative information. Either way, check your credit reports frequently for late payments or other credit problems because you will not have access to the statements. Those go to the primary cardholder.

If you see evidence of delinquencies or a high credit utilization ratio on your reports, you may want to ask the authorized user to take you off the account. You can also remove yourself from the account at any point by calling the company and making the request.

Read Also: What Bank Does Carmax Use

Why You Might Want The Navy Federal Credit Union Nrewards Secured Credit Card

Few fees

There are many secured cards on the market, but many tack on additional charges like account opening fees or annual fees. The only thing you’ll pay upfront for the Navy Federal Credit Union® nRewards® Secured Credit Card is a minimum $200 security deposit. The card also charges no foreign transaction fees, making it a good choice for use abroad. And there’s no fee for balance transfers.

Reporting to all three credit bureaus

The Navy Federal Credit Union® nRewards® Secured Credit Card will report your activity to TransUnion, Equifax and Experian, the three major credit bureaus that collect the information used to calculate your credit scores. This means that with responsible payment behavior, you can work toward building good credit generally, FICO scores of 690 and above which can qualify you for more favorable rates on things like credit cards, auto loans and mortgages.

» MORE:Why your credit score is important

Potential to ‘graduate’ to an unsecured card

Starting at six months, Navy Federal will review your account for good payment behavior. If you qualify, it will return your deposit and convert your account to the unsecured Navy Federal Credit Union® cashRewards Credit Card.

Ability to earn Rewards

Cell phone protection

Malignant End Credit Scene

Category: Credit 1. Is There a Malignant Post-Credits Scene? If so, What Does It Fans of James Wans latest horror movie Malignant are curious about whether the film has a post-credits scene. Heres what we know about Since the director is used to including additional elements in the credits,

You May Like: How Do I Unlock My Experian Credit Report

How To Improve Your Credit Score

Your credit score will change if there are any changes to your credit history. To help improve it, here are a few important factors to make note of:

- Keep your balance low. Keeping a low credit utilization ratio is good for your credit score. A credit utilization ratio compares your credit balances to your credit limits . Ideally, try to keep your utilization ratio below 30 percent.

- Always pay your bills on time. Making a habit of timely payments can improve your credit score over time. You can automate the process with payment scheduling services such as Navy Federals Bill Pay.

- Review your credit report for mistakes and request corrections. You can order one free credit report per year from each of the three major credit bureaus at AnnualCreditReport.com. Check out our step-by-step guidance on disputing any inaccuracies or mistakes.

- Avoid opening new accounts right before a major purchase like a home or car. New accounts can affect the average age of your credit history and score, possibly disqualifying you from better loans.

Virginia Credit Union Live Seating Chart

Category: Credit 1. Virginia Credit Union LIVE! Seating Chart Virginia Credit Union LIVE! at Richmond Raceway offers 6,000 seats across three columns of seating. The seating area is covered to protect from light The most detailed interactive Virginia Credit Union LIVE! at Richmond Raceway seating chart available, with all venue

Also Check: When Does Wells Fargo Report To Credit Bureaus

What Should I Know Before I Apply

To apply for this card, you must be a member of the Navy Federal Credit Union and have a Business Membership Savings Account with at least $5. For a new Business Membership Account, you need to deposit $100.

Who can join the Navy Federal Credit Union?

- Active-duty members of the Marine Corps, Navy, Air Force, Army and Coast Guard

- Army and Air Force National Guards

- Members of the Delayed Entry Program

- Department of Defense officer candidates, reservists, civilian employees and contractors

- US government employees assigned to Department of Defense installations

- Members of the ROTC

- Veterans, retirees and annuitants

- Family members to any of the above, including grandparents, parents, spouses, siblings, children, grandchildren and household members

What do I need to join?

- Social Security number

- Drivers license or government ID

- Home address, phone number and email address

What credit score do I need?

Apply with a good to excellent credit score of 670 or more. If you have a high credit score and low credit utilization ratio, you can likely get approved for a higher credit line.

What Really Should Consist Of In Does Zebit Report To Credit Bureaus

Nicely, it is the vital pieces you ought to point out within your does zebit report to credit bureaus. And, here the pieces are:

Whats the Format to get a does zebit report to credit bureaus?

A does zebit report to credit bureaus is a formal letter which has the obvious rule for people today in everywhere in the planet. In order thats why, you need to pay attention with its format and font. But again, Each and every Firm can have distinctive structure and style for his or her Qualified communication. And weve been below to share the widespread sorts of The fundamental does zebit report to credit bureaus structure. Listed here some details about it:

- Block Structure

- Punctuation

Also Check: Whats A Good Paydex Score

Navy Federal More Rewards American Express Card

Earn 20,000 bonus points when you spend $2,000 within 90 days of account opening. Expires on Nov. 01, 2021.

| $0 | |

| Rewards Earning Rate | 3 points per dollar at gas stations, supermarkets, restaurants and commuting expenses. 1 point per dollar on all other purchases. |

| INTRO BALANCE TRANSFER APR |

The Navy Federal More Rewards American Express® Card is not one of our top-rated rewards credit cards. You can review our list of the best rewards credit cards for what we think are better options.

Heres What You Need To Know About Navy Federal Credit Card Cash Advances:

- Location: You can get a Navy Federal credit card cash advance at an ATM or bank branch that displays the logo of your cards network. In-branch cash advances require a government-issued photo ID, your card and account number. ATM cash advances require a credit card PIN.

- Cash advance fees: Cash advances performed at a Navy Federal branch or ATM do not incur any cash advance fees, but all other domestic cash advances are subject to a $0.5 fee. In addition to the Navy Federal fee, some ATMs may also charge an additional fee of their own.

- Cash advance APR: The Navy Federal cash advance APR is 2% above the regular APR, not to exceed 18%. For instance, the Navy Federal Credit Union Platinum Credit Card features a regular APR of 5.99% 18% , depending on creditworthiness, so its cash advance APR is between 7.99% 20% . Check your monthly statement to see what your exact cash advance APR is. Cash advance APR starts accruing from the moment of the transaction.

Read Also: How Long Can Eviction Stay On Your Credit

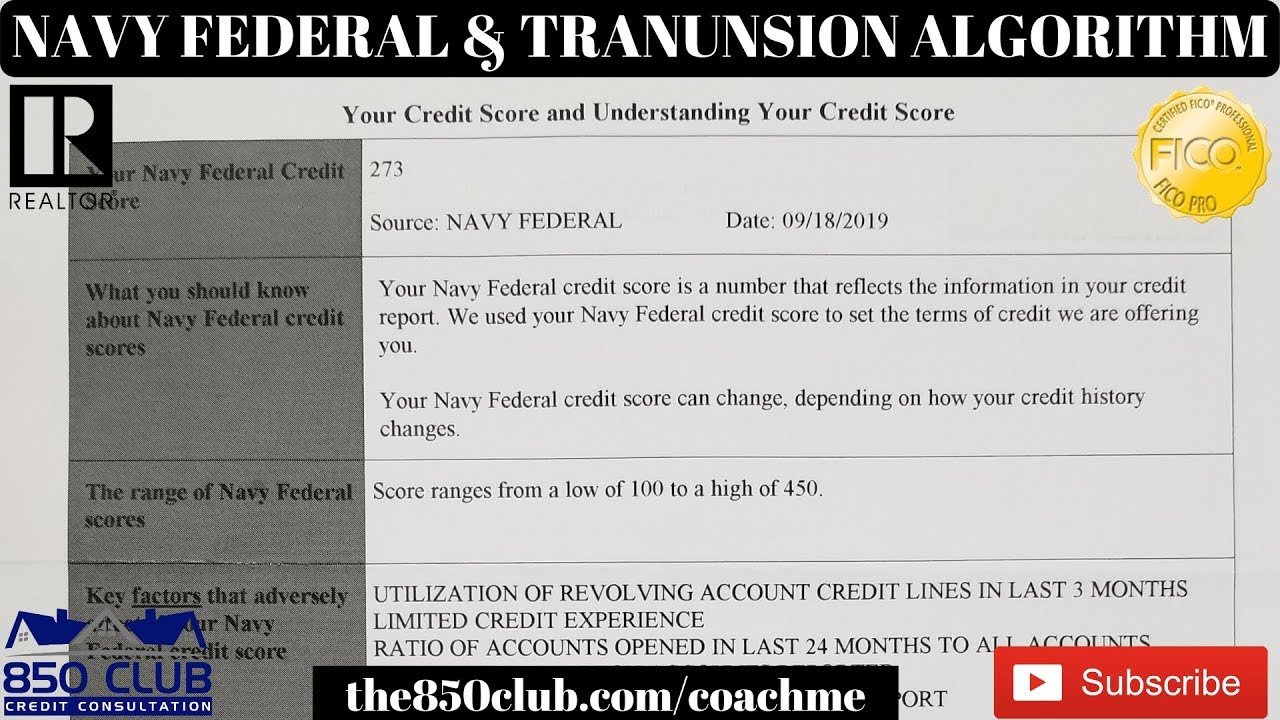

Re: Navy Federal Reporting

They always report the statement balance, so as long as your statement shows zero balance, that is what will be reported.

Mine reported shortly after the 1st statement posted even with a zero balance.

Eq 485 TU 467 Ex 400 BK filed Dec 2016Eq 723 TU 665 Ex 682700 All 3

wrote:As of today the card is reporting on Ex. Still waiting on EQ& TU

My NFCU accounts have only reported to EX for dec and jan, nothing for TU or EQ, however the balances are all the same

Fees To Watch Out For

The Navy Federal More Rewards American Express® cards fees are lower on the whole than those of most credit cards. Theres no balance transfer fee or cash advance fee if you request the advance at an eligible branch or ATM, and it also doesnt charge a foreign transaction fee. Whats more, the cards late and returned payment fees are lower than most cards charge.

Also Check: What Is Syncb Ntwk On Credit Report

Also Check: Is Ic Systems A Legitimate Company

What Is Rapid Rescoring

Rapid rescoring may be useful if youre trying get approval for a credit product, typically a mortgage, and your credit score is close, but not at a lender requirement. If youve recently made positive credit moves but theyre not yet reflected on your reports, lenders can request the information be added. This can result in your report and score being updated within a few days instead of having to wait for the next cycle. Its important to note that:

- You arent able to request a rapid rescore on your own.

- A lender must request one on your behalf and theres usually a fee for the service.

- A rapid rescore cant fix previous mistakes or make negative information disappear.

If youve been working hard to improve your credit health, it can be frustrating to feel your positive progress hasnt been recognized. Ultimately, you may just need to wait for your lender to provide the updated information. In the meantime, keep that momentum going with additional healthy credit habits. If youre looking for other ways to improve your credit health, gives clear, actionable recommendations based on your credit data to help you earn the credit score you want.

Get Focused On Your Score

Lenders at financial institutions check your credit score when you submit a loan application, so shouldnt you, too? Know your credit score ahead of applying for your next personal loan so you can improve it, if needed. Navy Federals Mission: Credit Confidence dashboard lets you check your credit score and provides a wealth of resources for anyone who is building, rebuilding, or simply managing their credit.

Recommended Reading: Unlock My Experian Account