Negotiate With Aargon Agency

Unfortunately, if the debt is legitimate and its less than 7 years old, removing Aargon Agency from your credit report will be very difficult .

Your best move at this point is to simply pay the debt. Newer credit scoring models ignore paid-off collection accounts, which means paying will boost your credit score even if you cant remove the item.

However, when you pay, there are two negotiation strategies you can try as a last-ditch attempt to remove Aargon Agency from your credit report:

- Pay for delete: You might be able to convince Aargon Agency to remove the negative mark in exchange for paying off the debt. You can open these negotiations by sending them a pay-for-delete letter.

- Goodwill deletion: This is an alternate strategy you can try after paying your debt. Once the account is paid off, you can send Aargon Agency a goodwill letter asking them to empathize with your situation and remove the mark from your credit report as an act of kindness.

If you cant afford to pay off your debt, try negotiating a debt settlement

If your debt is fairly old, then theres a chance that Aargon Agency will accept less than the full amount you owe to minimize their losses. You can negotiate a debt settlement with Aargon Agency over the phone or by sending a debt settlement letter.

What Prompts You To Change The Personal Information On Your Credit History

One may have to learn how to remove personal information from credit cardfor various purposes. Wedding, citizenship, and other occurrences often result in legal modifications. Transfers in residences are more prevalent.

Due to issues like identity fraud, individuals also might alter their Social Security number.

Personal details on your credit file could be wrong owing to inaccuracies, even if it all stays the same for you. Its possible that ones identity is misspelled or that the data has a location where youve never stayed. You must fix these errors so that your report appropriately reflects your data.

Also, read What is the Average Credit Card Debt in America in 2022?

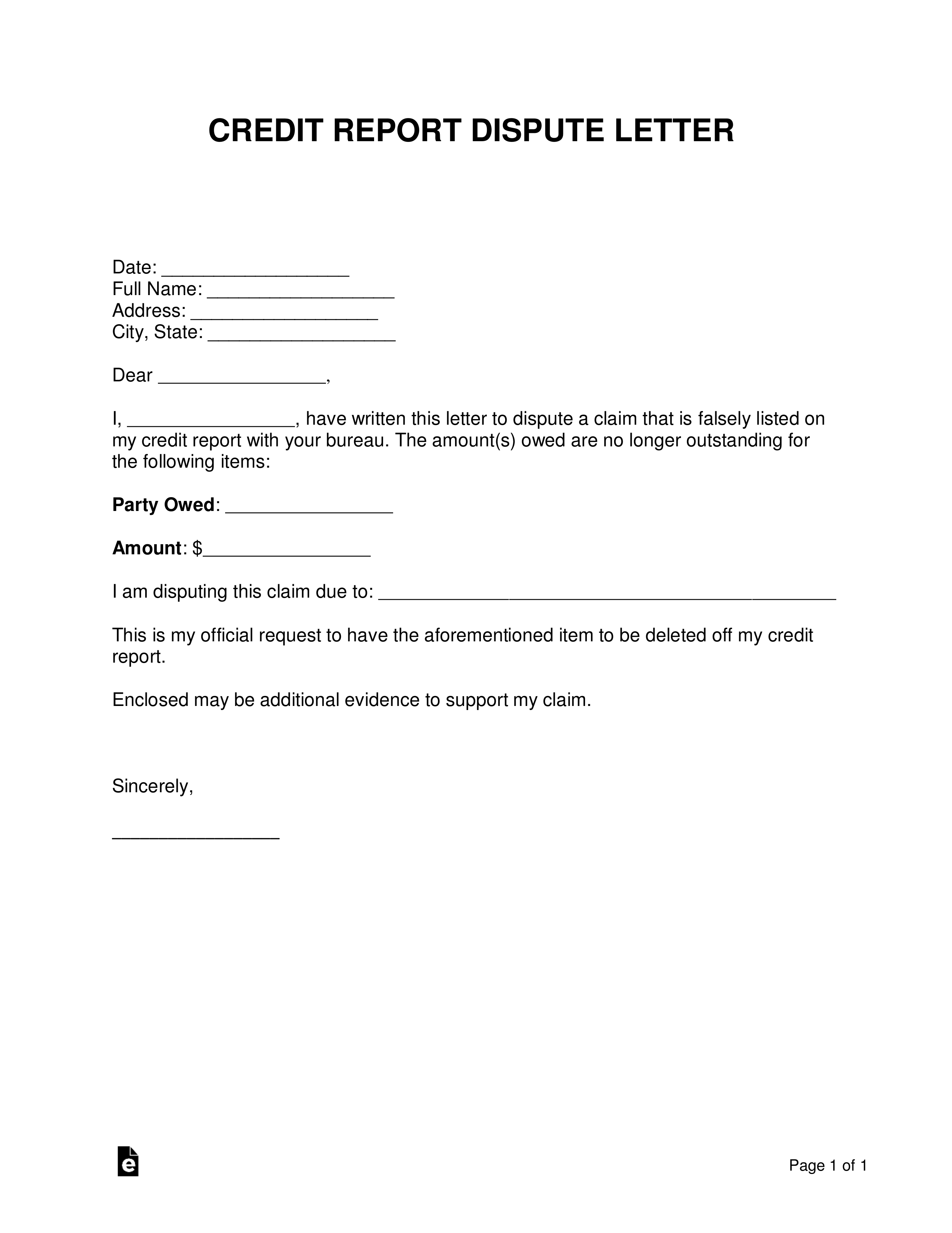

How To Dispute Credit Report Errors

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Errors on your credit reports can cause your credit scores to be lower than they should be, which can affect your chances of getting a loan or credit card and how much interest you pay. Disputing credit report errors and getting those negative items removed can be a quick route to a better score.

Here’s how to dispute credit report errors and have them removed in four steps.

Read Also: How To Remove A Repo Off Your Credit

Common Credit Report Errors To Look Out For

According to the Consumer Financial Protection Bureau, these are the most common errors consumers find on their credit history:

Mistaken identity

- Wrong name, address or phone number

- Accounts from someone with a similar name

- New credit accounts opened by someone who stole your identity

Incorrect account status

- Accounts wrongfully labeled as open, past due or delinquent

- Accounts that wrongfully listed you as the owner instead of authorized user

- Wrong date for the last payment received, date the account was opened or delinquency status

- Same debt listed multiple times

Data management

- Information that is not removed, despite already being disputed and corrected

- Accounts that are listed multiple times, with different creditors

Balance

- Incorrect credit limit

Get A Copy Of Your Credit Report

Once you have your credit report write down the accounts that you need to remove disputes from. You will now need to call each Credit Bureau that lists dispute comments on your report. Tell them you need to remove dispute comments from all of the accounts on your report.

Below are working phone numbers to connect you to a live person with all three Credit Bureaus.

Don’t Miss: How To Get Credit Report Without Social Security Number

Send A Debt Verification Letter

A debt verification letter is a formal request that obligates a debt collector to provide evidence of a debt. You must send it within 30 days of them first contacting you.

Debt Verification Letter

Use this debt verification letter template if Aargon Agency has contacted you about a debt and you want to dispute it. If you send this within 30 days, theyre legally obligated to respond with evidence of the debt and cant contact you until they do.

Benefits of sending a debt verification letter

Sending a debt verification letter has three benefits:

Make A Goodwill Request For Deletion

If you have a good relationship with a creditor that has listed a late or missed payment, consider sending a goodwill request for deletion letter. The letter requests the original creditor to pretty please remove the offending item from your credit report. You can send the letter through the mail or make the request through email or on the phone.

Goodwill requests work best when you have a long and positive relationship with the creditor. Naturally, youll have to be completely current on your payments to the creditor. The letter you send should be polite because the creditor is under no obligation to agree.

As with other credit repair letters, examples of goodwill request for deletion letters are available on the internet for free. Note that a creditor may be willing yet unable to remove an item due to its own policies or agreements with credit bureaus. Nonetheless, you have nothing to lose by making the request, except for some of your time.

Since a goodwill letter is not considered an official credit dispute letter, you may never get a response back from the creditor there are no mandatory deadlines for response. Your best bet is to demonstrate that the late payment was a rare oversight, and youll never do it again.

Goodwill letters are usually less successful for more serious transgressions, such as collections and repos.

Recommended Reading: Attcidls

What Happens When An Item Is Deleted From Your Credit Report

Whenever your credit report is altered because of a dispute lodged by you or a credit repair service, the credit bureau must inform you in writing. You are then entitled to a fresh copy of your credit report from the bureau.

Many credit cards offer free alerts that inform you whenever your credit score changes. Thus, if an item deletion results in a change to your score, your credit card company may be the first to inform you of the good news. You also may get a free fraud alert service.

You should see your credit score improve when negative items are removed from your reports. How much it improves, however, depends on the type of item that is removed and its age.

The credit bureau must send you written results about your dispute, which usually arrive within the initial 30-day window. If the results are favorable, you can instruct the bureau to notify anyone who received your report in the past six months.

Documentation To Provide For Your Dispute

In addition to the above, you’ll need to provide:

-

Proof of identity

-

Your Social Security number and date of birth

-

A copy of government-issued identification

-

Your current address and past addresses going back two years

-

A copy of a utility bill or bank or insurance statement that includes your name and address

Recommended Reading: How Long For Collections To Fall Off Credit Report

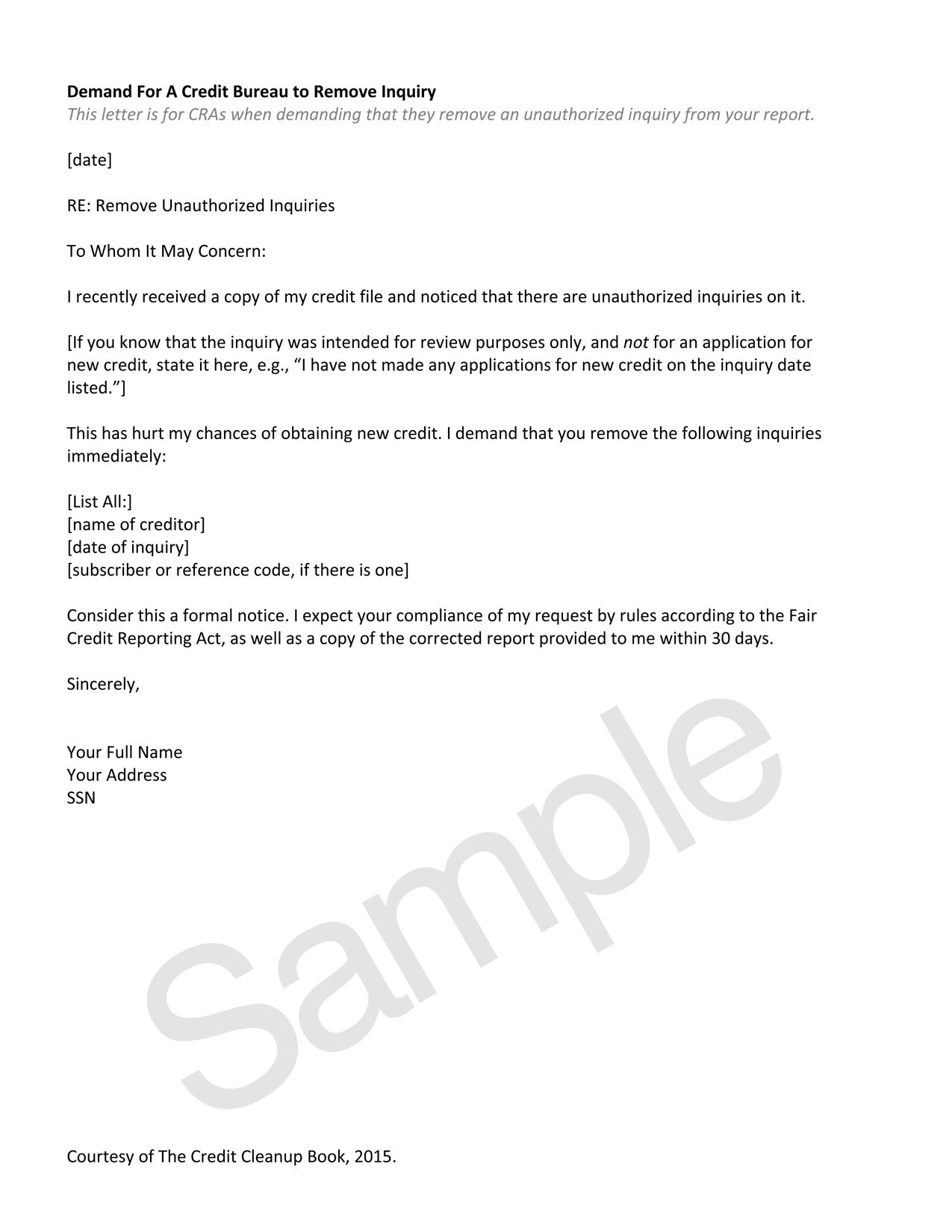

Look For Inaccurate Hard Inquiries

Once you get the report, look over the whole thing. There should be a hard inquiries section. Make sure you recognize each hard inquiry on your report. But dont jump to conclusions if you see any information you dont recognize.

Often, companies will outsource their credit checks to other companies. This usually happens with store credit cards, so do a quick Google search to see if the name listed on the hard inquiry matches up with a company you recognize.

How An Error On Your Credit Report Can Affect You

Is it really necessary to keep close tabs on your credit report? Can one error really have an impact on you? Yes. Your credit report contains all kinds of information about you, such as how you pay your bills, and if youve ever filed for bankruptcy. You could be impacted negatively by an error on your credit report in many ways.

To start, its important to understand that credit reporting companies sell the information in your credit reports to groups that include employers, insurers, utility companies, and many other groups that want to use that information to verify your identity and evaluate your creditworthiness.

For instance, if a utility company reviews your credit history and finds a less-than-favorable credit report, they may offer less favorable terms to you as a customer. While this is called risk-based pricing and companies must notify you if theyre doing this, it can still have an impact on you. Your credit report also may affect whether you can get a loan and the terms of that loan, including your interest rate.

Read Also: Tri Merge Credit

The Dispute Resolution Process

Every Credit Bureau allows you to file a dispute with them if you notice an error on your credit report that was obtained through them. You need not file a dispute with each and every bureau. The dispute resolution process follows very simple process as detailed below.

You can file a dispute on the official websites of the credit bureaus in the following easy steps:

Step 1: Download the Dispute Resolution Form and clearly state your query in the space provided. While some credit bureaus also allow you to fill in an online form for disputes after logging into your account on the bureau’s website. Choose your area of error properly it could error regarding your identity details or account details. Be as accurate as possible, as this will help with faster processing.

Step 2: Once you have filled in the form, you need to attach a valid, self-attested copy of Identity Proof and Address Proof .

Step 3: You need to send the form along with the self-attested documents through courier, regular post or speed post to the address mentioned on the official website of the credit bureaus.

Guidelines For Sending The Dispute Form and Supporting Documents

-

Keep in mind the all photocopies should be properly self-attested

-

Make sure that ID card numbers and photographs are clear and visible

-

If you are sending any utility bills as way of address proof, then it should be within three months from the current date

Typically, it takes up to 30-45 days for the error to be resolved.

Sample Credit Bureau Letter To Remove Disputed Comments

Instead of calling you may also write to the credit bureaus but this may take a few weeks to correct the report. Below is a sample dispute letter to remove dispute comments, use it and modify to fit your own words. Format to dispute as many inquiries as necessary. Send out the letter out to each of the three credit bureaus via certified mail or fax. Enclose a copy of each of the following: SSN card , Recent utility bill , State-issued identification.

Full Name

OR BY FAX : 1-972-390-4908

OR BY FAX : 1-888-826-0549

OR BY FAX : 1-610-546-4657

RE: REQUEST TO UPDATE CREDIT REPORT, PLEASE RUSH LOAN PENDING

To whom it may concern,

In accordance with the Fair Credit Reporting Act Section 611 , I am practicing my right to UPDATE information that does not reflect the current status of certain accounts. More specifically pertaining to comments on accounts. I am requesting that you remove the disputed comments on each of the accounts below with immediate effect. The accounts have either never been disputed, to begin with, or are no longer in dispute.

I am asking the dispute comment to be removed from the following items:

Once again this is not a request to investigate, but to update, so I expect you to update my file as soon as possible and not the regular 30 day period youre allowed for disputes

Truly,

Read Also: What Credit Score For Care Credit

How To Remove Personal Information From Credit Report

The question of how to remove personal information From Credit Report is always revolving in the minds of those who look to borrow money from lenders in the future to counter the emergencies. To know more about it, one must know that credit reports significantly impact your life. The information determines your credit score in regular credit reports, which impacts what kind of residences one could rent, precisely what sort of car you can purchase, and what type of loan you can get.

These reports have to be reliable, hence you are eligible to receive them from each of the three credit bureaus, Experian, Equifax, and TransUnion, every 12 months at AnnualCreditReport.com.

The reports generated by the three bureaus should be crosschecked and examined clearly, e.g, did you change your name, address, or Social Security number? Is there any private info in the records that you believe is untrue? If thats the case, check certain the information is accurate. By doing so, you can come one step closer to the process of removing personal information from credit cards.

Here, I will take you down to the brief information where you will come to know how to remove personal information from credit history that was hampering your life when looking for financial assistance.

In This Article

Best Ways To Change The Personal Information On Your Credit Report In 2022

Identifiable data refers to the individual data obtained in the credit history, like your name, residence, work history, and Social Security number. Ones reports reflect the identifiable data provided to the agencies from your creditors. You must examine this data in your credit history to guarantee that none of your personal accounts have been compromised by scammers.

You May Like: Opp Loans Credit Score

Review Your Credit Reports For Errors

Your are based on information provided by companies to the three major credit bureausExperian, Equifax and Transunion. To identify which credit reports contain errors, you have to review each report separately. You can do this by visiting AnnualCreditReport.com. Due to Covid-19, you can view all three of your reports for free weekly through April 20, 2022.

How Does The Dispute Process Work

File a dispute for free

If you see information on your Equifax credit report that you believe is inaccurate or incomplete, you have two options to submit a dispute form and required documents: electronically or by postal mail.

Results

After your dispute is processed, we will notify you with the results and outcome of the investigation. If you submitted your documents electronically, you will receive the results by email. If you printed and mailed in your dispute information, your results will be mailed to you.

Please note that you will need to contact Trans Union of Canada, Inc. directly to correct inaccuracies found on your TransUnion Canada credit file.

Also Check: How To Report To Credit Bureaus On Tenants

Check All Three Credit Reports For Errors

Through April 2022, youre entitled to free weekly credit reports from the three major credit reporting bureaus: Experian, Equifax and TransUnion. Request them by using AnnualCreditReport.com.

There may be small differences among your reports, because some creditors dont report your account activity to all three bureaus. But if negative information has popped up on one report, its wise to see whether its also on the other two.

There is no cost to dispute credit report errors, and you can dispute as many items as you like. Filing a dispute does not hurt your credit score, but the result of the dispute may have an effect on your score.

Dispute Mistakes With The Credit Bureaus

You should dispute with each credit bureau that has the mistake. Explain in writing what you think is wrong, include the credit bureaus dispute form , copies of documents that support your dispute, and keep records of everything you send. If you send your dispute by mail, you can use the address found on your credit report or a credit bureaus address for disputes.

Equifax

Recommended Reading: How Long Do Evictions Stay On Credit Report

How To Remove A Dispute From A Credit Report

This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013. This article has been viewed 31,736 times.

If you go to a bank for a mortgage, the lender will look at your credit history to check your creditworthiness. A lender may refuse to make a loan to you if any of your creditors have reported your account as being in dispute. You may have “disputed” a particular charge attributed in error to your credit card, for example. Then in order to secure a loan you may want to have that dispute settled and removed from your record. Here’s how to do that.