Offer To Move In Right Away

Having one or more empty apartments is expensive for landlords. They have to pay the mortgage and utilities without any reimbursement in the form of rent. Because of this especially if you live in a place with low rental demand you may be able to rent a place without a credit history if youre able to move in immediately.

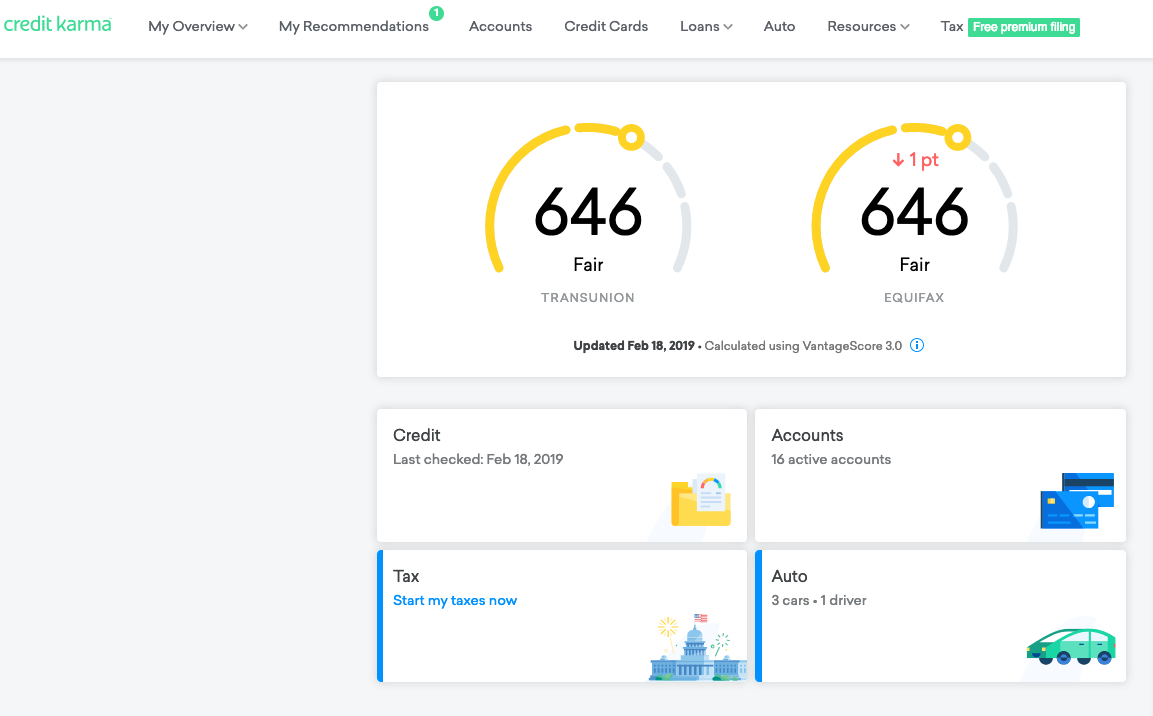

» SIGN UP: Check your free credit score and track your progress

Be Prepared To Pay More Up Front

Whether you’re able to get around the credit check altogether or you get approved for an apartment despite your credit history, expect to pay more money upfront. You might be required to pay a higher security deposit or between one and three months worth of rent to move into your new apartment.

If you dont have the best credit and expect to move in the near future, start setting some money aside now so you can cover the higher upfront costs.

Shorten The Term Of The Lease

Another option is to shorten the term of the lease you originally had in mind when signing with a tenant you are unsure about. This may mean changing a yearly lease to month-to-month or your 6-month lease to 3-month. This will allow you to end the tenancy early and easily in case you have any difficulties.

Recommended Reading: Does Paypal Report To The Credit Bureau

Look For Apartments That Don’t Require Credit Checks

Although you’ll likely have fewer options if you go this route, it may be possible to find some listings on places like Craigslist that specifically say whether or not a credit check is required. You’ll want to ensure everything is above-board with places that don’t run credit checks , and that there is an actual lease you’ll be signing that makes sense for all parties involved.

How Can You Build Your Credit Score From Scratch

Let me use an analogy to answer this question. A high credit score is not a race car that allows you to hit the gas and feel the result right away. Its more like your driving record. Instead of showing your current spot, it traces your past behavior. Thats why building a credit score takes time and effort. You can build one over time with a student loan, mortgage, personal loan, just to name a few.

According to the expert opinion, using credit cards on a regular basis can help you tremendously in building your credit score:

I always say use credit cards as a tool to build your credit history. If you look at credit cards as a way to build up your credit by paying on time, keeping balances low, in time you need a larger loan such as a home mortgage you have good history.

Also Check: How To Unlock My Experian Credit Report

What To Do If Your Credit Is Subpar

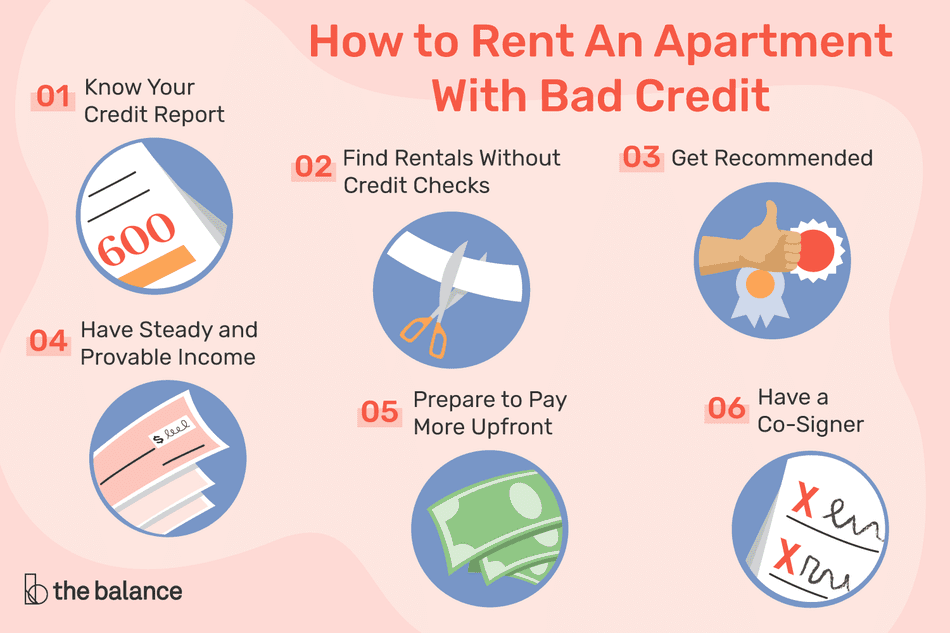

If your credit is between 500 and 650, what should you do to improve your chances of getting an apartment? First, know your credit score ahead of time. There are a number of places where you can obtain it for free online.

This will help you to be better prepared when you apply for the apartment. If you know that your score is low, find a co-signer that you know and trust. Finally, be willing to leverage other tools in your favor, for example a higher security deposit, character references or a month-to-month lease.

These can help you to negotiate a lease that will convince the landlord that you are a minimal risk while helping you to rebuild your credit.

With a little preparation, you can take some of the stress out of moving and ensure that you know the answer to the question: “What credit score do I need to rent an apartment?“

Offer To Pay More Upfront

Ultimately, what matters is that management gets the money. If you’re willing and able to offer a larger deposit, multiple months’ rent or even the entire term of the lease upfront, they’ll be a lot more likely to take you, bad credit and all. If you stay in the apartment for a year, have a clean payment record and choose to renew, you might not need to make as large of an upfront payment for the second year’s lease.

Don’t Miss: Syncb/ppc On Credit Report

What Is Classed As Bad Credit

Bad credit is when you have had credit issues in the past, resulting in a low credit score.

Your credit score is a number that tells lenders how reliable you are when it comes to borrowing money. A good can unlock better deals and interest rates for you, while a bad credit rating can make things more difficult when it comes to borrowing money or renting a property.

Bad credit can happen for a number of different reasons. It could be a missed or late credit card or loan repayment, a payday loan or applying for multiple credit cards. When you have bad credit, you’re considered riskier than other borrowers.

Read more about what makes a bad credit score in our Guide: What is a Bad Credit Score?

Extra Rent In Advance

Some landlords will accept rent upfront to reduce the risk of missed payments. If you can’t pass a credit check, you could consider paying more rent in advance.

There’s no limit to how much rent you can pay upfront.

Check what your contract says about when rent should be paid. Each time you renew your tenancy, you can discuss with your landlord whether you’ll:

-

pay rent monthly or weekly after the fixed term ends

-

need to continue paying rent in advance every few months

-

have to get a guarantor if you can’t continue paying rent in advance

Read Also: What Is Syncb/network On My Credit Report

Sign A Lease With Someone Else

Again, this requires a bit of trust, but if you would be okay with getting an apartment with a roommate and you can find someone who wants to live with you you could have the application run with your roommate’s credit score, then you could make your rent payments directly to him or her. This won’t work in every situation, though, since some landlords require all occupants to be on the lease.

Does A Bad Credit Score Affect Renting

Yes, it does. Your credit history report is the only document that can give landlords an idea of your ability to pay rent on time. It demonstrates how good you are at managing your finances, so this factor affects the final decision of landlords significantly. So, its time to reveal the secrets of renting with a low credit score.

Also Check: Credit Score 575

Offer A Higher Security Deposit

The other way to prove your financial solvency is to pay a larger security deposit. This approach will make you more appealing in the eyes of your future landlord and can sweeten the deal. Of course, some properties might have exceptionally strict rules regarding security deposits, but it doesnt happen frequently.

Can I Rent An Apartment With A Bad Credit Score

Do you have a credit score lower than 650? Have you ever gotten denied for rental applications? Renting can be incredibly challenging when you have a bad credit score. From a landlords perspective, a bad credit score usually means late payments, or worse, financial losses. Landlords, therefore, may be reluctant to rent to someone who has a low credit score, or they may require more security deposits. However, just because you have a bad credit score, it does not mean that you will not be able to rent. In this post, we will go through everything you should know when it comes to renting with a bad credit score.

In case you are unfamiliar, a credit score is a statistical three-digit number that predicts how likely a consumer will repay his or her debts. Landlords utilize credit scores to see if renters will be able to pay rent on time. Credit scores range from 300 to 850, and a credit score of 700 or above is generally considered good. With proof of income, a valid photo ID, and a good credit score, a renter should be able to apply for an apartment without difficulty.

Once you have identified the neighborhoods, you can then shift your focus onto apartments. A bad credit score might hurt your chances of getting approved. However, there are still ways to get an apartment, such as:

1. Focus on properties owned or managed by independent landlords and property managers.

2. If that does not work, try looking for sublets or roommates.

3. Offer to pay more security deposit.

Read Also: When Does Usaa Report To The Credit Bureaus

How This Site Works

We think it’s important you understand the strengths and limitations of the site. We’re a journalistic website and aim to provide the best MoneySaving guides, tips, tools and techniques, but can’t guarantee to be perfect, so do note you use the information at your own risk and we can’t accept liability if things go wrong.

- This info does not constitute financial advice, always do your own research on top to ensure it’s right for your specific circumstances and remember we focus on rates not service.

- We don’t as a general policy investigate the solvency of companies mentioned , but there is a risk any company can struggle and it’s rarely made public until it’s too late .

- Do note, while we always aim to give you accurate product info at the point of publication, unfortunately price and terms of products and deals can always be changed by the provider afterwards, so double check first.

- We often link to other websites, but we can’t be responsible for their content.

- Always remember anyone can post on the MSE forums, so it can be very different from our opinion.

MoneySavingExpert.com is part of the MoneySuperMarket Group, but is entirely editorially independent. Its stance of putting consumers first is protected and enshrined in the legally-binding MSE Editorial Code.

Do You Need A Credit Score To Rent A House Or Apartment

Searching for a house or apartment to rent is exciting, but as with many of life’s big expenses, your can make a difference in whether you get approved for the rental property you want. When you apply to rent an apartment or house, the landlord will want evidence that you can afford the rent and will pay it on time as agreed. It may not be required, but having positive credit can help you qualify for the apartment of your dreams.

Read Also: Does Paypal Report To Credit Bureaus

Fix Errors On Your Credit Reports

First, get your reports from the three major credit bureaus, Experian, TransUnion and Equifax. In general, you can get one free copy from each of the bureaus annually at AnnualCreditReport.com, but during the pandemic, free reports are available weekly.

The reports include instructions for disputing errors. Be sure to fix your reports well before you begin an apartment search because it might take some time. Pay special attention to late rent payments or problems with past landlords, which can show up on your report, according to the Consumer Financial Protection Bureau.

Address any remaining negative items on your reports with your prospective landlord. For instance, explain that you had emergency medical bills or went through a layoff.

What Credit Score Do You Need To Rent An Apartment

- Renter Guides

When you apply to rent an apartment, you can expect nearly all landlords to run a credit check. As a general rule, youll want a credit score of 620 or higher. But theres no hard and fast number it varies by landlord, and is only one factor in your rental application.

When the landlord checks your credit score and report, theyre looking to be assured that youll pay rent on time, and a strong credit history gives them peace of mind.

When you get ready to apply, its common to have a few questions in mind, including:

- What is the minimum credit score to rent an apartment?

- Do landlords only look at the credit score, or are they reviewing the report, too?

- Can you get an apartment with fair or bad credit?

- How can I figure out if my credit score is good enough?

If you are searching for your next apartment and want to understand what role your credit score may play, heres what you need to know.

Recommended Reading: When Does Opensky Report To Credit

I Want To Rent A House But Have Bad Credit

Heres a scenario that a lot of people find themselves in I want to rent a house but have bad credit. Where do you go from here? Landlords have to perform a financial background check before agreeing to take you on as a tenant but they need your permission to do so first.

You are well within your rights to refuse the check but this could damage your chances before they have even started if it looks like you have something to hide. Find out more about what a credit score is if you are unsure about having an assessment done.

You could always be honest with your landlord. Tell them your history is bad and that you fully expect the search to fail to reach the minimum credit score for renting in the UK.

This honest approach may actually help you because your landlord can see that you are not trying to hide something from them and they then see you in a much more favourable light. Just because you have bad credit it doesnt automatically rule you out from applying for tenancy.

If you want to give yourself the best opportunity to succeed, request copies of your report from each of the big reporting agencies. These are available for free once a year by law and only cost a couple of pounds after that.

Once you have them, scour them with a fine tooth comb for any discrepancies and if there are any get them removed as soon as possible. Removal of misinformation can have a massively positive effect on your score and improve your chances of scoring higher on the credit check.

Importance Of Credit Scores

Most landlords are not going to know potential apartment tenants on a personal level. A credit score provides an objective standard on which to compare potential renters and shows how they have handled money and responsibilities in the past. Credit scores are commonly evaluated by landlords to determine whether they qualify for a property. According to CreditCards.com, most landlords look for a credit score of 670 or above.

Also Check: Does Removing An Authorized User Hurt Their Credit Score

Can I Still Rent A Home If I Have A Bad Credit Record

While a good credit profile can increase your chances of getting an apartment, those with bad credit can still find ways to rent a home. Heres what you need to do.

Most landlords use a credit check to vet potential tenants. By assessing a tenants credit history, landlords are able to identify how much of a financial risk they might pose as their tenant.

For those with a less-than-stellar credit history, you might have a tough time qualifying as the ideal candidate for that rental home you love so much.

But while trying to rent a home with a bad credit record can be difficult, its certainly not impossible.

By taking the right steps, you can improve your chances of renting a home in no time heres what to do:

Tell The Landlord Upfront

If the landlord or letting agent will be able to see your credit score during the tenant check be upfront.

Tell them what they need to know before they find out!

Being open and honest should always be one of the first steps for those wondering how to rent a house with bad credit. This will make you appear a much more trustworthy and reliable tenant.

Recommended Reading: Does Opensky Report To Credit Bureaus

Failed Credit Check For Renting

If youve failed a credit check for renting then what should your next step be? Just because you have failed the perceived minimum credit score for renting in the UK that does not mean that your landlord will not be open to having you as a tenant. You should speak to them and see whether the failed check is an issue for them.

If it turns out that the rating is a potential sore point the landlord can also do something known as tenant referencing. This is basically a character reference from someone you know attesting to the fact that you are capable of paying your rent on time.

This is usually from your employer or from someone who has known you a long time in a position of responsibility such as a teacher or doctor. You could also get a guarantor who would act as an insurance policy for the landlord. If you cannot make your monthly rent payments then the guarantor promises to make them for you.

A failed credit report does not mean the end of the road for you as a tenant. Explore all the possible avenues available to you and renting a place of your own will be available to you.

Acceptable Credit Score For Renting A Property In The Uk

Knowing what an acceptable credit score for renting a property in the UK is can be a confusing affair. There are three main reporting companies that financial institutions use to determine credit suitability, but the problem is that they all have their own scales.

For this reason, you dont have just one credit score, you actually have three. The table below illustrates how they use their own ratings and what they actually mean for you in terms of a good or bad score.

| Scoring Company |

|

Excellent |

Read Also: How To Take A Repo Off Your Credit