How Does Your Credit Score Compare

Most of the top credit rating agencies have five categories for credit scores: excellent, good, fair, poor and very poor. Each credit rating agency uses a different numerical scale to determine your credit score which means each CRA will give you a different credit score. However, youll probably fall into one category with all the agencies, since they all base their rating on your financial history.

|

Experian |

|---|

|

628-710 |

A fair, good or excellent Experian Credit Score

Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good. A score of 961-999 is considered excellent .

A fair, good or excellent TransUnion Credit Score

TransUnion is the UKs second largest CRA, and has scores ranging from 0-710. A credit score of 566-603 is considered fair. A credit score of 604-627 is good. A score of 628-710 is considered excellent .

A fair, good or excellent Equifax Credit Score

Equifax scores range from 0-700. 380-419 is considered a fair score. A score of 420-465 is considered good. A score of 466-700 is considered excellent .

To get a peek at the other possible credit scores, you can go to ‘What is a bad credit score‘.

Paying Your Bills On Time

While paying each of your bills on time may seem like the most obvious way to improve your credit score, its also the most important one. There is nothing that will harm your credit score as much as having a series of late payments on anything from car loans to mortgage loans. This is why it is extremely critical that you always make the minimum monthly payments by the determined date each month WITHOUT ANY EXCEPTIONS.

Even skipping just one mortgage payment is going to have a detrimental effect on your credit score. Sorry if that sounds cruel, but its the truth, and it should serve as your primary source of motivation for making your payment on time.

Heres an important fact to keep in the back of your mind: every time that you fail to make a monthly payment when you are required to do so, whether it be on a car or your home or anything else, it will be on your credit history and thus impact your credit score for up to seven years. Seven years. Think about that.

Now, one primary benefit to using a credit card here is that you can choose how much money you spend while using them, and then also determine how much you pay back each month, so long as that amount is equal or greater than the minimum payment you owe.

The reason why this is a benefit to you is because it allows you to budget your money accordingly and make the smartest financial decisions you can. In other words, you can avoid going into serious debt.

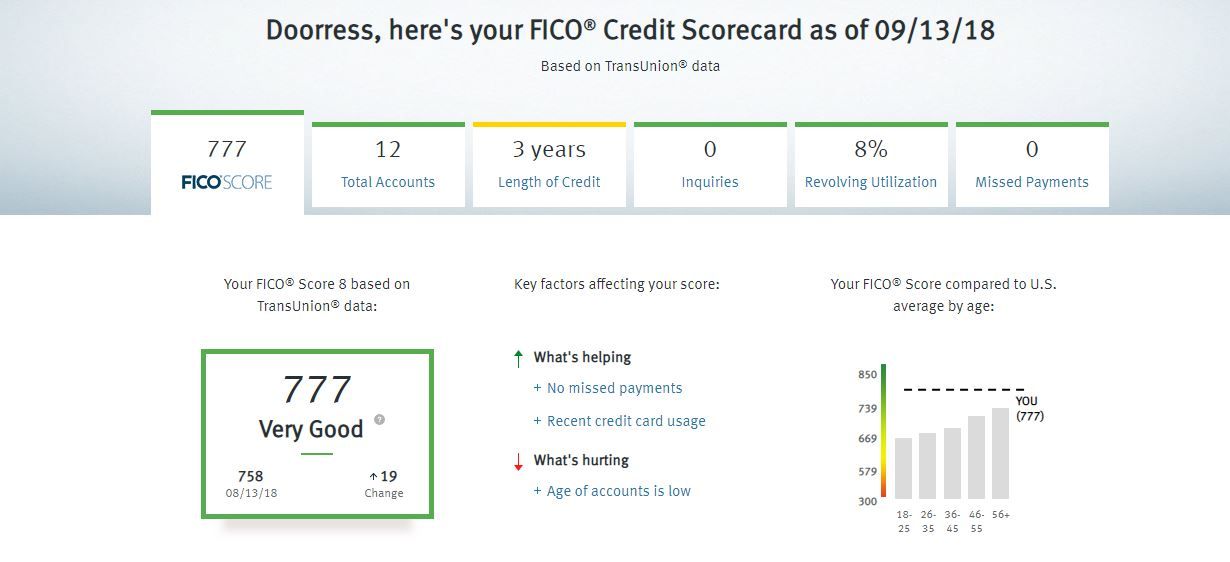

Heres How To Get A 777 Credit Score:

Recommended Reading: Transunion Account Locked

What Is A Good Credit Score For Credit Cards

The best credit card offers are typically reserved for consumers with excellent credit. Still, there are plenty of great credit card products that frequently accept consumers with good credit, or even fair credit. Consumers with poor credit are typically restricted to secured credit cards. These cards can help rebuild credit over time.

Can I Buy An Apartment

A credit score of 777 means that you can easily get a mortgage to purchase the apartment you have your eye on without a lot of hassles. You are what is considered to be a low-risk borrower, and many lenders will be happy to get your business. What’s more, the mortgage is guaranteed to be affordable and flexible.

Recommended Reading: How Long Do Repos Stay On Credit

Pay Your Bills On Time All Of Them

Paying your bills on time can improve your credit score and get you closer to an 800+ credit score. Its common knowledge that not paying bills can hurt your credit score, but paying them late can eventually hurt also.

I think a lot of people dont really understand that there isnt a bill thats really too small, says Thomas Nitzsche, a certified credit counselor and financial educator with ClearPoint Credit Counseling Solutions, and the owner of an 800+ credit score.

If a bill goes unpaid long enough and the debt is sold to a third-party collection agency, that will be reported to credit bureaus, Nitzsche says. But being late can lead to fourth-level reporting parties, such as online searches, that credit bureaus can become aware of.

From late utility bill payments to magazine subscriptions or even $10 medical co-pays that people dont think are important enough to pay on time, all bills should be paid on time.

Any bill I get is treated as a serious situation, he says.

Payment history counts for 35% of a credit score, says Katie Ross, education and development manager for American Consumer Credit Counseling, a national financial education nonprofit group.

Formulating A Plan To Improve Your 777 Credit Rating

First aid foremost, you need to understand that it takes time for you to build up your credit score. Dont expect it to be improved in the next week or the next month, even if you do everything necessary to improve it.

If you have any negative factors on your credit report right now, including a late payment, a bankruptcy, or an inquiry, you may want to pay the bills now and then wait. Remember that time is your ally, not your enemy. In the end, there is no quick fix for rebuilding a credit score. It takes time.

In formulating a plan to rebuild your credit rating, you need to understand how specific actions that you take will harm or hurt your credit score. For example, will working with your creditor to close an existing account in favor of rebuilding a new one with more favorable terms hurt or harm you?

Here are two factors for you to consider: a change to your credit report will affect your credit score , and your score is based entirely on the figures that are already in your report.

A major question that people have is how long it will take for them to improve their credit score. But heres what these people are missing: there isnt anything you can do to boost your actual score. Instead, you can do many things to rebuild your history of credit, and the healthier your credit history, the more elevated your credit score will be.

Recommended Reading: What Score Is Needed For Care Credit

How To Read Your Credit Report

Your credit report contains both personal information and financial information. Your credit report illustrates who you are as a borrower, both the good and the bad. Checking it allows you to keep an eye on your accounts, make sure there are no errors, and even potentially prevent the damaging effects of fraud. Your credit report is the report card of your financial life and understanding how to read it can help you take control of your finances and be prepared for any of your future credit needs.

Lets Break Down The Credit Score Range

CIBIL, TransUnion Credit Information Bureau India Limited is Indias first credit rating agency that started analysing credit health. Your CIBIL score is estimated through a complex statistical calculation based on your credit history received from banks and other financial institutions. The CIBIL score is scaled between 300 and 900, with 300 being the lowest and 900 being on the highest side. The minimum CIBIL score that you need for a quick loan approval is 750.

Let’s understand what is bad, average, good and an excellent rating in CIBIL scoreboard.

Excellent CIBIL Score : The score between 750 and 900 is considered to be an excellent CIBIL score by lenders. CIBIL score under this bracket fetches highest chances of you getting a loan. Moreover, the loan approval process is usually quick and hassle-free with this score range. An excellent CIBIL score reflects your positivity on the creditworthiness front. It also gives lenders a certain level of confidence about timely loan repayment. A high credit score gives you the advantage to negotiate on the rate of interest and the loan amount.

Recommended Reading: When Does Self Lender Report To Credit Bureaus

Auto Loans You Can Get With A 777 Credit Score

Getting an auto loan is easy with a credit score of 777. Youll generally qualify for the lowest interest rates on the market, and you may even be eligible for 0% APR car loans that some new car dealers offer.

According to a 2020 quarterly report by Experian, people with credit scores of 661780 had average interest rates of 5.59% on their used car loans and 3.69% on new car loans, whereas people with credit scores of 501600 had average interest rates of 16.56% and 10.58%. 6

Depending on the loan term and how much youre borrowing, this difference could amount to hundreds of dollars in savings. Nevertheless, you could save even more by waiting until your score reaches 781850, at which point youll be considered a super-prime borrower.

What Is A Good Credit Score

What is considered a good credit score? :59

Reading time: 3 minutes

-

Theres no magic number to reach when it comes to receiving better loan rates and terms

Its an age-old question we get, and to answer it requires that we start with the basics: What is a, anyway?

A credit score is a number, generally between 300 and 900, that helps determine your creditworthiness. Credit scores are calculated using information in your , including your payment history the amount of debt you have and the length of your credit history.

Its also important to remember that everyones financial and credit situation is different, and theres no magic number to reach when it comes to receiving better loan rates and terms.

There are many different credit score models used today by lenders and other organizations. These scores all have the same goal: to predict a consumers likelihood to pay their bills. There are some differences around how the various data elements on a credit report factor into the score calculations.

Although credit scoring models vary, generally, credit scores from 660 to 724 are considered good 725 to 759 are considered very good and 760 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behaviour in the past, which may make potential lenders and creditors more confident about your ability to repay a debt when evaluating your request for credit.

How Do Your Actions Impact Credit Scores?

Don’t Miss: Repossession Credit Repair

Credit Score: Personal Loan Options

With a score this high, you wont face any problems securing a loan. Your personal loan interest rates for credit score 777 and above should range from 13% to 15% on average, but lower rates are definitely available. Shopping around will be in your best interest, because youll qualify for nearly every loan. However, be sure to do your shopping in a brief period of time so your credit score doesnt take a dip.

What Factors Affect Your Credit Score

Your credit score is comprised of five factors: payment history, amounts owed, length of credit history, new credit, and credit mix, as this screenshot from myFico.com shows. If your FICO Score is 750 and above, theres a good chance your credit report contains no derogatory information. That means youre perfect when it comes to payment history.

Your is also most likely in a very desirable range. That means you have total outstanding credit card balances of 30% or less of your total credit card limits. Even so, youll want to keep a close eye on this ratio. As it moves above 30%, it begins to negatively impact your credit score. And if youre in the excellent credit score range, that can be easier to do than you might think.

Also Check: Is 650 A Good Fico Score

The Basics What Is A Credit Score

Your credit score isnt just for getting a mortgage. It paints an overall financial picture. The term credit score most commonly refers to a FICO score, a number between 300 and 850 that represents a persons creditworthiness the likelihood that, if given a loan, she will be able to pay it off. A higher number corresponds to higher creditworthiness, so a person with a FICO score of 850 is almost guaranteed to pay her debts, whereas a person with a 300 is considered highly likely to miss payments.

The formula for calculating a FICO score was developed by Fair, Isaac and Company , and while the specifics remain a secret so that no one can game the system, FICO has made the components of the score public. The formula takes into account the following factors, in descending order of importance:

How To Improve Your Credit Score From 777 To 800+

A credit score of 777 is on the brink of perfection, and you probably wont have to change much to join the 800+ credit score club. Your personalized credit analysis from WalletHub will tell you what needs improvement and exactly how to fix it.

A few things in particular tend to stand between a credit score of 777 and perfect credit, though. And if you do nothing else, make sure to take the following steps.

Don’t Miss: How Long Do A Repo Stay On Your Credit

Points To Keep In Mind While Clearing Your Past Dues

- No Due Certificate: After paying your outstanding dues in full to the lender, obtain a No Due Certificate. This is the proof and indication that you have closed the loan completely.

- Incorrect Closure of Credit Card: Some agencies or the credit card issuer might offer you a discount on closing the outstanding dues on your credit card. Lured by the offer, you might tend to settle for 80% or 90% of the amount to be paid. However, this is not a complete closure. The discount will not be taken into consideration by the bureaus and eventually, you remain with bad credit. Hence, make a complete closure to clear your negative status completely.

- Removing negative issues from your credit report does not mean it will improve your credit score, it can only prevent a further drop. You should have a loan or credit card account active to get an improved credit score over a period.

- Becoming credit healthy does not happen in a day. You will have to be patient as there is a certain procedure followed across all banks and credit bureaus.

- Get your credit report and look for any errors on it. By raising a dispute resolution with the lender and credit bureau, you can get the errors removed.